Until the Chinese government introduces more robust stimulus packages to counter soft economic data and exporters in the world's second-largest economy ease up on flooding global markets with copper, prices of the base metal—crucial for power lines and AI data centers—are expected to remain under pressure.

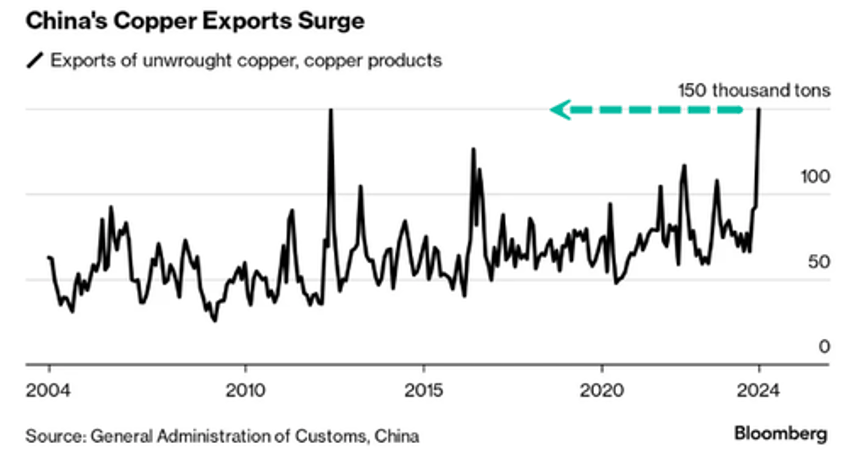

The latest customs data from Bloomberg shows that Chinese exports of unwrought copper and other products in May doubled from last year to roughly 150,000 tons, exceeding the previous high in 2012. This comes as copper prices hit a record high of more than $5.10/lb on COMEX.

In late May, copper hit a record of $5.10/lb, as traders panicked and bought the red metal on the 'Next AI Trade' theme, primarily because of tightening supplies and rising demand from electric vehicles, AI data centers, reshoring, and power grid upgrades.

However, as Bloomberg explained:

"Producers have been locked in deflation for much of the past two years due to a tepid economy, opening up opportunities abroad where prices are higher..."

In other words, Chinese exporters have been exporting deflation via the red metal as domestic economic activity remains in a slump.

"We believe copper prices will likely remain under pressure in the short-term, unless the Chinese government unveils sustained stimulus measures, or we see Chinese smelters cutting output," analysts at ING wrote in a note.

Traders have also been watching for signs of recent price declines stimulating buying from manufacturers. But traders and analysts remain doubtful that demand will rebound meaningfully.

"With Chinese smelters still delivering cathode into bonded warehouses owing to the open export arbitrage, it still feels too early to say we are at the bottom of the current copper price cycle," Colin Hamilton, managing director for commodities research at BMO Capital Markets, wrote in a note to clients.

Last week, Trafigura Chief Economist Saad Rahim, one of copper's biggest bulls, called the recent copper price surge unjustified due to real-world supply:

"Prices of non-ferrous metals have moved much higher than fundamentals in the physical spot market might indicate or justify, especially for copper."

At the end of last week, Goldman's James McGeoch pointed out to clients that the multi-month trend line supporting prices has been broken.

There is some good news for bottom watchers, as Bloomberg noted:

"China's smelters are at least starting to pare their production of refined copper from the record levels seen in recent months, according to the latest output figures for May, although the decline is more likely linked to a global shortfall in raw materials rather than a response to weak demand."

Now, the copper bull market is at crossroads. Bulls need supply to continue tightening, and China needs to stop dumping supply for the 'Next AI Trade' to play out.