What’s behind the numbers?

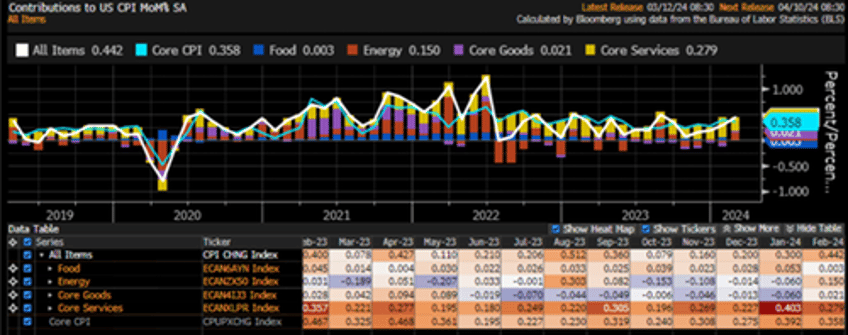

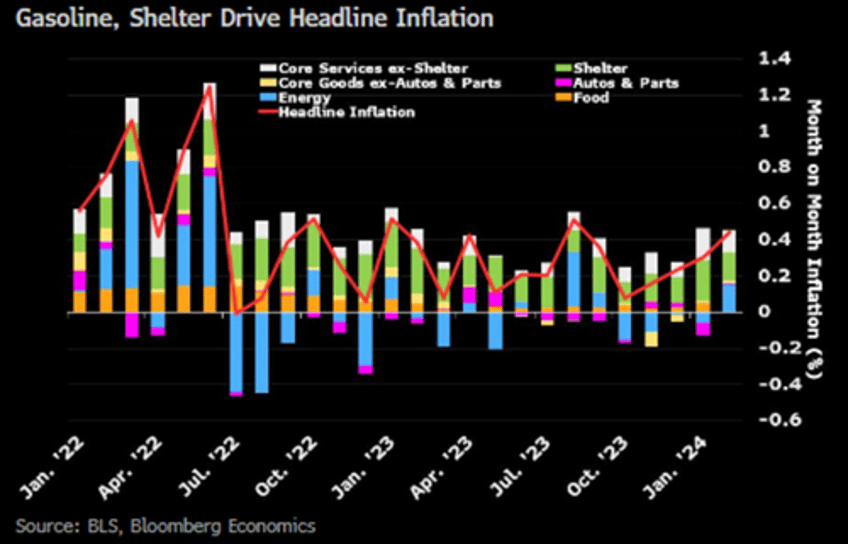

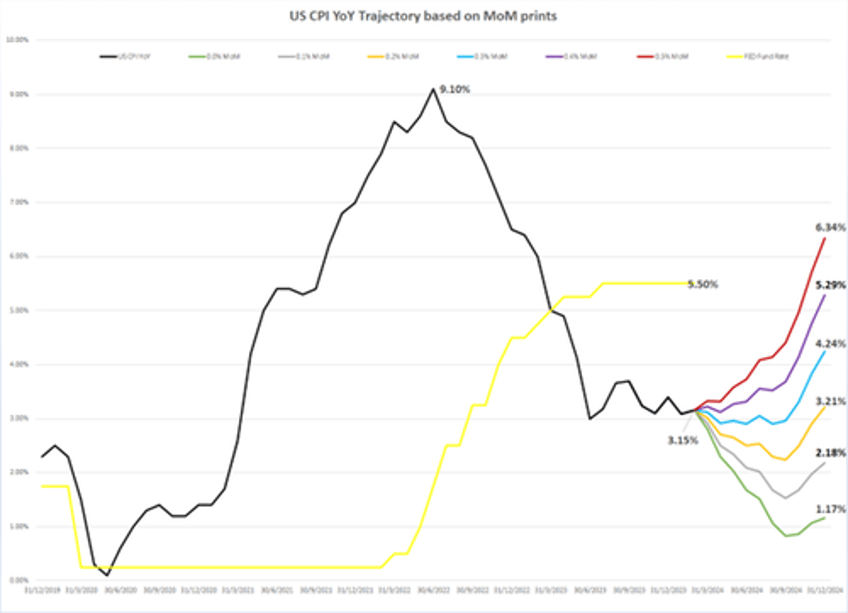

After January's surprising shift in inflation gear, the headline CPI in February rose by 0.4% MoM, as anticipated, marking the highest increase since August. This lifted the year-over-year CPI to +3.2%, surpassing the expected +3.1%.

