China’s retaliation against President Donald Trump’s tariffs went into effect on Monday, imposing levies of ten percent to 15 percent on a range of key American goods, including liquefied natural gas (LNG), coal, agricultural equipment, and automotive products.

Coal and LNG were hit by the highest levies of 15 percent. The Chinese Communist government also blacklisted an American apparel company and restricted exports of five critical rare earth mineral products to the United States, ratcheting up pressure on the defense, solar energy, and electric vehicle sectors.

“Compared with the blanket US tariffs, China’s measures – which target US exports of liquefied natural gas, coal, crude oil and farm equipment as well as some automotive goods with levies of 10 per cent to 15 per cent – were seen as creating space for negotiations to avert a wide trade conflict,” the Financial Times reported on Monday.

China announced its retaliatory agenda on February 4, less than an hour after Trump’s ten-percent tariffs on Chinese goods took effect. Trump formally announced those tariffs just two days before imposing them.

On Sunday, President Trump announced 25 percent tariffs on all steel and aluminum imports into the United States, a move that will primarily affect Canada and Brazil in the short term – but which ultimately targets China, the dominant global producer of steel and aluminum.

Direct imports of Chinese steel and aluminum to the United States are relatively small, and have already been walloped by tariffs from previous administrations, including that of President Joe Biden.

However, as the Chinese economy crumbles, its massive steel production is no longer needed by domestic industries – so China is exporting that steel at fire-sale prices, flooding the world with cheap goods and pushing steel producers like Canada and Mexico to export their own surpluses to the United States.

“China’s overcapacity is swamping world markets and severely injuring U.S. producers and workers,” United Steelworkers of America trade adviser Michael Wessel told the New York Times (NYT) on Monday.

The next stage in the escalating trade war could begin on April 1, when the U.S. Trade Representative (USTR) is scheduled to file a report on Chinese compliance with the trade deal Trump signed with China near the end of his first presidential term. Trump directed other federal agencies to submit recommendations for balancing foreign trade by April 30.

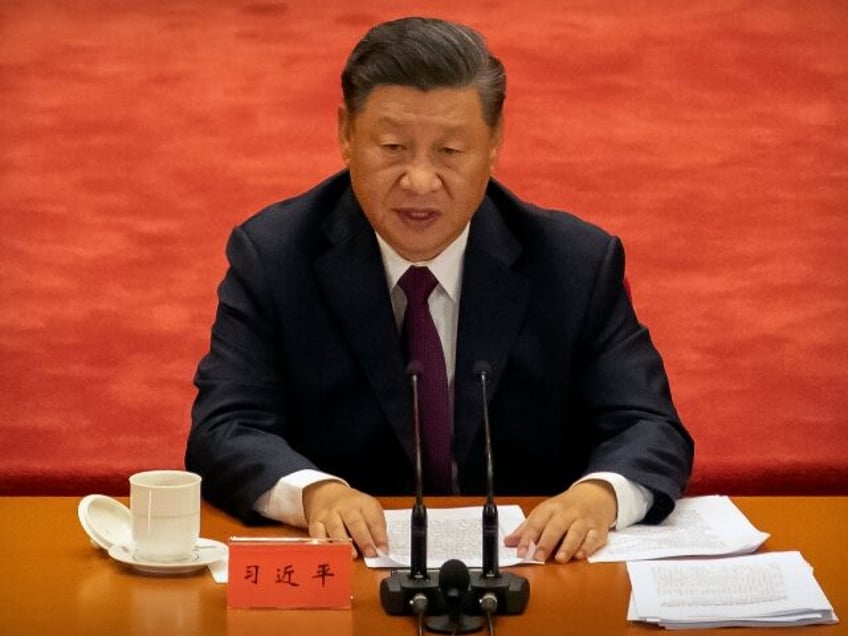

China signed a trade deal with the first Trump administration in January 2020 that included a promise to dramatically increase purchases of American exports, to the tune of about $100 billion a year for the following two years. Trump hailed the deal as a “sea change in international trade,” and Chinese dictator Xi Jinping seemed enthusiastic about it as well.

However, a devastating report from the Peterson Institute for International Economics (PIIE) in July 2022 found that China almost completely reneged on its side of the 2020 deal, effectively purchasing zero dollars of additional U.S. exports. China blamed this failure, in part, on the Wuhan coronavirus pandemic and ensuing recession.

USTR seems highly likely to confirm PIIE’s findings in its April report, giving China low marks for holding up its end of the 2020 trade deal, which would in turn give Trump ample justification for imposing even tougher tariffs and trade restrictions on China.

Although some observers criticized Trump for moving quickly to slap tariffs on China without allowing much time for Beijing to negotiate its way out of the impasse, others see the interim between Trump imposing tariffs on February 4 and the agency reports due in April as the real high-pressure negotiating period. Trump could be using that span of two months to demonstrate to the Chinese that he will not back down from his trade demands, not even under pressure from China’s retaliatory actions.

“If there was only a 10% tariff on China and we left it at that, I think many investors would sleep more comfortably. The big worry, of course, is this is a prelude to potentially larger trade restrictions,” HSBC’s chief Asia economist, Frederic Neumann, told the Financial Times on Monday. President Trump does not seem inclined to let anyone sleep comfortably until his trade agenda has been fulfilled.