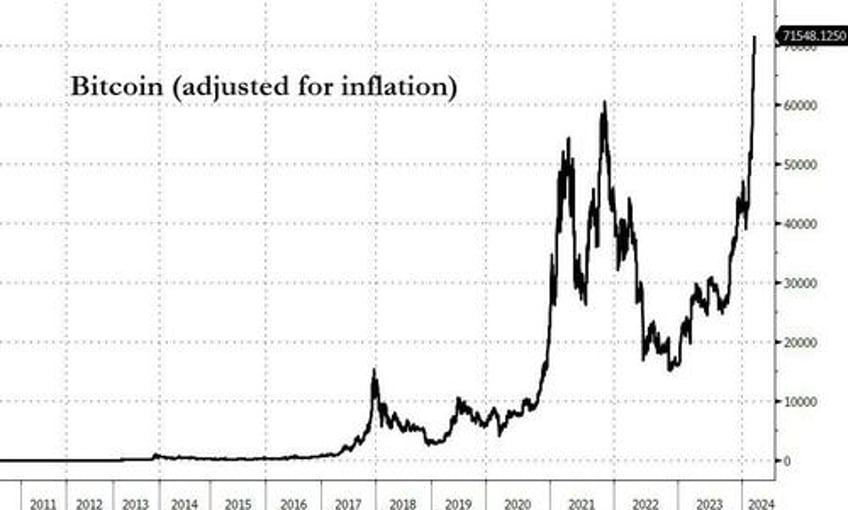

Bitcoin soared above $72,000 for the first time in history this morning, far surpassing its historical (inflation-adjusted highs)...

Source: Bloomberg

“This rally comes following a weak Asian trading session in which shorts tested the conviction of longs — it appears the longs have given a rather convincing positive answer,” said Richard Galvin, founder of Australia-based crypto-focused investment firm DACM.

The largest cryptocurrency's latest move has been attributed to two notable shifts in the UK.

The London Stock Exchange (LSE) announced that it will start accepting applications for Bitcoin and Ether crypto exchange-traded notes (ETNs) in the second quarter of 2024.

On March 11, the exchange confirmed that it would accept applications following the guidelines specified in its Crypto ETN Admission Factsheet. However, the exchange did not provide the exact date that it will start accepting applications.

Additionally, the U.K.'s Financial Conduct Authority decision to allow exchanges to offer similar products - exchange-traded notes backed by cryptocurrencies - to institutional investors.

But, as The Wall Street Journal reports, the FCA said it would continue to block individual investors from buying these notes or crypto derivatives, warning that both were "ill-suited for retail consumers due to the harm they pose."

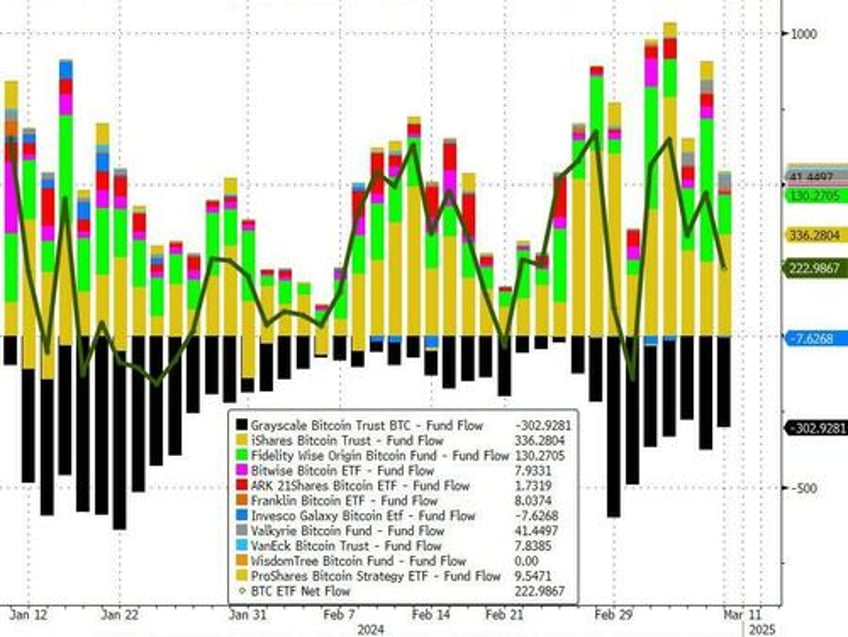

"The market is continuing to see strong reception to the ETFs. The asset class is opened more widely to the public, which allows it to gain more credibility," said Joel Kruger, a currency strategist at LMAX Group.

