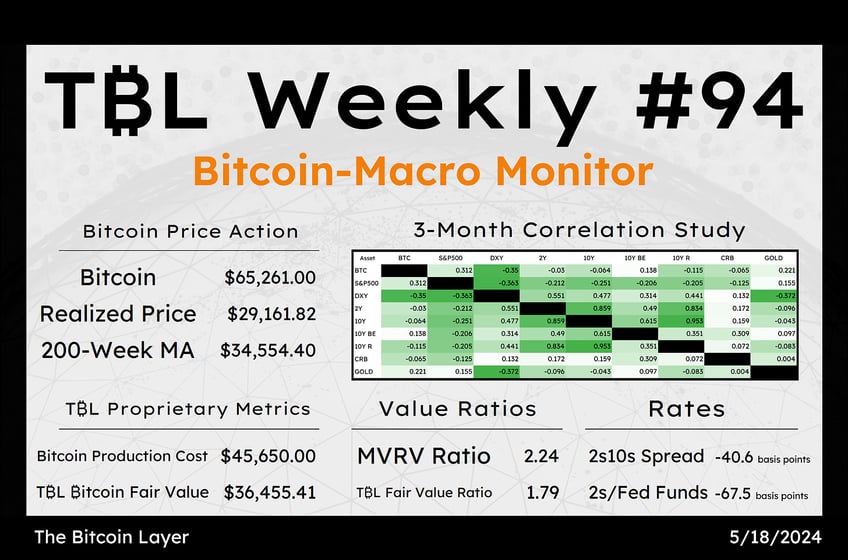

Welcome to TBL Weekly #94—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Good morning everyone, happy Saturday ☕

The week kicked off in earnest with PPI on Tuesday that came in red hot. Producer prices are the price of goods as they leave their place of production. They serve as an upstream indicator for price inflation before they hit shelves and wind up as consumer price inflation. The expectation was for a bump in the month-over-month change in producer prices from 0.2% to 0.3%—it came in at 0.5%. This brings the yearly rate of producer price increases on to 2.1%, the fastest pace since last September:

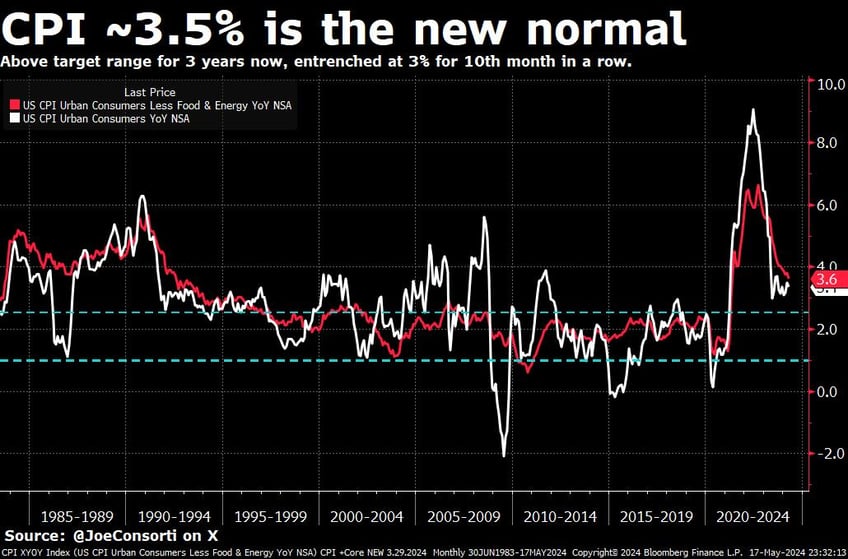

The following day, the market no longer seemed to care, for an as-expected slowdown in the CPI report tamed growth and inflation expectations just as quickly as they briefly reignited.

The month-over-month change in CPI came in at 0.3%, lower than the 0.4% expectation. Core CPI came in at 0.3% as expected. The yearly rate of change in headline and core CPI came in flat to slightly lower, at 3.4% and 3.6% respectively. The biggest development was the decline in yearly core CPI, which printed its lowest level since April of 2021—13 full months before I started working here at The Bitcoin Layer.

