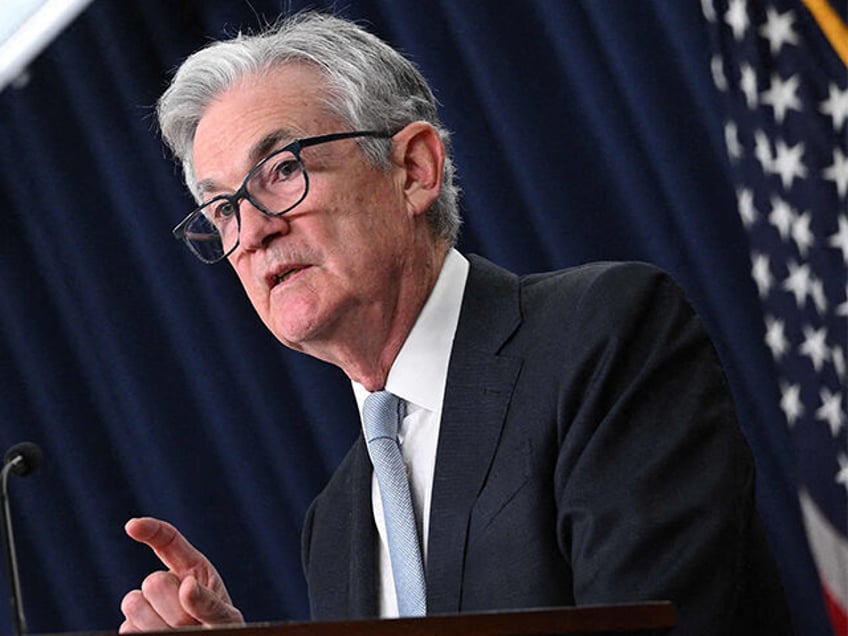

Federal Reserve chairman Jerome Powell signaled that the central bank is probably at the end of its rate hiking cycle and further hikes are unlikely unless there is clear evidence that stronger economic activity is undermining the campaign to bring inflation back down to two percent.

“Given the uncertainties and risks, and how far we have come, the Committee is proceeding carefully,” Powell said in prepared remarks Thursday. “We will make decisions about the extent of additional policy firming and how long policy will remain restrictive based on the totality of the incoming data, the evolving outlook, and the balance of risks.”

Powell said he was pleased with the progress the Fed has made in its fight to bring down inflation and once again emphasized that the Fed remains committed to its two percent goal.

The remarks, delivered at a luncheon in New York, echoed those of several of his colleagues in recent weeks. They appeared to set the stage for the Fed to stop raising rates and to move toward holding rates at their current level.

“My colleagues and I are committed to achieving a stance of policy that is sufficiently restrictive to bring inflation sustainably down to 2 percent over time, and to keeping policy restrictive until we are confident that inflation is on a path to that objective,” Powell said.

Powell reiterated his view that there may still be tightening “in the pipeline” from earlier Fed hikes. Many Fed officials believe that monetary policy often filters through the economy with long lags.

Powell said that although the labor market remains tight there are indications that demand for labor is cooling.

“Job openings have moved well down from their highs and are now only modestly above pre-pandemic levels. Quits are back to pre-pandemic levels, and the same is true of the wage premium earned by those who change jobs,” Powell said. “Surveys of workers and employers show a return to pre-pandemic levels of tightness. And indicators of wage growth show a gradual decline toward levels that would be consistent with 2 percent inflation over time.”