"Once an asset class is legitimized in the U.S., we're going to have similar adoption around the globe, giving more momentum," he said.

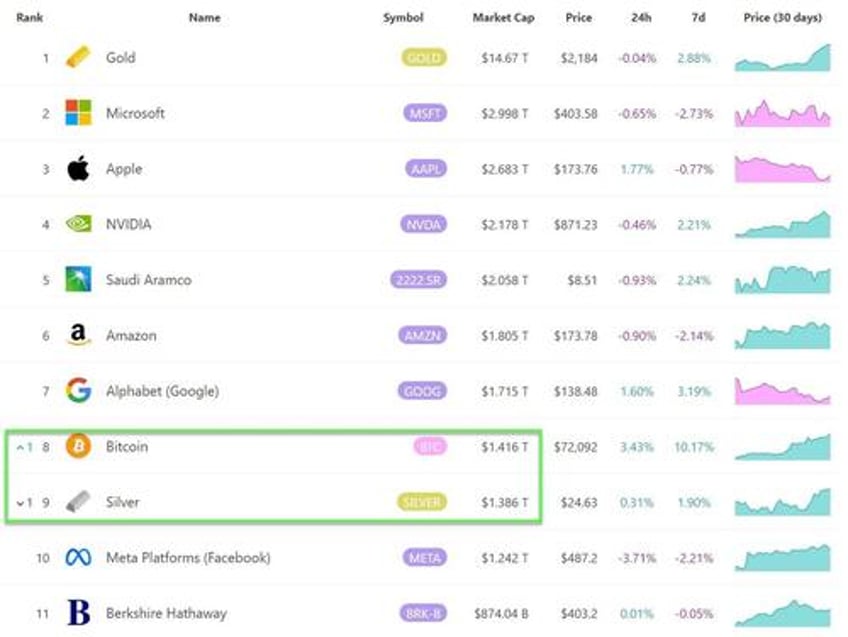

This most recent surge has lifted Bitcoin's total market cap above that of Silver, becoming the 8th most valuable asset in the world...

CoinDesk reports that newsletter service LondonCryptoClub attributed gains to a "confluence of factors."

"Asia is buying in an illiquid market coupled with continued positive news, with the London Stock Exchange just announcing it will take applications for BTC and ETH ETNs. The powerful demand-supply dynamic from the BTC ETFs continues unabated," they said.

"Meanwhile, the macro, which had been a headwind, has now become a tailwind as U.S. rates and the dollar appear to have topped out and are turning lower. Additionally, as we approach key resistance levels, short-term speculative traders trying to call a top, short into these key levels and then get liquidated, causing a pseudo negative gamma effect which propels us higher."