All told, an inflation report in line with expectations with blips of undershooting—a big departure from the norm of the last few quarters, where CPI has consistently beat expectations and caused growth, inflation, and policy rate expectations to pop. We smell a cycle shift in the air:

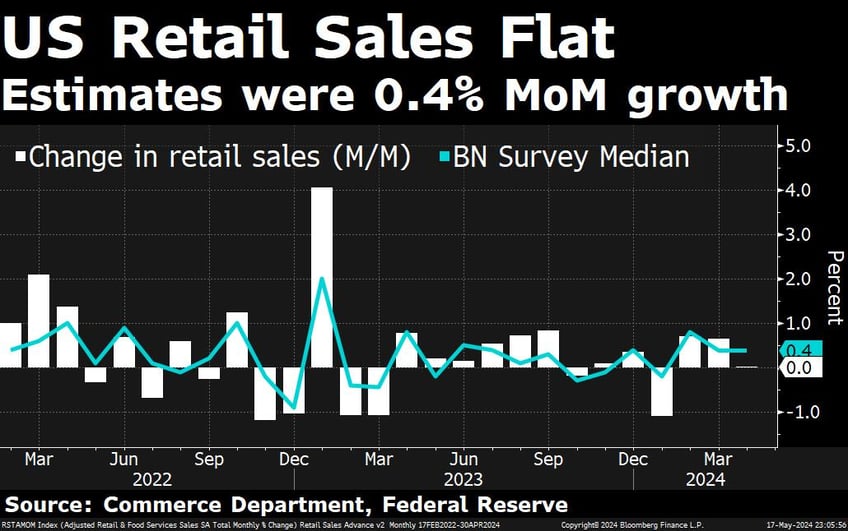

Also on Wednesday was the retail sales report for April. It was not great. It elucidated what we’ve been harping on for ages, the slowdown in spending growth for consumers. We may have been too early to the party on that train, but now that consumer excess savings from post-pandemic have been fully depleted, we are starting to see the impact of the tightening of monetary policy, even if at the margins.

Let’s go year by year in the month of April:

1.4% US retail sales growth in April 2022

0.8% US retail sales growth in April 2023

0.0% US retail sales growth in April 2024

You see?

April’s CPI report confirmed decelerating price inflation here in the United States, and the retail sales report that released right afterward further added to the picture of softening growth and inflation expectations. It may not be falling at the clip you and I want it to, but the Fed’s reaction function to declining price inflation is what matters because it is the forcing function behind most price action in markets—the data is now starting to fully illustrate this:

Subscribe now

Twos fell 4 bps this week and 10s fell 7 bps, marking softening growth and inflation expectations, and a declining expectation for policy rates come the end of the year. It is clear that the market cared less about PPI and more about Wednesday’s CPI and US Retail Sales reports.

Price is truth, and the market made clear that it cares most about the incremental progress toward the Fed’s 2% target, regardless of how slow it is taking. Heck, the depletion of excess savings and how it’s showing up in retail sales may bring us there sooner than you might want. Fast disinflation comes with a side of recession, generally speaking.

Don’t miss Nik’s post from Thursday about the Fed’s current 5.5% policy rates being restrictive enough to cause a recession, regardless of the path of inflation. For me, it is a must-read. Today’s post is just a taste of our full macro view.

Let’s talk bitcoin.

