S&P 500 futures are flat, holding near Wednesday’s record high, with WTI futures bouncing around after OPEC+ agreed to delay output hikes for 3 months. As of 8:00am, futures were flat in a quiet trading session ahead of NFP after closing at a new all-time high for the 56th time in 2024; Nasdaq futures are down 0.1% as Mag7 names are mostly lower premarket with Semis underperforming. Bond yields are 1-2bps higher. Financials indicated higher. Bitcoin topped $100,000 for the first time after President-elect Trump named crypto proponent Paul Atkins to head the SEC. Microstrategy, which has become a proxy for crypto in the world of stocks, was up 8% crushing the latest onslaught of shorts. French assets rose slightly as investors debated the implications of the collapse of Michel Barnier’s government. The CAC 40 stock index climbed 0.1% in Paris, tracking Europe’s regional Stoxx 600 gauge. Commodities are mixed while the USD extends losses for a third consecutive day. It is a relatively light macro data day with jobless claims, which is not thought to be catalytic given tomorrow's NFP print.

In premarket trading, cryptocurrency stocks jumped on Thursday after Bitcoin rallied past $100,000 for the first time, boosted by President-elect Donald Trump’s embrace of digital assets. Microstrategy, Coinbase, Riot Platforms and MARA Holdings were among those sharply higher in premarket trading. Here are some other notable premarket movers

- AeroVironment (AVAV) falls 8% after the drone maker reported 2Q adjusted EPS that disappointed amid higher R&D spending.

- American Eagle Outfitters (AEO) tumbles 13% after the apparel retailer lowered its full-year comparable sales forecast.

- ChargePoint (CHPT) jumps 11% after the electric-vehicle charging company reported third-quarter revenue that beat average expectations.

- Fiserv (FI) drops 9% after President-elect Donald Trump tapped the fintech’s CEO Frank Bisignano to serve as the Commissioner of the Social Security Administration.

- Five Below (FIVE) jumps 14% after the discount retailer boosted its full-year net sales guidance and named former Forever 21 head Winnie Park as CEO.

- Nano-X Imaging (NNOX) rises 11% after the medical imaging technology company said it received FDA clearance for its Nanox.ARC x-ray system.

- NCino (NCNO) declines 19% after the banking software maker’s fourth-quarter revenue forecast fell short of estimates.

- SentinelOne (S) falls 15% after the cybersecurity software company posted 3Q profit that fell short of estimates.

- Synopsys (SNPS) declines 8% after the maker of electronic design automation software provider a weaker-than-expected forecast.

S&P 500 contracts were steady after the 56th record close of 2024 put the index on course for its best year since 2019. Fed Chair Jerome Powell buoyed sentiment on Wall Street by saying the US economy is in “remarkably good shape.” The dollar and Treasuries were lower. Attention turns next to today’s US jobless claims numbers before key non-farm payrolls data Friday.

In comments at the New York Times DealBook Summit in New York, Fed Chair Powell said downside risks from the labor market had receded. He also said Fed officials could afford to be cautious as they lower rates toward a neutral level — one that neither stimulates nor holds back the economy. Powell’s comments on the US economy did little to alter expectations implied by market pricing that the Fed will cut rates again when it meets later this month. Meanwhile, two surveys showed that US executives turned significantly more optimistic about the economy and prospects for their own businesses after Trump won the election.

France’s far-right leader Marine Le Pen teamed up with a left-wing coalition to topple Barnier’s administration on Wednesday, pitching the country into further political turbulence. President Emmanuel Macron now needs to find another premier who can pass a budget for 2025 through the deeply divided parliament.

“The markets have partially anticipated this development, but repercussions can be expected,” said Alexandre Hezez, chief investment officer at Group Richelieu. “Any political or budgetary misstep could punish France much more severely on the markets.”

