Amid Trump's anti-Iran 'maximum pressure' and the current climate of the White House telling Tehran to negotiate a new nuclear deal or else bombs could fly, fresh statements from US Energy Secretary Chris Wright just added fuel to the fire.

Wright while on a trip to Abu Dhabi told Reuters that the United States is able to step up pressure on Iran and stop its oil exports altogether with force if need be, in order to get Tehran to the table on its nuclear program.

He described provocatively that the US "can follow the ships from Iran" as "we know where they go" and thus the Islamic Republic's export of oil can be fully stopped.

Crucially he added that in his view the market can "tolerate squeezing out" of Iran oil exports if this full-court press option is pursued.

This would necessarily involve US militarization of shipping lates and strategic oil chokepoints not only in the Middle East but in southeast Asia, while stepping up reconnaissance operations.

The US has already long monitored and condemned Iran's 'shadow fleet' activity and efforts to disguise Iranian oil shipments. China has been the largest customer by far, especially since 2022 when Tehran in the face of expanding sanctions upped its exports with nearly 300 'dark fleet' tankers also going to places like Venezuela, and sanctions-decimated Syria (under Iran-ally Assad at the time).

*MARKET CAN `TOLERATE SQUEEZING OUT' OF IRAN OIL EXPORTS: WRIGHT

— zerohedge (@zerohedge) April 11, 2025

Looks like 3MM barrels about to drop out of the market https://t.co/eTNlnB5Gik

"The Iranian regime relies on its network of unscrupulous shippers and brokers like Brar and his companies to enable its oil sales and finance its destabilizing activities," Treasury Secretary Scott Bessen said Thursday, in rolling out yet more counter-Iran actions to crackdown on its oil and petroleum products.

The new Treasury measures involve the following:

The U.S. Department of the Treasury has unveiled sanctions against a sophisticated maritime network responsible for smuggling hundreds of millions of dollars worth of Iranian petroleum, targeting UAE-based shipping magnate Jugwinder Singh Brar and his fleet of nearly 30 vessels, many of which operate as part of Iran’s “shadow fleet.”

Meanwhile, the U.S. Department of State has simultaneously sanctioned a Chinese terminal operator, along with two additional vessels, that feeds product to a co-called “teapot” refinery.

Operating through UAE-based companies Prime Tankers LLC and Glory International FZ-LLC, the Treasury’s Office of Foreign Assets Control (OFAC) alleges Brar’s network employed an intricate web of smaller Handysize tankers for coastal operations, conducting high-risk ship-to-ship (STS) transfers in waters off Iraq, Iran, the UAE, and the Gulf of Oman.

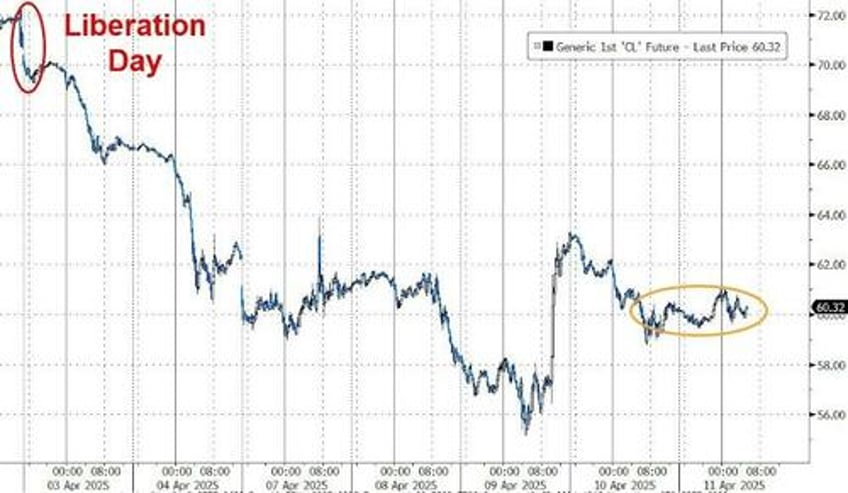

Oil prices dropped slightly Friday upon China announcing its retaliation against the US by raising tariffs on US goods to 125%. The ongoing US-China trade and tariff tit-for-tat has dented demand for oil amid a climate of fear and uncertainty, pushing prices down.

Commenting further on Wright's Friday words, Reuters notes that he said "there will be a positive outlook for oil demand and supply in the next few years under President Donald Trump's policies, and the concern of markets about economic growth will be proven wrong."