Equity markets appear to finally be starting to react to the move in bonds with 10Y yields at their highest level since November 2022...

Source: Bloomberg

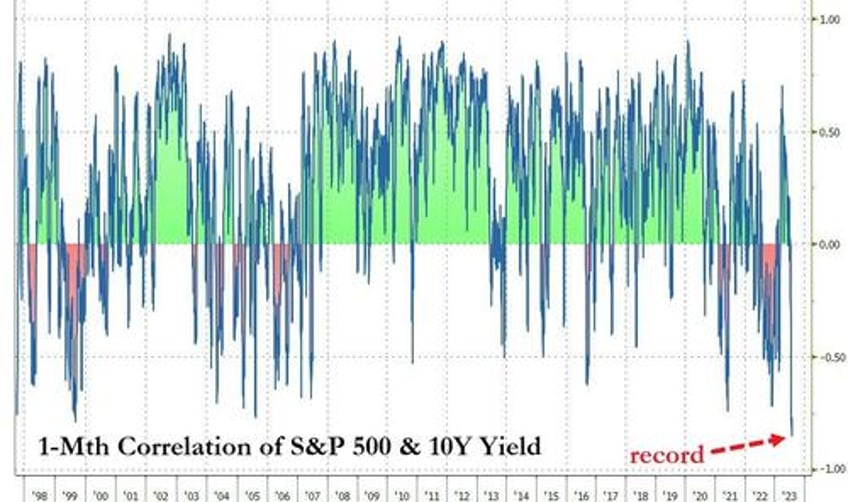

Most notably, the correlation of changes in the the S&P 500 relative to 10Y yields has dropped to its most negative ever...

Source: Bloomberg

In his ubiquitously long tweet thread, he explains that he is short Treasuries (as both a hedge on long-duration stocks - think about the correlation above - and as a standalone bet that yields go higher, prices of bonds lower): (emphasis ours)

I have been surprised how low US long-term rates have remained in light of structural changes that are likely to lead to higher levels of long-term inflation including de-globalization, higher defense costs, the energy transition, growing entitlements, and the greater bargaining power of workers. As a result, I would be very surprised if we don’t find ourselves in a world with persistent ~3% inflation.

From a supply/demand perspective, long-term Treasurys (T) also look overbought. With $32 trillion of debt and large deficits as far as the eye can see and higher refi rates, an increasing supply of T is assured. When you couple new issuance with QT, it is hard to imagine how the market absorbs such a large increase in supply without materially higher rates.

I have also been puzzled as to why the @USTreasury hasn’t been financing our government in the longer part of the curve in light of materially lower long-term rates. This does not look like prudent term management in my opinion.

Then consider China’s (and other countries’) desire to decouple financially from the US, YCC ending in Japan increasing the relative appeal of Yen bonds vs. T for the largest foreign owner of T, and growing concerns about US governance, fiscal responsibility, and political divisiveness recently referenced in Fitch’s downgrade.

So if long-term inflation is 3% instead of 2% and history holds, then we could see the 30-year T yield = 3% + 0.5% (the real rate) + 2% (term premium) or 5.5%, and it can happen soon.

There are many times in history where the bond market reprices the long end of the curve in a matter of weeks, and this seems like one of those times.

That’s why we are short in size the 30-year T — first as a hedge on the impact of higher LT rates on stocks, and second because we believe it is a high probability standalone bet.

There are few macro investments that still offer reasonably probable asymmetric payoffs and this is one of them.

The best hedges are the ones you would invest in anyway even if you didn’t need the hedge. This fits that bill, and also I think we need the hedge.

We do note that Ackman later qualified his 'short' Treasury position is in fact in options:

We implement these hedges by purchasing options rather than shorting bonds outright. This makes it easier to sleep at night as it makes your downside finite. Our sleep-at-night test’ is a critical risk management tool.

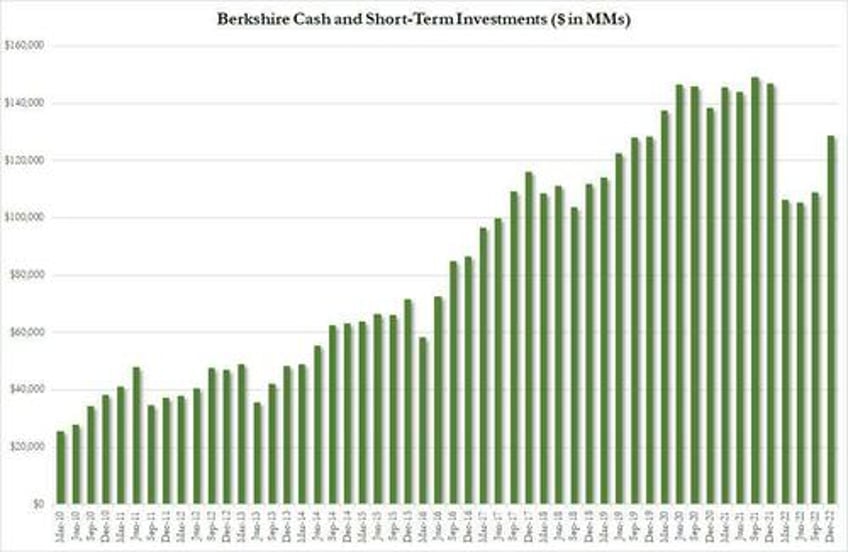

But, on the other side of the fence, Warren Buffett came out this morning, shrugging off Fitch's USA downgrade, confirming that Berkshire Hathaway is still buying $10 billion in Treasuries every Monday.

"There are some things people shouldn't worry about," he told CNBC's Becky Quick.

"This is one."

That's quite cash haul...

It appears Buffett still thinks the US equity market is too expensive...

Source: Bloomberg

So to summarize - the bond-stock-relationship regime has never been this extremely decoupled; Ackman is shorting bonds as a hedge on high-flying (long duration) stocks; and Buffett is buying bonds (because stocks are too expensive still).

Does that sound like a stock market that mom-and-pop should be piling their hard-earned retirement savings into?