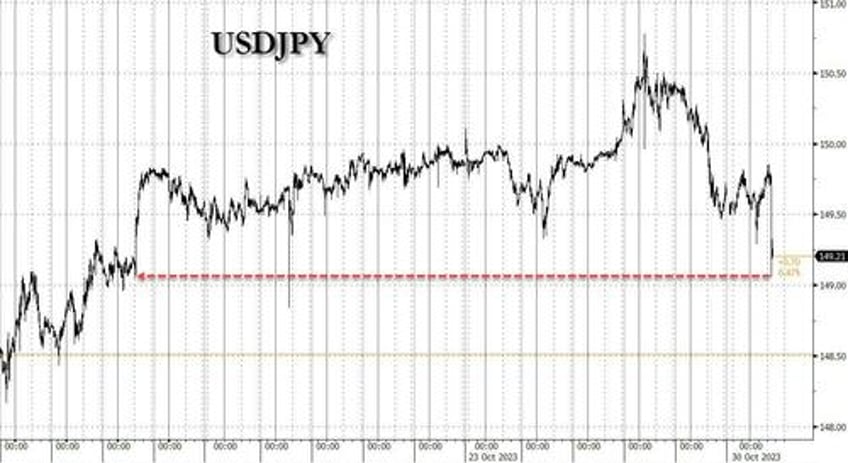

With tomorrow's BOJ "live" announcement already expected to be a far more exciting affair than either the Fed or BOE later this week (both of which will unveil no surprise), moments ago the yen spiked to a session high against the US dollar, and the highest since Oct 12, after Japan's Nikkei reported that the Bank of Japan may tweak its YCC again and allow long-term yields to rise above 1% as soon as its Tuesdays meeting.

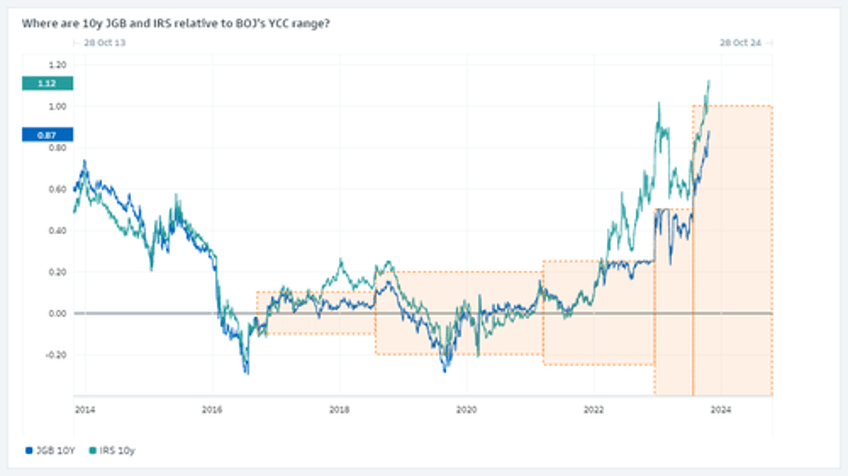

According to the Nikkei, which correctly warned just ahead of the last YCC tweak by the BOJ, after several YCC tweaks, the BOJ is once again realizing that it is trapped, and has to adjust its YCC more "potentially allowing 10-year Japanese government bond yields to rise above 1%" at Tuesday's monetary policy meeting.

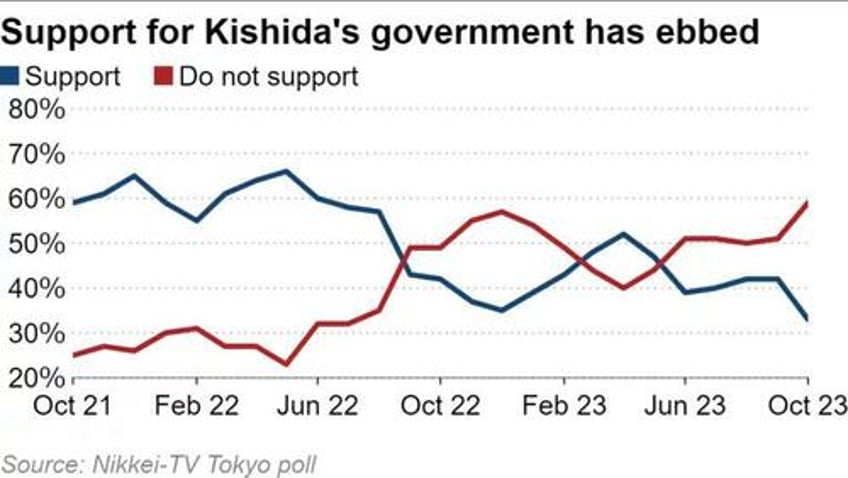

With the long-term interest rate currently capped at 1%, the central bank has been conducting unlimited fixed-rate buying operations to keep yields below that mark, in the process crushing the yen, and pushing inflation sharply higher even as Ueda's approval rating plunges to record lows...

