Submitted by QTR's Fringe Finance

Friend of Fringe Finance Mark B. Spiegel of Stanphyl Capital released his most recent investor letter on June 28, 2024, with updates on macro and his fund’s positions.

Mark is a recurring guest on my podcast and definitely one of Wall Street’s iconoclasts. I read every letter he publishes and thought it would be a great idea to share them with my readers.

Like many of my friends/guests, he’s the type of voice that gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

In his most recent letter he offers new takes on his favorite long, his favorite short and his outlook on the market.

Mark On His “Second Worst Month Ever”

This was our second worst month ever, and the reason why is twofold: we’re running very net short in a stock market that keeps climbing almost entirely on PE multiple expansion despite an economy that’s beginning to crumble beneath it, and our large Volkswagen long position was pounded due to the threat of an EU tariff war with China that I believe will be resolved with minimal impact for VW.

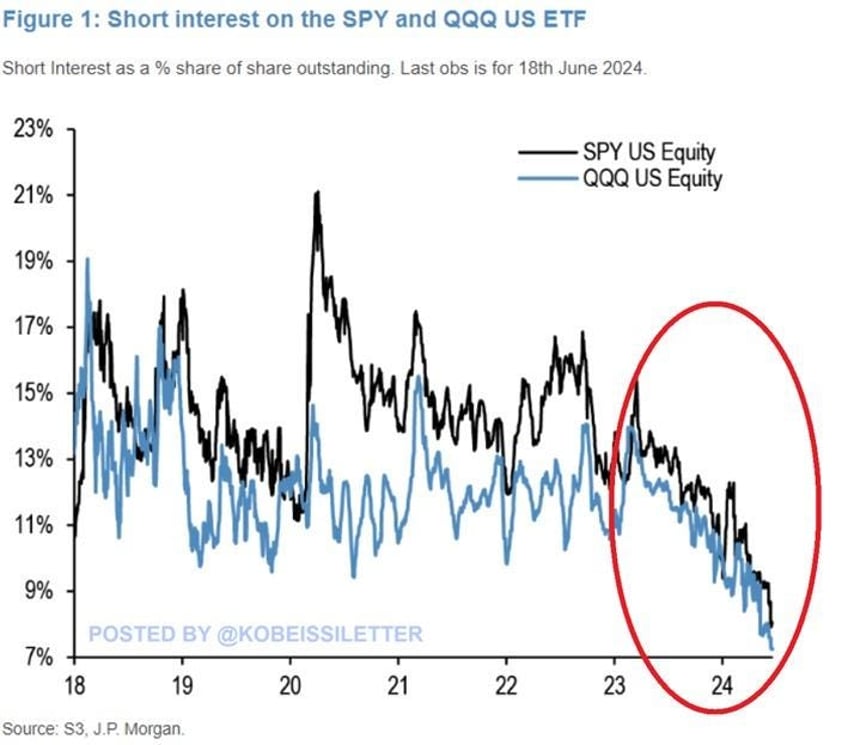

The vast majority of investors currently believe that a long-short fund willing to run net short is a dinosaur. Even Jim Chanos, one of the all-time great fundamental short analysts, recently closed his fund and reverted to a family office because he couldn’t find enough investors willing to join him, and just today Bloomberg reported that Jim is far from alone. Yet throughout financial history, it has been when most investors abandoned all interest in short selling (as they have now) that it soon turned out to be needed the most.

As Stanphyl’s largest investor, I’m as frustrated as you are with our recent performance and perhaps more so, as the majority of my personal wealth is in the fund. And yet when I’ve been as out-of-sync as I am right now with the market, the market usually cracked soon thereafter. This happened in my personal portfolio (pre-Stanphyl) when I was very net short through most of 2007 as stocks blithely climbed during the housing crash, and then in this fund in late 2019 when stocks soared despite Covid clearly being on its way from China to the U.S., and again in late 2021 when it was obvious that the Fed would soon raise rates beyond anything we’d seen in decades, yet stocks obliviously continued climbing nearly every day (much as they are now) before crashing heavily. For reasons I clearly lay out below, I think stocks are now in the same situation that they were in early 2000, late-summer 2007, late 2019 and late 2021, and regardless of whether the current imbalance is resolved via a “crash” or a “long, grinding bear market,” the direction of the resolution will be the same: down, a lot.

