The German government is no longer a "Bitcoin billionaire", as Arkham Intelligence reports that this morning saw them unload another 2000 BTC ($117mm) to exchanges, leaving just 13,360 BTC ($785mm) remaining - 26.8% of the original bitcoin seizure from movie-pirating site, Movie2k.

But while the US and German governments are simultaneously doing their best to instill FUD in the crypto community (helped by Mt.Gox), bitcoin ETF investors are piling back in at quite a pace.

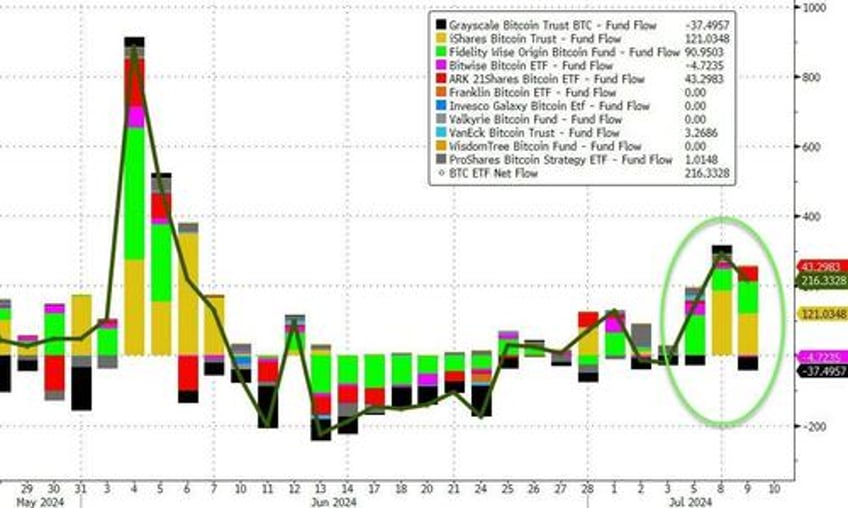

🇺🇸 ETFs bought 3,760 #Bitcoin ($216.4m) on July 9 🚀🚀

— Thomas | heyapollo.com (@thomas_fahrer) July 10, 2024

Highlights:

IBIT +2,100 BTC

FBTC +1580 BTC

ARKB +750 BTC

GBTC -650 BTC pic.twitter.com/z5hLWXQorI

Total net inflows across all ETFs for July 9 came to $216.4 million, or 3,760 Bitcoin. The burst of inflows, which includes $294.8 million on Monday, July 8, and $143.1 million on Friday, July 5, totals $654 million over the past three trading days.

Source: Bloomberg

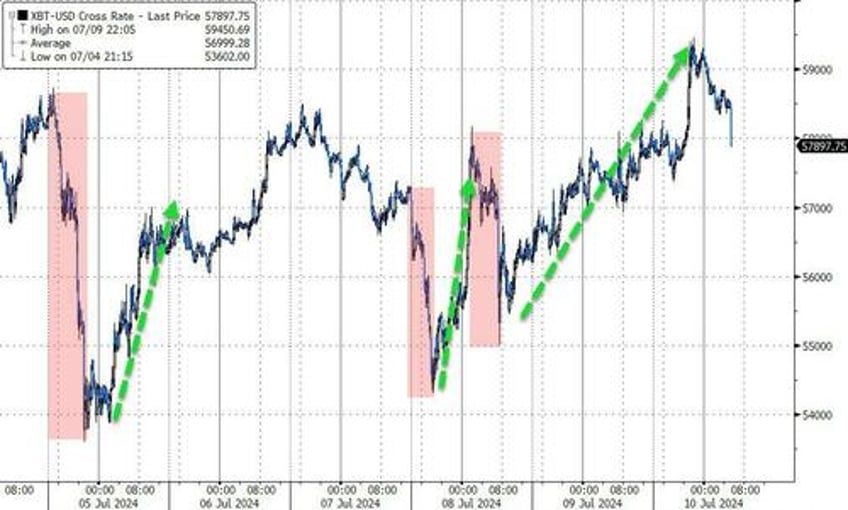

And so, despite the German Govt overhang, bitcoin rallied up to $59,000 this morning...

Source: Bloomberg

"Germany selling all their Bitcoin will go down as one of the most retarded things their politicians ever did."

While initial concerns had forecast ongoing sell pressure from Mt. Gox and Germany, experts Decrypt spoke to said those concerns are "overblown."

The worst of Germany's selling appears to be "in the rear-view mirror," Ryan McMillin, chief investment officer at crypto fund manager Merkle Tree Capital, told Decrypt.

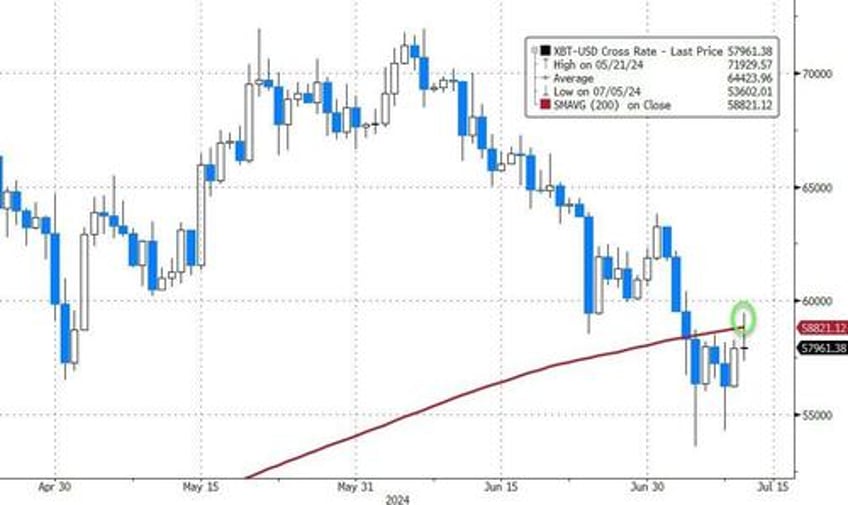

Finally, we note that bitcoin is trying to break above its key technical resistance level (200DMA) and this morning's smack down stalled that...

Source: Bloomberg

...for now.

Discussing the market narrative and sentiment with CoinTelegraph, Ante said that the ongoing event “may be forgotten in a few months, and new events, such as the Mt. Gox payouts, may be the subject [of] debate.”

“Such sales likely lead to an even broader distribution of Bitcoin ownership, so the whole event may be positive for Bitcoin in the medium term.”