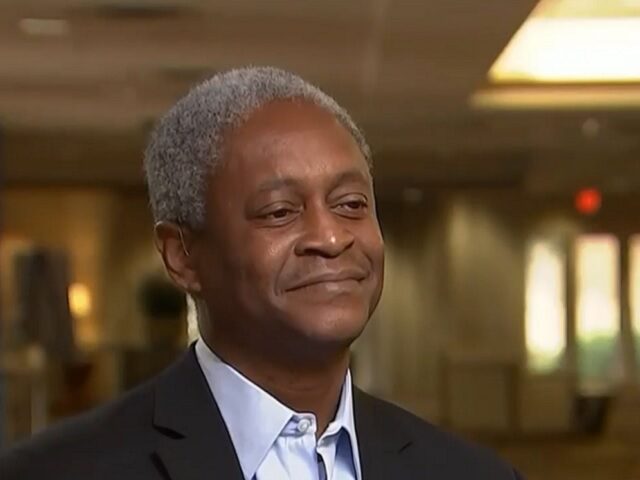

There’s a significant risk that a rate cut from the Federal Reserve could rekindle inflation, Atlanta Fed president Rapahel Bostic said on Monday.

In an essay published on the Atlanta Fed’s website, Bostic argued that the Fed should take a cautious approach to the economy, cognizant that the danger of higher inflation remains and easing monetary policy could fan the flames of rising prices.

In particular, Bostic warned that a premature rate cut could trigger a surge of business activity that would raise demand and push inflation higher.

“I asked one gathering of business leaders if they were ready to pounce at the first hint of an interest rate cut,” Bostic said. “The response was an overwhelming ‘yes.'”

Fed officials began the year expecting to cut interest rates at some point in 2024. The projections of Fed officials released after their December meeting showed a median expectation of three rate cuts. The market initially expected even more rate cuts but has recently dialed back those expectations to be closer to the Fed’s December projection.

That projection, however, may now be outdated. Data that has come in since the December meeting has indicated that economic growth remains stronger than expected, inflation has not come down further in recent months, and the jobs market remains strong.

The Fed releases projections of its officials after every other meeting, so there was no update in January. At the January meeting, however, the Fed held rates steady and indicated it did not expect to cut rates at the March meeting. While the market initially priced in a near certainty of a cut at the May meeting, the swaps market implied odds have now fallen to just a 20 percent chance of an easing.

Even the idea of a rate cut in June is now in doubt, with the swaps market pricing in around a 65 percent chance. A cut by July get an 85 percent chance.

Some analysts have recently come around to the view that that the Fed may not cut at all this year. Torsten Slok of Apollo Management said in a note last week that he expects no cuts. Jim Bianco of Bianco Research has been arguing for several months that the Fed would not cut.

On Monday, Bostic said that if businesses respond to a rate cut by unleashing new hiring and expansion plans, the result could undermine progress on bringing down inflation.

“If that scenario were to unfold on a large scale, it holds the potential to unleash a burst of new demand that could reverse the progress toward rebalancing supply and demand. That would create upward pressure on prices. This threat of what I’ll call pent-up exuberance is a new upside risk that I think bears scrutiny in coming months,” Bostic said.

Most of Bostic’s essay is focused on the risks of higher inflation and a premature Fed cut. He does, however, mention that there is also a risk that the Fed keeps interest rates high for too long, which could force the economy into an unnecessary downturn.

But with growth and the labor market strong, the Fed can afford to wait, he argues.

“The good news is the labor market and economy are prospering, furnishing the FOMC the luxury of making policy without the

pressure of urgency,” Bostic said.