French assets rebounded slightly as investors debated the implications of the collapse of Michel Barnier’s government. The CAC 40 stock index climbed 0.1% in Paris, tracking Europe’s regional Stoxx 600 index which rose for a sixth straight session and French equities outperform in early Thursday trading amid optimism that tax hikes proposed by the toppled government will not materialize. French aerospace firm Safran was lagging behind as analysts didn’t approve of its new targets. Aurubis rose on a higher-than-expected dividend. Here are the biggest movers Thursday:

- Aurubis shares rise 14%, the most in 15 years, after the German copper producer announced a higher dividend than expected, which analysts called a positive surprise

- French equities rise after a no-confidence vote toppled Prime Minister Michel Barnier, amid optimism that his proposed tax hikes will not pass in parliament, with the CAC40 up as much as 0.7%

- HelloFresh shares gain as much as 12% on Thursday after Jefferies analysts raised their rating to buy from hold, saying the meal-kit firm’s stock is still trading “in value territory”

- Watches of Switzerland shares jump as much as 10%, hitting their highest level since January, after the watch retailer reported a much better set of revenue figures in its second quarter

- Avanza gains as much as 5.7% following an upgrade to buy at SEB, which expects the retail-trading platform’s outlook to be boosted by improving disposable incomes in Swedish households

- TotalEnergies gain as much as 1.9% after the French energy company was upgraded to outperform at RBC, which notes a stronger outlook for shareholder compensation, relative to peers

- Card Factory shares rise as much as 10%, the most since April 30, after the UK retailer’s acquisition of Minnesota-based Garven Holdings for $25 million

- Continental shares rise as much as 1.9% after Bernstein analysts upgraded the auto parts maker to market perform, saying they expect the company’s tire business to remain strong next year

- Safran shares drop as much as 5.5% after some analysts said the new targets outlined by the aerospace firm for the coming years are well below consensus expectations

- Serica Energy drops as much as 5.7% after the oil and gas producer warned it has had to shut production at the Triton FPSO because of more issues, resulting in another cut to FY production guidance

- Frasers Group shares fall as much as 15%, the biggest intraday drop since March 2020, after after the UK owner of retail outlets such as Sports Direct and House of Fraser cut its FY profit forecast

- Tullow Oil shares plunge as much as 11% after announcing it has started to search for a new head as Chief Executive Rahul Dhir will step down in 2025

- Synsam falls as much as 9.7% after its shareholder Theia Holdings offered as many as 16 million shares at a 9.9% discount compared to Wednesday’s close

In Asia, the MSCI Asia Pacific index was little changed as technology shares advanced while Korean stock losses extended amid a political turmoil with the country’s ruling party looking to prevent President Yoon Suk Yeol’s impeachment by voting against a motion to initiate proceedings that may take place Saturday. The MSCI Asia Pacific Index traded in a narrow range, with TSMC and other chip shares in the region tracking the sector’s gains on Wall Street overnight. Shares in Hong Kong declined, while Chinese equities listed in the city also snapped a four-day winning streak with traders awaiting a key policy meeting later this month. South Korean stocks slid for a second day, with the ruling and opposition parties set to clash over an impeachment motion to unseat