... as Japan realizes that the one thing it hated more than deflation is inflation.

Support for Japan’s Kishida Hits New Low in Nikkei Poll

— zerohedge (@zerohedge) October 29, 2023

Maybe replacing the yen with the lira and ignoring galloping inflation wasn't the smartest plan

The report also noted that "the second framework tweak in three months appears to have been deemed necessary as 10-year yields are approaching 1% amid a backdrop of rising U.S. rates" and added that the "BOJ is also likely to more flexibly conduct its JGB purchase operations... This, along with a more flexible cap on 10-year yields, is aimed at deterring speculators from targeting the upper limit and sparing the BOJ the need to buy droves of JGBs to keep rates under 1%."

Long-term rates have risen faster than the central bank had expected in July. On Monday, the newly issued 10-year government bond yield reached 0.89%, its highest since July 2013. It is approaching 1% -- what BOJ Gov. Kazuo Ueda has called "the upper limit."

Which, if nothing else, again confirms that the BOJ is by far the dumbest central bank and its leaders are nothing more than headless chickens running around in circles.

BOJ right now pic.twitter.com/oU6QaHqq3y

— zerohedge (@zerohedge) October 26, 2023

The Nikkei report comes just hours after this morning's 2yr JGB Auction tailed by the most since 2010, despite having a 10bp Coupon for the first time in 32 months, as investors balk at the "opportunity" of buying long-term paper just ahead of another substantial tightening move by the BOJ.

Also ahead of the NIkkei report, Goldman's FICC desk published a lengthy note from Ryoya Wakamatsu (available to pro subs here), in which he summarized the key aspects of Tuesday's decision:

- What will the BoJ do? ‘Should the BOJ move, the option of raising the hard cap to 1.50% appears most likely given that multiple media outlets have specifically cited this option as the MPM's point of discussion.’

- Where will 10y JGBs go? ‘10y JPY OIS swaps have priced JGBs path well through the multiple YCC band widening in the past year. Current levels of 1.12% suggests JGBs will breach 1.00% following further YCC amendments which we agree with. In fact, depending on which option BOJ elects, we currently think 10y yields can range from 1.10%~1.30%. The path to these levels however will likely be gradual, similar to what we saw in the 3 months after the July MPM. BOJ will likely utilize Rinban purchases and FSO to stem volatile moves.’

- What if No-Change? ‘In the event of no policy change, initial short covering will push JGB yields back to the 0.8% range. However, we expect a limited rally as the narrative will only shift to the Dec MPM (19th Dec).‘

- What about the Curve? ‘Following a BOJ YCC band widening scenario, we expect 10y to be sold the most. Thereafter, we expect the curve to steepen into FY24 due to fundamental lack of demand in the back-end. Lifers will provide seasonal demand in Jan~Mar2024 but as duration gaps have materially closed thanks to higher rates and convexity, regulatory need to buy JGBs have waned. We think 20y may be the fundamentally weak point of the curve and like to keep an eye on 10s20s steepener from here.'

- What about NIRP? ‘NIRP exit is now fully priced in for the March'24 meeting and 40% for the Jan'24 meeting. A 10bps hike will have limited impact to the economy, especially considering that the -0.1% policy rate only applies to a fraction of BOJ Deposits. Short term prime rates (base reference rate of floating rate mortgages) would not move since they have not moved in the last 8 years despite NIRP/lower rates. Thus, the hurdle for BOJ to move to ZIRP seems low and in fact, may be quite needed should YCC band widening have limited effect on the USDJPY.’

- USDJPY? ‘USDJPY Lower on BOJ YCC amendments but rebounding to move higher into 2024. No YCC Change will push USDJPY higher towards 155. We saw this last July when USDJPY moved from 144 to 138 following surprise YCC amendments only to be back at 145 three weeks later. Given that there is less of a surprise element to this MPM, with higher market expectations, we may only move back to 144-145. We continue to believe that one of two things (or both) need to happen for the USDJPY to move substantially lower 1) USD index/USD Rates lower 2) BOJ NIRP exit (and rate hikes).’

Finally, as Bloomberg's Mark Cranfield writes, the USD/JPY is likely to end the week lower in two of three Bank of Japan scenarios which traders are likely to be confronting.

- 1. The BOJ is widely expected to hold policy unchanged, which will be the catalyst for USD/JPY to grind higher. If the pace of the rise is moderate, not alarming to Japanese authorities, the pair may extend toward the 155 area

- 2. The BOJ removes yield curve control, which generates a steepening of JGB curve and supports the yen. JGB 10-year yields may head toward 1.25%, with USD/JPY heading into 140-145 zone

- 3. The BOJ exits negative rate policy and ends YCC in what is seen as a coordinated move with Japan’s MOF to strengthen the yen. As USD/JPY moves lower, Japanese authorities follow up with intervention to reinforce the message that yen weakness has reached a line-in-the-sand. USD/JPY picks up downward momentum in similar mode to the slide which ended in January on a 127 handle

Much more in the full Goldman note available to pro subs.