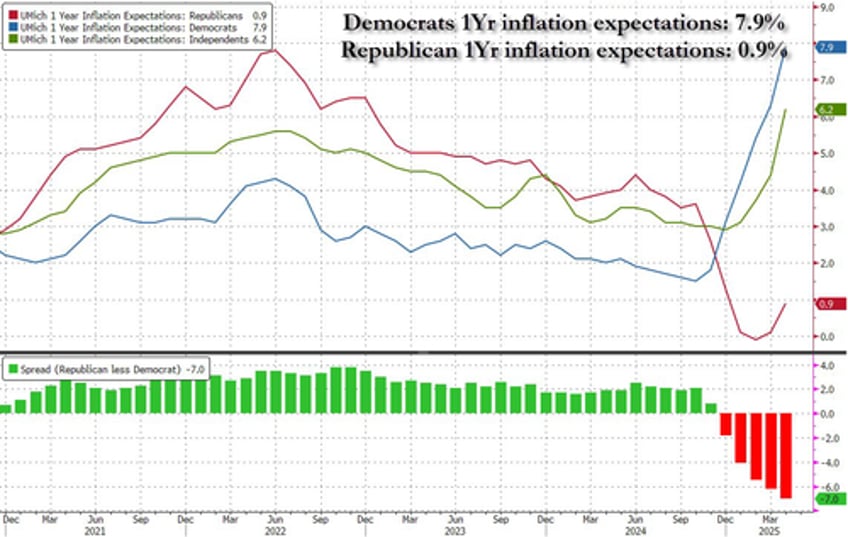

The cognitive dissonance for Democratic UMich survey respondents is about to go to '11' as various 'hard' data signals show inflation falling far more rapidly than expected (and not the hyperinflationary hell they were told to expect by the legacy media).

You know you've pushed the Overton Window too far when even the chair of The Fed shrugs off your extreme data points as an outlier with partisan bias.

So what will preliminary April data bring?

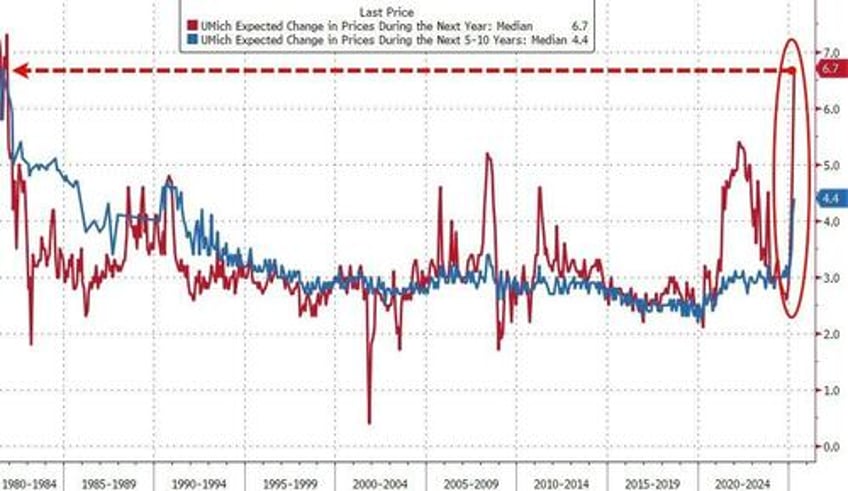

Year-ahead inflation expectations surged from 5.0% last month to 6.7% this month, the highest reading since 1981 and marking four consecutive months of unusually large increases of 0.5 percentage points or more. This month’s rise was seen across all three political affiliations. Long-run inflation expectations climbed from 4.1% in March to 4.4% in April, reflecting a particularly large jump among independents.

Source: Bloomberg

Democrats dominate the crazy with expectations for a 7.9% surge in prices this year...

