As the Russian revolutionary and founding father of the USSR famously said on the eve of the Soviet Revolution, ‘There are decades where nothing happens, and there are weeks where decades happen.’ Bringing this quote into the contemporaneous context of the Jubilee year, it has been only a month since the 47th U.S. president was inaugurated, and investors lacking wisdom have been flooded with Truth Social-related noise about Tariff Executive Orders (TEOs) as well as ‘DODGING’ measures, which are supposed to reverse the reckless government spending that took place under the 46th U.S. president.

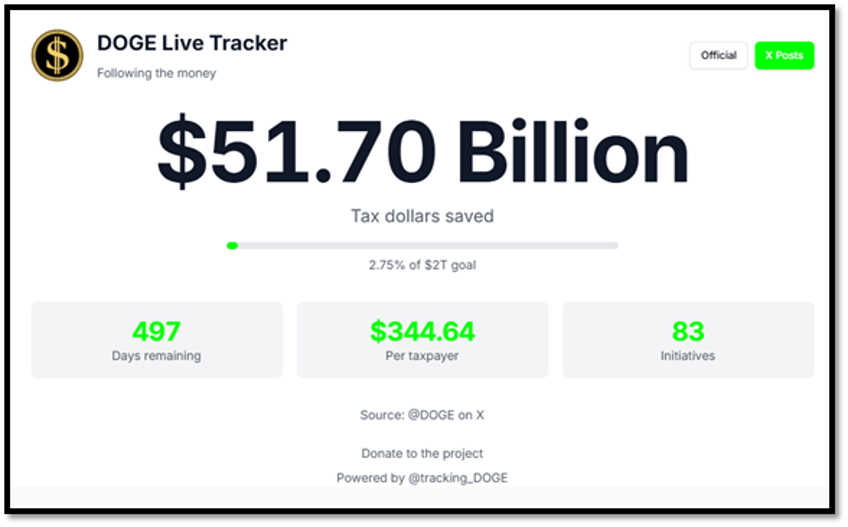

While Rasputin-like tech bros have taken control of the White House and are now populating the Washington plutocracy, nobody should be surprised that the U.S. government has set up a DOGE clock, to relay the propaganda of the new administration. While pursuing a ‘Trumperialist’ American diplomacy focused on striking plutocratic real estate deals domestically and abroad, the $50+ billion saved over the past 30 days in office pales in comparison to the ‘USS Titanic’, effectively on autopilot toward its own debt trap. While some may acknowledge that the DOGE team has achieved more in a month than the previous administration did in four years, it would be presumptuous to claim they will solve the debt problem of a moribund US empire.

https://dogegov.com/dogeclock.html

As a matter of fact, in January alone, U.S. government spending surged 29% to $642 billion, while tax revenues rose just 7.5% YoY to $513.3 billion, resulting in a $129 billion deficit, the second-largest January shortfall ever, trailing only 2021’s post-COVID spike. This pushed the fiscal 2025 deficit to $840 billion, with the first four months marking a record-high cumulative shortfall. With only discretionary spending on the chopping block, debt interest being untouchable unless defaulted on (or inflated away, as it inevitably will be), gross interest on federal debt hit a record $1.167 trillion over the past year, with another $83.6 billion spent in January alone.

