Exclusive: China and LATAM Silver Part 1

Crowding Out the Competition

Contents:

- Bottom Line: Supply-Demand Economics

- Background: China Wants the Silver

- China’s Trade Negotiation Style

- Trinidad and Tobago: From Oil to Infrastructure

- Argentina: Yuan for Dollars

- Part 2 Overview

1- The Bottom Line: Supply-Demand Economics

- According to Mainland China sources: China is buying unrefined Silver concentrate from LATAM miner/refiners, something infrequently done except briefly during times of acute supply/demand imbalances.

- From LATAM mining sources: China is paying refined prices for unrefined Silver Concentrate, spending as much as $200 more a ton for each load of material.

- China is effectively laying claim to LATAM silver before it is refined and crowding out Western buyers by paying higher prices for ore without directly affecting spot price.

Based on these findings, there are serious implications for Silver’s price and accessibility down the road which also raise questions about Silver’s importance as a critical metal in the US.

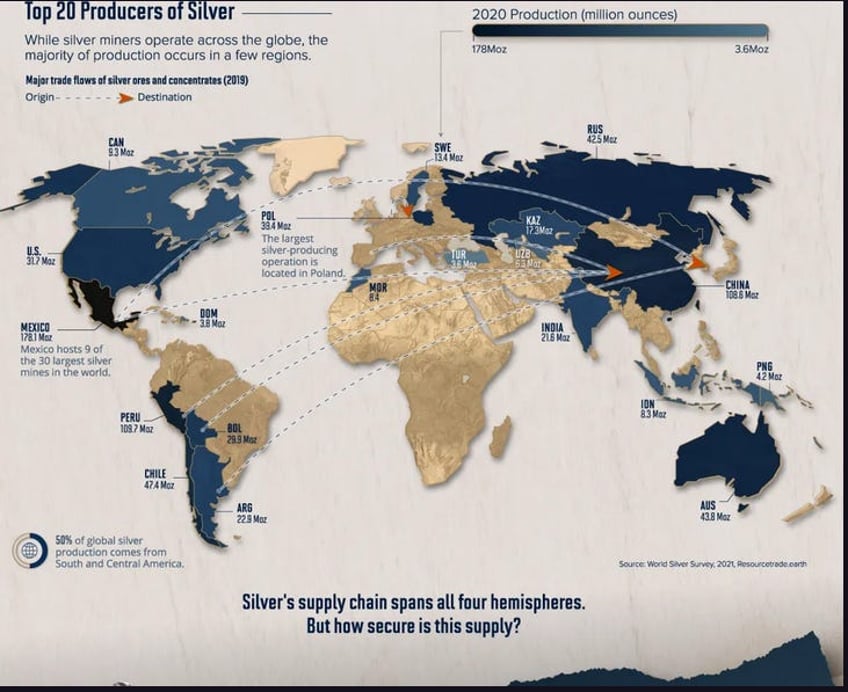

2- Background: China Wants LATAM Silver

China’s domestic Silver production is in decline, while their industrial demand due to solar panels is soaring. China’s domestic supply shortage was described in a collaborative work with Bai Xiaojun

Peak China Silver: The Looming Silver Extinction Event

China stands among the top five silver consumers globally, with an average annual demand of 6300 tons over the past decade. Startlingly, the United States Geological Survey (USGS) data from 2011-2020 reveals that China's yearly silver mineral production barely reaches 3350 tons, leaving a significant supply gap of approximately 3000 tons to be fulfilled through imports.

- China had been buying more refined silver overseas to make up the growing shortfall

- To ensure Silver supply and meet their growing industrial demand, they are paying a higher price for Silver in LATAM than competing buyers are

- China is in many cases assuming the cost of Silver Concentrate treatment and subsidizing the concentrate vendor for it. In some cases, they are subsidizing more than 100% of Concentrate treatment cost.

China Customs releases Concentrate data monthly...

Silver concentrate. https://t.co/00pQy931wm

— VBL’s Ghost (@Sorenthek) July 29, 2024

An emerging crisis may be manifesting in the front part of the supply chain (Mining>some Refining) involving procurement of raw materials due to: decreasing mine yields, fragmenting global trade from nationalization/mercantilism trends, and growing competitive demand.

In covering the reason for China’s growing Silver demand this was also stated previously.

From China Dominates Solar Silver:

Meanwhile as China grows its influence on the Value-added portion of the supply chain, investors should assume more global drainage of above ground silver leading right to their domestic manufacturing facilities.

China is the world’s largest solar panel manufacturer and controls between 80 and 90% of the global supply chain. Consequently, they have increased overseas acquisition of silver to secure raw materials for it to cover domestic production shortfalls

China needs more Silver to satisfy its manufacturing demand...

How then, are they getting it?

3- China’s Trade Negotiation Style

China’s approach to securing natural resources is well known in LATAM.

They have sought and secured raw commodity supply for in things like Grains and Oil for years using a simple premise: Find what the seller needs beyond payment for the commodity, and get it for them. Build trust by negotiating each deal in good faith. They try to add value to the deal if they can in creating longer term business relationships.

Here are two known examples from personal experience.

4- Trinidad and Tobago: From Oil to Infrastructure

Since 2010 China had been openly courting Trinidad & Tobago for their Oil. Visitors back them reported to this author stating they saw “more Chinese than locals” 1on the islands. These were businessmen cutting deals with T&T for Oil in the early days of the Belt and Road Initiative that also included infrastructure development. Today, these nations share a full blown trade relationship

5- Argentina: Yuan for Dollars

During the Argentine peso crisis in the early 00’s and beyond, it was China who rode to the rescue offering much-needed dollars to the cash strapped country for its Soybeans essentially playing a large role in rescuing Argentinians central bank. Gradually over the years Yuan were added to the mix in their deals. Now, as of August 2023, Argentina is paying IMF dollar loans back with Yuan on loan from China

For the first time, it met a payment obligation with the International Monetary Fund (IMF) in Chinese yuan worth the equivalent of one billion US dollars, with a further $1,7 billion disbursed in Special Drawing Rights, considered the IMF’s currency as it is a reserve asset made up of a basket of the world’s main currencies.

Shortly after this China and Argentina announced a new bolder deal in which China would loan Yuan to Argentina to help its central bank remain liquid

China knew what Argentina (still) needed, and gave it to them in return for more favorable trade status. Now they are doing it in Silver all over LATAM according to two sources on opposite ends of the Silver supply chain and separated by the Pacific Ocean

6- Part 2 Preview: How They Do it

In part two we will post specifics from that conversation with the mining exec, analyze the direct implications, some numbers and comment on longer-term economic effects of this strategy.

Questions asked and answered include:

QUESTION: What is Silver Concentrate, Dore bars, and where do they fit in the chain?

QUESTION: The supply deficit is about 4 years old now and running, how is this shortfall being covered?

QUESTION: We have been seeing since 2022 a marked drop in financial hedging activities for LATAM silver miners using Comex and also as reflected in the SiFO rates for leasing metal. Is that consistent with what you are seeing on the ground there?

QUESTION: We’ve been told that China silver production has been declining for quite some time and they’d been outsourcing increasingly. Any comment on that?

QUESTION: Are you seeing more direct purchases of Silver now? If so, by who?

QUESTION: Where do Bullion Banks Fit in?

And more….

Continues here

Free Posts To Your Mailbox