A Materials Stock With Solid Fundamentals…

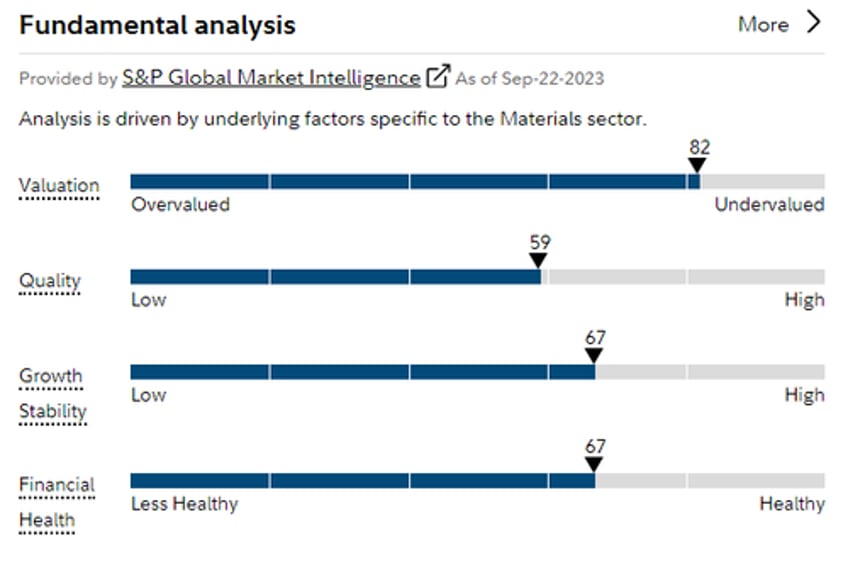

Here’s a snapshot of the fundamentals of a lithium stock that’s been on my radar recently:

Here’s some additional data on it via Chartmill:

Piotroski F-Score: 8 (on a scale of 0-9)

Profitability Rating: 8 (all Chartmill proprietary ratings are on a scale of 0-10)

Growth Rating: 8

Valuation Rating: 8

Health Rating: 9

In addition, there’ve been no insider sales this year.

…But A Beaten-Down Share Price

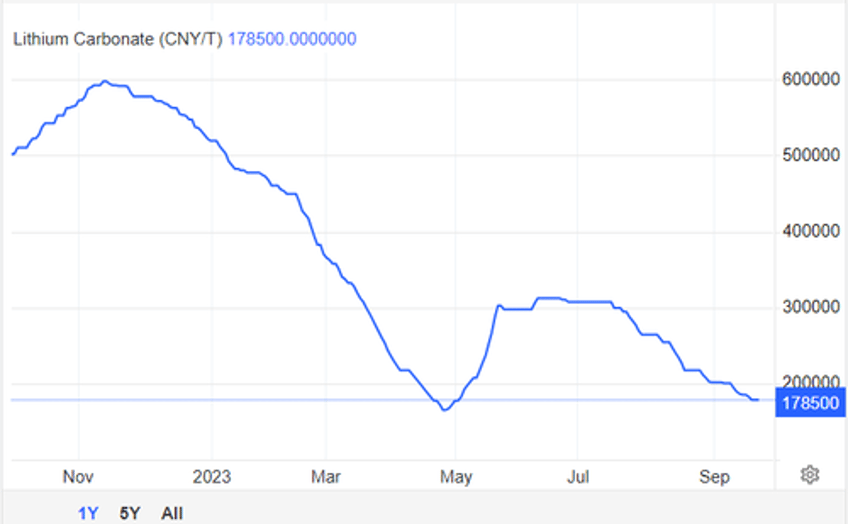

The stock is down nearly 40% since July, mainly because lithium prices have tumbled this year (since China is a major lithium buyer, prices for it are often quoted in CNY, or Renminbi per ton).

Why It Might Be Due For A Bounce

Its RSI (Relative Strength Index) is under 20 currently, indicating that the stock is oversold, and it has short interest of more than 15%. If its next earnings report is even a little better than expected, the stock might get a bounce as short sellers are forced to cover.

Details below.

Read the rest here.

If You Want To Stay In Touch

You follow Portfolio Armor on Twitter here, or become a free subscriber to our Substack using the link below (we're using that for our occasional emails now). You can also contact us via our website. If you want to hedge or see our current top ten names, consider using our website (our iPhone app is currently closed to new users).