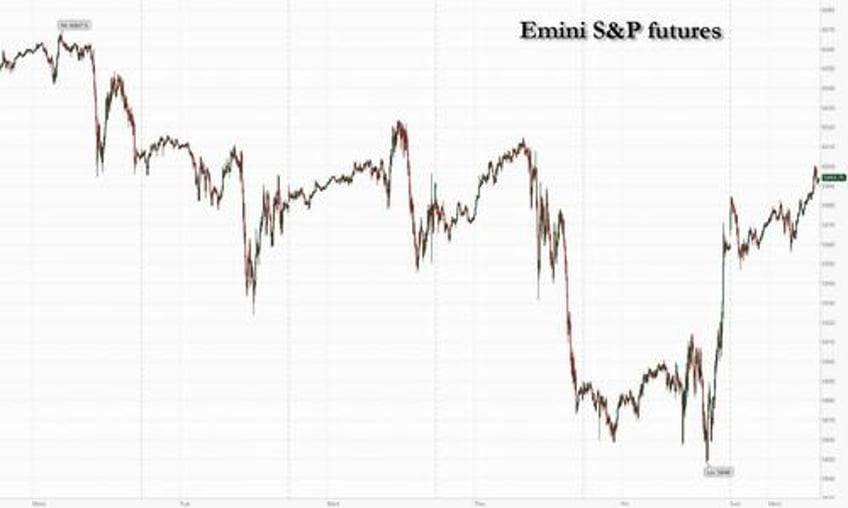

Futures are higher with both tech and small caps outperforming as investors look for Canada/Mexico tariffs to be adjusted lower or delayed again based on Trump comments of the border being closed (Fox News) and Hegseth comments warning of military action without compliance. As of 8:00am ET, S&P futures are up 0.5% and Nasdaq futures rise 0.8% in what appears to be a powerful short squeeze after the second biggest shorting spree by hedge funds in the past five years. Pre-market Mag7 is mixed with AAPL/NVDA lower but Semis and Cyclicals higher. Defense firms surged again in Europe with leaders fast-tracking their spending plans, while bond yields jumped as markets brace for a new debt-funded spending spree. Asian stocks also rose, although China’s benchmark CSI 300 Index erased gains of as much as 1% to end the day little changed. Treasuries dip, with the US administration on the verge of slapping new tariffs on Canada and Mexico while doubling a levy on China. US 10-year yields climb 4 bps to 4.25%. The Bloomberg Dollar Spot Index falls 0.3%. Commodities are mixed with precious/softs leading and oil flat. The macro data focus today is on ISM-Mfg, Construction spending, and vehicle sales. JPM followed other banks to cut its Q1 2025 GDP estimate from 2.25% to 1.5%.

In premarket trading, cryptocurrency-exposed stocks rally as Bitcoin recoups some of its recent losses after President Donald Trump once again talked up his plan for a strategic crypto reserve (MicroStrategy +13%, Coinbase +9.2%, Riot Platforms +9.9%, MARA Holdings +11%, Bit Digital +9.8%, CleanSpark +11%, Hut 8 +12%). Bitcoin traded around $92,000, paring some of its weekend gains but up about 20% from its Friday lows. Chipotle shares gain 2.4% after the restaurant operator was upgraded to overweight from equal-weight at Morgan Stanley as stock’s weakness presents an opportunity to buy into an “excellent tech play.”

- Allegro MicroSystems (ALGM) shares rise 14% after the semiconductor devices company is said to be drawing takeover interest from larger competitor ON Semiconductor

- AppLovin (APP US) shares rise 5.9% after the marketing services company modified the current limit of its share repurchase program, which had about $1.77 billion remaining

- AST SpaceMobile (ASTS) jump as much as 8.8% in premarket trading after the company signed an agreement with Vodafone to create a jointly-owned European satellite service business

- Aurora Innovation (AUR) shares rise 5.0% after Morgan Stanley initiated coverage of the stock with an overweight rating and a Street-high price target, saying the self-driving technology company is “on the cusp of history”

- Capri Holdings (CPRI) shares climb 7.2% as Prada is said to be moving closer to a deal to buy Versace, after agreeing to a price of nearly €1.5 billion ($1.6 billion)

