Iron ore and Chinese property stocks surged after three of the country's largest metro areas loosened homebuyer rules. This move follows last week's central government stimulus package, which was aimed at stabilizing the vicious downturn in the housing market.

Bloomberg reports that Shanghai, Guangzhou, and Shenzhen eased homebuying rules:

On Sunday, the trading hub of Guangzhou became the first tier-1 city to remove all restrictions, saying it will stop reviewing homebuyer eligibility and no longer limit the number of homes owned.

Both Shanghai and Shenzhen said they will allow more people to purchase residences in suburban areas, as well as allow others to buy more homes. Shanghai, China's financial hub, and Shenzhen, the southern city known for its tech industry, also announced they were lowering minimum downpayment ratios for first and second homes to 15% and 20%, respectively, in a bid to boost demand.

Goldamn's James McGeoch told clients this AM:

The weekend Spec was that China fiscal would come ahead of the holiday, as a "gift" to the 75th anniversary on National Day, released in the press release of the Second State council Meeting. Focus on property and consumption in the headlines i have read and the iron ore indexes up a short 10% (SGX $112 and DCE +10%).

Iron ore's stunning multi-day reversal has sent prices from $90/ton to $108/ton. Gains overnight topped 11%, adding to 11% last week following the central government's move to deploy stimulus (read here).

A separate note from Goldman's Thomas Evans early last week told clients to "fade iron ore rallies" on potential short covering ahead of the long holiday in China, noting "steel overcapacity and growing supply in iron ore are the two biggest headwinds to ferrous supply chain, which can't be fixed any time soon."

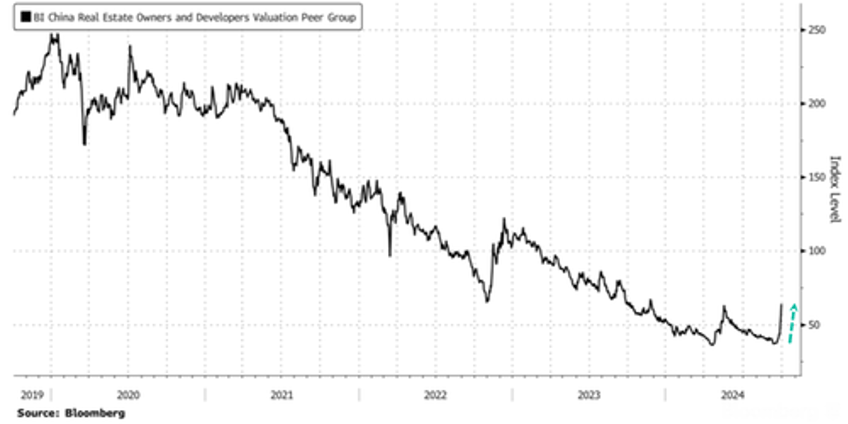

In equity markets, a Bloomberg gauge of Chinese real estate stocks jumped as much as 14% after the news. There was also mention that China's central bank would allow mortgage refinancing.

Bloomberg's Jake Lloyd-Smith penned a note this Am titled "Iron Ore's Sudden Euphoria May Be Overdone," in which he said:

Beijing's pre-holiday salvo, plus follow-through steps in key urban centers, will do much to improve the mood. Over time, this may stabilize the real estate market. But whether that's enough to persuade mills that have been complaining of an industry-wide crisis to change course and actually increase steel output on a sustained basis in the coming quarter remains to be seen.

The slowdown in China's property market has been a significant challenge for steelmakers, with some slashing production and warning about an outlook that mirrors 2008 and 2015.

Meanwhile, Citigroup analysts led by Wenyu Yao noted that China's stimulus will be supportive: "Bullish momentum could persist into LME Week."

The most interesting aspect of China's recovery will be its shape. Analysts warn that the property market still faces headlines.

"It may take time and could still prove challenging to turn around residents' bearish views with existing policies," Morgan Stanley's Cheung told clients.

Perhaps the days of a 'V-shape' recovery are long past.