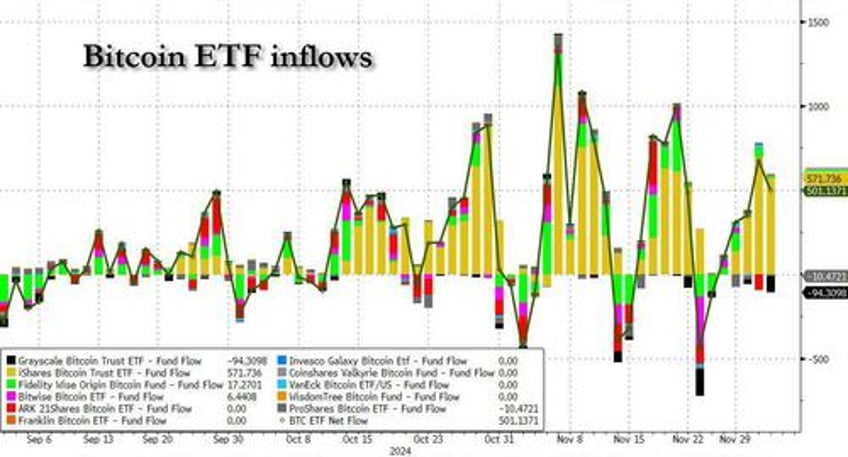

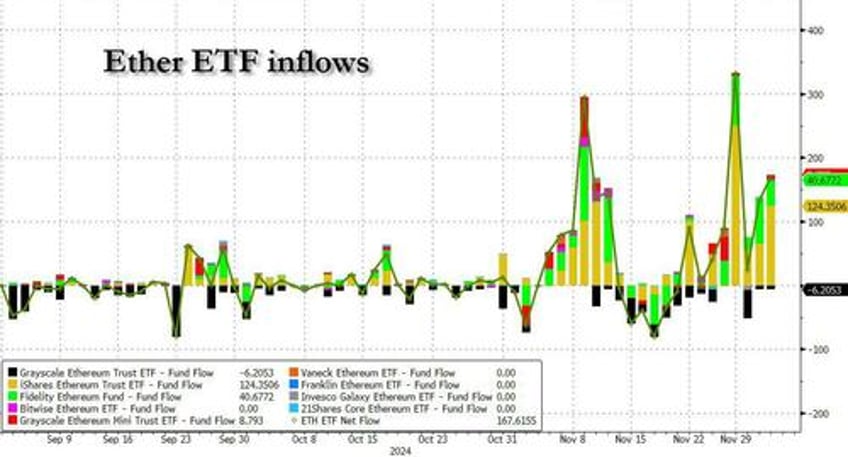

Bitcoin jumped as much as 6.1% to breach the $100,000 mark for the first time, boosted by Trump’s embrace of digital assets. Crypto tracking ETFs have seen huge inflows in recent days.

In FX, the Bloomberg Dollar Spot Index slipped 0.1%, falling for the second straight day; the yen extended gains after Bank of Japan Board Member Toyoaki Nakamura said he didn’t object to an interest rate hike later this month. EUR/USD edged up 0.2% to $1.0530 after France’s Prime Minister Michel Barnier was toppled in a no confidence vote, as widely expected

In rates, treasuries are slightly cheaper across maturities, underperforming core European rates ahead of weekly jobless claims and Friday’s broader US employment report. The US 10-year yield is higher by 3 bps to 4.21% with comparable bunds and gilts little changed, while French 10-year bond rise, trades around 5bp richer vs US, and outperforming their German peers and narrowing the 10-year yield spread to the lowest level this week despite the collapse of Michel Barnier’s government. President Macron is scheduled to make a statement at 8 p.m.

In commodities, oil prices edged higher as OPEC+ meets to discuss a further delay to its plans to revive oil production. WTI rises 0.5% to $68.90.

The US economic data calendar includes November Challenger job cuts (7:30am New York time) and October trade balance and weekly jobless claims (8:30am). Fed speaker slate includes Barkin at 12:15pm

Market Snapshot

- S&P 500 futures little changed at 6,094.75

- Brent Futures up 0.2% to $72.45/bbl

- Gold spot down 0.3% to $2,642.18

- US Dollar Index down 0.13% to 106.19

- STOXX Europe 600 up 0.2% to 518.70

- MXAP little changed at 186.91

- MXAPJ little changed at 585.56

- Nikkei up 0.3% to 39,395.60

- Topix little changed at 2,742.24

- Hang Seng Index down 0.9% to 19,560.44

- Shanghai Composite up 0.1% to 3,368.86

- Sensex up 0.9% to 81,698.29

- Australia S&P/ASX 200 up 0.1% to 8,474.92

- Kospi down 0.9% to 2,441.85

- German 10Y yield little changed at 2.07%

- Euro up 0.2% to $1.0530

Top Overnight News

- BOJ’s Toyoaki Nakamura delivers somewhat dovish remarks, calling for policy tightening to proceed at a cautious pace and expressing doubt about the sustainability of wage growth. Bets on a BOJ rate hike this month fell to 37% WSJ

- South Korea’s main opposition leader said ousting President Yoon Suk Yeol may be difficult due to lack of support from the ruling party. BBG

- French stocks and bonds gained ahead of an address by Emmanuel Macron at 2 p.m. ET. As the president looks for a new PM, SocGen strategists see political uncertainty driving risk premium higher until new parliamentary elections. BBG

- The ECB may resort to yield-curve control if a surge in government borrowing costs damps the impact of rate cuts, ING said, though that would be a “bold call” and not its base-case scenario. BBG

- Ukrainian officials are holding high-level talks with the incoming Trump administration, seeking to narrow wide differences on achieving a settlement of Kyiv’s war with Russia even before President-elect Donald Trump takes office. WSJ

- US President-elect Trump picked Paul Atkins for SEC Chair, while he picked Faulkender for Deputy US Treasury Secretary and Gail Slater as assistant AG for the antitrust division at the Department of Justice. Trump also named former Senator Kelly Loeffler to serve as Administrator of the Small Business Administration and Frank Bisignano to serve as the Commissioner of the Social Security Administration, while he named former Congressman Billy Long of Missouri to serve as the Commissioner of the Internal Revenue Service.

