The Case For America Buying Greenland

With President-elect Trump saying today that he would consider pressuring Denmark into selling Greenland to the United States, it's worth sharing perspectives on this from two of the best posters on X, one American, and the other Danish. Let's start with the American, Nate Hochman. Then we'll share the Dane, Jonatan Pallesen's take, and then we'll close with a brief market note.

Back in 2019, when Trump first proposed to buy Greenland, the Prime Minister of Denmark—which currently owns Greenland—called it "absurd."

— Nate Hochman (@njhochman) January 4, 2025

This week, Greenland announced their intent to pursue independence from Denmark. The PM says the process has "already begun." pic.twitter.com/6vOYGDNcmr

But despite its natural resources, Greenland’s economy is fragile—heavily dependent on fishing and grants from Denmark.

— Nate Hochman (@njhochman) January 4, 2025

If they break from Denmark, they'll need new economic partnerships—and frankly, new benefactors. Joining our sphere of influence makes a great deal of sense. pic.twitter.com/UqQW70kMWP

U.S. territorial expansion isn't ancient history. It's continued well into the modern era—including quite recently.

— Nate Hochman (@njhochman) January 4, 2025

Just over a year ago, we gained roughly 386,000 square miles—more than two Californias—of maritime territory in the largest expansion since the Alaska Purchase. pic.twitter.com/s0LOuhV5Qn

America's major expansions—The Louisiana Purchase (1803), Alaska Purchase (1867), and Virgin Islands Purchase (1917)—were all criticized as foolish when they were proposed.

— Nate Hochman (@njhochman) January 4, 2025

Alaska was famously panned as "Seward's Folly." Today, it's one of our most strategically vital states. pic.twitter.com/WIrRy4lOyi

Greenland sits at a critical chokepoint between America and Europe. It's essential for missile defense and naval operations.

— Nate Hochman (@njhochman) January 4, 2025

China knows this. They've repeatedly tried to build airports and research stations in Greenland—and even attempted to buy a former U.S. naval base there. pic.twitter.com/g2WZfnYtn3

The numbers are staggering. Greenland has:

— Nate Hochman (@njhochman) January 4, 2025

• 38.5 million tons of rare earth oxides

• Massive uranium deposits

• Vast oil and gas reserves

• Precious metals

• Some of the world's largest fresh water reserves

And all of this will only become more accessible as ice melts. pic.twitter.com/pmeheTZ8I6

As for the "not for sale" thing—that has preceded almost every major territorial acquisition in U.S. history.

— Nate Hochman (@njhochman) January 4, 2025

Napoleon initially saw Louisiana as part of a broader plan to rebuild France's empire in the New World. Just a few years later, he sold it to the U.S. for $15 million. pic.twitter.com/uKZk6lQvic

Trump's proposal was a serious idea—and it's even more serious today than it was when he first proposed it. Expansion is a time-honored American tradition. (In a fundamental sense, it's the essence of the American ethos itself). pic.twitter.com/CdX2bFCaBH

— Nate Hochman (@njhochman) January 4, 2025

One thing Hochman and Pallesen agree on is Greenland's vast, untapped mineral wealth, as you'll see below.

The Case For Denmark Selling Greenland To The US

Why my country Denmark should sell Greenland to the U.S.:

• USA is a highly valued ally to Denmark.

• We are a small country and we can't contribute that much to the alliance. But we can contribute by selling Greenland, and that's something.

• Denmark doesn't have the capability to mine or extract the oil. Selling to someone who can makes sense, as does not selling the rights to China.

Whether the people of Greenland would want to join the U.S. is not a real hurdle. There are 56,000 people living there. For about $5 billion you could give each of them $100k, and they would agree.

But Denmark should also receive a reasonable payment.

There are vast metal deposits underground there and possibly 50 billion barrels of oil equivalent. And we are the rightful owners of this.

Greenland has been under control of the Danish crown since before USA was even a country. (Officially since 1814.) We have taken care of Greenland, and about 30% of its GDP is block grants from Denmark.

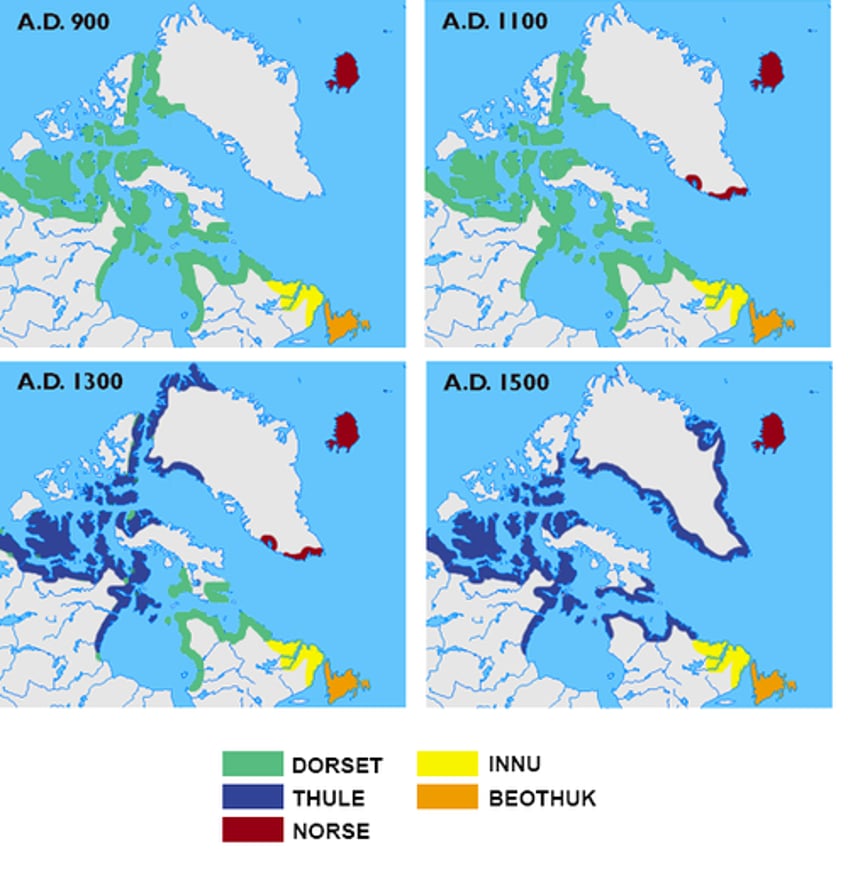

Also noteworthy, our Norse ancestors inhabited Southern Greenland before the ancestors of the Inuit (Thule culture).

Market Note: The Hindenburg Discount

ZeroHedge readers may recall that Hindenburg Research released their bearish analysis of Carvana (CVNA) last week. The gist of it was accounting irregularities in the past might jeopardize the company's financing. As we noted on our trading Substack today, their bearish case was effectively invalidated yesterday, when Ally Financial renewed its financing deal with Carvana.

In light of that--and Carvana appearing in our top names on Monday--we placed a bullish options trade on the stock, which you can read about at the link below.

If you'd like a heads up next time we place a trade, you can subscribe to our trading Substack/occasional email list below.

And if you're long Carvana and still worried about Hindenburg's short thesis for it, you can download our optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone).

If you'd like to stay in touch

You can follow Jonatan Pallesen on X here, and visit his Substack here.

You can follow Nate Hochman on X here.

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).