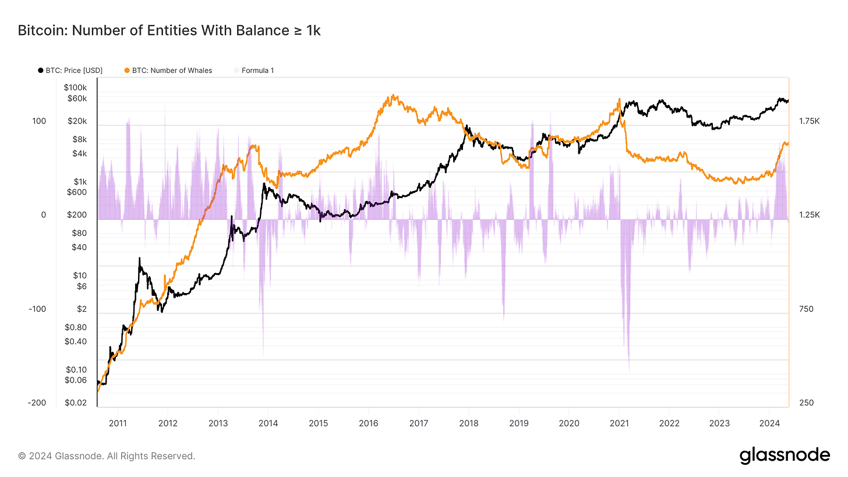

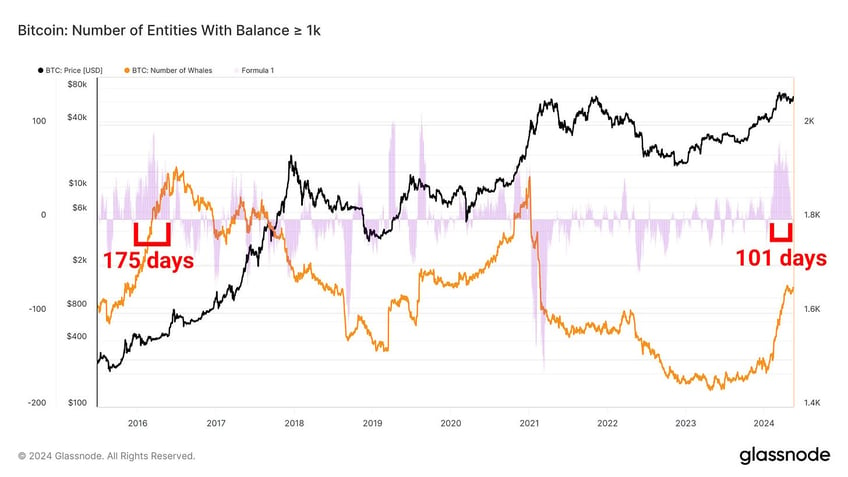

Whales are stacking bitcoin in earnest, according to on-chain data compiled by Glassnode. Its proprietary clustering algorithms group addresses believed to belong to the same network entities—those holding at least 1,000 bitcoin are considered whales, i.e. the ownership cohort that owns an eyewatering amount of bitcoin. The big money, as it were.

The 30-day rate of change of the number of whales has been at its highest level in almost half a decade, and its longest uninterrupted period of growth since 2016:

Zooming in, we can see it even better. The longest prolonged accumulation phase for whales was 175 days from December 2015 to the end of May 2016, peaking at 93 new entities holding 1,000+ BTC as its highest 30d rate of growth. That was at the start of the 2015-2017 bull run. The period we’re in now is strikingly comparable. This accumulation phase (now seemingly dying down) has lasted 109 days from the end of January 2024 to today, peaking at an 80-entity 30-day growth rate. Whales accumulate into strength and distribute into weakness, i.e. buying at what they view as the start of bull runs when bitcoin is relatively undervalued, and selling as the bull market goes on and approaches targets they view as fair value. This adds to the slew of indicators that suggest bitcoin still has tread in the tires this cycle, and the peak we reached back in March was a local top:

For more on why we’re bullish on an upward stairstep for bitcoin this summer, take a look at Tuesday’s post.

Subscribe now

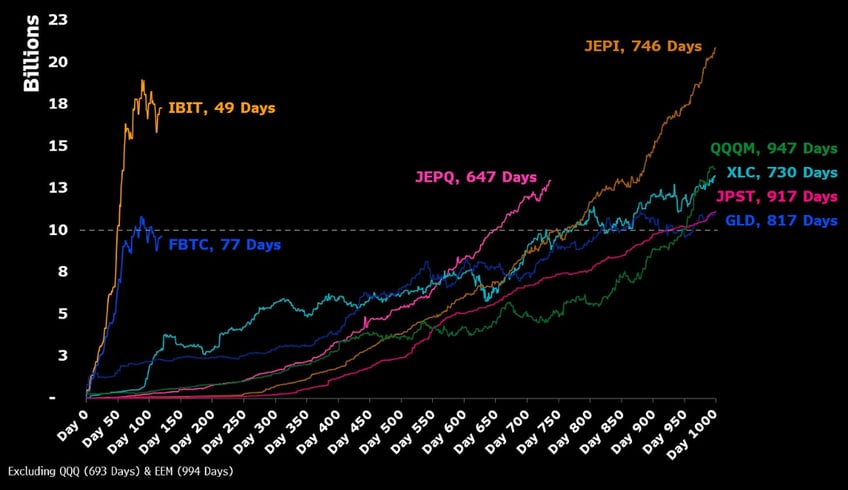

Lastly, a few charts from Nik’s interview from yesterday with Bloomberg’s Eric Balchunas. BlackRock’s IBIT spot bitcoin ETF reached $10 billion in AUM in just 49 days, a record that blows other comparably-sized ETF launches out of the water:

