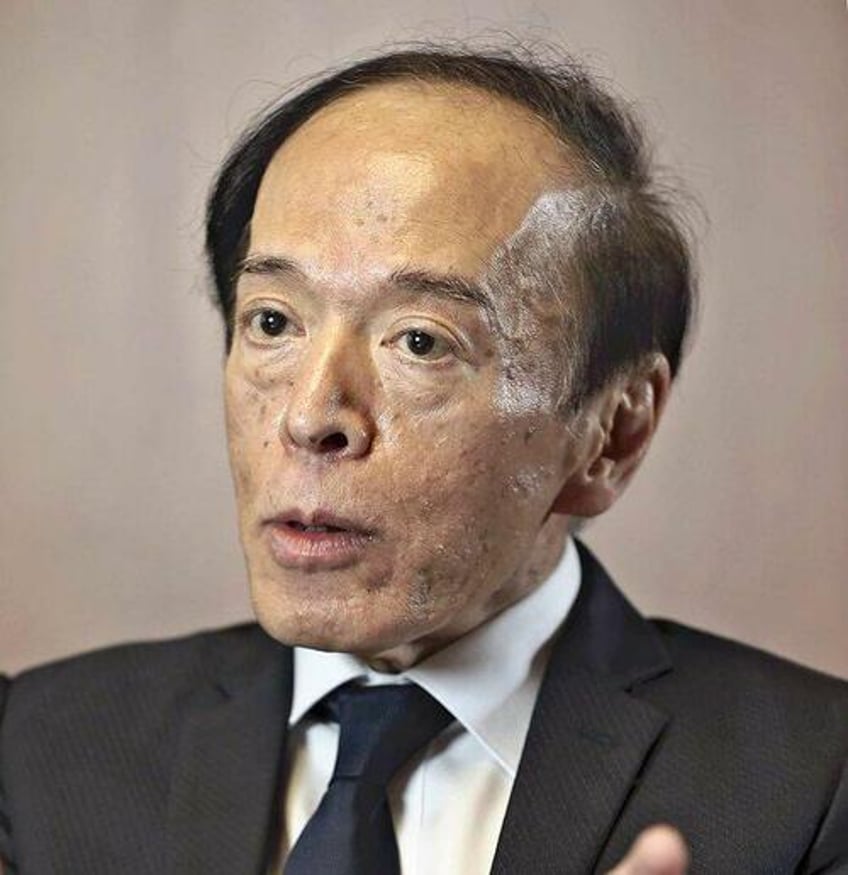

After several weeks of relentless selling, the yen finally strengthened as much 1% versus the dollar before trimming the move after BOJ boss Kazuo Ueda's hawkish comments: USDJPY fell to 146.50 after closing just shy of 148 after Ueda said in an interview with the Yomiuri newspaper that an end to negative interest rates was possible if they were confident that wages and prices were rising sustainably, and that they could have enough information on the wage outlook by the end of the year.

“It is not impossible that we will have enough information by the end of the year to anticipate [wage hikes next spring]" Ueda said, adding that the end of the year as a possible time to assess the trend of wage increases, a key factor in setting price increases and which would give insight on the negative interest rate policy

Ueda also said that “there are some things we cannot see,” including overseas economies, and expressed his cautious approach and described the monetary policy modification decided in July as “a mechanism to change the balance between the effects and side effects” of monetary easing measures. The focus will now be on “a quiet exit,” which the BOJ is seeking to avoid significant impact on the market.

Justifying the BOJ's catastrophic response to Japan's soaring inflation, Ueda said that although rising interest rates are a "burden" on households and corporate finances, if the economy improves the economy will have the strength to absorb the increased burden. The BOJ’s aim of achieving a 2% inflation rate with accompanying wage increases would become a reality; of course, until then households will see their purchasing power crater and countless old households (which Japan has plenty) may very well not survive.

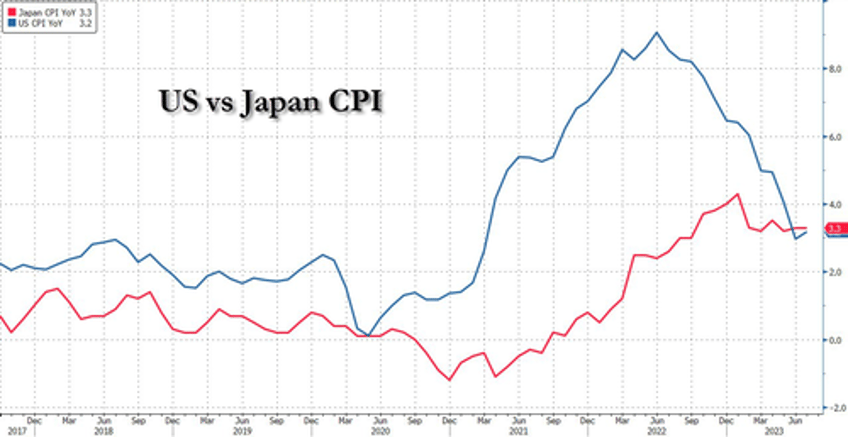

Ueda explained the July revision of the upper limit of long-term interest rates as a kind of risk management. “It was necessary to create room for a response so that things would not go crazy when prices swing upward,” he said, revealing that the BOJ had made the decision based on reflections that it had underestimated the price outlook until now. The central bank’s quarterly announced inflation rate forecast for fiscal 2023 was 1.6% as of October last year, but it was revised upward in April and July, and the outlook as of July was 2.5%, well above the BOJ's inflation target of 2.0%. In fact Japan now has a higher YoY inflation than the US!

"Ueda’s remarks in an interview sounded hawkish,” said Takeshi Ishida, currency strategist in Tokyo at Resona Bank. “We expect the end to negative interest rate policy in the first three months of 2024, and Ueda may have started to encourage the market to price in such a scenario."

Ueda’s comments may be intended to keep yen depreciation in check, wrote Naomi Muguruma, chief fixed-income strategist at Mitsubishi UFJ Morgan Stanley Securities in Tokyo. And sure enough, with the BOJ terrified of intervening knowing well it could buy a brief 500-600 pip drop in the USDJPY for $50 billion or so, it would then promptly disappear due to the relentless chasm in rate differentials between the US and Japan. For the time being, however, the latest attempt to jawboning the yen higher worked, if only briefly, and the USDJPY was down 140 pips from the Friday close.

In response to the Ueda comments, Deutsche Bank changed its call on the Bank of Japan’s monetary policy outlook; their economists now expects yield curve control to be removed in October (previously April 2024), and for negative interest rate policy to end in January 2024 (previously December 2024).

Ueda's comments also sparked another selloff in JGB, where futures tumbled 15 ticks 146.10 and lifted yields on 10yr JGB above 0.70% for the first time since 2014...

... and pushed 5-year yields 7bps higher to 0.285%, the highest level since January, and even though the BOJ promptly announced it will conduct a 5-year funds-supplying operations on Sept. 14 to curb rises in yields, 10-year JGB bond futures held their losses as the countdown to the end of Japan's NIRP has once again restarted.