- Donald Trump's Middle East envoy has traveled to Qatar and Israel to kickstart the U.S. president-elect's diplomatic push to help reach a Gaza ceasefire and hostage release deal before he takes office on January 20th. RTRS

- Bitcoin blew past $100,000 as traders took in the prospect of relaxed regulations under Donald Trump’s pick of crypto proponent Paul Atkins to lead the SEC. BBG

- China is accelerating its efforts to wean itself off of American semiconductors. FT

- US execs turned sharply optimistic after Donald Trump’s presidential win, with 67% confident about the economy, up from 26% in August, a survey showed. Business leaders plan to ramp up investments and hiring, despite inflation jitters. BBG

- Fed's Daly (2024 voter) said they do not need to be urgent and need to carefully calibrate policy, while she will wait until the December meeting to make her decision. Daly also stated that inflation is still the number one challenge people are facing and there's a lot more work to deliver on 2% inflation and durable expansion.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed and partially sustained the momentum from the fresh record levels on Wall St where tech led the advances with the help of earnings releases and softer yields following weak ISM Services data. ASX 200 eked slight gains with tech stocks taking inspiration from the outperformance stateside, while there was also an improvement in the latest trade and household spending data. Nikkei 225 gapped higher at the open but then gave back some of the initial spoils amid a choppy currency, while there was some intraday support seen after cautious rhetoric from BoJ's Nakamura although the momentum waned shortly after. Hang Seng and Shanghai Comp were mixed with sentiment clouded after the PBoC's operations resulted in another net liquidity drain and with a recent article in Chinese state media downplaying the pursuit of fast growth ahead of next week's Central Economic Work Conference.

Top Asian News

- China Foreign Ministry has decided to impose sanctions on 13 US military firms and executives from December 5th, it announced. Some of the firms under sanctions include Teledyne Brown Engineering, Brinc Drones, Shield AI.

- South Korean army chief offered to resign, according to Yonhap

- Chinese state media warned against blindly pursuing faster growth and signalled more focus on supporting consumption in a flurry of articles ahead of the Central Economic Work Conference, according to Bloomberg.

- BoJ board member Nakamura said he is not confident about the sustainability of wage growth, while he added they are at a critical phase and must check many data and cautiously adjust the degree of monetary support in accordance with an improvement in the economy. Nakamura said that he sees a chance inflation may miss 2% from fiscal 2025 onward and noted that Japan's economy has yet to move on course for a stable growth path. Furthermore, he said structural changes in Japan's economy are required for inflation to stably hit 2% which will take a significant amount of time but also stated the adjustment of easy monetary policy will proceed gradually as the economy is expected to head toward a growth path. BoJ Board Member Nakamura later commented during a press conference that they will decide policy by examining data and he is not against a rate hike but believes it should be data-dependent.

- Japanese PM Ishiba said the government should mull what's an appropriate FX level and there are no plans to change the government-BoJ joint stance.

- South Korean ruling party leader Han said the party will try to stop the impeachment motion from passing parliament but demanded that President Yoon leave the party, according to Yonhap. Furthermore, the opposition party said it plans to vote to impeach President Yoon at 7pm local time on Saturday.

European bourses opened flat but started grinding higher shortly after the open despite relatively quiet newsflow but potentially as some of the optimism potentially emanating from the gains on Wall Street. European sectors kicked off the session with a mild positive bias which later expanded as sentiment continued to improve shortly after the cash open. CAC 40 shrugged off the vote of no confidence which played out as expected, while President Macron is reported to be looking to announce a replacement before Saturday as opposed to taking the country to the polls. In terms of US equity futures, mild downward bias seen in the ES and NQ after yesterday's session on Wall Street in which US stocks gained and the major indices printed fresh record highs with the Nasdaq leading advances amid outperformance in Tech and Consumer Discretionary and Communication names.

