A Tale Of Two Campaigns

In our last post ("The Meaning Of Trump's McDonald's Shift"), we noted that Trump 2024 was an expertly-run campaign.

The Meaning Of Trump's McDonald's Event

— Portfolio Armor (@PortfolioArmor) October 21, 2024

Why it resonated. https://t.co/zGVY6o8RuU

Kamala Harris's campaign this year has not been well-run, and the X thread below explains why: the people running it are diversity hires.

Following that thread, we'll look at a (surprising) possible risk of a Trump victory: a decline in gold.

Who Is Running Kamala's Campaign

To start off with, her only interesting quality, and the only reason she's gotten anywhere in life, is that she is latino labor activist Cesar Chavez' granddaughter. The irony of this, is that Chavez' entire struggle was defined by being against illegal migration. pic.twitter.com/oyWHAuaoxx

— 🏛 Aristophanes 🏛 (@Aristos_Revenge) October 22, 2024

Cesar Chavez himself was born in Yuma, AZ. And his struggle was one to organize the farmworkers in order to get better conditions in the central valley of California. Ironically, the Okies that came after the dustbowl tried this and were replaced by Mexican and Filipino Americans pic.twitter.com/RK4bCuCSsW

— 🏛 Aristophanes 🏛 (@Aristos_Revenge) October 22, 2024

[Skipping the part of this thread that focus on Cesar Chavez]

>Attends UC Berkeley and obtains Bachelors of "Science" in "Latin American Studies" in 2001

— 🏛 Aristophanes 🏛 (@Aristos_Revenge) October 22, 2024

>Interns with the AFL-CIO and UFWA during the summers

>Graduates and spends the next 8 years as a "program director" at the Cesar Chavez Foundation

>Volunteers for Obama campaign in 2008

She got the boot when Trump came into the WH, and she became the State Director for Kamala Harris when she was a Senator, which is a pretty hard job to fuck up in California, where the entire state apparatus is just the DNC crime syndicate.

— 🏛 Aristophanes 🏛 (@Aristos_Revenge) October 22, 2024

>Director of White House Intergovernmental Affairs

— 🏛 Aristophanes 🏛 (@Aristos_Revenge) October 22, 2024

>Senior advisor to President Biden

>Campaign manager of Biden 2024

Essentially, Julie is a lifelong bureaucrat in the NGO/Political sphere, which doesn't lend itself well to understanding what normal people think, it's a bubble.

>Director of White House Intergovernmental Affairs

— 🏛 Aristophanes 🏛 (@Aristos_Revenge) October 22, 2024

>Senior advisor to President Biden

>Campaign manager of Biden 2024

Essentially, Julie is a lifelong bureaucrat in the NGO/Political sphere, which doesn't lend itself well to understanding what normal people think, it's a bubble.

And I think this says something about the future of the DNC. They haven't selected for competency, but for ideology. The patronage they have given for over a generation amounts to giving unproductive and unintelligent people makework sinecures and we wonder why they suck.

— 🏛 Aristophanes 🏛 (@Aristos_Revenge) October 22, 2024

Also, not to go too into depth on Cesar Chavez again, but the problem when he was organizing a trade union was that he needed money to pay his own salary and that of the organization itself. What happened was a sequence of "for pay" projects to register mexican-americans to vote.

— 🏛 Aristophanes 🏛 (@Aristos_Revenge) October 22, 2024

These are the dangers of a veto proof majority, Hart-Celler changed the future of America just as much as the Civil Rights Act when it was signed into law, in much more irreperable ways.

— 🏛 Aristophanes 🏛 (@Aristos_Revenge) October 22, 2024

Lets go get our own veto proof majority and fix it. pic.twitter.com/D9JetnDDIS

Let's hope we get that veto-proof majority. In the meantime, let's consider a possible risk of Trump winning: a decline in gold.

Why Gold Could Decline Under Trump

Conventional wisdom holds that our government would continue to spend beyond its means under Trump, fueling further inflation and extending the record rally in precious metals. That could very well happen. But there are a few proposed Trump policies that could be deflationary:

- Tariffs. Critics call this a tax on American consumers, and to the extent that it is one (and a regressive one at that), it would be deflationary, by causing consumers to spend less.

- Deportations. If Trump actually deports millions of illegal aliens, that would be deflationary, for two reasons. First, we'd have fewer people competing for the same housing and other resources. And second, it would reduce the enormous government spending, funneled through NGOs, that subsidizes housing and other costs for these aliens.

- Drilling. Expanding domestic energy production, as Trump has promised to do, would, all else equal, be deflationary.

- Peace. If Trump succeeds in his goals of ending the Ukraine War and the ending the current Mideast war, that should lower the costs of energy and other commodities transiting through the war zones, and if the peace deal is accompanied by a removal of sanctions on Russia and Iran, that would increase the supply of energy too. Peace would also lower the geopolitical risk premium component of gold's current price.

