The recent University of Michigan survey’s reading of one-year inflation expectations rose to 3.4% in July from 3.3% in June. The five-year outlook also increased to 3.1% from 3.0% in the previous month.

There is a mainstream narrative that is growing all over the financial media:

We must accept three percent annual inflation as a success at combating rising prices.

This is enough to pivot and return to monetary easing.

It is not.

Three percent annual inflation for ten years is a loss of purchasing power of the currency of 34% after what is already a disastrous inflationary environment.

There is nothing positive about rising long-term inflation expectations. It is not just the confirmation of a terrible destruction of real wages and deposit savings, but a huge incentive to maintaining the least efficient and unproductive parts of the economy. Inflation is not just a hidden tax created by bloated government spending financed with artificially created currency, it is also a hidden subsidy to obsolescence and a huge disincentive to innovation and technological transformation.

It is not a surprise to read so many market participants demanding more quantitative easing. Monetary expansion has been a huge driver of market bubbles, and many investors want the “bubble of everything” to return, even if it means weaker economic growth, poor productivity, and declining real wages.

The evidence from the past six months is that the entire bounce of the S&P 500 has been driven by multiple expansion. While sales and earnings growth have been weak, the index now trades above twenty times earnings from seventeen times at the end of December. Furthermore, and considering the wave of downgrades of earnings’ estimates, the most bullish investors seem to require more multiple expansion, and that can only come from easing.

The reality, though, is that a three percent per annum average inflation rate means much higher food, utilities, gas, and all essential purchases. The June inflation reading was particularly concerning because all items except four were rising in a month when we should have seen steep declines in most prices.

Inflation is not caused by commodities, wages, or profits. Inflation is caused by the constant increase in the quantity of currency in circulation well above real demand. The biggest consumer of newly created currency is the government, in a country where the annual deficit is not expected to be lower than $1 trillion every year until 2032. Government spending causes inflation, which is the loss of the purchasing power of the currency the central bank issues. When many said there was “no inflation” what we witnessed was massive financial asset inflation and a disproportionate increase in the prices of non-replicable goods and services. How can anyone that pays for healthcare, insurance, education, or housing truly believe that “there was no inflation”?

Remember that what they call “no inflation” was the period between 1996 and 2018, when healthcare costs rose 100%, childcare by 110%, housing by 60%, college tuition by 200% and the average price increase of non-replaceable goods and services rose by 57%, according to the American Enterprise Institute study collecting Bureau of Labor Statistics data. Between 2000 and 2022 the same study showed an overall inflation of essential goods and services of 74%.

If no inflation is 74% price increases in the average basket of essential goods and services, imagine for a second what three percent annual official consumer price index would be for those same non-replaceable goods.

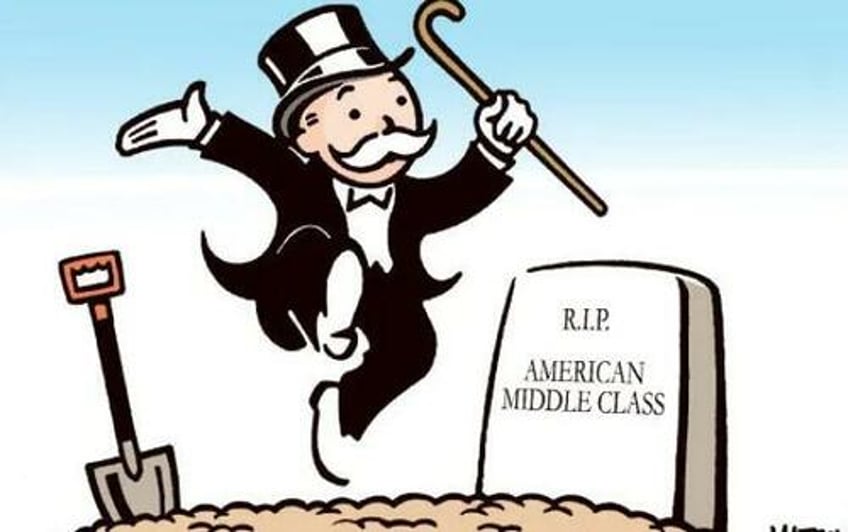

This is what is wiping out the middle class. Negative real wage growth and massive increases in the prices of the essential goods created by the constant erosion of the purchasing power of the currency.

Can economists truly ignore the destruction of the economy and the middle class only to justify more government spending or a small increase in equity and bond valuations? Maybe, but it is a bad idea to support the destruction of the economy only to see some asset values rising, particularly because those vanish with increasingly frequent and aggressive market corrections. The economy should not be driven by government spending and financial assets, but by a thriving middle class and growing productive investment. Monetary easing is not strengthening the economy. It is weakening the fabric that creates progress only to support an ever-increasing size of government.