- Check Point Software Technologies (CHKP) shares are up 0.7%, after Piper Sandler upgraded the company to overweight from neutral

- Dollar General (DG) shares slip 0.6% after Deutsche Bank downgraded the discount retailer to hold from buy, citing intensifying competition and pricing pressures

- Lexicon Pharmaceuticals (LXRX) shares were down as much as 57% after reporting a lack of separation in ADPS reduction between Pilavapadin’s 20 mg dose arm and placebo

- Southwest Airlines (LUV) shares fall 2.3% after JPMorgan downgraded the carrier to underweight from neutral, citing its surging valuation premium

“How much more cautious can the market get?” Katrina Dudley, senior investment strategist at Franklin Templeton, said on Bloomberg TV. “If you look at that fear and greed index, we are right in the red zone that flashes and says: caution.”

Defense stocks lead gains in Europe as a concerted push by regional leaders to demonstrate broad support for Ukraine fueled bets on a wave of military spending. The Stoxx 600 was up 0.5% while the euro climbs 0.7%. Defense stocks soared: BAE Systems Plc soared 13%, Rheinmetall AG gained 10% and Saab AB gained 9%. Tech shares also rose, while utilities and real estate sectors fall. Bonds in Germany and France fell on expectations for increased debt issuance. Germany’s next government is exploring options for large-scale investments in defense and infrastructure spending which could amount to hundreds of billions of euros, according to Reuters. Here are some of the biggest movers on Monday:

- European defense shares soar on back of European pledges to support Ukraine and fast-track the continent’s military capabilities. JPMorgan increases price targets in the sector by an average of 25%. Avon Technologies shares rise as much as 8.5% to the highest level since 2021 — amid a broad rally in defense stocks — as the maker of respiratory equipment and helmets received an order worth $17.6 million from the US army.

- Gubra shares surge as much as 29% after the Danish drug developer and AbbVie announced a license agreement to develop GUB014295, a potential best-in-class, long-acting amylin analog for the treatment of obesity.

- Valneva shares gain as much as 7.5%, putting them among the top performers on France’s CAC Mid 60 Index on Monday, following positive developments for the company’s chikungunya vaccine called Ixchiq.

- Bunzl drops as much as 7.1% following full-year results, with analysts at Jefferies saying they remain cautious on the value-added distributor amid weak growth and disappointment that the margin guidance has not been improved.

- Tecnicas Reunidas shares climb as much as 6.9% after analysts at Barclays said the engineering and construction services provider’s results released on Friday have left them feeling more confident that the company can deliver its 2028 ambitions.

- Scout24 shares rise as much as 5.8% after analysts at Deutsche Bank hiked their price target on online property platform, saying it has laid the foundations to fuel growth going forward.

- Warsaw-listed Ukrainian stocks slide after the acrimonious White House meeting between Volodymyr Zelenskiy and Donald Trump dampened hopes of a speedy deal that could end the conflict in Ukraine.

- Brunello Cucinelli shares drop as much as 2.3% after Stifel downgrades the Italian luxury stock to hold from buy, noting the strong year-to-date rally and the lack of significant earnings upgrades.

- Carrefour shares fall as much as 2.6% after Bryan Garnier & Co cut its recommendation on the French retail chain to sell from neutral.

- Senior shares drop as much as 5% on Monday after Jefferies said consensus expectations for this year may come under pressure due to rising costs in the UK.

Earlier in the session, Asian stocks also rose with Indonesia’s stock gauge leading gains in the region after JPMorgan upgraded the nation’s banks. The MSCI Asia Pacific Index advanced as much as 0.8%, with China’s Tencent and Alibaba among the biggest contributors ahead of the nation’s annual national parliament meeting. The Jakarta Stock Price Index surged by the most in almost five years. Shares gained in Japan as they tracked their US peers higher. Investors will be watching the Two Sessions for Beijing’s plan to counter risk from US tariffs after Trump threatened to add an additional 10% levy from Tuesday. Any effort to boost technological advancements will also be crucial to sustain the artificial intelligence-led rally in Hong Kong. The tariffs “would deliver a negative signal to the market that the trade conflict between China and the US is going to escalate,” said Jason Chan, a senior investment strategist at Bank of East Asia. “It may hurt the near-term market sentiment and trigger an ongoing technical correction toward Chinese equities, especially for those AI thematic stocks with rich valuations.”