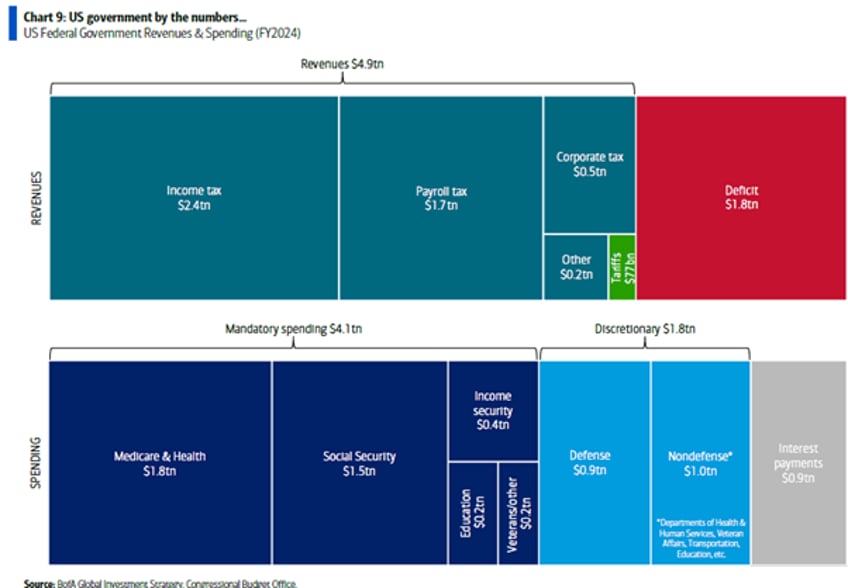

In this context, the $51.7 billion saved by DOGE over the past month seems like a drop in the bucket compared to the $1.8 trillion spent last fiscal year on Medicare, the $1.5 trillion allocated to Social Security, or even the $1.0 trillion in discretionary non-defence spending and the $900 billion devoted to defence to perpetuate the forever bankers’ wars.

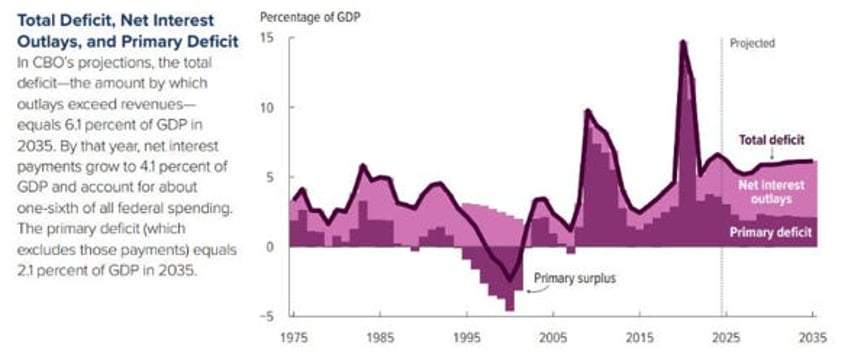

Two days before the 47th U.S. president's inauguration, the supposedly apolitical CBO issued its 2025-2035 outlook, more a desperate SOS than a forecast, as the USS Titanic U.S. government drifts toward financial ruin. While its economic projections are as laughable as ever, no recessions, 1.8% GDP growth, 2% inflation, 4.4% unemployment, and a 3.8% 10Y yield, the real spectacle is in how this fantasy is funded: trillions in endless deficits. The CBO forecasts a $1.9 trillion deficit in 2025, rising to $2.7 trillion by 2035, with deficits exceeding the 50-year average. Reality will be far worse as any recession will unleash a flood of debt-driven spending, without the promised growth.

Debt alone isn’t the issue, it’s the Debt-to-GDP ratio and how debt is refinanced that matter. With debt outpacing GDP, this ratio is set to swell from 122% as of December 2024 to 150%+ or even higher by the next decade. For once, the new Treasury Secretary gets it, admitting, “We don’t have a revenue problem. We have a spending problem.” Yet cutting spending—discretionary or mandatory, would devastate an economy addicted to debt-fuelled excess. For the record, tax revenues remain near the 50-year average, but spending keeps rising, driven by a $1.2 trillion gross interest expense that will never shrink, as debt accumulation outweighs any rate cuts. Meanwhile, national security and social programs will cost $1.85 trillion next fiscal year. If DOGE succeeds, discretionary spending is expected to drop to 5.3% of GDP, well below the 50-year average of 7.9%.

However, the new Treasury Secretary received a parting gift from Yellen: the U.S. hit its debt ceiling on Trump’s inauguration day. Until Congress lifts it, likely by late summer, total U.S. debt remains frozen for 5–6 months as the Treasury drains its $828 billion cash balance to zero. For markets, this means shadow liquidity will flow in from behind the curtain a trend that has historically boosting equities and temporarily lowering long-term yields until the Treasury General Account is depleted.

Upper Panel: S&P 500 index (blue line); US Treasury General Account (axis inverted; red line); Lower Panel: US Treasury General Account (red line); US 10-Year Yield (green line).