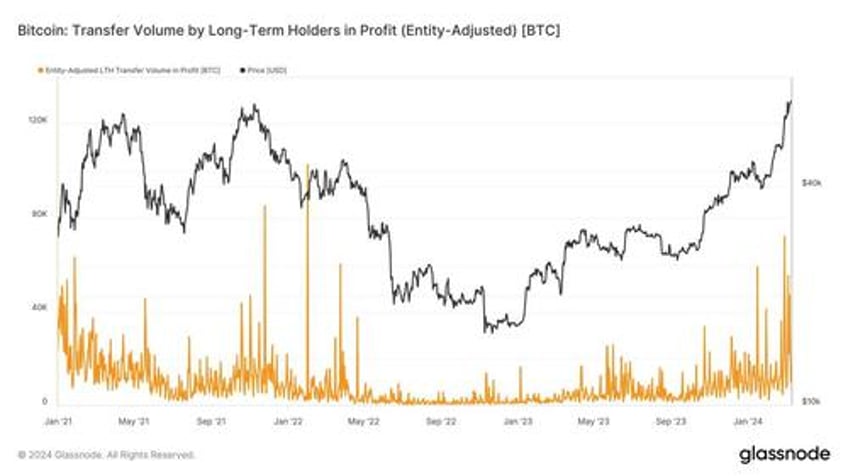

Additionally, as CoinTelegraph reports, amid the inbound price discovery, seasoned Bitcoin hodlers are keeping their hard-earned coins firmly in their wallets.

Data from on-chain analytics firm Glassnode shows long-term holders (LTHs) not yet matching transfer volumes seen during 2021, the year when BTC/USD first hit $69,000.

“Bitcoin’s most convicted holders are still holding at unrealized profit levels that usually occur well before the cycle peak,” it told X followers on March 11.

Even President Trump has come around the the idea of Bitcoin...

If you're a single issue voter regarding crypto - and most of you are not, but if you are! - there is simply no comparison between Trump and Biden this fall.

— Ryan Selkis (d/acc) 🇺🇸 (@twobitidiot) March 11, 2024

One will usher in common sense regulation, and the other will all but destroy the industry in the U.S. https://t.co/6ADCdJB77Z

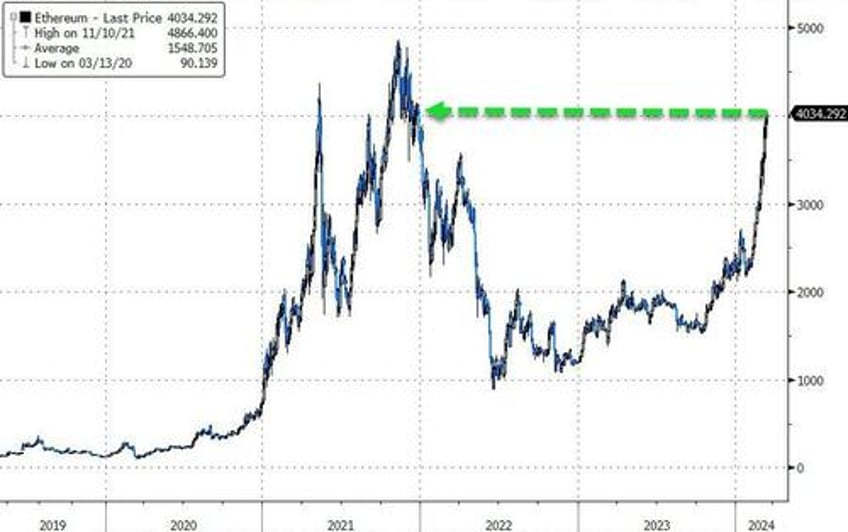

And it's not just Bitcoin that is seeing investor interest as Ethereum tops $4000 for the first time since Dec 2021...

Source: Bloomberg

Ether’s price performance appears to be boosted by Ethereum’s upcoming Dencun update and the possible approval of a spot Ether exchange-traded fund (ETF) by the SEC.

CoinTelegraph reports that the Dencun upgrade, the most significant improvement to the Ethereum network since the Merge, aims to implement a number of Ethereum Improvement Proposals (EIPs), including EIP-4844, which introduces “proto-danksharding.”

Proto-danksharding is a feature that allows the blockchain to use blobs, thereby simplifying the transaction process by storing some data off the blockchain, speeding up transactions and cutting costs for layer-2 chains and rollups that depend on Ethereum.

Ethereum developers have set the Dencun mainnet to go live on March 13.

Bloomberg ETF analyst James Seyffart believes the SEC will not take as long to process Ether ETF applications as it did with Bitcoin ETFs. In a Feb. 7 post on X, Seyffart that May 23 is the “only date that matters” when it comes to Ether ETFs.