In FX, Bloomberg Dollar Spot Index falls 0.3%. EUR/USD rose as much as 0.9% to 1.047 on the prospect of more EU defense spending; Hedge funds cut bearish euro wagers for a second straight week, according to the latest CFTC data; the Polish zloty and Hungarian forint led gains among emerging-market currencies.USD/SEK fell as much as 1% to 10.67 as the Swedish krona led Group-of-10 gains against the dollar; Strategists at Societe Generale say the large size of the nation’s defense sector as a proportion of GDP is buoying the currency.

In rates, treasuries are cheaper as US trading gets under way, following bigger losses in core European rates, where German curve steepens on prospect of increased supply tied to support for Ukraine and improved security measures for the continent. US yields are 3bp-4bp higher across maturities with curve spreads steeper but within 1bp of Friday’s closing levels; 10-year is around 4.25% with bunds and gilts in the sector lagging by an additional 5bp and 1bp. Bunds fall, led by longer-dated maturities, as any increase in defense spending will likely be funded by higher debt issuance, which in turn means QE is just around the corner. German 30-year yields rise 7 bps to 2.77%. German two-year borrowing costs climb 3 bps and rose to session highs after euro-area headline and core February CPI topped estimates and contributed to the selloff during London morning.

In commodities, spot gold rises $13 to around $2,870/oz. WTI falls 0.5% to $69.40 a barrel.

Bitcoin is on a firmer footing and sits comfortably above $92K, as sentiment in the complex is lifted following Trump's recent announcement. Trump is to host the first White House cryptocurrency summit on March 7th. Trump also commented that the executive order on digital assets directed a strategic reserve that included XRP, Sol and ADA. Trump also stated that BTC and ETH, as other valuable cryptocurrencies, will be at the heart of the reserve, as well as commented that he loves Bitcoin and Ethereum.

US economic data calendar includes February S&P Global US manufacturing PMI (9:45am), January construction spending and February ISM manufacturing (10am). Fed speaker slate includes Musalem at 12:35pm; later this week, Chair Powell is slated to speak on the economic outlook Friday

Market Snapshot

- S&P 500 futures up 0.2% to 5,972.50

- STOXX Europe 600 up 0.3% to 559.12

- MXAP up 0.7% to 184.69

- MXAPJ little changed at 577.22

- Nikkei up 1.7% to 37,785.47

- Topix up 1.8% to 2,729.56

- Hang Seng Index up 0.3% to 23,006.27

- Shanghai Composite down 0.1% to 3,316.93

- Sensex down 0.2% to 73,066.35

- Australia S&P/ASX 200 up 0.9% to 8,245.65

- Kospi down 3.4% to 2,532.78

- German 10Y yield little changed at 2.43%

- Euro up 0.3% to $1.0410

- Brent Futures down 0.4% to $72.50/bbl

- Gold spot up 0.4% to $2,868.30

- US Dollar Index down 0.36% to 107.22

Top Overnight News

- Zelensky says he is prepared to sign a mineral rights deal w/the US and thinks the relationship with Washington can be salvaged. NBC

- Trump posted on Truth "We should spend less time worrying about Putin, and more time worrying about migrant rape gangs, drug lords, murderers, and people from mental institutions entering our Country - So that we don’t end up like Europe!".

- Trump commented on Truth "Treasury Department has announced that they are suspending all enforcement of the outrageous and invasive Beneficial Ownership Information (BOI) reporting requirement for U.S. Citizens".

- Treasury Secretary Bessent said will appoint an affordability czar to address high prices: CBS News.

- Commerce Secretary Howard Lutnick over the weekend suggested the Mexico/Canada tariffs due to come into effect on Tues could be less than the 25% previously mentioned. FT

- The Pentagon is sending mechanized infantry and air support to help secure the US border with Mexico, including a combat team of about 4,400 soldiers. BBG

- Trump risks losing support from Americans who say he isn’t prioritizing the battle against inflation, two polls suggest. BBG

- House Speaker Johnson said he wants a clean Continuing Resolution for the fiscal year through September: Punchbowl.

