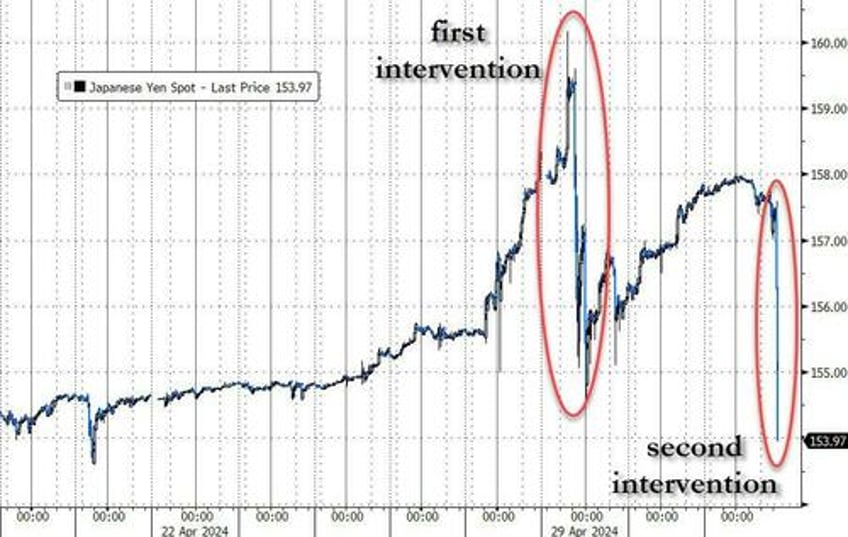

Two days after the yen soared after crashing to a 34 year low of 160 against the US, when the Japanese Ministry of Finance reportedly spent around 5 trillion yen, or just over $30 billion, to push the imploding Japanese currency to levels not seen in ... about 48 hours, moments ago with much of the impact from the first intervention having fizzled, the Japanese Ministry of Finance appeared to step in again when moments after the US cash market close, USDJPY cratered in seconds in the second Japanese intervention in as many days.

Of course, one can't help but be amused by the sheer amateur hour at the BOJ where the second consecutive intervention, one which will cost the MOF another $30 billion or so, has managed to push the yen to levels not seen since... last week.

And speaking of the intervention cost, while we won't know how much they officially cost Japan until the end of the month, what is notable is that the first intervention - which took place amid super thin liquidity due to a holiday in Japan which typically exacerbates market moves - cost nearly as much as one of the interventions in 2022, when they bought a record amount of yen, according to a Bloomberg analysis of central bank accounts.

"Despite spending ¥5 trillion in a market where there should have been little trading activity, the yen was pushed up by only a little over ¥5 and quickly recovered more than half its value,” said Takuya Kanda, the head of research at Gaitame.com Research Institute. “That doesn’t seem very cost effective” compared to intervention two years ago, he said.

What is notable about this particular intervention is that it took place just 2 hours after the latest Fed decision - which was viewed as moderately dovish due to the greater than expected QT taper. And indeed, it would be pointless to intervene had the Fed come out as hawkish and sent the dollar soaring.

In fact, one can argue that the BOJ and MOF - having had discussions with Powell and Yellen about this intervention ahead of time - received some assurance that as far the Fed and Treasury are concerned, the US dollar isn't going to spike in the near-future. In fact, one can probably go so far as speculating that Yellen actually leaked to the BOJ what the next NFP and CPI prints will be so that Japan doesn't waste tens of billions in yentervention firepower only to watch the JPY plunge again in two days when a red hot jobs print send the USD soaring.

If so, we've seen the dollar highs for the year.