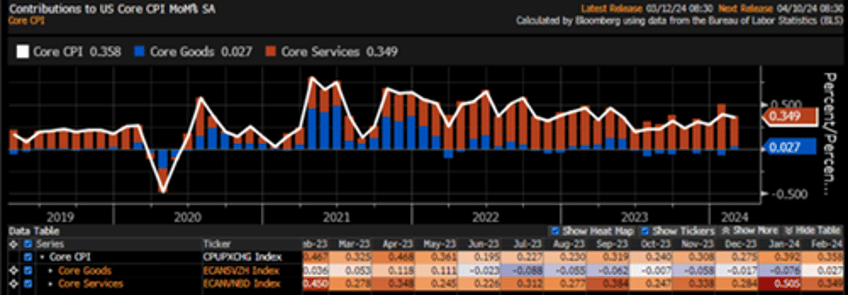

On the darker side for the FED, core CPI rose by +0.4% MoM, exceeding the expected +0.3%, and bringing the YoY change to +3.8%. This is above the expected +3.7% but still the lowest since April 2021, largely due to favourable base effects.

Looking at the details, goods deflation continues (-0.3% YoY) but has been flattening out, while services inflation remains stubbornly high at +5.2% YoY. On a positive note, OER moderated in February and could still be a source of disinflation for the rest of 2024.