- China’s Caixin manufacturing PMI came in a bit ahead of expectations at 50.8 for Feb (up from 50.1 in Jan and better than the Street’s 50.4 forecast). WSJ

- China will target US agricultural and good products as it formulates a response to the latest round of Washington tariffs. Global Times

- Singapore is investigating whether some Dell and Super Micro servers that were shipped from the country to Malaysia contained Nvidia chips that are barred from China — and whether those servers were then sent to other destinations, potentially violating US sanctions. BBG

- Eurozone CPI for Feb runs a bit hot, coming in at +2.4% on the headline (down from +2.5% in Jan, but above the Street’s +2.3% forecast) and +2.6% for core (down from +2.7% in Jan, but above the Street’s +2.5% forecast). BBG

Tariffs/Trade

- US Commerce Secretary Lutnick said Mexico and Canada have done a reasonable job on the border and there will be tariffs on Canada and Mexico on Tuesday but President Trump will decide at what levels. Lutnick added that China tariffs are set unless they end fentanyl trafficking into the US.

- White House official announced on Saturday evening that President Trump ordered to bolster the supply of forest resources and directed the Commerce Secretary to investigate harm to US National Security from imported lumber, while any tariffs resulting from the lumber investigation would be added to other tariffs, including fentanyl-related tariffs on Canada, Mexico and China. Furthermore, the official said China, Canada and Mexico could take quick action to avert fentanyl-related tariffs.

- China is studying countermeasures in response to the US March 4th tariff threat, while countermeasures will likely include both tariffs and a series of non-tariff measures with US agricultural and food products most likely to be listed, according to Global Times.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the new trading month mostly higher in a rebound from Friday's Asian session sell-off and despite geopolitical uncertainty from the fallout of the Trump-Zelensky heated exchange in the Oval Office, while participants digested better-than-expected Chinese PMI data from over the weekend. ASX 200 traded higher with gains led by strength in the tech, real estate, telecoms, miners and materials sectors, while quarterly Australian company gross profits growth smashed forecasts. Nikkei 225 recovered some of Friday’s substantial losses despite the lack of fresh drivers and ongoing tariff uncertainty. Hang Seng and Shanghai Comp were underpinned following the better-than-expected official Chinese Manufacturing PMI data over the weekend which showed a surprise return to expansion territory, while Caixin Manufacturing PMI also topped forecasts. However, the gains in the mainland were contained as the tariff threat lingered with US Commerce Secretary Lutnick noting that China tariffs are set unless they end fentanyl trafficking into the US and with China reportedly studying relevant countermeasures in response to the US March 4th tariff threat.

Top Asian News

- Japan's Top-Currency Diplomat Mimura says the bright spots in the economy include tourism and strong corporate investment. Hearing not only big firms but from small/medium ones about the strong prospect of wage increases. Weaker JPY is a matter of inflation domestically, via increased import costs. Adds, Japan should increase reliance on foreign investors in the JGB market as the BoJ tapers and the population shrinks.

European bourses (STOXX 600 +0.3%) are mixed vs opening modestly firmer across the board; a significant sell-off was seen soon after the cash open, but with little fundamental driver at the time. As it stands, indices have rebounded from worst levels and look to be approaching the earlier highs. The complex was initially little reactive to slightly hotter-than-expected EZ HICP but then retreated from best levels thereafter. European sectors are mixed vs opening with a strong positive bias. Industrials take the top spot and is by far the clear outperformer, as Defence names prop up the industry. The likes of Rheinmetall (+8%), BAE Systems (+13%) and Rolls Royce (+5%) all gain for the reasons listed in the next bullets. Firstly, sentiment regarding a Ukraine-Russia peace deal has been hit after the recent bust-up between US President Trump and Ukrainian President Zelensky at the Oval Office on Friday. Secondly, French President Macron's proposed to raise the EU's defence spending to 3.5% of GDP. And finally, Germany is reportedly considering defence-specific funds in the formation of a new government.

Top European News

- Austrian liberal NEOS party members voted in favour of a coalition agreement which paves the way for a three-party government to take office.

- S&P affirmed France at AA-; Outlook revised to Negative from Stable and upgraded Portugal to A; Outlook Positive.

- S&P Global says US Tariffs would likely dent growth prospects in central Europe; weaker growth could compound existing fiscal challenges, impact of these tariffs are likely to be smaller than that of the weakening demand for German cars in China.