Hedging Against A Drop In Gold

If you're long gold (as almost everyone reading this probably is), one thing you can do to lower your risk of a drop in gold is to take some profits now.

We did that ourselves recently, selling half of our calls on IAMGOLD (IAG -1.29%↓), which we had bought in the trade alert below, for a 100% gain.

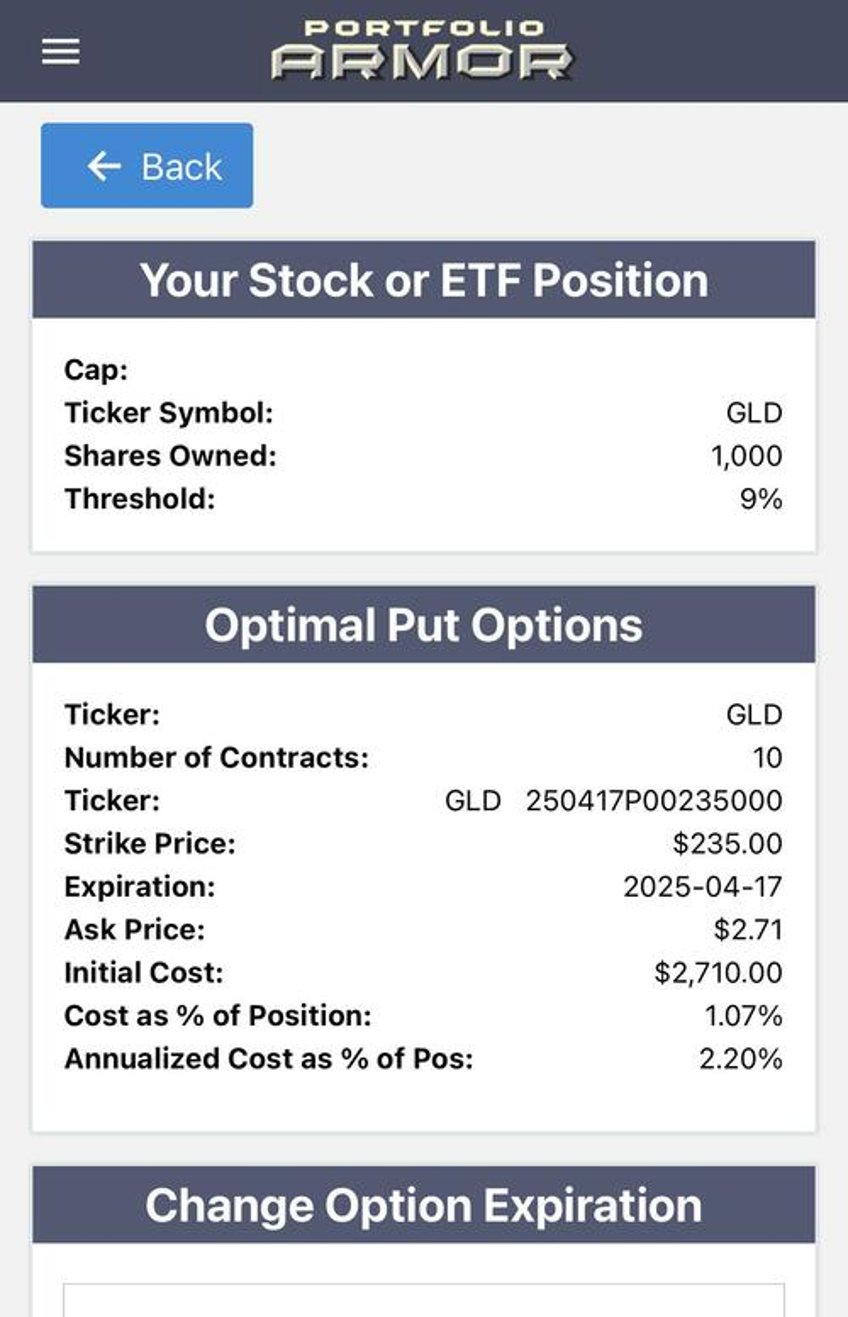

Another thing you can do to lower your risk, is to buy optimal put options on a gold-tracking ETF such as SPDR Gold Shares (GLD). For example, as of Tuesday's close, these were the optimal puts to hedge against a greater-than-9% decline in GLD over the next 6 months.

You can download our optimal hedging app by aiming your iPhone camera at the QR code below, or tapping on it, if you are reading this on your iPhone.

We're also researching trades that might do well in a second Trump term. If you'd like a heads up when we place one of those trades, feel free to subscribe to our trading Substack/occasional email list below.

If you'd like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).