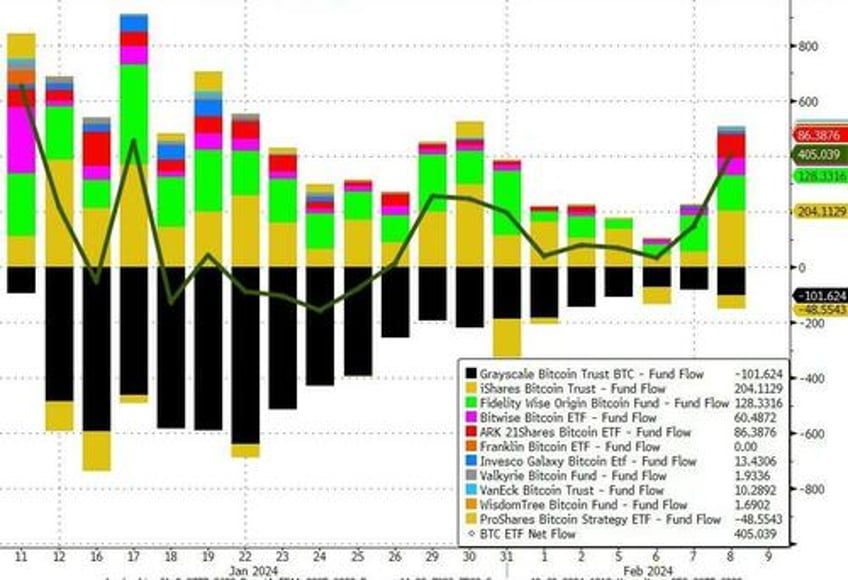

Yesterday saw the third largest net inflow into spot Bitcoin ETFs, totaling over $400 million with iShares Bitcoin Trust (IBIT) seeing over $200 million inflows alone, dominating the $101 million outflow from GBTC...

Source: Bloomberg

The net inflow yesterday meant that 8,698 BTC were taken off the market and put into cold storage.

“We think bitcoin could be one of the most talked about brands on Wall Street in the next decade,” Mike Willis, CEO and founder of ONEFUND, told CoinDesk.

“You're at the beginning of the ‘bitcoin era’ on Wall Street.” Although remiss to offer a price prediction, Willis said he thinks bitcoin could easily catch up to gold's market cap.

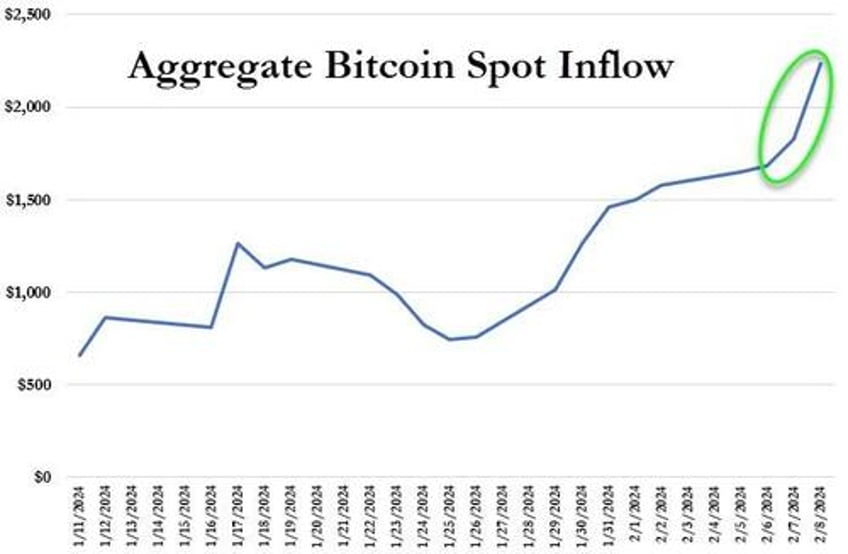

That has pushed the total net inflow into spot bitcoin ETFs up to $2.23 Billion...

Source: Bloomberg

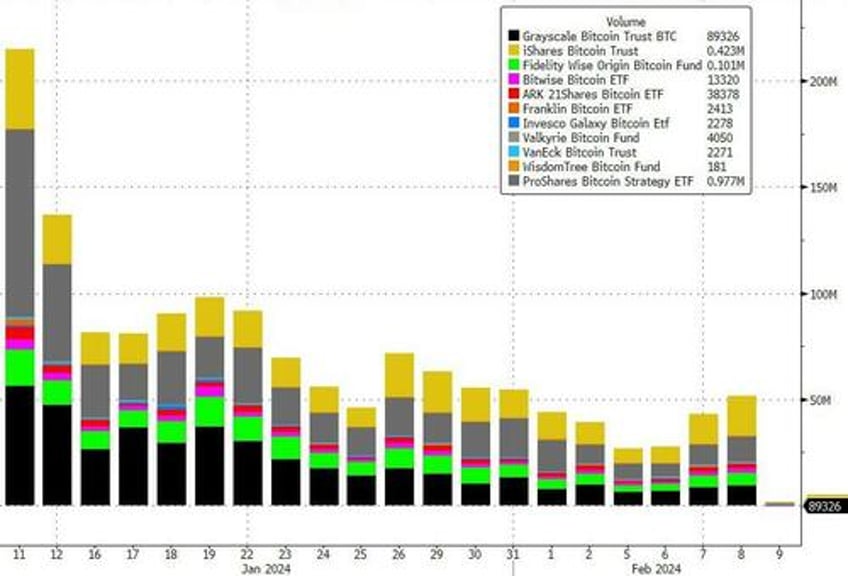

IBIT also became the first ETF to exceed GBTC’s daily trading volume. However, the total trading volume of all 11 spot Bitcoin ETFs fell below $1 billion for the first time since they launched.

