Despite signs of economic growth and a lower inflation rate in the U.S., Alignable's December Small Business Revenue Report, released today, reveals that the majority of small business owners are ending 2023 on a low note.

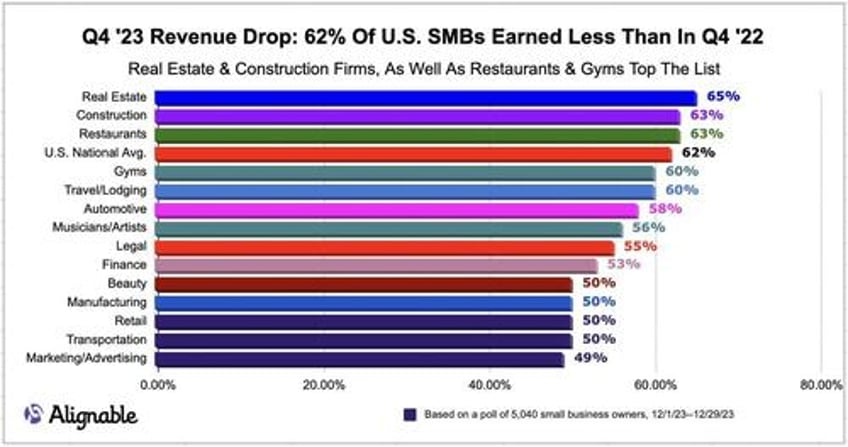

Revenue losses are up even higher than predicted this quarter -- with 62% of small business owners saying they earned less during Q4 2023 than they did in Q4 2022. That's up 10 percentage points from their gloomy expectations stated in the fall, where 52% anticipated a disappointing fourth quarter.

In fact, for the first time in three years of surveying small business owners, Alignable noted that "ramping up revenue" is now the No. 1 concern among SMB owners, pushing their struggles with inflation to the No. 2 spot on their list of financial worries.

These findings are based on input from 5,040 randomly selected small business owners surveyed from 12/1/23 to 12/29/23, along with 100,000+ historical responses. Here are other highlights:

- The stress over producing more revenue is so strong that 37% of those polled now have at least one side job to help bring in extra revenue, and another 56% say they need a side gig to pay for mounting costs. That leaves only 7% saying that concentrating all of their efforts on the business they own is sufficient for the income they require.

- Only 11% say they're starting to feel some relief from inflation, while 64% say continued high prices for many supplies and services are cutting into their margins and forcing them to backslide financially.

- Compounding those issues, still-high interest rates are hurting 52% of small businesses, contributing to a drop in consumer spending at Main Street shops, increased difficulty paying off SBA loans or qualifying for new ones, and other hurdles. Some 46% of this group says that the Federal Reserve would need to drop the current interest rate by at least three points before they could start to recover.

- In December, 41% of SMB renters say they were unable to pay their rent in full and on time, matching November's 2023 rent delinquency record. And 51% are facing rent spikes.

- A high percentage of realtors (65%), construction firms (63%), restaurants (63%), gyms (60%), and retailers (50%) say their revenues have fallen short of what they generated in Q4 2022.

- 67% of NY and OH small business owners say they've had a disappointing Q4 2023, as well, and their peers in other states aren't far behind: IL & FL (64%), NC (63%), CA & MD (59%), PA & TX (58%), CO (55%), & MI (54%).