Basel III Countdown: The Gold Crisis Banks Can't Ignore

Unlocked with additional content

The Basel III Countdown Begins

Basel III will be implemented in the U.S. on July 1, 2025. The much needed change strengthens bank capital requirements, limits leverage, and increases liquidity standards to reduce financial risk and enhance banking system stability.

This final set of rules for US adoption has been dubbed the “Basel III Endgame” by major accounting firms no less then PWC and EY. These rules focus on the amount of capital that banks must have against the credit, operational, and market riskiness of their business. Simply put, bank leverage will shrink as the need for better collateral takes precedent.

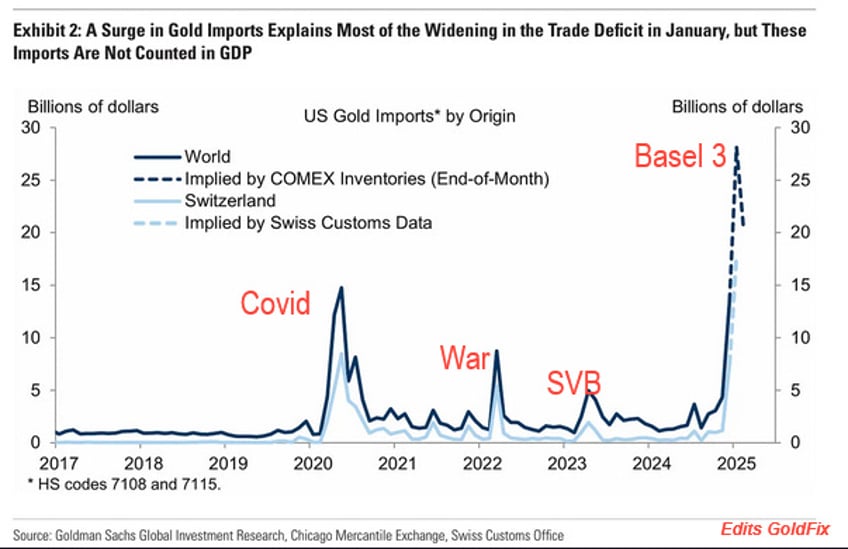

What follows is an analysis and explanation of the current scramble to repatriate both Gold and Silver by American banks as that deadline approaches.

1. Repatriation: Quiet Additions to the U.S. Balance Sheet

A significant part of that involves restoration of Gold to its status as Tier 1 capital reserved for the world’s highest valued collateral.

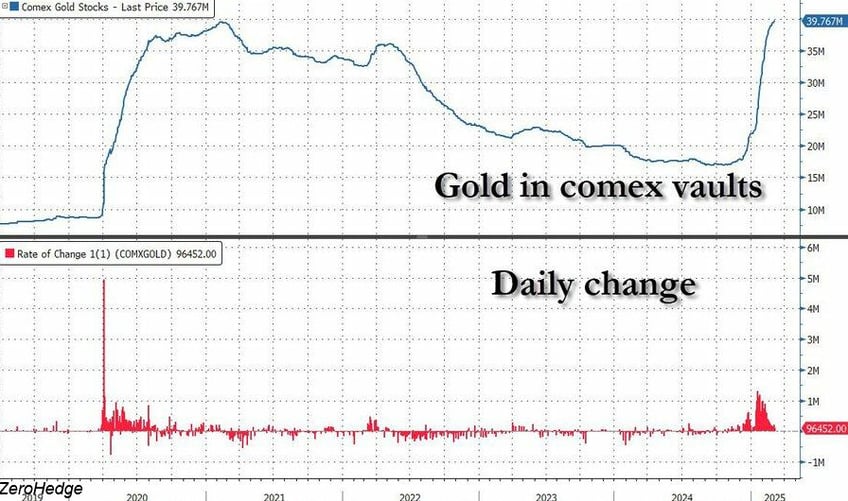

The 2000 tons of Gold being repatriated right now isn’t just sitting idle. A significant portion is being added—or more accurately, restored—to the U.S. balance sheet.