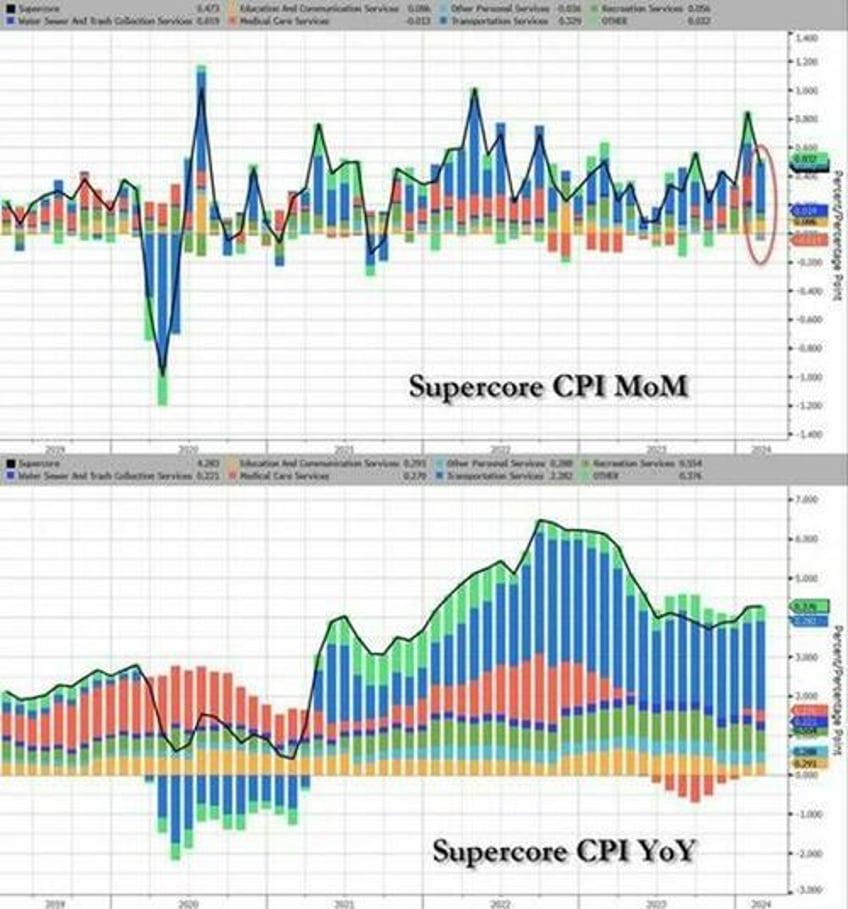

More problematically for the Fed (and the rate-cut proponents) is the fact that the Core CPI Services Ex-Shelter (SuperCore) rose by 0.5% MoM, reaching +4.5%YoY, the highest level since May 2023.

Thoughts.

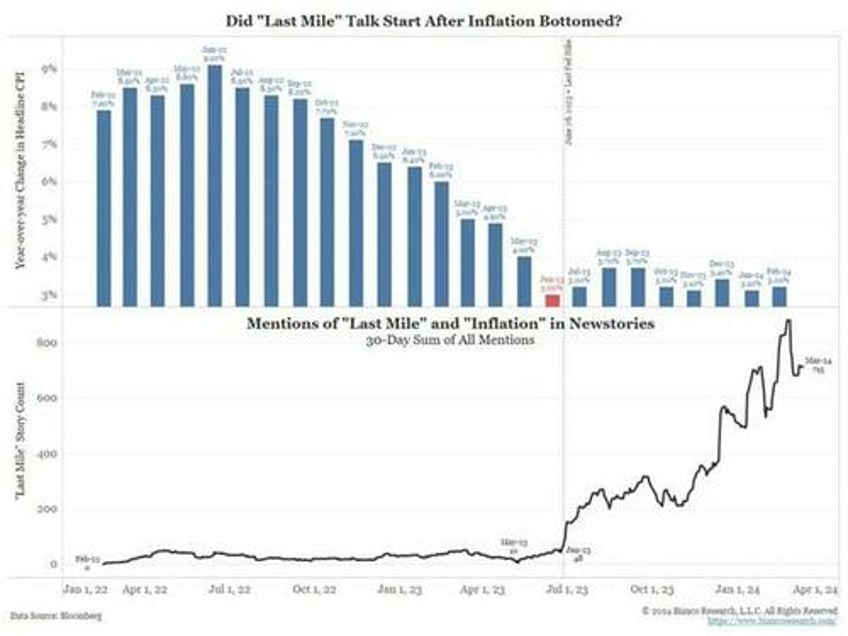

The second robust core CPI print for 2024 underscores further challenges in achieving a sustained return to 2% inflation. While Wall Street is still optimistic about reaching this goal, this narrative is likely to vanish by the summer.

This also confirmed that the magical immaculate 2023 disinflation owed more to luck (Chinese subsidies; easing of supply chains) and based effects rather than to the FED action.

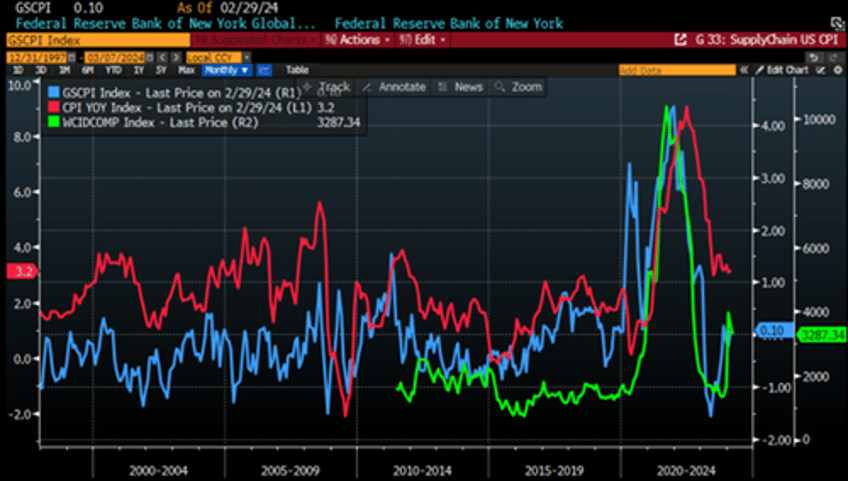

The rebound in Headline, Core, and SuperCore inflation occurred while the "Red Sea crisis" has not yet substantially affected the CPI data. Historically, there has been a six-month lag between the trend in container prices and the year-over-year change in CPI. Consequently, the first impact of the "Red Sea Crisis" will likely be felt with a resurgence in goods inflation by the end of the second quarter.

