Back in late March, when prevailing consensus was that the SEC would not approve an ethereum ETF and when its price had dramatically diverged from that of bitcoin, we took the other side.

Why was that?

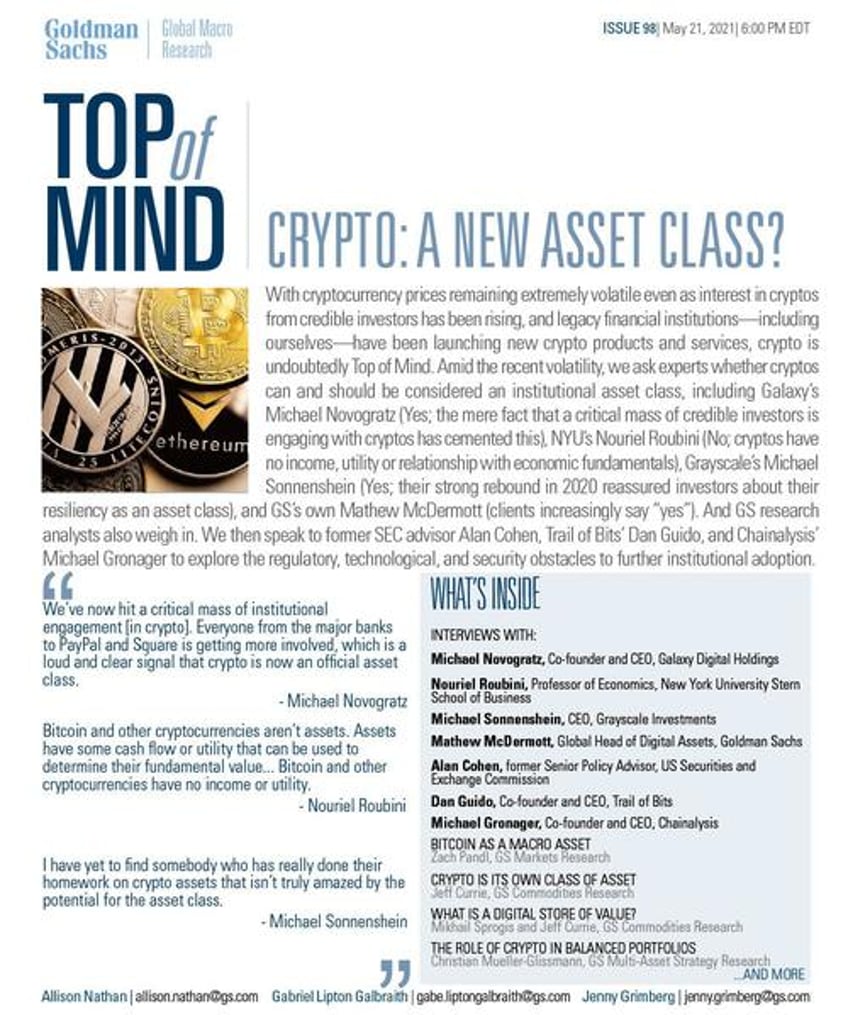

For several reasons: first of all, recall that in recent years, Wall Street had traditionally held ethereum, due to its smart contract nature and flexible architecture, in much higher regard than the relatively boring bitcoin, whose only role was to be "digital gold". None other than Goldman Sachs said, three years ago when it initiated coverage on the crypto sector, wrote that bitcoin is a good asset, and "ironically" will be used as the "scarce resource" to make PoS systems work "instead of natural resources", but while bitcoin may end up being a one-trick pony (if quite valuable) it is the new blockchain platforms - like Ethereum - that will serve as the basis for a "large market of trusted information", as Goldman puts it "like Amazon is for consumer goods today" (Pro subscribers can find the full Goldman report can be found in the usual place).

But it's not just Goldman: none other than the most important man in the world of finance (sorry Jamie Dimon), the head of Blackrock - which buys and sells ETFs, bonds, and any other asset class at the Fed's bidding - Larry Fink, said he is backing an ether ETF just after the SEC gave approval to Bitcoin. Specifically, the king of Wall Street, said "I see value in having an Ethereum ETF. These are just stepping stones towards tokenization and I really do believe this is where we're going to be going." And whatever Larry sees, and wants, Larry gets.