- Riksbank Business Survey: Economic activity is weak in most parts of the economy and largely unchanged compared with the previous survey in the autumn.

NOTABLE US HEADLINES

FX

- DXY is giving back some of Friday's upside, following the heated exchange between Trump, Vance and Zelensky. Focus today turns back to the US ISM Manufacturing PMI and on US tariffs. On the latter, US Commerce Secretary Lutnick said there will be tariffs on Canada and Mexico on Tuesday but President Trump will decide at what levels, and could be lower than 25%. DXY is around the 107 mark.

- EUR is firmer vs. the softer USD and one of the better performers across the G10 complex. Despite the tense conversation on Friday between Trump-Vance-Zelensky, markets remain optimistic over Europe's efforts to provide a plan to get the US and Ukraine back to the negotiation table. Elsewhere, EZ manufacturing PMI was revised a touch higher but ultimately remained below the 50 threshold. EZ flash CPI for February saw the headline (2.4% vs. Exp. 2.3%) and super-core (2.6% vs. Exp. 2.5%) metrics print a touch above expectations, whilst services fell to 3.7% from 3.9%. EUR/USD has moved back above its 50DMA at 1.0388 and gained a firmer footing on the 1.04 handle, towards highs of 1.0444.

- USD/JPY has pulled back after hitting resistance at the 151.00 level with the pair dragged lower amid the softer dollar and the early mild upside in Japanese yields; 30-year JGB yield touched its highest since October 2007. USD/JPY briefly made its way onto a 149 handle with a current session trough at 149.95.

- GBP is a touch firmer vs. the broadly weaker USD with UK newsflow on the light side and potentially set to remain so this week given the light calendar. The only real notable even this week is BoE Governor Bailey's appearance before the Treasury Select Committee on Wednesday. UK Manufacturing PMI printed a touch above the prior - but ultimately had little impact on price action. Cable currently sits towards the upper end of a 1.2577-1.2649 range.

- Antipodeans both have received some mild reprieve after trickling lower throughout most of last week, while the latest manufacturing PMI data from Australia and New Zealand’s largest trading partner China also provided some encouragement.

- PBoC set USD/CNY mid-point at 7.1745 vs exp. 7.2857 (prev. 7.1738).

- SNB Chairman Schlegel said the SNB will only reintroduce negative interest rates if necessary.

Fixed Income

- A softer start for Bunds as sentiment in Europe has shrugged off the Zelensky-Trump fallout with Chinese PMIs and the APAC handover seeing a stronger start to the session which has been exacerbated by blockbuster performance in European defence names on reports/remarks around spending. Final Manufacturing EZ PMIs were revised modestly higher; EZ Inflation measures printed slightly hotter than expected and spurred a modest hawkish reaction, which then continued to take Bunds to a fresh session trough of 132.15.

- USTs are a touch softer as the latest geopolitical/defence developments don’t have quite the same ramifications for the US as they do for Europe. Currently at the lower end of a 110-27+ to 111-03 band, with recent pressure coming alongside the pressure seen across the pond. US newsflow is very much focused on the fallout from Trump-Zelensky, as we await concrete details into a potential Italian-led gathering, and the implementation of tariffs on Canada and Mexico tomorrow. Ahead, focus will be on US ISM Manufacturing PMI which will be scoured for tariff-related movements in input prices, as this could be indicative of a resurgence in inflation in the months ahead.

- Gilts are softer, trading in-fitting with European peers. As such, the benchmark is at the bottom end of a 92.76 to 93.39 band. February’s Manufacturing PMI was revised marginally higher but remains well into contractionary territory with internal commentary bleak.

Commodities

- Crude is flat but off overnight highs, as the complex unwinds some of the geopolitical premia seen overnight. Focus has been on both the Middle East and on Ukraine-Russia (Friday clash between Trump/Zelensky); on the former, Israel blocked aid to Gaza after the first phase of the truce deal expired over the weekend with no phase two deal in place. Brent'May trades around USD 72.90/bbl, and off worst levels.

- Some of the pressure today could be attributed to traders digesting news over the weekend that suggested Ukrainian President Zelensky is still "ready" to sign a minerals deal with Trump.