2. The Gold Wasn’t Sold—But It Was Lent and Shorted.

The U.S. Treasury never sold this gold outright. That would have been a constitutional violation, as gold can only be sold to retire U.S. debt directly. Instead, in the 1990s, the gold was loaned out to bullion banks under a perpetual rolling structure. These banks then hedged it through carry trades, profiting off borrowed gold.

Who was behind this? Look no further than Robert Rubin and Alan Greenspan. The Fed facilitated it, the Treasury allowed it, and the bullion banks executed it. In some cases, what now sits in place of actual gold are IOUs issued by those same banks.

3. Why It Happened: Monetizing Gold While Keeping Prices Down

At the time, the rationale was simple:

The Fed got to monetize gold by loaning reserves, earning a small return.

Gold prices remained suppressed, preventing inflation fears from spiking (a lesson Greenspan learned from Volcker’s battles).

Bullion banks used the gold for leveraged carry trades, compounding their profits.

No laws were broken. But in the process, a critical asset tied to American sovereignty was placed in the hands of private banks—banks that could, and eventually would, default.

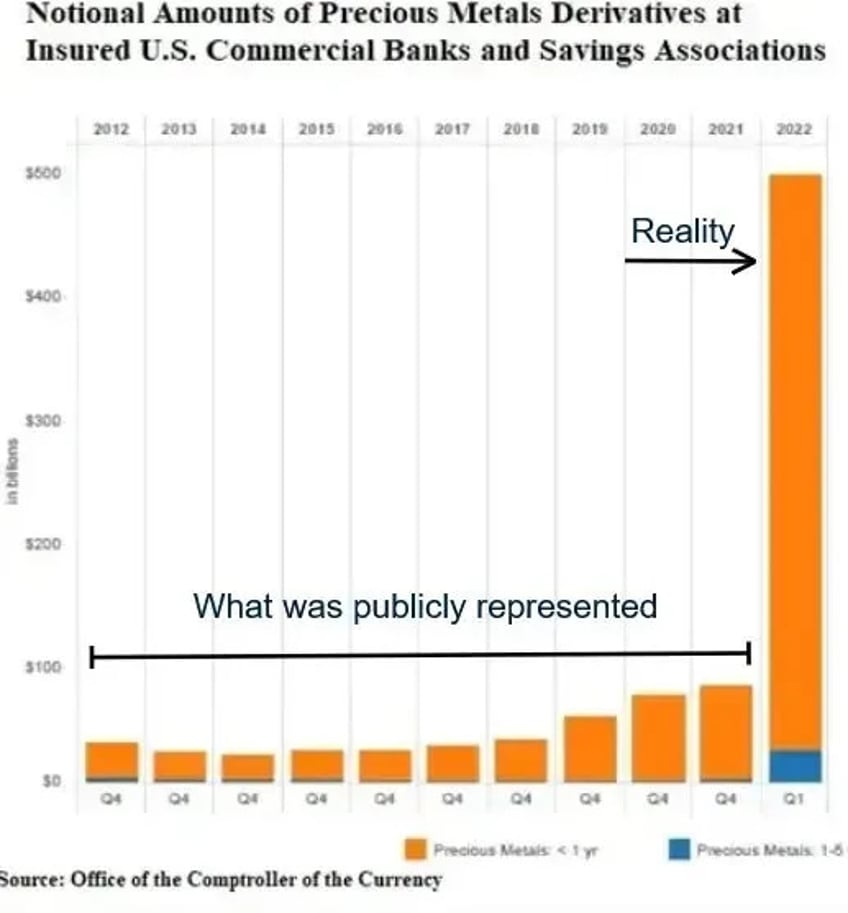

This gold leasing and carry trade structure went on for decades. The OCC chart below illustrates just how long.

