By Mitchell Vexler, President Mockingbird Properties

Although it sounds tough, yet often stated by me, is that I don’t give a damn what someone has to say, but very much I care what can be proven. Knowledge vs Ignorance. Repetition of ignorance is ignorance raised to the power two.

Time and careful thought lead to the clarity created by quantifying the issues via math and understanding the associated risks.

People who do stupid things and violate the laws with capital and labor should be accountable and in the case of intent, jailed. Capitalism works when the playing field is even.

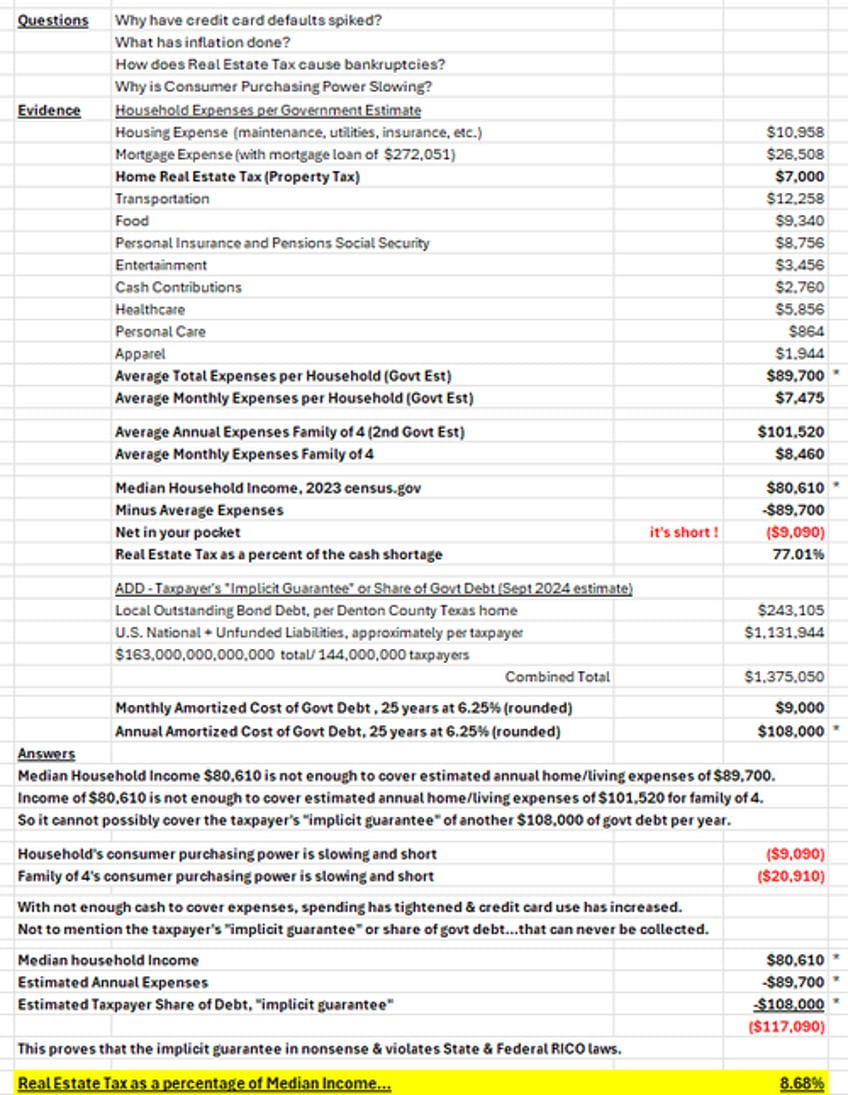

In Texas as in most States when a politician is told what the law is, and that is law is being broken, and that politician chooses to ignore the law, that is a violation of both State and Federal laws (“power to prevent”), in Texas that is a 3rd degree felony for impersonating a public official. When school board trustees who also signed an Oath of office state we are “well capitalized” or “there is no problem” or “we are not bankrupt” without producing a shred of evidence (bond schedule, balance sheet with notes, sources and uses), rarely has a bigger lie been told. With a mountain of evidence available, the same can be said for those at the Federal level who refuse to look at the U.S. National Debt + Unfunded Liabilities and explain to the U.S. Taxpayers exactly how those taxpayers (144,000,0000) are each responsible for roughly $1.1mm as a result of the Federal system and approximately $240K as a result of the local Taxing Entities both of which would require an immediate increase in household income by $9,000 per month to pay off over the next 25 years assuming all Federal and Local expenditures are immediately frozen which is impossible because the expenditures continue as does the interest clock by the milli-second. The point being the debts cannot be paid back as it is impossible for 99.9% of any taxpayer to increase their immediate revenue by $9,000/month to be amortized over the next 25 years to pay the debt created at the hands of the liars and criminals.