Source: Bloomberg

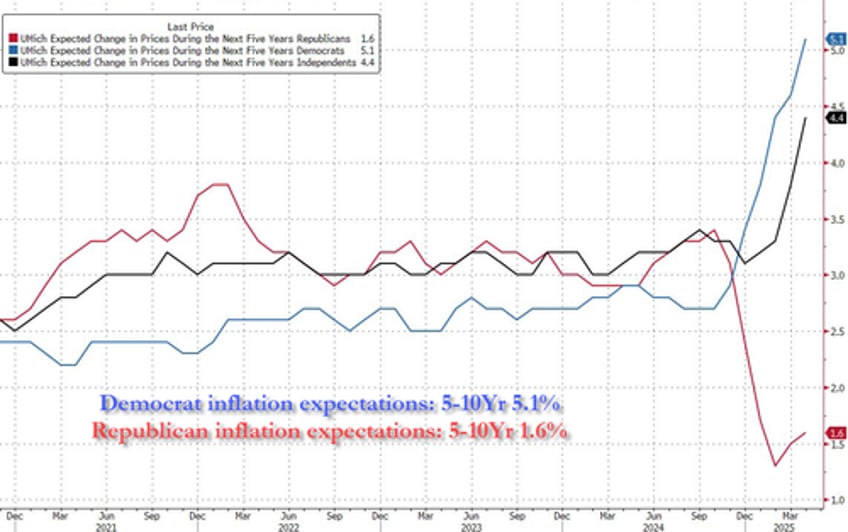

And 5-10Y expectations for Democrats are up at 5.1%!!

Source: Bloomberg

Consumer sentiment fell for the fourth straight month, plunging 11% from March. This decline was, like the last month’s, pervasive and unanimous across age, income, education, geographic region, and political affiliation.

The preliminary April sentiment index slid 6.2 points to 50.8, the weakest reading since June 2022, according to the University of Michigan. Economists called for a decline to 53.8, based on the median projection in a Bloomberg survey that had a wide range of estimates.

Expectations plunged to the lowest since April 1980...

Sentiment has now lost more than 30% since December 2024 amid growing worries about trade war developments that have oscillated over the course of the year.

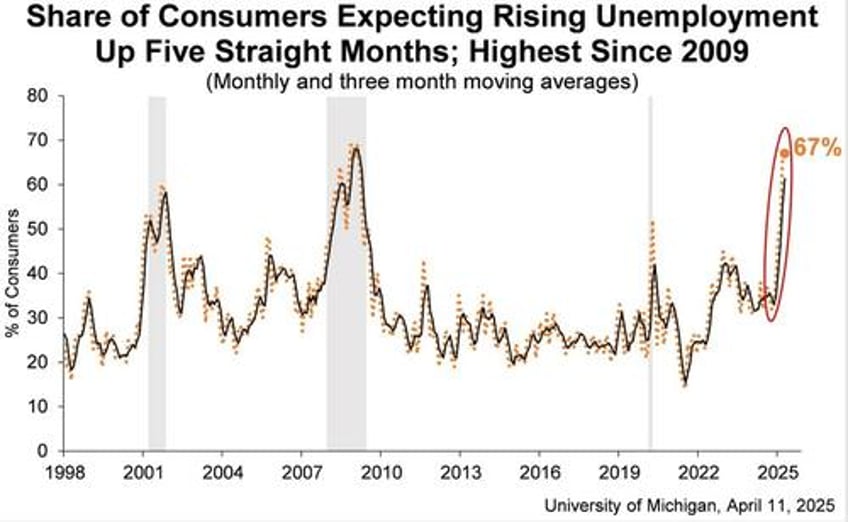

The share of consumers expecting unemployment to rise in the year ahead increased for the fifth consecutive month and is now more than double the November 2024 reading and the highest since 2009.

Unsurprisingly, trade policy continues to weigh heavily on consumers’ minds.

“Unemployment expectations have worsened sharply over the last few months, which may not lead to a pull-back in spending if consumers do not expect to be personally affected by layoffs or income losses,” Joanne Hsu, director of the survey, said in a statement.

“Alarmingly, though, consumers are now worried that they will be personally affected.”

About two-thirds of consumers spontaneously mentioned tariffs during interviews, up from about 40% in February and March of this year.

Evidence from the past several months suggest that consumers may not feel much relief from the April 9 social media post reversing some tariff increases.

Comparing Democrats view of the inflationary outlook to the 'hard' inflationary data...

Source: Bloomberg

It would appear all that tariff terror propaganda worked eh?