Following yesterday's dismal Manufacturing survey data (both in contraction - sub-50 - for multiple months), 'soft landing'-hopers are banking on this morning's Services survey data to save the narrative.

ISM Services (Final) dropped to 52.3 (below exp) in July (from 54.4 in June) - its lowest since Feb.

PMI Services dropped to 52.7 (below exp) in July (from 53.9 in June)

These disappointments are happening as US Macro data has been surprising to the upside...

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

"The service sector remains the main engine of growth in the US economy, though there are signs of the motor spluttering amid rising headwinds."

"Business activity rose in July at the slowest rate since February, with the rate of expansion sliding further from May's recent peak in response to sharply reduced growth of new business. Although spending from foreigners in the US continues to grow strongly as the post-pandemic travel surge shows signs of persisting, demand growth waned from domestic customers, often linked to the rising cost of living and higher interest rates. "

"Reflecting concerns that the upturn is faltering, companies have become much less optimistic about the outlook and reined-in their hiring as a result."

Inflationary pressures remained historically elevated in July, as service providers in particular continued to register marked increases in input costs and output charges, often attributed to hikes in wages.

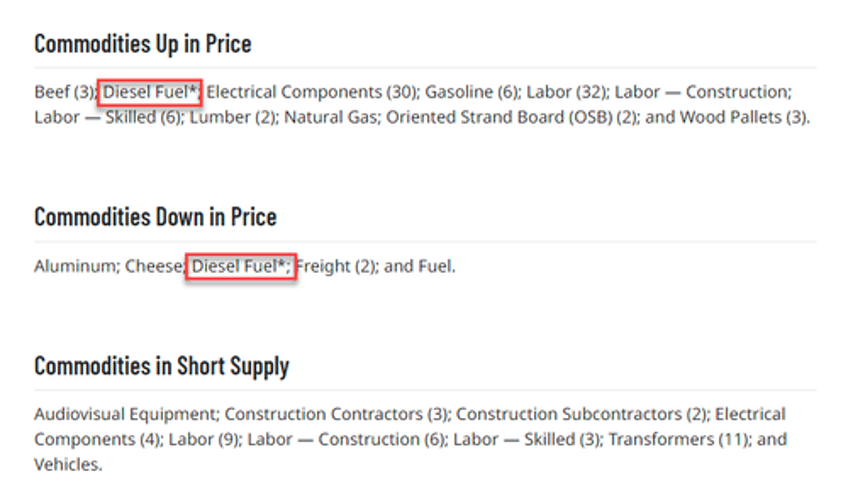

By the way, Diesel prices are both up... and down...

Services Employment slowed...

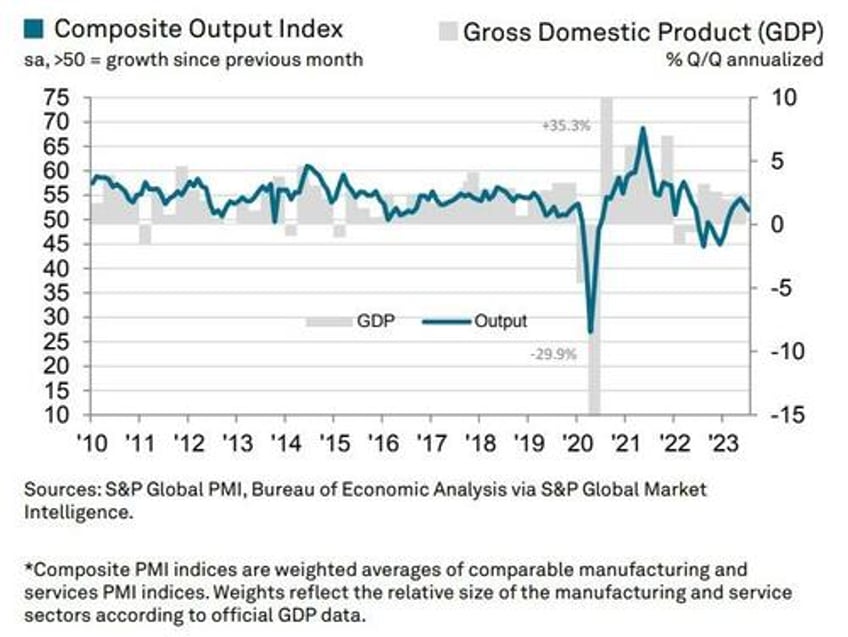

The S&P Global US Composite PMI Output Index posted 52.0 in July, down from 53.2 in June, to signal only a modest upturn in private sector business activity.

"With the weakening service sector expansion accompanied by a near-stalled manufacturing sector, the overall message from the surveys is that economic growth weakened at the start of the third quarter, cooling to an annualized rate of around 1.5%.

Williamson concluded even less optimistically that the survey's price gauges, however, continue to signal a stubbornness of inflation around the 3% mark:

"An additional concern is that prices charged for services rose at an accelerated rate in July, often linked to higher staff costs. Such a wage-led stickiness of inflation in the vast service sector will naturally worry policymakers."

So, in other words - STAGFLATION!