4. Fast Forward to Today: A Balance Sheet Reckoning

For reasons still unclear, the U.S. has decided to clean up its balance sheet. That means some of those IOUs have been called in.

The problem? Many bullion banks, complacent for years, now face a scramble. They have far more claims against gold than they have actual gold. And with IOUs being recalled, they’re being forced to cover their positions—at any cost.

Why is the U.S. doing this now? Is it fear of BRICS gold purchases? Perhaps it is a need to consolidate assets for monetization, as Treasury Secretary Bessent has hinted. Or maybe it is all in preparation to create a gold-backed bond-type instrument for international dealings? Nobody is really sure.

Regardless of the reason, the underlying reality is the same: If everyone else is securing gold, the U.S. needs gold too. The bullion banks, caught in the middle, are paying the price.

5. From Greed to Fear: The Shift in Bullion Bank Behavior

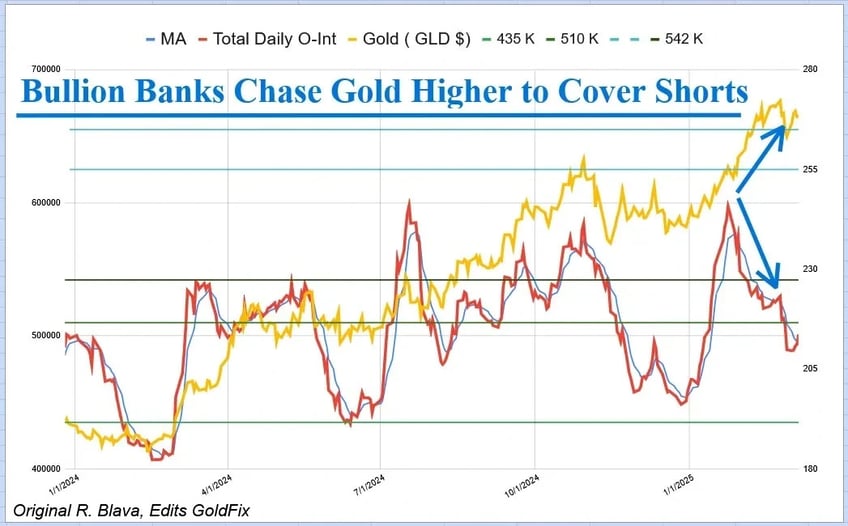

Over the last two years, bullion banks have gone from aggressively shorting gold to desperately covering their positions.

Bullion Banks Covering shorts On All Time Highs…

Before March 2023: They played the usual game—selling high, buying low, profiting from hedge funds scrambling in and out of bullish positions.

Post-December 2023: They started covering shorts more aggressively but still maintained some patience in their purchases, keeping gold prices elevated but controlled.

Post Trump’s Inauguration the game changed. Banks (next chart) go from booking profits to locking in losses over a 2 year period-

At that point, bullion banks began urgently covering shorts, not to profit but to survive. They started locking in losses, breaking even at best, often losing money outright. The dark blue arrows in the attached charts highlight this shift.

The turning point came in 2022 (see OCC orange Bar chart above) when JPMorgan, Citibank, and others were forced to disclose their derivative books in compliance with Basel III. But the cracks had been forming for years.

6. Basel III: The Countdown to Gold-Backed Reality

Basel III, which started in 2009 after the Global Financial Crisis, was delayed repeatedly due to EU crises (GREXIT 2011, BREXIT 2016, etc.). Now, it’s scheduled for full implementation in the U.S. in July 2025—and current bullion bank behavior suggests that deadline will hold.

This is why gold is flowing back into the U.S. If banks can’t reclaim their encumbered gold in time, they’ll be forced to continue covering shorts in a rallying market. Everyone already knows there’s a problem. If this continues without government intervention, it could get ugly.

Bullion banks haven’t even begun to hedge their silver shorts yet. Stay tuned.

End

Free Posts To Your Mailbox