- Precious metals are on a firmer footing, with gold benefiting from the geopolitical uncertainty, with a softer USD also helping; XAU currently towards the upper end of a USD 2856.08-2876.62/oz range.

- Base metals are mixed; 3M LME copper was initially firmer as the complex digested the better-than-expected Chinese Manufacturing PMI figures - but the upside has gradually faded. 3M LME Copper is back towards opening levels of USD 9358 in USD 9330-9432 parameters.

- Guyana’s President Ali said a Venezuelan armed patrol ship entered Guyanese waters on Saturday morning and threatened oil production ships, claiming they were in Venezuelan waters, according to News Source Guyana.

- Canada is to extend mineral exploration tax credit for two more years, according to the Natural Resources Minister.

- Russian President Putin’s ally Matthias Warnig pushes a deal to restart the Nord Stream 2, according to FT.

- Russian oil products from Black Sea port of Tuapse planned at 0.798mln T in March vs 0.799mln T scheduled for February, according to traders cited by Reuters.

- Diesel loadings from Russia's Primorsk port set at 1.8mln T for March vs 1.73mln T scheduled for Feb, according to traders cited by Reuters.

Geopolitics: Middle East

- Israel conducted strikes on Gaza on Sunday which killed four Palestinians, according to Reuters citing Gaza health officials. Furthermore, the Israeli military said it eliminated suspects who were planting an explosive device in Gaza.

- Israeli PM’s office said they will adopt the outline of US envoy Witkoff for a temporary ceasefire for the Ramadan and Passover holidays.

- Israel announced that it had ceased the entry of humanitarian aid into Gaza. It was separately reported that Israel’s Foreign Minister Saar said Hamas rejected the framework for a ceasefire and this is why were not able to move forward for the time being, while he added that the commitment for goods to enter was only for the first phase which has lapsed and the US understands Israel’s stance on the decision to halt Gaza aid. Saar also said that Israel is ready for the second phase of the agreement but “not for free”.

- Israel plans to increase pressure on Hamas to accept the proposal to extend the first phase of the Gaza agreement, according to Israeli media cited by Asharq News.

- Hamas said Israeli PM Netanyahu’s decision to halt humanitarian aid is cheap blackmail and a coup on the agreement while it urged Gaza ceasefire mediators to compel Israel to end punitive measures against Gaza. Furthermore, a Hamas official said the group will not agree to extend the first phase of the ceasefire deal and that the hostage release will only occur under the agreed phased deal, according to Reuters.

- Egypt’s Foreign Minister said Egypt will continue intensive efforts to start negotiations on the second phase of a Gaza ceasefire deal and the Gaza reconstruction plan has been completed which will be presented at the emergency Arab summit on Tuesday for approval, while foreign ministers of the Organisation of Islamic Cooperation will meet in Saudi Arabia after the emergency summit. Furthermore, Egypt’s Foreign Minister said using aid as a weapon of collective punishment and starvation in Gaza cannot be accepted or permitted.

Geopolitics: Ukraine

- Russia's Kremlin on the London Summit, says this as not aimed at a peaceful settlement. On the Oval Office clash: Russia President Putin is aware of what happened at the Oval Office. Says Ukrainian President Zelensky does not want peace. Russia-US: Russia continues dialogue with the US on normalising bilateral ties. If Russian assets are given to Kyiv then there will be grave legal consequences.

- Ukrainian President Zelensky said late on Friday that he wants peace but will require security guarantees to prevent Russia from attacking again, while he is very thankful to US President Trump and said he respects him and the American people but refuses to apologise and believes the relationship with Trump can be repaired.

- Ukrainian President Zelensky commented on Sunday that they are ready to sign the minerals deal which he believes the US would be ready to sign as well, while he believes the relationship with the US will continue. Zelensky also said there has not been a day when they have not felt gratitude to the US for support and after meeting with European leaders, he said there will be more diplomatic peace efforts for the sake of Ukraine, all of Europe, and definitely America.

- Ukrainian President Zelensky met with UK PM Starmer on Saturday, while Ukraine and the UK signed an agreement that provides an additional GBP 2.26bln in loans towards Ukraine’s defence. It was separately reported that Zelensky said he met with Italian PM Meloni to discuss a common plan to end the war.