The fund is extremely liquid and if you notify me by July 29th I will redeem any of you either partially or fully as of July 31 (waiving our normal “three-month notice” and giving you a chance to see how things go over the next few weeks). You’re a terrific group of LPs and those of you who are also personal friends shall remain so regardless of what you decide to do regarding your investment here! But as Stanphyl (by design) constitutes only a relatively small percentage of the net worth of any of you, I hope you’ll remain in the fund and think of it as a hedge against your current (possibly extremely stretched!) long positions. To understand why we continue to be positioned the way we are, please read on…

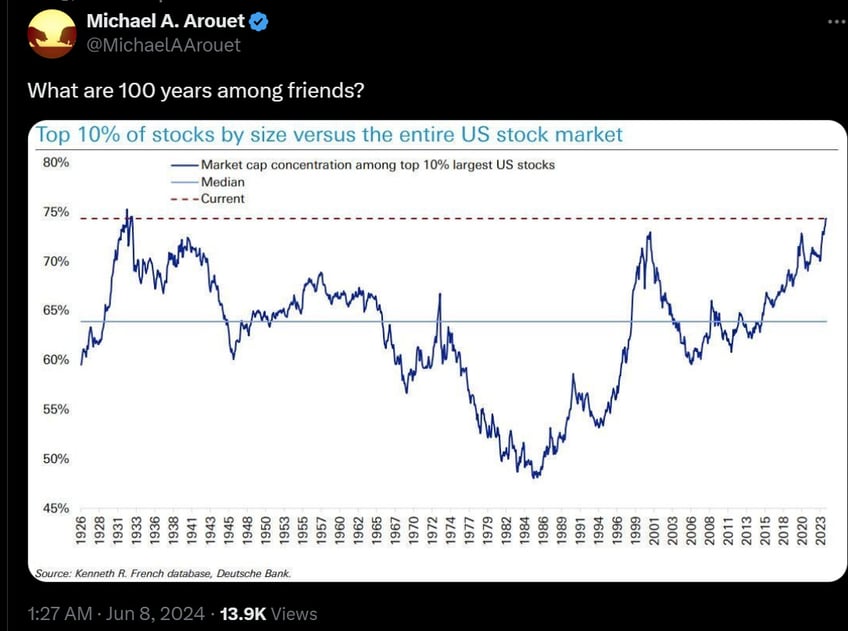

The S&P 500 (which we’re short via the SPY ETF) has only reached its current level of market-cap concentration two other times in modern financial history. What were those other times? Have a look:

Yes, it was 1929 and early 2000. And yet here we are with that same concentration in 2024 with a very expensive market (approximately 25x run-rate operating earnings!) and a U.S. consumer who's finally cracking in a consumer-driven economy. Retail sales comps are now negative on an inflation-adjusted basis and scores of retailers have recently warned about a tough business environment. (Even heretofore fairly strong Walmart warned in June about a weakening consumer.)

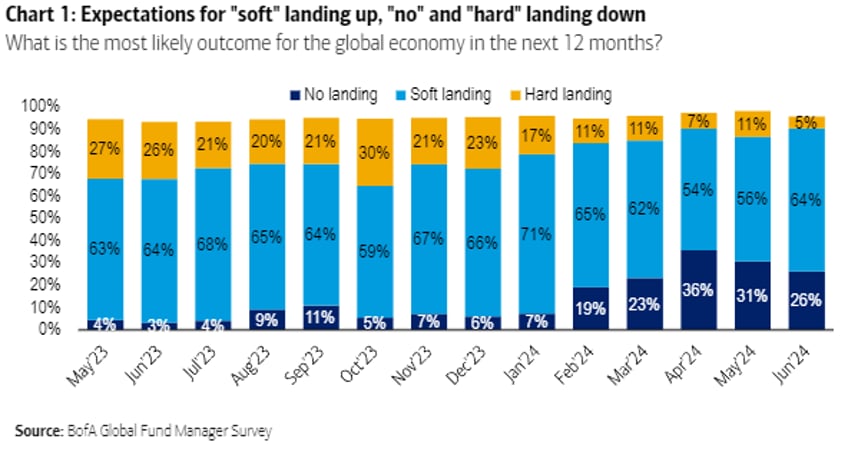

Meanwhile, Q1 GDP growth came in at just 1.4% while home sales are plunging. At some imminent point in time, this stock market will switch from "bad news is good news" to "bad news is bad news" as it suddenly realizes that there's a HARD economic landing coming which, according to a recent Bank of America survey, only 5% (!) of investors expect…

…while sticky inflation (3.4% core CPI and 2.6% core PCE) driven by massive federal budget deficits prevents the Fed from cutting enough to compensate for that. That's what we remain positioned for.

So for now, at least, we’ll remain net short and I hope you’ll stay with us for the journey.

Mark On His Fund’s Key Positions

Here is some commentary on some of our other positions; please note that we may modify them at any time…(READ THIS FULL LETTER HERE).