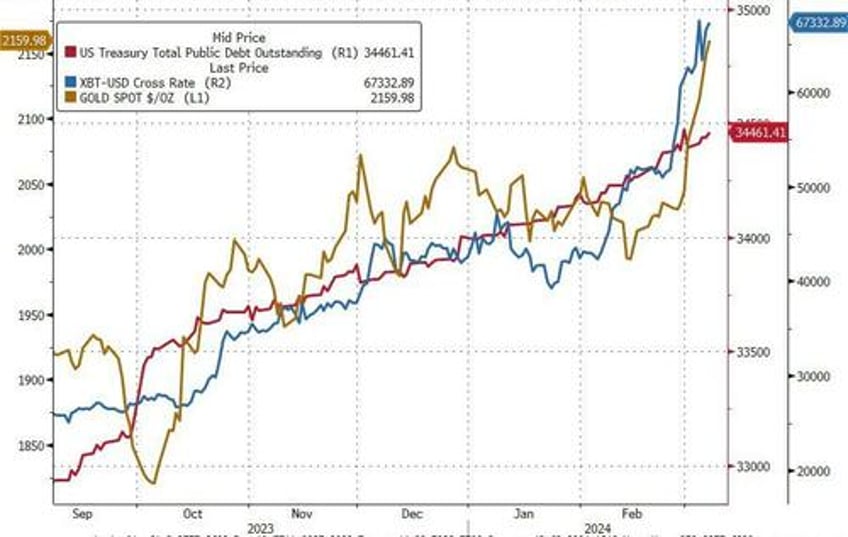

Finally, it appears more people are realizing 'why' alternative currencies (like crypto and precious metals) have seen such demand recently.

As CoinTelegraph reports, in an X post on March 11, entrepreneur and angel investor Balaji Srinivasan argued that Bitcoin is the only realistic solution to escape the inevitability of unsustainable government spending and potential asset confiscation.

“We’re in the looting-the-treasury phase of imperial collapse,” the former Coinbase chief technology officer told his 994,000 followers.

Srinivasan argued that government debt and wasteful spending continue to grow rapidly at unsustainable levels. U.S. national debt is currently at a record high of $34.5 trillion, increasing 25% since 2020.

U.S. national debt since 2000. Source: Bloomberg

Srinivasan, a general partner at Andreessen Horowitz (a16z), said there are four approaches to the problem: Deny it is happening, fix it through political processes, give up, and “simply feed yourself at the trough,” or:

“Starve the beast with Bitcoin, which is money they can’t easily seize or print.”

“The last is radical but actually realistic,” he said, adding that government deficits are now at $10 billion per day and growing.

Rich Dad Poor Dad author Robert Kiyosaki also advised “being prepared” and investing in store-of-value assets such as Bitcoin in a March 11 post.

“Debt increasing by $1 trillion every 90 days. America is sick. Prepare now. Buy more gold, silver, Bitcoin. Please take care.”

Meanwhile, Srinivasan also warned that as financial reckoning approaches, the “ravenous state” may consider confiscating private assets.

Srinivasan offered a handful of examples, such as the seizing of assets from protesting Canadian truckers, freezing Russian assets and the “weaponization of Delaware against Elon [Musk] and New York against [Donald] Trump.”

“Private property will not be protected by the state in a bankrupt Blue America,” he said before adding:

“Fortunately, we have Bitcoin, which isn’t dependent on the state and can’t easily be seized.”

Finaly, one headline that raised an eyebrow was that BlackRock’s spot Bitcoin ETF has overtaken MicroStrategy’s holdings of the cryptocurrency.

According to data compiled by BitMEX Research, BlackRock’s IBIT holds 197,943 BTC, worth over $13.5 billion as of March 8, nearly 40 trading sessions after the United States Securities and Exchange Commission approved nine new funds on Jan. 10.

While not an ETF issuer, technology firm MicroStrategy has built a portfolio of 193,000 BTC as part of its corporate treasury strategy.

MicroStrategy’s CEO, Michael Saylor, has no plans to sell its Bitcoin reserves.

“I’m going to be buying the top forever. Bitcoin is the exit strategy,” Saylor said, speaking to Bloomberg on Feb. 20.