Top European News

- BoE Monthly Decision Maker Panel data November 2024: Year-ahead own-price inflation was expected to be 3.7% in the three months to November vs. 3.5% in October. Expectations for CPI inflation a year ahead rose from 2.6% to 2.7% in the three months to November.Three-year ahead CPI inflation expectations was unchanged at 2.6%. Firms reported that annual wage growth was 5.5% in the three months to November vs. 5.6% in October. Expected year-ahead wage growth dropped by 0.1ppt to 4.0% on a three-month moving-average basis in November

- French President Macron will address the nation on Thursday evening in a televised speech at 18:00 GMT, according to Sky News.

- French Far-right leader Marine Le Pen said they have some requirements for backing the next PM and will contribute to crafting a budget, while she is not calling for President Marcon's resignation but noted that the pressure is piling up.

- Istat cut Italy's 2024 GDP growth forecast to 0.5% (prev. 1.0% seen in June); cut 2025 GDP growth to 0.8% (prev. 1.1%).

- Moody's said French no-confidence vote is "Credit Negative".

- S&P said the fall of the French Govt. leaves France without a clear path towards reducing its budget.

FX

- USD remains on the backfoot vs. peers following yesterday's ISM-induced move in yields. Commentary from Fed Chair Powell who noted that the Fed can afford to be cautious in finding neutral failed to cause a stir in markets. Today's US Calendar is a lighter one with US challenger layoffs and Fed's Barkin on deck. Tomorrow's NFP release looms large. DXY briefly slipped below yesterday's 106.09 low. The next target comes via the 106 mark; Monday's low sits @ 105.78.

- EUR on a firmer footing vs. the USD with not much in the way of follow-through selling from the collapse of the French government (which was widely expected). Focus remains on the next steps and who (if anyone) Macron can appoint as PM. The main kicker is that the 2024 budget will likely be rolled into 2025. From a broader Eurozone perspective, pricing of a 50bps move at next week's ECB meeting continues to be unwound with odds of a 25bps move now @ 86%. EUR/USD has made some progress on a 1.05 handle with the next upside target coming via the 21DMA @ 1.0561.

- JPY is one of the better performers vs. the USD on account of remarks from BoJ dove Nakamura who stated that he is not against a rate hike. Pricing around the December announcement remains particularly choppy. However, odds of an unchanged rate sit @ 62% vs. 42% seen at the start of the week. USD/JPY is currently tucked within Friday's 149.51-151.22 range.

- GBP firmer vs. the USD for a third session in a row after shrugging off a dovish headline from the FT yesterday about BoE Governor Bailey's view on the rate path (which appeared to in the end be more related to market pricing than his own view). MPC member Greene is due to speak later today. The BoE's DMP (on which it places great weight) saw no follow-through into GBP. Cable has gained a firmer footing on a 1.27 handle and is now eyeing last Friday's high @ 1.2749.

- Antipodeans are both firmer vs. the USD with slight outperformance in NZD/USD despite a lack of fresh NZ-specific drivers. NZD/USD is currently caged within yesterday's 0.5829-0.5884 range and yet to approach the 0.59 mark. AUD/USD failed to garner much additional support from an improvement in Australian trade and household spending data. AUD/USD currently sits towards the middle of yesterday's 0.6399-0.6488 range.

Fixed Income

- Mar'25 USTs are seeing a modest pullback from yesterday's ISM-induced rally in US paper. The release further cemented expectations for the Fed to cut rates later this month with odds of such a move @ 73% before likely pausing in January. Comments from Fed Chair Powell yesterday did little to stand in the way of this pricing. A dovish outturn for NFP tomorrow could seal the deal on the FOMC.

- French paper remarkably calm after yesterday's collapse of the French government. The outcome was as expected and attention now turns towards who, if anyone Macron can appoint as PM (there is currently no obvious replacement candidate). The main kicker is that the 2024 budget will likely be rolled into 2025 and policy will likely end up being less restrictive than initially thought. In response to recent events, Moody's has cautioned that the no confidence vote is "credit negative". The GE/FR spread has narrowed to just below 81bps having peaked just shy of 89bps on Monday with last week’s 12yr high at 90bps just above.

