Why Businesses May Find Better Value in Bitcoin Mining

Bitcoin and other cryptocurrencies have garnered substantial attention as investment assets. However, direct investment in these digital currencies carries significant risks. According to the Federal Reserve, the volatility of Bitcoin prices makes it a speculative investment. For instance, Bitcoin's price plummeted from nearly $65,000 in April 2021 to around $30,000 in June 2021. This unpredictable nature can be detrimental to businesses looking for stable returns. Consequently, more businesses are finding better value in Bitcoin mining.

Our discussions below explore why investments in digital currency mining servers, such as those manufactured by ASICRUN, are becoming a preferred option. We’ll consider the benefits of these mining servers, their energy efficiency, and the impressive return on investment (ROI) value proposition they offer.

The Volatility of Direct Cryptocurrency Investments

Investing directly in Bitcoin or other cryptocurrencies can be highly volatile. The market's unpredictable swings can lead to significant financial losses. According to one detailed analysis of volatility in the digital currency sector between January 2017 and January 2023, Bitcoin experienced an average daily price fluctuation of 3.03% - versus 0.36% for the Yen, 0.34% for the Euro, and 0.42% for the Euro. Other digital currencies, such as Ethereum, Binance and Ripple didn’t fare any better either!

This kind of volatility makes it challenging for businesses to maintain consistent profitability. Given this volatility, businesses are exploring more stable investment avenues within the digital currency landscape. Mining servers provide a controlled and predictable way to benefit from cryptocurrencies.

ASIC Digital Currency Servers: Energy Efficiency and Cost-effectiveness

Bitcoin mining has come under scrutiny for its significant energy consumption. According to the Cambridge Bitcoin Electricity Consumption Index, Bitcoin mining consumes more electricity annually than entire countries like Argentina. This high energy consumption raises environmental concerns and can lead to negative publicity for businesses involved in Bitcoin mining.

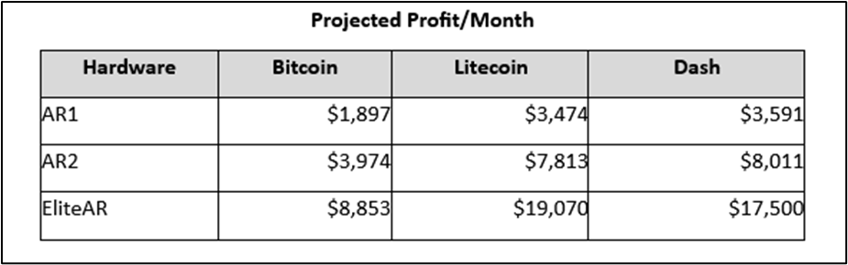

However, advancements in mining technology are addressing these concerns. ASICRUN mining servers stand out due to their higher energy efficiency. Despite their high computational power, ASIC servers consume relatively low power: the AR1 Miner at 650W, the AR2 Miner at 1,300W, and the EliteAR Miner at 2,800W. This translates to lower monthly power costs, ranging from $50 to $250, depending on the server used.

The energy-efficient design of ASICRUN servers significantly reduces operational costs. Lower power consumption directly translates to higher profitability for miners. The cost savings on energy, combined with high computational output, make these servers an attractive option for businesses looking to maximize their returns in the cryptocurrency mining space.