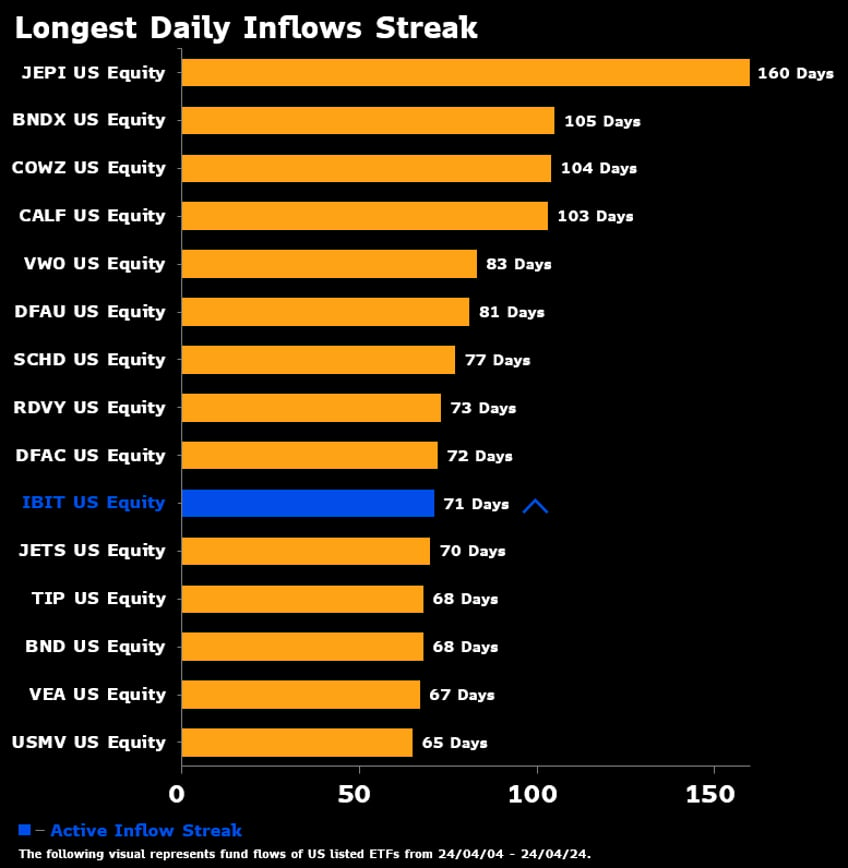

IBIT also ranks 10th for the longest streak of daily net inflows, at 71 days, seeing a minor net outflow on May 1st that unfortunately broke its streak, one that shattered records for a new ETF. An ETF for an entirely new asset class to that cohort of investors performing this well this consistently portends very blue skies for passive flow demand in the years to come:

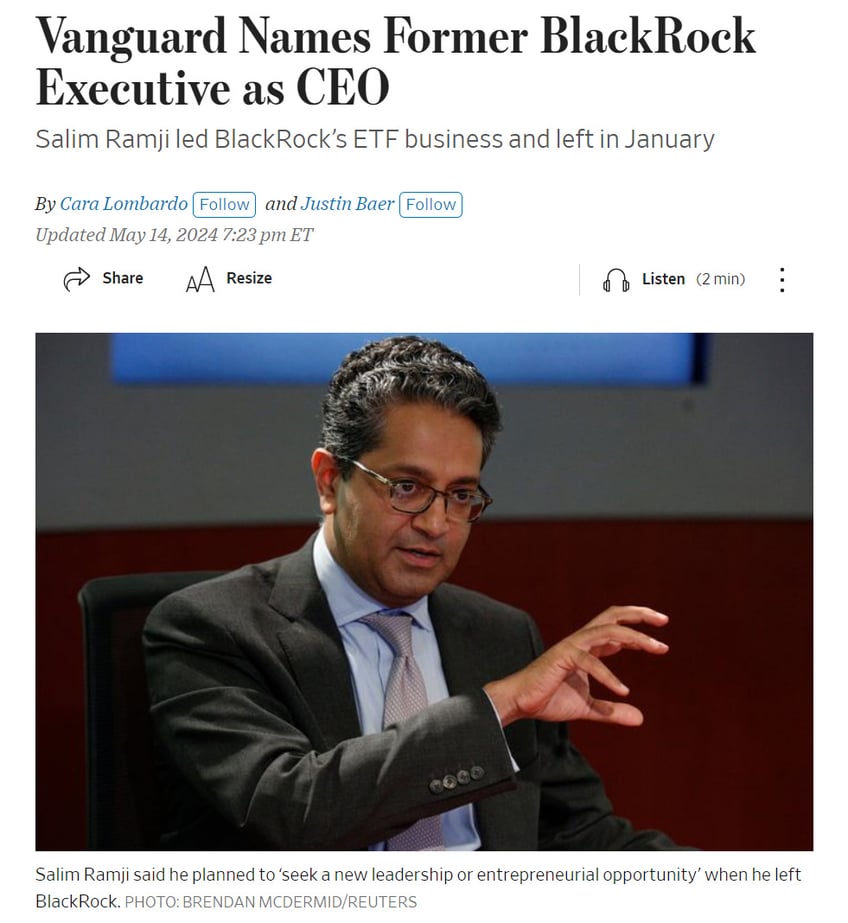

Lastly, Vanguard chose the recent head of BlackRock’s ETF business as its new CEO. This is noteworthy, as Vanguard has infamously decided to not offer any of the spot bitcoin ETFs to its clients. Bitcoin is undeniable at this point. Vanguard will inevitably turn around, else it risk clients abandoning ship (ironic given Vanguard’s logo), and even worse, flagrantly ignoring the asset with the best absolute returns over 90% of timeframes over the last decade, and the best risk-adjusted returns year-to-date.

Bitcoin gives investors portfolio completion. Vanguard is learning the hard way how badly people crave that.

Next Week with Nik

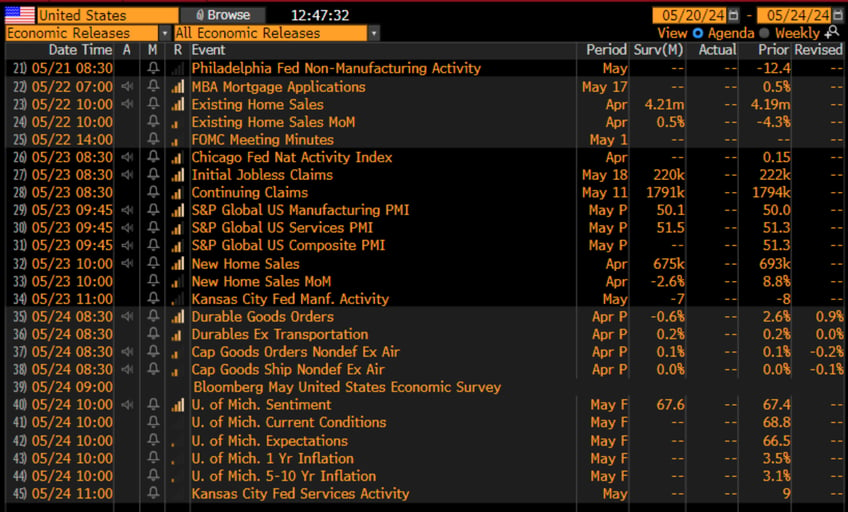

With Memorial Day now right around the corner and an early close for the bond market on Friday, investors will be delighted to find out that most market participants will be mostly summer plotting for the next few weeks. After all, June 12th is the date everyone has circled—the FOMC will meet and May’s CPI will be released. Until then, we are left with releases that might surprise one way or the other but are unlikely to dictate policy.

