European markets opened higher on Monday, with the Euro Stoxx 50 gaining nearly 1%, while defense stocks erupted amid expectations of increased military spending. The jump in EU defense stocks follows last week's collapse in the US-Ukraine peace deal negotiations, prompting European leaders on Sunday to call for increased defense spending.

The Goldman EU Aerospace and Defense Index jumped 12.5% to a record high after European leaders met on Sunday to discuss increased support for Ukraine and broader security measures across the continent. Individual names skyrocketed, with Rheinmetall soaring 11.5%, BAE Systems jumping 13.5%, Leonardo 11%, and Rolls-Royce gaining 5%. France's Thales jumped 11.5% and Dassault Aviation +15%.

JPMorgan analysts told clients earlier that events in recent weeks "turbocharged" their thesis of increased defense spending for EU states:

"There are 30 European countries in NATO, and we expect many of them will soon commit to much higher defence spending."

In a separate note, Goldman analyst James Fitzsimmons cited thoughts from his trading desk about the surge in defense stocks:

"Seems breakdown in US/Ukraine talks have put the momentum behind a European initiative (UK + France) that could bring increased defence spending, security guarantees and a mineral deal. Equally stories coming from Germany on increased defence spending: "Economists advising the parties that will likely form a new government coalition estimate around 400 billion euros ($415 billion) are needed for the defense fund and 400 billion to 500 billion euros for the infrastructure fund, the people said."

Goldman analyst Fahad Javid shared insights on how European nations plan to ramp up defense spending:

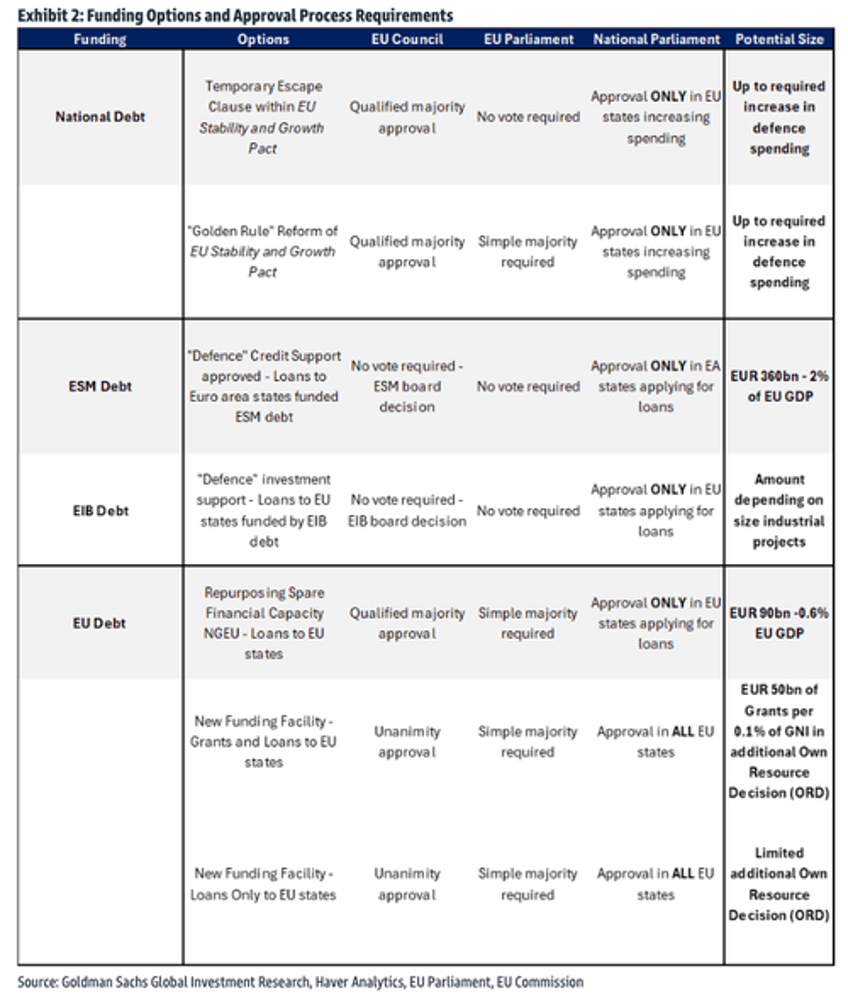

"EU Defence Spending – European leaders meet this week to agree on a common strategy for increasing defence spending and identifying the best ways to fund a structural shift in fiscal policy. Funding military spending through national debt would create tensions with the fiscal consolidation required by the new European fiscal framework. EU member states could borrow from existing EU institutions like the European Stability Mechanism and European Investment Bank. EU debt could provide stable funding shielding defence spending from idiosyncratic national factors. The EU could also consider establishing a new European funding programme in conjunction with strategic partners like the UK or Norway. We continue to expect the EU to use national debt, NGEU and a new funding facility, in that sequence."

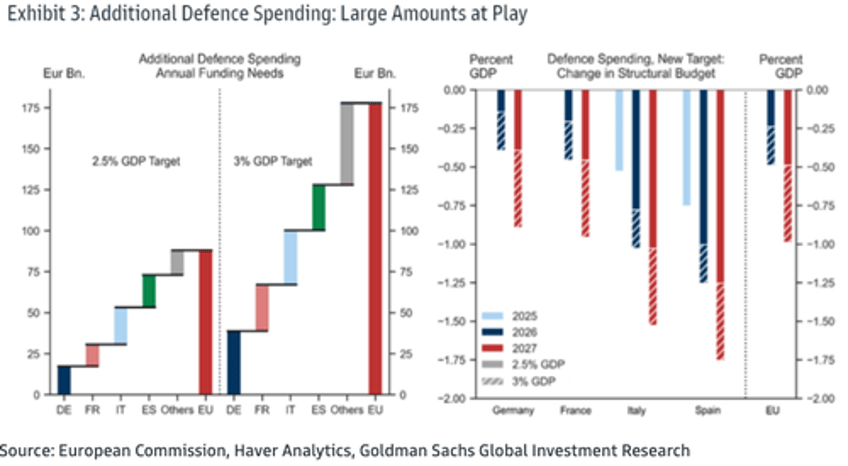

Chart of The Day: The structural increase in government spending ranges implies an increase in the structural deficit between 0.5% - 1% BY 2027.

Goldman's Sven Jari Stehn, Filippo Taddei, and others examined the different funding options for increased military spending:

Stehn noted, "We expect the EU to gradually increase annual military spending to reach 2.5% of GDP by 2027 in line with different policy announcements."

All it took was Turmp's hard lining with Zelenskyy last week to get the Europeans to increase defense spending to adequate levels.