The Business Case: Superior ROI with ASICRUN Servers

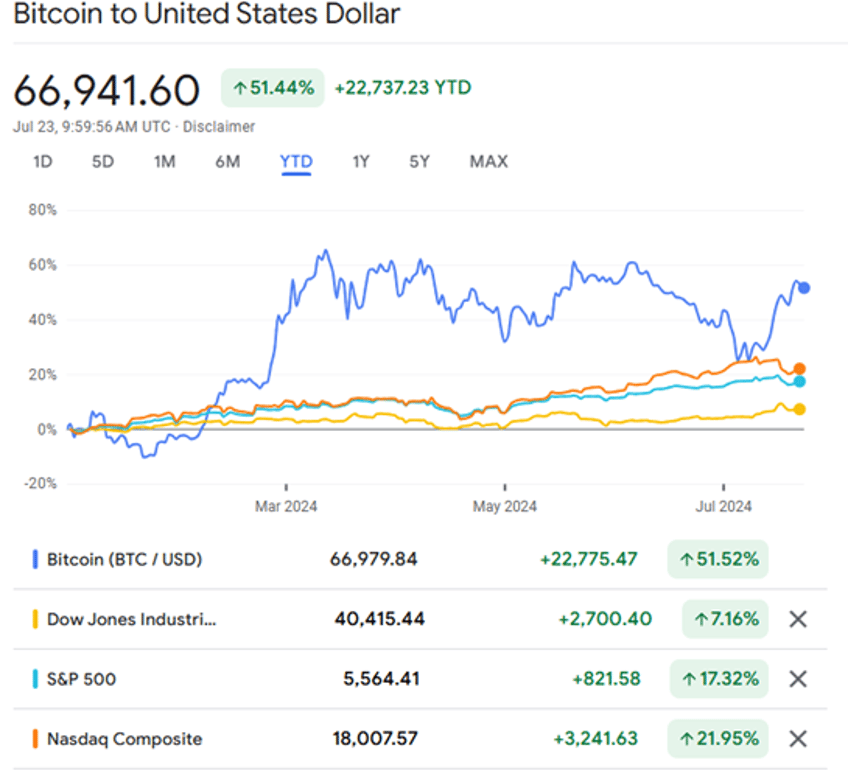

Any smart business investor considers an investment opportunity based on its return on investment (ROI). And that’s where factors such as digital currency valuations come into play. For instance, with the year-to-date price-gains of Bitcoin far outpacing all the major stock indices, it’s clear that the demand for highly volatile digital currencies continues to grow, compared to other investment opportunities.

However, the investor rush for digital assets like Bitcoin, Litecoin and Dash, opens doors to greater profitability for the miners of those assets – especially those that use high end, optimized, state-of-the-art mining servers. This exceptional demand-side dynamics of digital currencies, provides supply-side miners an attractive (and highly profitable) value proposition!

One of the most compelling reasons to invest in ASICRUN servers is the impressive ROI they offer. Thanks to their low power consumption and high efficiency, users can expect substantial profits in a relatively short period. Miners quickly offset the initial investment in these servers by the earnings generated through mining activities.

Unlike direct cryptocurrency investments, where the ROI is subject to market fluctuations, the ROI from mining with ASIC’s servers is more predictable and stable. Businesses can plan their finances better and achieve their financial goals with greater certainty.

Avoiding Regulatory Hurdles

Regulatory uncertainty further complicates direct digital currency investments, making the business case even stronger for investing in digital currency mining infrastructure as an alternative. Governments around the world, including the United States, are still developing frameworks to regulate cryptocurrencies. The SEC has repeatedly warned investors about the risks associated with cryptocurrency investments and has taken actions against several crypto firms for non-compliance.

This evolving regulatory landscape can result in sudden changes that negatively impact Bitcoin's value and liquidity. Businesses investing in Bitcoin must stay abreast of regulatory developments, which can be both time-consuming and resource-intensive. Regulatory changes can also introduce compliance costs and legal risks, further eroding the potential profitability of Bitcoin investments.

As a user of ASIC mining servers, there are additional regulatory benefits:

- They comply with all applicable laws and regulations of the country for which the products are destined.

- ASIC deals with customs and fees required (if applicable).

- The equipment is insured by ASIC – which provides additional stress relief for miners

This makes mining digital currencies an even better value proposition that investing in other sectors of the digital currency landscape.

Insulation from Economic Downturn Effects

Interest in Bitcoin and digital currencies continue to gain traction, which is an encouraging development for ASICRUN digital currency miners. According to Statista,

“Cryptocurrency mining produced increasing revenue over the years, leading to 63 million U.S. dollars on a single day in 2021”.

However, economic downturns can drastically affect Bitcoin prices. During times of economic instability, investors often move their assets to more stable investments, causing a drop in Bitcoin value. For instance, during the COVID-19 pandemic, Bitcoin experienced significant volatility, reflecting broader economic uncertainties.

Businesses relying on Bitcoin investments may find their financial health adversely impacted during economic downturns. This can complicate cash flow management and strategic planning, making Bitcoin a risky proposition in uncertain economic climates. As a digital currency miner, however, you’ll still enjoy more stability and predictability in your cash flow.

Tax Implications

Direct digital currency investments come with complex tax implications – none of which impact miners. The IRS classifies cryptocurrencies as property, meaning investors must report each transaction for capital gains or losses. This can create significant administrative burdens for businesses, requiring meticulous record-keeping and reporting.

Additionally, the tax treatment of digital currencies varies by jurisdiction, adding another layer of complexity for businesses operating in multiple regions. Failure to comply with tax regulations can result in hefty fines and legal issues. This further diminishes the appeal of direct digital currency investments, but strengthens the business case for investing in Low-cost, high-profitability mining servers.

Parting Thoughts

Investing in digital currency mining servers offers a more stable and predictable return compared to direct cryptocurrency investments. ASICRUN mining servers, with their energy efficiency and high ROI, provide businesses with an excellent opportunity to capitalize on the cryptocurrency market's potential while mitigating risks associated with price volatility. As the digital currency landscape continues to evolve, businesses that adopt mining infrastructure like ASIC manufactured servers will be well-positioned to reap substantial rewards.

By choosing ASICRUN servers, businesses not only benefit from lower power costs and high efficiency but also enjoy the peace of mind that comes with a more stable and profitable investment. They make a strong business case for your next investment to achieve significant profits in a short time.