Subscribe on our website www.gmgresearch.com

3 MAJOR THEMES IN 2025

Underestimated AI Impact and Infrastructure Spending; The transformative power of AI over the next 3-4 years remains vastly underestimated - this is not a bubble, but a fundamental reshaping of the economy. Traditional economic cycles are becoming obsolete as AI enables companies to scale through technology rather than workforce expansion. Massive infrastructure buildout (spanning AI, EVs, and crypto) will require capital market funding on a scale comparable to the Industrial Revolution. This transformation will be funded through both public and private markets.

Rethinking Traditional Investment Approach; Traditional investment frameworks, including the 60/40 portfolio model are dead. The market is shifting from broad asset allocation to thematic factor investing, requiring more dynamic portfolio management as historical trends become less reliable. Investors must focus on company-specific opportunities rather than regional exposure, reflecting the S&P 500's increasingly concentrated nature. This environment demands a pro-risk stance, particularly in U.S. markets, as the AI theme broadens beyond tech. Static allocations and traditional portfolio construction methods don’t work.

Higher Interest Rates, USD and Inflation; A new paradigm of persistently higher rates and inflation is here, driven by policies focusing on deregulation, tax relief, and tech innovation. The U.S. economy shows resilience even with higher rates, supported by broad earnings growth beyond just AI. Global economic fragmentation is accelerating, particularly in U.S.-China competition. Supply chain reorganization accelerate these trends.

4. Bitcoin Higher in 2025 (probably beating most asset classes again.)

Positioning:

Increased overweight U.S. equities

Underweight long-term U.S. Treasuries

Positive on infrastructure

Risk Factors:

New political leadership driving policy volatility

Spike in long-term bond yields

Real War

Key changes needed:

More emphasis on tactical views vs long-term allocations

Active portfolio management

Company-specific rather than general index investing

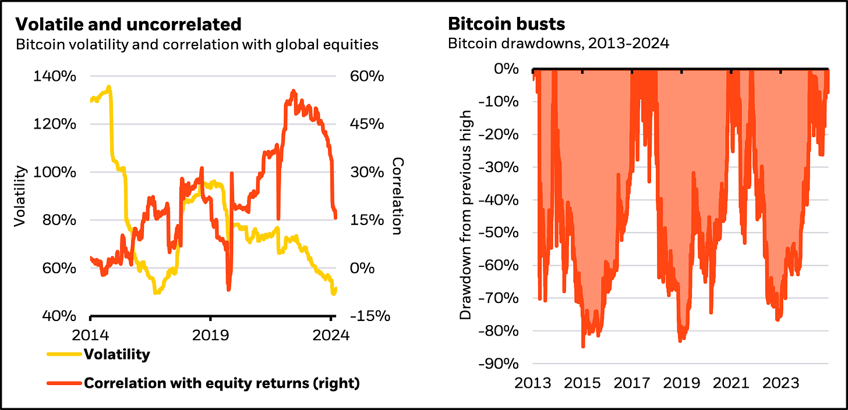

Bitcoin vol and equity correlation heading lower over time.

Illiquid Assets: Sealed Trading Card Products are going way higher.

Sealed collector’s Magic The Gathering (LOTR)

Pokemon Prismatic Evolutions (if you can get your hands on it)

Flesh and Blood Welcome to Rathe Sealed First Edition Alpha Print

Classic graded video games (Halo 2, FF7, WoW)

Return always wants its risk payment.

NOT INVESTMENT ADVICE. Only for entertainment.