We will learn more about what was discussed on May 1st at the FOMC meeting when the minutes are released this week, but we aren’t expecting a large admission on the money-market-fear motivated decision to curtail QT or what it might mean to broader volatility to try and stuff the market with MBS. Additionally, we don’t expect to learn anything about balance sheet expansion eventually after QT is expired. It shouldn’t then surprise you that I personally am not too interested in Wednesday’s FOMC minutes that are already three weeks stale. What does interest me more are the PMI releases we’ll get from Europe which might be enough to sway the ECB to cut rates in June—the dollar has cooled down as Treasury yields have declined of late, but a dangerous strengthening always waits around every corner. European yields falling will do nothing to help the euro, and the relative strength of the US economy versus the rest of the world does threaten Europe in particular as interest rate differentials remain a magnet for capital (money leaving low-yielding euro-denominated securities for higher-yielding American ones).

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Subscribe to The Bitcoin Layer

Here are some quick links to all the TBL content you may have missed this week:

Monday

In this episode, Nik is joined by Crypto.com's head of legal Justin Wales. He is the author of a new book, The Crypto Legal Handbook, an overview of the laws and regulations surrounding the young industry of digital assets. A long time bitcoiner, Justin walks us through the industry's latest legislative battles against the SEC and the notable victory in Congress from a bipartisan contingent to block the SEC's anti-crypto agenda. He concludes that the future is bright for bitcoin regulation in the United States.

Check out—Bitcoin's Future Is Bright In USA, Congress Stops Anti-Crypto Agenda

Tuesday

Today I’ve prepared several charts covering GameStop and risk sentiment, bitcoin spending behavior that we can see on-chain, and will wrap up with some thoughts on mining economics and the downward difficulty adjustment arriving in 9 days.

Check out—GameStop is back, bitcoin still has tread in the tires, and miners are doing well

In this video, Joe provides a timely bitcoin update after more sideways price action. He covers GameStop's surprise resurgence, why credit spreads are still low and can stay there for a while, miner economics, spending behavior, and why bitcoin stands to chop higher through the summer given the favorable macro and liquidity backdrop.

Check out—Bitcoin Update: GameStop Soars 170%, Bitcoin Flashing Bull Signal, Difficulty Adjustment

Wednesday

In this episode, Nik delivers a global macro update after CPI misses expectations and bitcoin jumps over 5%. He starts with the latest inflation data and weighs policy motivations at the Federal Reserve. After recapping inflation and very poor retail sales data, Nik goes through the candlesticks of Treasuries, stocks, and bitcoin to measure the market's reaction, which is bullish due to the promise of more liquidity and rate cuts this year. He also notes that TBL is on recession watch and Ethereum death watch.

Check out—Global Macro Update: Bitcoin Soars as CPI Falls

Thursday

I can’t name the manager or event, but it is true. Late last year, to a full room of pre-retirement wealthy retail investors, a portfolio manager said he saw the economy in a no-landing scenario. The cringe was painful, but we stand here half a year later with 4% GDP. Was he correct or wildly irresponsible for such a claim? I’d claim the latter. Today I’ll break down my extremely traditional albeit somewhat out-of-consensus view that 5.5% policy rates are sufficiently restrictive to cause a recession, independent of the path of inflation.

Check out—Growing conviction on type of landing

Friday

Make sure you don’t miss our new series TBL Thinks.

TBL Thinks is our way to summarize the most important paywalled, longer reads relevant to global macroeconomics, helping you cut through the noise. With that in mind, please enjoy.

This week we delve into the US-China trade war and how France is positioning itself as a hub for foreign investments and AI innovation in Europe.

Check out—TBL Thinks: US-China Trade War, France Wins on AI in Europe

In this episode, Nik is joined by Bloomberg's senior ETF analyst Eric Balchunas. Eric details the records shattered by BlackRock's and Fidelity's bitcoin ETFs, explains why bitcoin gives investors portfolio completion, and forecasts the next couple years of institutional demand. He also opines on the latest disclosures showing that hedge funds and pension funds have started purchasing bitcoin ETFs.

Check out—Bitcoin ETFs are DEMOLISHING Records: "This Is Crazy" | Eric Balchunas

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

Subscribe to The Bitcoin Layer

That’s all for our markets recap—have a great weekend, everyone!

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.