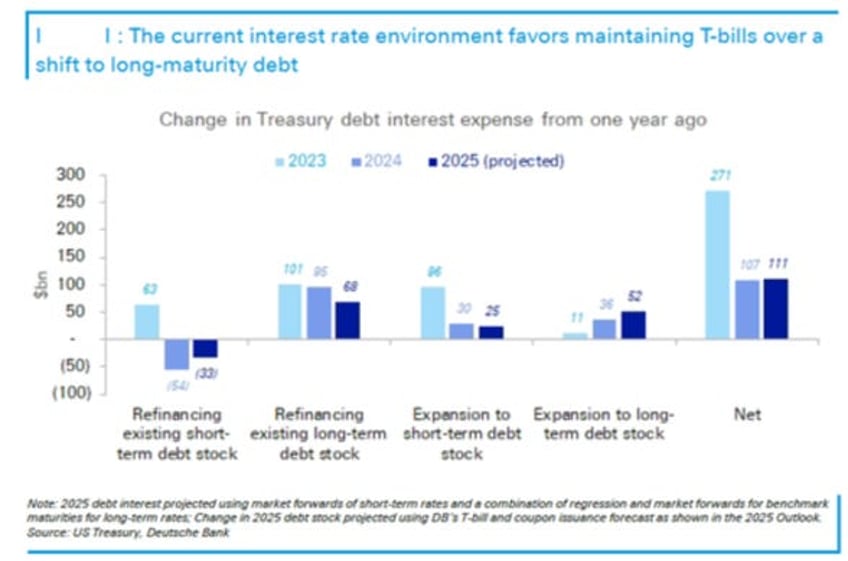

The optics may change, but U.S. debt keeps piling up. By July, expect a $2 trillion surge post-debt ceiling freeze. Refinancing short-term debt could save $33 billion, if the Fed cuts rates, but ‘Trump-Re-Flation’ may force hikes instead. Meanwhile, a $500 billion bill supply boost adds $25 billion in interest; while rolling over long-term debt will cost $68 billion more due to higher rates. With $1.6 trillion in notes and bonds coming, total interest jumps $111 billion, unless rates defy logic.

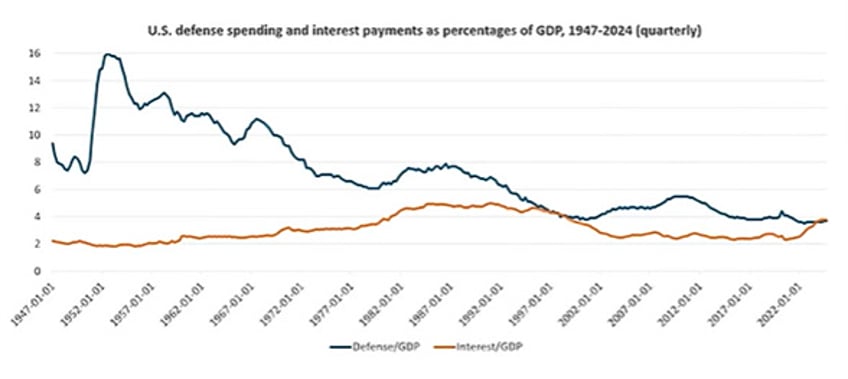

Adam Fergusson, a noted historian, is often associated with an observation referred to as a "law" in discussions of national power and fiscal policy: a great power that spends more on debt interest payments than on defence will not remain great for long. Though not a formal statute, this concept stems from Fergusson’s analysis of historical economic collapses, notably in his book When Money Dies, which chronicles the Weimar Republic’s hyperinflation. It highlights a critical shift when a nation diverts financial resources from vital investments like military strength—key to geopolitical influence—to debt servicing, signalling vulnerability and decline. In fact, the United States breached this "Fergusson Law" in 2024, as the currently uncontested U.S. empire spent more on debt interest than on defence by year’s end.

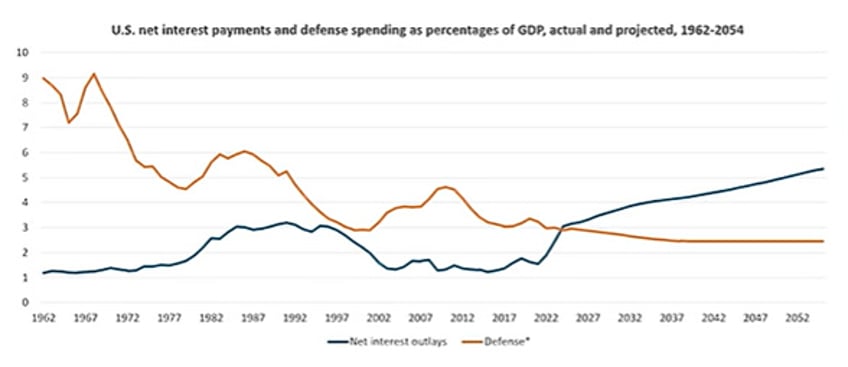

Per CBO projections from January 2025, U.S. net interest payments on debt are set to dwarf defence spending, reaching $952 billion versus $859 billion in 2025, a gap that balloons by 2035, with interest at $1.8 trillion and defence around $1 trillion. This trajectory, driven by rising debt (118% of GDP) and higher rates, sees interest costs doubling defence outlays within a decade, straining fiscal priorities. By 2049, the United States will be spending two times as much on interest payments than on defence spending, a very bad and unsustainable path indeed.