To make matters worse, utilizing the Rule of 72, the trajectory of the debt loads will likely double in the next 7 years if not sooner depending on the velocity of increasing the debt. As the debt cannot be paid back today, what will happen when that debt doubles, and this assumes there is no crises in the interim at either the State of Federal level?

The inter-agency agreements, cross collateralization, on balance sheet and off balance sheet guarantees, mortgage back securities, credit loan obligations, credit default sways, sovereign obligations, and their bailout puppets being the government operated Federal Reserve, International Monetary Fund, of the world’s leading “democracies” have financially engineered debts that far exceed our ability to repay or their ability to manage and then that garbage has been sold across the globe to be further levered as if it was the physical asset collateral based on the good faith guarantee of that Federal or Local side of the government.

Federal spending is in excess of $5 trillion a year. That is twice what the Federal government collects in income taxes. And it’s equal to the entire federal revenue. After paying for all of the handouts, there’s nothing left – not a penny for interest, not a penny left for paying down debt.

Americans are becoming more dependent on the Federal government for handouts.

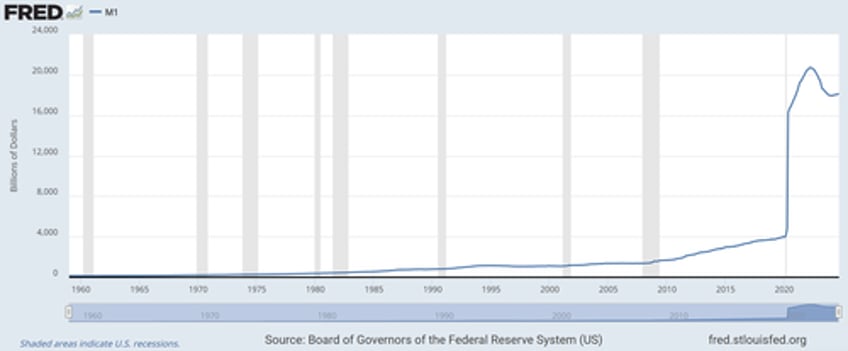

The impact of the demand for handouts can be seen in the amount of money in circulation (M1 money supply). The chart shows the impact of printing trillions and trillions of dollars during 2020. The amount of dollars circulating in the banking system grew from $4 trillion to over $20 trillion in a two-year span.

We will continue to see rising inflation and prices as a result.

Our interest expense is a function of how much inflation bond investors expect to see in the future. As those expectations rise, so will the government’s funding costs.

This is the loop of doom I referred to in several videos where inflation causes both transfer payments and interest expenses to rise sharply. Efforts to contain the bond market by printing money and buying bonds will make inflation worse. Inflation caused by printing money is an illegal tax.

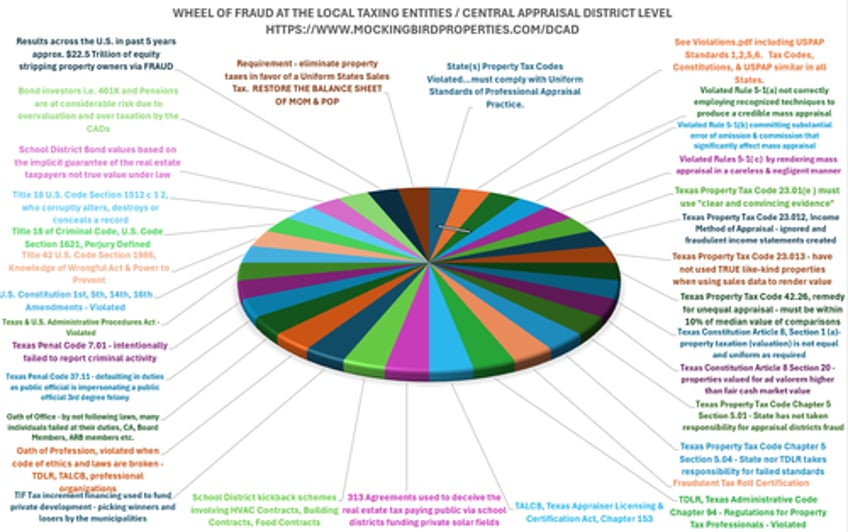

Isn’t it interesting that the Local Taxing Entities (regardless of County) have mimicked the Federal level of illicit activity?