- Dec'24 Bunds are currently within yesterday's 134.66-135.28 trading band with the corresponding 10yr yield around the 2.08% mark vs. yesterday's 2.10% peak.

- Mar'25 Gilts are marginally softer and in-fitting with price action in global peers. From a UK-specific standpoint, yesterday's FT headline on Governor Bailey caused a stir, however, desks are broadly of the view that his comments over four rate hikes next year were taken out of context as he was referring more to market pricing than his own view. Today's DMP release saw expectations for CPI inflation a year ahead rose from 2.6% to 2.7% in the three months to November, expected year-ahead wage growth dropped by 0.1ppt to 4.0%; BoE pricing was little changed.

- France sold EUR 5bln vs exp. EUR 3-5bln 4.0% 2038, 0.5% 2040, 1.5% 2050, 0.5% 2072 OAT

- Spain sold EUR 2.447bln vs exp. EUR 2-3bln 2.70% 2030 & 3.45% 2034 Bono

Commodities

- Crude futures holding a modest upward bias after selling off in the US afternoon on Wednesday, which was later attributed to a bank offloading a large volume of US oil futures contracts ahead of today's OPEC+ meeting. Sources today, so far, have failed to move prices.

- Precious metals trade with a softer bias despite the weaker Dollar with traders cautious as they look ahead to the US jobs report tomorrow ahead of the US CPI data due next week.

- Copper trades higher this morning with prices supported by the softer Dollar intraday coupled with the positive risk bias in Europe. Traders look ahead to next week's Central Economic Work Conference which was hoped to provide fiscal stimulus, although Chinese press played this down in overnight reports.

- Russian oil producer Rosneft invested USD 20bln into India, according to an Indian Government statement citing Russian President Putin. Russia are reportedly ready to set up manufacturing operations in India.

- China's Ministry of Commerce expresses strong concern over the EU's plans to impose duties on Chinese titanium dioxide in 2025. China hopes the EU will conduct its investigation in line with WTO rules and avoid abusing trade remedies. Says it will firmly safeguard the legitimate rights and interests of Chinese enterprises.

- OPEC+ has a deal in principle to delay output hike, according to delegates cited by Bloomberg; OPEC+ still discussing duration of delay, with three months in focus.

- Several OPEC+ sources suggested a delay of output cuts for three months is the most likely outcome, while others have said a longer period is possible, according to Reuters sources.

- OPEC+ voluntary cuts are expected to be pushed back by 3 months and then the group collective cut is expected to be extended until the end of 2026, according to Energy Intel's Bakr.

Geopolitics

- Israel's cabinet will meet today to discuss the proposal for an exchange deal with Hamas, according to Israeli Media.

- Russia reportedly fired missiles from its bases in Tartus, targeting Syrian rebels near Hama, according to a journalist via X.

US Event Calendar

- 07:30: Nov. Challenger Job Cuts26.8% YoY, prior 50.9%

- 08:30: Nov. Initial Jobless Claims, est. 215,000, prior 213,000

- 08:30: Nov. Continuing Claims, est. 1.9m, prior 1.91m

- 08:30: Oct. Trade Balance, est. -$75b, prior -$84.4b

DB's Jim Reid concludes the overnight wrap

It’s been a very eventful 24 hours for markets, with the French government losing a no-confidence vote for the first time since 1962, alongside ongoing political uncertainty in South Korea and some hawkish-leaning comments from Fed Chair Powell. But despite everything that’s happening, risk assets have been broadly unphased by the various developments, with the S&P 500 (+0.61%) closing at another record high yesterday, whilst Bitcoin has crossed the $100,000 mark overnight for the first time. Indeed, it now means the S&P 500 is up +27.6% so far in 2024, which is only a couple of points behind its 2013 gain (+29.6%) that still stands as the strongest annual advance of the 21st century so far.

In terms of the French situation, the National Assembly voted yesterday to oust the government of Michel Barnier, with 331 votes in favour out of 577. However, the result was broadly expected, so it’s little surprise that markets haven’t seen much of a reaction. Indeed, since Marine Le Pen’s announcement on Monday that her party would vote against the government, it was clear that the numbers were there to remove the government, so that was when the biggest market reaction took place.