Source: Bloomberg

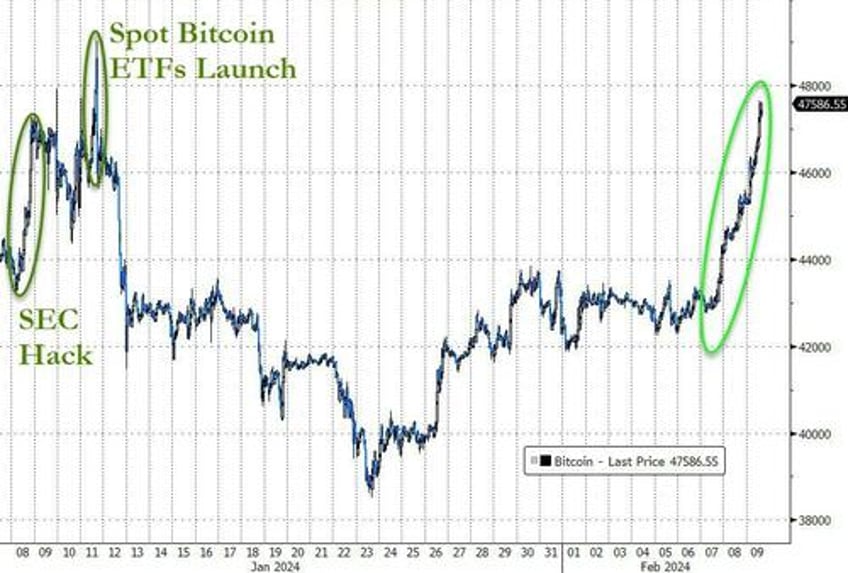

The result of all this is that bitcoin prices have soared back up near $48,000, erasing all the post-launch 'sell the news' losses...

Source: Bloomberg

Interestingly, this is a seasonally positive period for crypto:

"The next few days are of paramount statistical importance as bitcoin tends to rally by +11% around Chinese New Year, starting on February 10 (Saturday)," Markus Thielen, head of research at Matrixport and founder of 10x Research.

"During the last 9 years, Bitcoin has been up every time traders would have bought bitcoin 3 days before and sold it ten days after the start of the Chinese New Year."

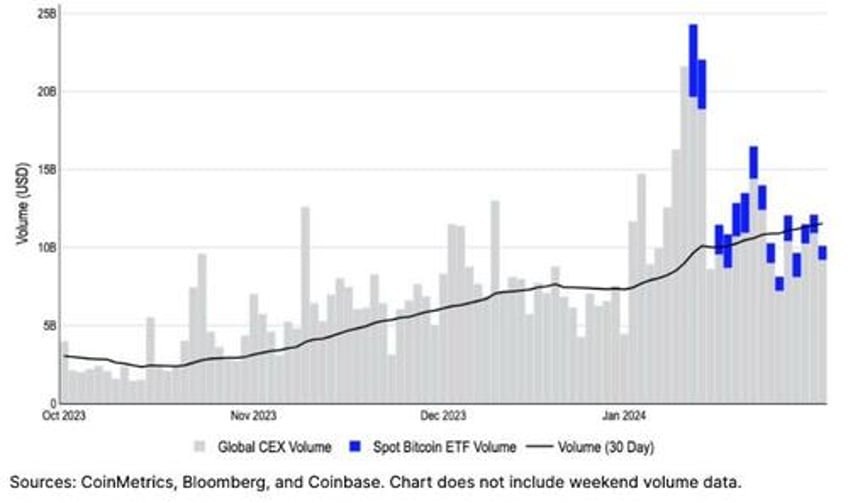

Coinbase just issued a report that suggests Bitcoin spot ETF activity accounts for around 10-15% of total bitcoin trading activity across centralized exchanges.

Smaller tokens such as Ether, Solana and Cardano also pushed upward...

Source: Bloomberg

As CoinTelegraph reports, Coinbase analysts say there have been more important crypto themes emerging in the aftermath of the spot Bitcoin ETF launches in the U.S., including the rising decentralized finance (DeFi) activity, which could “add meaningfully” to the value proposition for Ether.

Ethereum community member and investor Ryan Berckmans believes that Ethereum’s switch from a proof-of-work to a proof-of-stake consensus mechanism could drive ETH’s price to as high as $27,000 during the bull cycle.

“Bitcoin appears set to resume its march up after the Grayscale outflows finally tapered off,” said Caroline Mauron, co-founder of digital-asset derivatives liquidity provider Orbit Markets.

The “halving narrative” will gather momentum, potentially taking Bitcoin past $50,000 in the next few weeks, she said.

The quadrennial halving cuts the quantity of Bitcoin that miners receive for operating power-hungry computers that secure the network by solving complex puzzles.

Halving is key to capping the supply of Bitcoin at 21 million tokens. Rewards drop to 3.125 coins per block from 6.25 coins in the upcoming event.

Previous halving events “preceded strong bull runs,” a team including DBS Bank Ltd. Chief Economist Taimur Baig wrote in a note.

“There is a simple economic reason why prices should rise. As the reward for mining decreases, the price for mining output (namely Bitcoin) must increase to compensate and not trigger a withdrawal of computational resources by miners,” the team said.

With the growing demand from institutional investors, the diminishing supply could help BTC hit new market highs.