Part 2: ETH ETF pic.twitter.com/qnmB7azyQN

— Cryptik1.eth |🛸 (@Cryptik1E) January 12, 2024

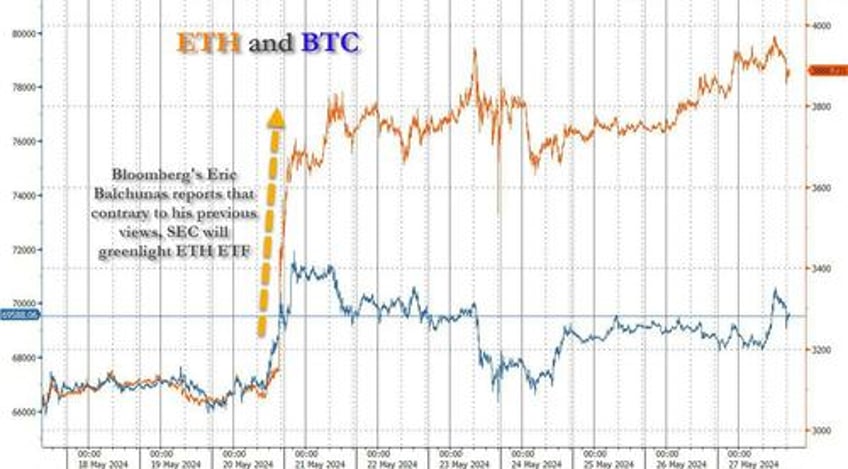

That said, it was back in late March when - with just 2 months left until the SEC's Ethereum spot ETFs decision - some industry luminaries were extremely skeptical that the regulator will be as "forthcoming" this time as back in January with bitcoin, most notably Bloomberg's ETF guru Eric Balchunas who back then gave just 35% odds of an Ethereum ETF being approved in May, as "we’re 73 days from the final deadline, and there’s been no contact or comments from the SEC to the issuers. That’s not a good sign... The SEC has to give comments and the issuers have to work on correcting them. They may have to refile and they might even want to have a couple of meetings — it’s kind of a long process."

We, for one, did not agree with Balchunas, instead arguing that - as noted above - what Larry wants, Larry gets...

Fink's endgame is ETH: he has repeatedly said the goal is tokenization

— zerohedge (@zerohedge) March 10, 2024

"I see value in having an Ethereum ETF. These are just stepping stones towards tokenization and I really do believe this is where we're going to be going."https://t.co/MfGAqHZLWc

.... and neither did Standard Chartered's analyst Geoffrey Kendrick - the same one who correctly predicted the explosive bitcoin ETF accumulation which would send it to $100,000 by year-end, and also a $4,000 ethereum price target by May (it was hit in March) - and just as he saw much more upside to bitcoin, he saw even more potential gains for ether.

That's because according to Kendrick, "ether ETF approval is coming one way or another", and the SEC would do so on May 23, the final deadline for the first batch under consideration, and consistent with the timeline for the SEC’s January 2024 approval of Bitcoin ETFs: "Albeit I note this is now a non-consensus view. I think the process should be the same as it was for the BTC ETFs and I don’t see why the SEC would not approve" especially since in the UK, the LSE announced on 11 March that it would accept applications for ETH and BTC ETFs, which Kendrick's think increases the chances of US approval.

Two months later, the prophetic Kendrick was once again proven correct, when against the odds the SEC did what he - and ZeroHedge - said it would, when it approved spot ether ETFs on May 23 (reportedly following a last minute U-turn to the Biden administration's notorious anti-crypto stance, which we correctly warned over a year ago would end up being a very political issue).

The ETH ETFs had their so-called 19b-4 forms approved last night, after US cash markets closed. This means the S-1 registrations still need to go live for them to start trading, something which will take days/weeks to process. The S-1 process delay was as expected given the rapid turn around in the SEC over the past days (there was essentially not enough time for this to happen yesterday).

Needless to say, the May 23 ETH ETF approval - and its leak two days earlier - has already had a dramatic impact on the price of ether, as shown in the chart below.

But, as Kendrick writes in his latest research note, the upward move in ether is only just getting started.

As the Standard Chartered analyst writes in his ETF approval post-mortem, "what this means is that in the next little while we will have several spot ETH ETFs live in the US in the same way we have several BTC ETFs. For clarity, those approved applications were from Grayscale, Bitwise, iShares, VanEck, ARK21, Invesco, Fidelity and Franklin. This makes 23 May the same as 10 Jan was for BTC ETFs, but unlike 11 Jan the spot ETH ETFs are not live today."

