Submitted by QTR's Fringe Finance

You can read Part 1 of this list here.

It seems like just yesterday I was writing about the 23 stocks I was watching for 2023. Now, with almost all of the year gone by, it’s time to look back at 2023 and talk about the 24 names I’m watching heading into 2024.

For 2023, I will start with the ugly – all 4 names that I thought would make good shorts for the year were up multiples of their prices heading into 2023, fueled by speculation in the options market and short squeezes. These names — Affirm (AFRM), SoFi (SOFI), Upstart (UPST), and Carvana (CVNA) — wound up bucking the trend in a serious way not only due to a squeeze, but also due to the overall market being up ~20% in a year where I expected the economy to come to a grinding halt (which is happening, just slower than expected).

Aside from those four trainwrecks, most of the names I was watching on the long side did decent. The biggest wins over this past year came from the running theme of cybersecurity, which saw names like Palo Alto Networks (PANW) and CrowdStrike (CRWD), along with the iShares Cybersecurity and Tech ETF (IHAK).

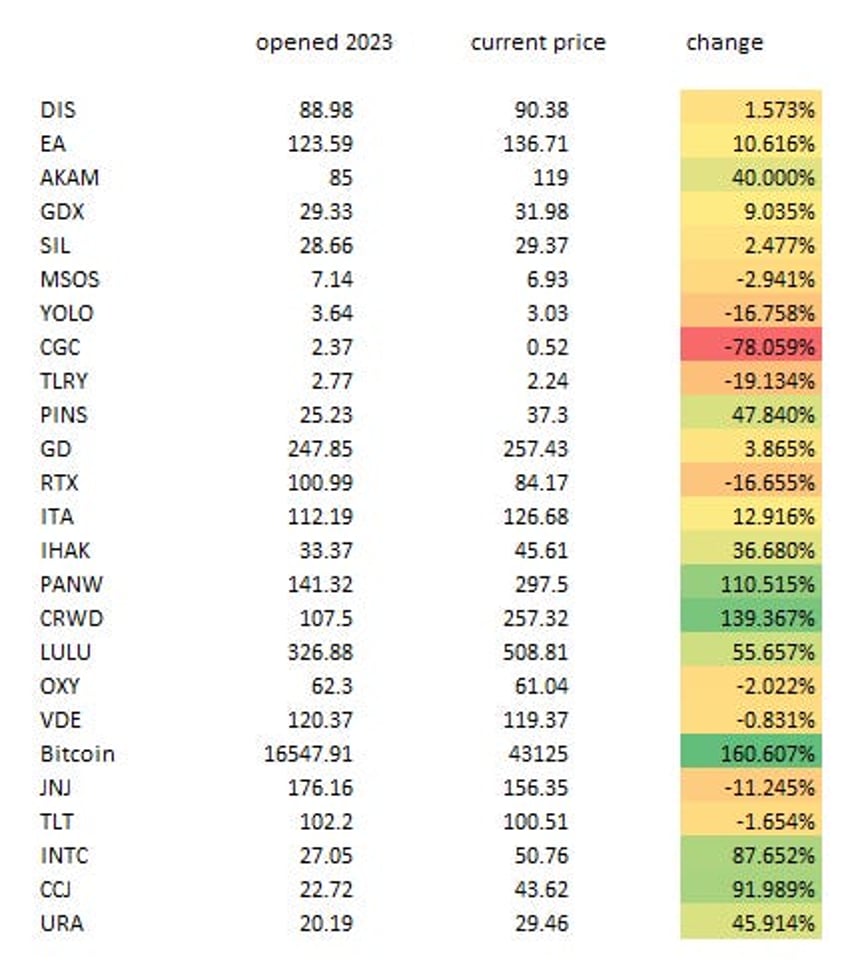

While my picks in the marijuana sector wound up lagging, individual growth names like Lululemon (LULU) and Pinterest (PINS) had great years. Additionally, uranium also had a great year with Cameco (CCJ) and Global X Uranium ETF (URA) outperforming — as did Bitcoin and Intel (INTC). Names like Disney (DIS), all of the defense names, and both Occidental Chemical (OXY) and the Vanguard Energy Index Fund (VDE) wound up for the most part unchanged for the year.

Here’s a very quick, unscientific, very loose spreadsheet of all the long names, and how they performed in 2023 as of sometime around 12/27/2023 (chart subject to below disclaimer). For the S&P, I used 3853 to start the year and 4780 to end it, representing a benchmark of about 24%.

(Disclaimer: I am terrible at math, didn’t double check these numbers at all, used both close price and total return figures where applicable, and took YE figures from either 12/26 or 12/27 depending on which day I worked on it, and don’t even know why I write a financial blog to begin with).

Heading into 2024, my focus is on some familiar names and sectors, but also on some new ones. First, let’s review my outlook for the market in 2024.

My general outlook isn’t going to be much of a surprise to those who read me regularly. Starting off the new year, I feel like the world is replete with risk, not the least of which is the uncertain outcome of the forthcoming US election, with equities overpriced pretty much by any type of valuation you want to look at them with.

By default, almost everybody in the industry, and in the financial media, is bullish heading into the new year, citing the backward reasoning of Fed rate cuts, which the market is already pricing in despite the fact that the economy hasn’t even felt the shock of rate hikes yet. This recent article lays out more about why I believe citing rate cuts as a bull case is a fool's errand.

The main themes I’m going to be watching heading into 2024 are as follows...(READ THIS FULL MACRO ANALYSIS AND GET THE FULL LIST HERE).

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. Contributor posts and curated content are posted either with the author’s permission or under a Creative Commons license. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.