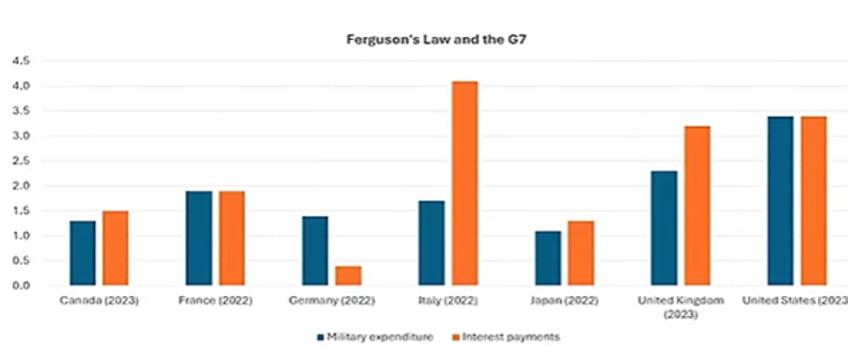

It is not only the U.S. that is violating "Fergusson’s Law"; among the G7 nations, representing the declining post-World War II old world order, all but Germany have long breached this so-called curse of "Fergusson’s Law."

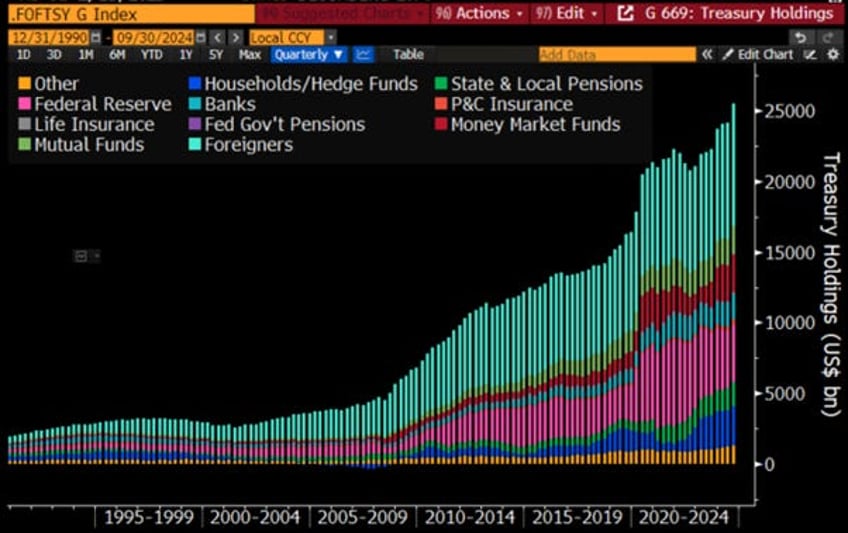

It should be clear by now that the ultimate endgame for the U.S. Treasury Secretary will be to inflate the debt away, rather than risk a direct default at least in the short-term, an approach that could spread social unrest far more quickly than hiding it behind a tariff-driven ‘Trump-Re-Flation’. Yet, it’s striking that foreigners, mutual funds, money market funds, and banks remain the top holders of what they still consider a ‘risk-free’ asset, despite the fact that anyone with even a basic understanding of finance knows it’s anything but risk-free anymore.

As the world becomes more polarized and the threat of weaponizing USD assets looms alongside tariffs and other threats, it’s unlikely that foreign holders of U.S. Treasury debt will continue to buy or even hold their bonds. The trend we saw under the 46th U.S. president, where foreign central banks, particularly in the global south, started ditching their treasuries in favour of hedge funds based in jurisdictions like the Cayman Islands, Ireland, and Luxembourg, is set to accelerate over the next four years.