Kendrick then writes, that for him, the rapid turnaround by the SEC on this has a number of key implications:

- ETH is not a security

- Other ETH like coins (a number of which the SEC claimed were securities in the 2023 XRP case) are also not securities. In several cases the core technology is so similar to ETH it would be difficult for the SEC to claim they were securities given the ETH position

- The crypto industry now seems to have political backing on both sides of the aisle

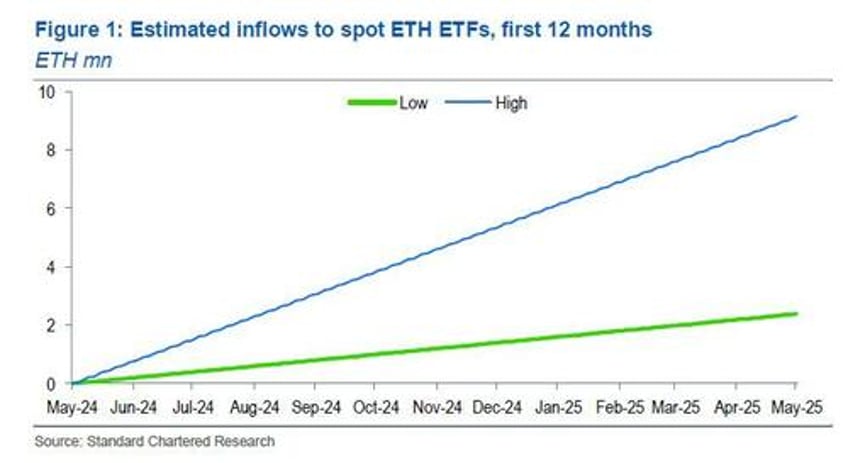

The next, almost immediate effect, will be inflows to the ETH ETFs, starting some time in June, and here Kendrick reiterates his views on this as he first presented them back in March: $15-45BN in inflows in the first 12 months, and ETH at $8,000 by year-end.

Meanwhile, for BTC ETF inflows, the recent improvement will continue according to the Std Chartered analyst, who writes that "a portfolio containing both BTC and ETH ETFs is likely attractive and the industry has been further validated by the SEC’s decision on ETH. So both ships should rise, BTC at USD150,000 by year-end."

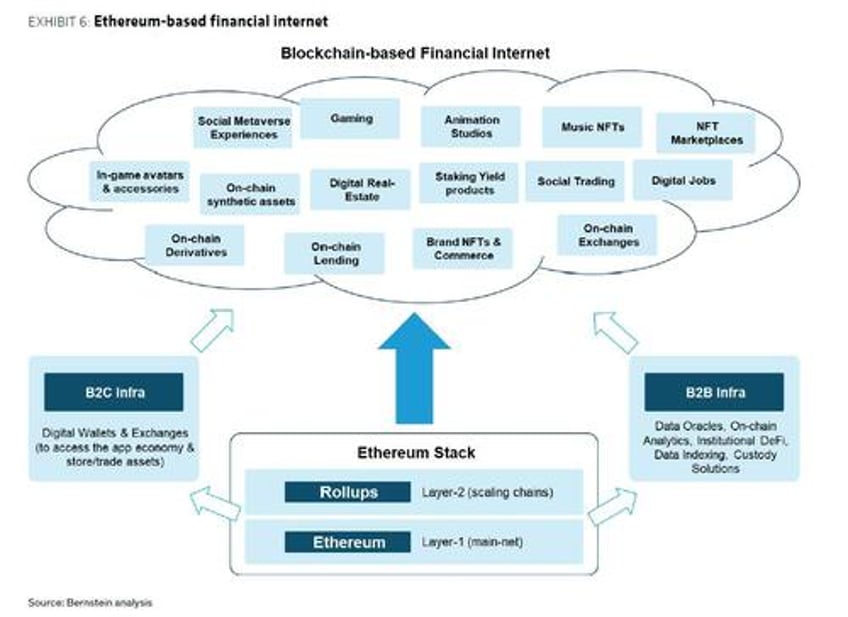

But while bitcoin is then expected to languish around that level, the real upside for ether will only just become apparent, and in 2025 Kendrick expects the ETH-BTC cross to track higher, back to 7%, as real world use cases on ETH - the same ones laid out by Goldman three years ago - start to take shape. This, he believes, "will see ETH to $14,000 by year-end 2025." There could be more gains: the report goes on to note borrow heavily from the Goldman ETH initiation report above, and states that...

"If real-world use cases start to take practical shape before the end of 2025 (we see gaming as the most likely), then we think markets will start to see ETH as the digital assets version of a big tech stock. Indeed, we see several crossovers between tech and ETH, but because tech (most recently via AI) is already visible to end-users, it has taken most of the limelight so far. We expect that to change over time in favour of ETH, which is effectively a behind-the-scenes technology solution. This is because ETH’s smart contract platform enables future applications in much the same that Apple’s iOS system enables the building of apps.

