The Chinese government on Monday reported its first-ever quarterly decline in foreign direct investment (FDI), potentially a sign that “de-risking” initiatives from Western governments and corporations are cutting into Beijing’s bottom line.

FDI slipped by $11.8 billion in the quarter that ended in September, leaving China with $3.2 billion in red ink on its basic balance sheet. It was only the second time China’s quarterly balance sheet has posted an overall deficit.

“Some of the weakness in China’s inward FDI may be due to multinational companies repatriating earnings,” Goldman Sachs said in an analysis quoted by Reuters on Monday.

“With interest rates in China ‘lower for longer’ while interest rates outside of China ‘higher for longer’, capital outflow pressures are likely to persist,” Goldman Sachs anticipated.

Some other analysts were a bit less pessimistic, suggesting that foreign companies were pulling their retained earnings out of China largely because of those interest rates, while China is having much more difficulty than usual bringing in new investments due to rising geopolitical tensions and its slowing economy.

The Wall Street Journal (WSJ) saw the beginning of a trend in which foreign companies pull their profits out of China instead of “using the cash to finance new hiring and investment” during the boom years of China’s growth.

The WSJ acknowledged the differential in interest rates — a trend that cannot easily be reversed because China needs lower rates to shore up its collapsing real-estate market, while the U.S. and other Western countries are raising rates to control inflation — but saw “de-risking” as a more important factor.

Several major corporations have hinted at their interest in pulling profits out of China to finance new acquisitions and investments in other countries, making themselves less dependent on China to sustain all of their supply chains.

Few of these companies are willing to discuss their strategy bluntly because Chinese officials are enraged by “de-risking” and could well retaliate against foreign executives who discuss it openly.

The Chinese Communist Party has lately been using cooperative shills like California Gov. Gavin Newsom to portray de-risking as a dead issue, old news that fashionable Western politicians and corporate managers do not really talk about anymore, but the surprising quarterly deficit in FDI undermined China’s spin with some striking balance sheet numbers.

“Recent surveys of U.S., European and Japanese companies in China show executives are souring on new investments there, unnerved by the prospect of conflict with Taiwan and China’s efforts to tighten oversight of foreign firms operating within its borders,” the WSJ noted.

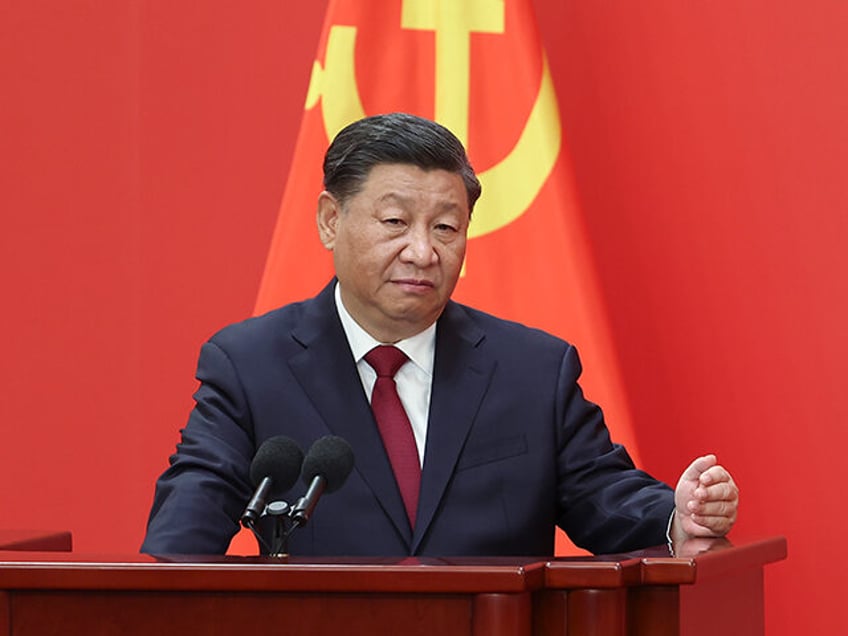

Some of that “souring” is a result of government policies in both China and Western nations, such as the United States restricting American investment in certain sensitive high-tech sectors. For its part, China has conducted regulatory crackdowns that made foreign CEOs nervous, and it would seem Xi delegating Premier Li Qiang to convince overseas money that China is safe for their investments did not create as much confidence as Xi wanted.

The International Monetary Fund (IMF) warned in October that de-risking could “result in a significant drag on growth around the world,” hurting everyone as the enormous Chinese economy deflates. The IMF thought a safer bet was to put Beijing on notice that “comprehensive reforms” are needed, then wait for “significant positive spillovers” to occur. China’s latest quarterly report suggested that advice was not heeded, at least not enough to reverse the de-risking trend.