US Treasury Holdings by Japan (blue line); China (red line); Saudi Arabia (white line); Luxembourg (green line); Cayman Islands (purple line); Ireland (yellow line).

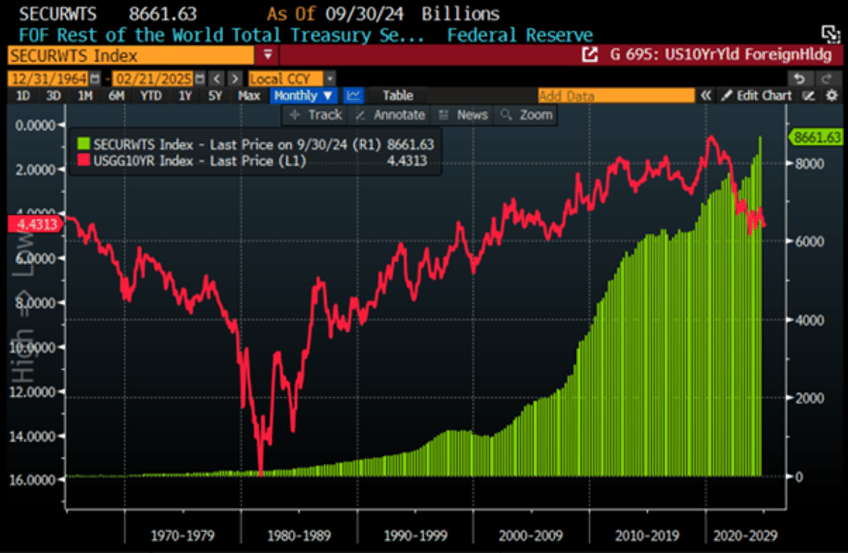

In the past, there was an inverse correlation between the U.S. 10-year yield and foreign holdings, but that relationship has broken down since the start of the decade. The shift in foreign holders from yield-insensitive central banks in developed and BRICS countries to yield-sensitive, fickle hedge funds in fiscal paradises like the Cayman Islands and Luxembourg has rendered that correlation irrelevant.

Foreign holdings of US Treasuries (green histogram); US 10-Year Yield (axis inverted; red line).

Since starting his term at the U.S. Treasury, Scott Bessent has attempted to play the peacemaker between the 47th U.S. president and the FED chairman. The new Treasury Secretary, who clearly understands financial markets better than his predecessor, declared upon inauguration that his goal is to lower the U.S. 10-year yield rather than pressuring the Fed to cut rates during the ongoing inflationary boom. However, he may have omitted that, in the long run, the 10-year yield is simply the FED Funds rate minus the term premium.

Upper Panel: US 10-Year Yield (blue line); US FED Fund Rate + US Term Premium on a 10-Year Zero Coupon Bond (red line); Lower Panel: US Term Premium on a 10-Year Zero Coupon Bond (histogram).

Those who have studied the bond market know that over the long term, the term premium acts as a rough proxy for the yield curve's shape, as it consistently aligns with the spread between the 10-year and 6-month yields.

US Term Premium on a 10-Year Zero Coupon Bond (histogram). Spread between the US 10-Year Yield & US 6-Month Yield (Histogram) & Correlation.

If Bessent is targeting the term premium, he’s essentially chasing a flatter or inverted yield curve, the same old trick Yellen perfected. Translated in layman’s terms, it means continue plugging the U.S. government’s gaping fiscal hole with short-term bills instead of long-term bonds. In the end, the Treasury may have a new chef, but the recipe remains unchanged, just with a different garnish.

US Total Debt Outstanding Bills to US Total Public Debt Outstanding (green histogram); US Term Premium on a 10-Year Zero Coupon Bond (axis inverterd; red line);; & Correlation.

Political comments may create ‘Forward Illusion’ and ‘Confusion’, but investors know that only the business cycle drives asset allocation. Two key market ratios, the S&P to Oil Ratio and the Gold to Bond Ratio, relative to their 7-year moving averages are what matter not what those ruling the country want ‘We The People’ want to believe. A look at the S&P 500 to Oil Ratio versus its 7-year moving average and the Public Debt to GDP ratio shows that, contrary to common wisdom, when the S&P 500 to oil ratio falls below its 7-year moving average, the U.S. Public Debt to GDP ratio typically declines first, bottoming at the inflection point of the S&P 500 to oil ratio, as seen in July 2008 and June 2022.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/dodging-debt

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.