FED of New York Global Supply Chain Index (blue line); US CPI YoY change (red line); WCI Composite Container Freight Benchmark (green line).

In 2024, headline CPI inflation is expected to fluctuate within the range of 3.0% to 4.0%, with the risk of a rebound to 5.0% if goods inflation resurfaces as anticipated by the summer.

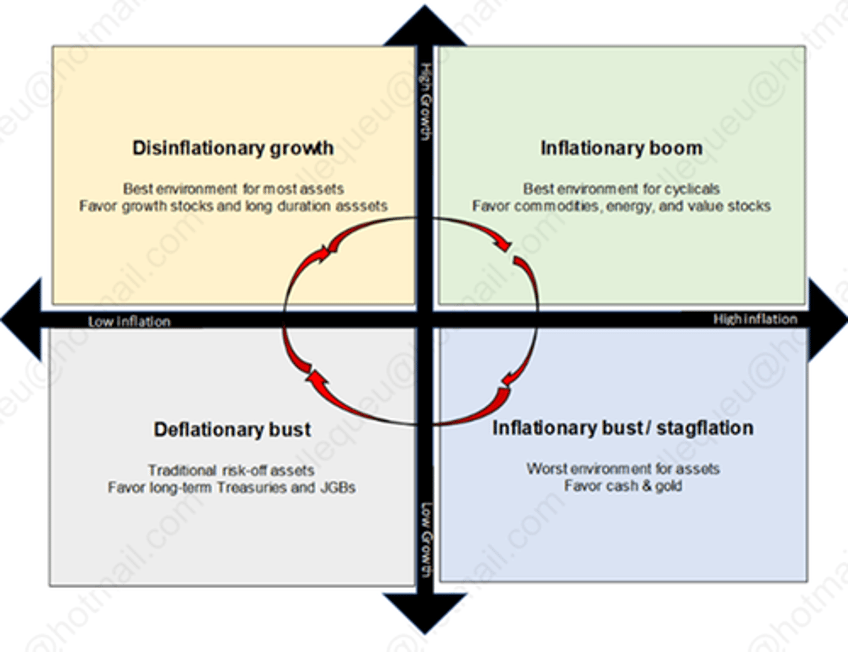

The US economy is transitioning from the bottom of the right-top quadrant of the business cycle (summer inflationary growth) to the top of the bottom-right quadrant (autumn stagflation).

In that context, the FED is most likely to raise its DOTs at its March meeting, and instead of announcing three cuts, it may opt for just one cut to remain politically correct in a presidential election year.

The most probable scenario is that hopes of any rate cuts are once again disappointed in 2024. While the Fed may need to raise rates in the current environment, it will likely stay on the sidelines to avoid being perceived as taking any political side, especially considering Powell and his colleagues' preference regarding the Oval office occupant after the November 5th election.

Bottom line: The February CPI report suggests that Wall Street bankers' hopes for the last mile of disinflation may remain elusive, as the economy could face the resurgence of inflation in the coming quarters. Additionally, geopolitical and social unrest both domestically and abroad may contribute to a stagflation environment by the end of the second quarter. Similar to the 1970s and previous periods marked by wars and social unrest, holding equities and hard assets, rather than long-dated bonds, appears to be the most effective strategy for safeguarding investors' purchasing power.

Read more and discover how to position your portfolio here:

https://themacrobutler.substack.com/p/core-and-supercore-pointing-in-the

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.