For the time being, the existing government will remain in place, and if needed, they can use emergency legislation to collect taxes and spend money. So this doesn’t mean a US-style shutdown beckons. But it’s still not obvious what ends the impasse, as the National Assembly remains fractured between different groups, with no obvious majority capable of being assembled. After all, it took almost a couple of months before Macron chose Michel Barnier as PM in the first place. And under the French constitution, a new election can’t be held until a year after the last one, which isn’t until the summer. President Macron is set to make a statement this evening, so that’ll be in focus for the path forward. Macron has said he will serve out his presidential term until 2027, but Le Pen continued to pressure him to resign yesterday in order to break the gridlock.

Overnight, the Euro has seen little change in response to these developments, and is currently trading at $1.052. Otherwise, French assets closed ahead of the vote yesterday, but they put in a reasonably strong performance beforehand, with the Franco-German 10yr spread tightening another -1.3bps on the day to 83.8bps. Moreover, France’s CAC 40 (+0.66%) outpaced the Europe-wide STOXX 600 (+0.37%). That came as European risk assets did well across the board yesterday, with the Italian-German 10yr spread (-3.5bps) reaching its tightest in 3 years at 115.5bps. And over in credit, Euro IG spreads (-1bp) and HY spreads (-5bps) both tightened as well.

That strength among French assets was echoed in the US, with the S&P 500 (+0.61%) hitting another record high and posting its 11th gain in the last 12 sessions. That came as Fed Chair Powell said the US economy is “in remarkably good shape”, and the growth has been better than previously forecasted. He added that he feels “very good about where the economy is and where monetary policy is”, and said the FOMC “can afford to be a little more cautious as we try to find neutral.” In the meantime, several other Fed speakers made similar comments about moving slowly, with San Francisco President Daly saying that “We do not need to be urgent”, and St Louis Fed President Musalem saying that “the time may be approaching to consider slowing the pace of interest rate reductions or pausing”. Richmond Fed President Barkin, also said he was in favour of a slower rate cut path to get policy to a “somewhat restrictive level.”

But even as Fed speakers leant in a somewhat hawkish direction, US Treasury yields fell across the curve thanks to some weaker than expected data. In particular, the ISM services index was only at 52.1 in November (vs. 55.7 expected), ending a run of 4 consecutive monthly increases. And the employment component was down to 51.5, which dampened expectations ahead of tomorrow’s jobs report. There also wasn’t much optimism either from the ADP’s report of private payrolls, which came in at 146k (vs. 150k expected), but also contained a negative revision to the previous month of -49k.

In light of that, investors dialled up the likelihood of a December rate cut from the Fed, with futures taking the probability up to a three-week high of 77.5% by the close. So that helped to push down US Treasury yields, with the 2yr yield (-5.4bps) closing at a 1-month low of 4.13%, whilst the 10yr yield (-4.5bps) fell to 4.18%. In turn, that helped to lift US equities, particularly in some of the more cyclical sectors, and the S&P 500 ended the day up +0.61% at a new record. That was supported by a further gain for the Magnificent 7 (+1.58%) which also hit a fresh record.

Overnight in Asia, South Korean markets have lost further ground overnight, with the KOSPI down another -0.85%. The South Korean won did stabilise yesterday, strengthening +1.11% against the US Dollar, but it’s since fallen back a bit, weakening another -0.16% this morning. Otherwise though, there’s been a fairly steady performance across the region, with Japan’s Nikkei (+0.31%), China’s CSI 300 (-0.23%) and Australia’s S&P/ASX 200 (+0.15%) not seeing any big moves in either direction. The only exception to that is the Hang Seng, which is down -1.15% this morning. And looking forward, US equity futures are only very slightly lower, with those on the S&P 500 down -0.05%.

To the day ahead now, and data releases from the US include the October trade balance and the weekly initial jobless claims. Meanwhile in Europe, we’ll get Euro Area retail sales, German factory orders and French industrial production for October, along with the November construction PMIs from Germany and the UK. Central bank speakers include the Fed’s Barkin, the ECB’s Vujcic and the BoE’s Greene.