- Make fraud difficult to detect…hide the documents (bond schedules, notes to balance sheets, sources and uses), at the School Districts and then at the Central Appraisal Districts, where noncompliance with USPAP, State law and U.S. Constitution have run amok resulting in approx. $22.5 Trillion of valuation fraud on single family homes in the last 5 years resulting in roughly $450 Billion in over taxation for 2024. The Federal Reserve claims they can’t be audited thus making fraud difficult to detect. Notice I said difficult…not impossible!

- Blast public messaging in the local newspapers and at Tax District meetings, that we have to “protect the children” or my favorite Federal psyops of this past election season “do whatever it takes because democracy Is on the ballot”.

- Assure the public that fraud is a myth — which means there’s no need to investigate it — which means that theoretically if a person or entity wanted to do it, they would probably get away with it.

The purpose of the local school bond election is not really to convince the populace that the district has consensus support — only that it has consensus compliance, which clearly, based on the amount owed, it does not and cannot in law.

Thus, those who promote the scam are complicit in aiding and abetting a criminal conspiracy to defraud.

Math provides and demands transparency.

Why does all this matter?

Consider the chart below that poses some important questions on U.S. household finances:

Consider the WHEEL OF FRAUD of the Local Taxing Entities which own the Central Appraisal Districts (CADS):

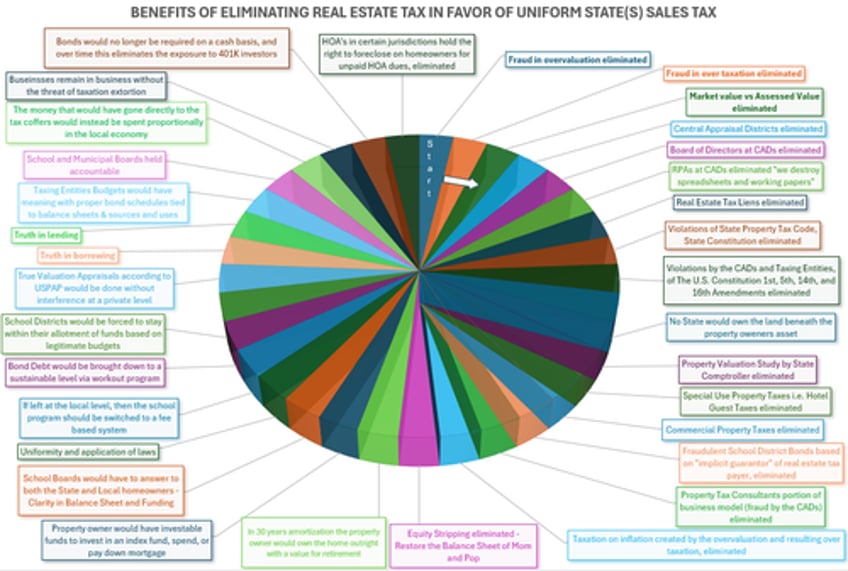

The result of this real estate tax fraud is that the average house across the U.S. owes roughly $240,000 in current debt at the school district level not to mention the past 5 years alone with a 100% increase in fraudulent property valuations up $21.2 Trillion from which roughly $450 Billion was stolen via over taxation on the fraud property valuations.

Now, let’s look at the benefits of eliminating real estate tax in favor of a uniform State(s) sales tax.

For those politicians who choose to turn a blind eye and let the criminals be criminals, the apathy puts your family, friends and neighbors in harms way. We are at the tipping point and that requires all hands on deck to get involved and protest your property values, force the school districts to deliver the bond schedule, balance sheet and sources and uses, and if necessary file suit against those individuals (joint and severally liable) who refuse to adhere to the law and demand that your district attorneys prosecute those involved in the crimes of real estate tax fraud.

We know the route cause of the problem (greed and corruption), we have the evidence, and the attached graphically shows the solution being the benefits of eliminating the real estate tax in favor of a Uniform State(s) Sales Tax.

In every video we did https://www.youtube.com/playlist?list=PLo3dZB8Cn9QuemgK3OwUL1qncSqqlfXl_, we went into great detail on these items utilizing spreadsheets, amortization schedules and Rule of 72 analysis etc. Further, we have also provided access to our evidence at www.mockingbirdproperties.com/dcad.

You can believe the numbers, or you can believe the politicians, but you can’t do both.