In that scenario, we see the ETH-BTC price ratio rising back to the 7% level that was in place for 18 months from mid-2021 to end-2022. This would present further upside to our estimated USD 14,000 price level by end-2025."

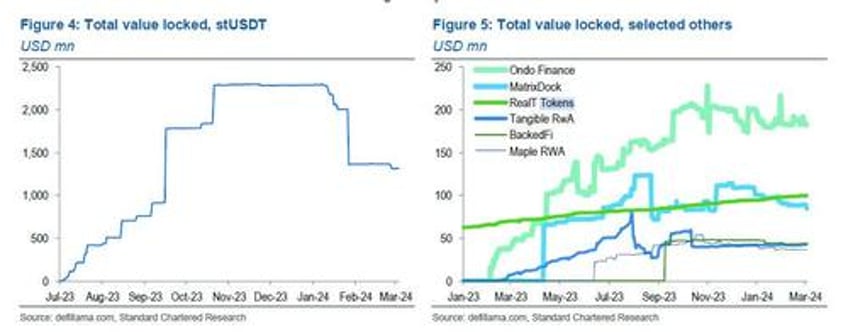

Impossible, you say, no way ETH rises 3x from its current price of $3,900 (and almost 5x from its pre-ETF approval price of $3,000). Perhaps, but consider the potential rise in use cases in the aftermath of the Dencun upgrade which has sent the cost of layer 2 transactions as cheap as Solanas. As a result, Kendrick believes that ETH’s use cases will "evolve towards gaming and tokenization, adding significant demand via the existing NFT and DeFi channels, respectively. Importantly, this should provide ‘proof of concept’ examples in which real-world industries come on-chain to exploit the benefits of Ethereum over their existing setups. We expect significant developments on these fronts by 2025-26."

Note, the Standard Chartered analyst is not the first to say the true value of ETH is in tokenization: initially it was Goldman, and most recently it was the king of Wall Street, Blackrock's Larry Fink, who as we noted above, said "I see value in having an Ethereum ETF. These are just stepping stones towards tokenization and I really do believe this is where we're going to be going."

But while Goldman and Blackrock betting on ETH would be effectively a home run, what would guarantee a trifecta would be the last major holdout joining the bandwagon, and that's precisely what happened two months ago when the bank - whose boss has been the most vocally skeptical of bitcoin in recent years - put its chips on ETH.

In a March 14 note on Coinbase from JPM's Ken Worthington, the crypto analyst echoed Goldman, Standard Chartered and Blackrock, and said that while "the focus of the cryptocurrency marketplace has been the net new money going into U.S. spot Bitcoin ETFs and the positive impact on Bitcoin token prices" it is "ethereum and its native token Ether as a substantial contributor to the cryptocurrency ecosystem, and developer of blockchain technology."

Specifically, JPM writes that "it sees see the progression along the Ethereum roadmap... as driving crypto development, which is a longer-term positive and discuss this further in this research." Compare and contrast that with, well, anything that Jamie Dimon has said about Bitcoin.

There is much more in the full report, including a full fawning section on ETH (that appears to have been taken almost verbatim from the Goldman initiating coverage report)...

... but the bottom line is that while Bitcoin was the pioneer in Wall Street's institutionalization race, having seen the startling success of bitcoin ETF adoption, the financial titans including Goldman, Blackrock - and now - JPM, have set their sights on what comes next, which is something near and dear to the people who manage trillions: the fastest, cheapest and most effective way to tokenize everything, from information, to data, to money itself. And they have picked the token to do it with.

* * *

As we correctly concluded our March Ethereum ETF preview note, when consensus was that the SEC would not approve the infamous ETF, "keep a close eye on what happens on May 23 when the SEC is reportedly pushing hard against ETF approval for the second biggest digital asset: with all three of the largest US financial institutions pushing hard, any resistance will die a quick and painless death."

We were right, and in the end it was the three largest US financial institutions 1, SEC 0.

And now that ethereum has been greenlit and institutionalized amid a dramatic reversal in regulatory sentiment toward the crypto space (as such staunch anti-crypto pawns as Elizabeth Warren have been shown the door), watch as bitcoin gets left behind as suddenly the market realizes that as Bernstein wrote in a recent note (available to pro subscribers), it is Ethereum that is the "next institutional darling"...

... thanks to its "staking yield dynamics (~4-5% in ETH, but could be higher in dollar terms), environmentally friendly design, and institutional utility to build new financial markets"...

... which in the simplest possible terms, means that ETH will soon trade much higher than where it is today.

More in the full notes from JPM, Bernstein, Std Chartered and Goldman