- UK PM Starmer said Europe needs a security guarantee from the US and that the UK, France and maybe others will work with Ukraine on a plan to stop the fighting which they will then discuss with the US and thinks it is a step in the right direction. Starmer said he would not trust Russian President Putin’s word and he does not think Ukrainian President Zelensky has done anything wrong, while he is clear that US President Trump does want lasting peace and added that there is a moment of real fragility in Europe.

- UK PM Starmer said on Sunday following the Ukraine summit that a new deal will allow Ukraine to use GBP 1.6bln of export finance and this will help protect Ukraine’s critical infrastructure, while he added that they agreed to keep military aid flowing to Ukraine and the economic pressure on Russia. Starmer said in the event of peace, they will boost Ukraine’s defence capabilities and the UK is willing to have boots on the ground and planes in the air regarding peacekeeping troops.

- US National Security Adviser Waltz said it was not clear Ukrainian President Zelensky was ready to negotiate in good faith at the White House and it is absolutely false that the Oval Office meeting was some kind of ambush. Waltz said Zelensky needs to make clear he is ready for peace and the US needs a Ukraine leader who can deal with Washington and Russia and end the war, while he added the US seeks a permanent end to the Ukraine war with European-led security guarantees, according to CNN.

- US Treasury Secretary Bessent said it is impossible to get an economic deal without a peace deal in Ukraine and the plan is for the EU to provide security guarantees for Ukraine not NATO.

- Ukraine’s Foreign Ministry condemned the breach of Ukraine’s territorial sovereignty by IAEA employees who visited the Zaporizhzhia nuclear plant via occupied territory which it said was the result of Russian blackmail.

- Russian Foreign Minister Lavrov said US President Trump is a pragmatist with the slogan common sense and the discussion in Europe about peacekeepers for Ukraine is arrogant. Lavrov said that the US bluntly said it wants to end the conflict in Ukraine but Europe demands the war to continue, while he added the West cannot explain what will happen to the territory of Ukraine and to the Russian language if European peacekeepers are deployed.

- Russia’s Medvedev said Russia is prepared to show flexibility in talks on Ukraine but only in accordance with the Russian constitution and realities on the ground, while he added Russia is ready to discuss a settlement but only with those who are ready to communicate.

- Russian Defence Ministry said Russian forces captured two new villages in eastern Ukraine, while Russian forces also struck gas processing plants in Ukraine, according to IFAX.

- French President Macron said France and Britain propose a one-month truce in Ukraine, according to The Telegraph.

- Germany reportedly discussed setting up special funds for defence and infrastructure, according to sources. It was separately reported that German Chancellor Scholz said they need to financially and militarily support Ukraine. Scholz also said they need a strong army in Ukraine in the future when the war is over and that Thursday’s summit will be about how to do more for their own defences.

- Polish PM Tusk said he supports Italian PM Meloni’s proposal to organise a US-Europe summit, while he sees no other power in the world than the US that can stop Russian aggression. Tusk separately commented that Ukraine summit participants declared they are ready to ramp up defence spending.

- EU’s von der Leyen said that they urgently need to rearm Europe and need to step up massively and have a surge in defence, while she added member states need more fiscal space to do a surge in defence and that they want the US to know that they are ready to defend democracy.

- Canadian PM Trudeau said everything is on the table when asked if he would contribute to a peacekeeping force in Ukraine and said nothing is more important to Canadians right now than standing up for their sovereignty, as well as noted regarding the Trump-Zelensky meeting that he stands with Zelensky.

US Event Calendar

- 09:45: Feb. S&P Global US Manufacturing PM, est. 51.6, prior 51.6

- 10:00: Jan. Construction Spending MoM, est. -0.1%, prior 0.5%

- 10:00: Feb. ISM Manufacturing, est. 50.8, prior 50.9

DB's Jim Reid concludes the overnight wrap

A belated welcome to March, and as it’s the first business day of the month, Henry has published our monthly/YTD performance review here. Interestingly most assets in our sample made steady gains, despite the threat of US tariffs and the huge transatlantic tensions around the war in Ukraine. In a rare move in recent times, the US equity market (-1.3%) underperformed (especially European markets), and the Magnificent 7 (-8.7%) posted its worst month since December 2022, which in turn dragged down US equities more broadly.

As we kick off a new month, this week’s highlight will again revolve around the US President as tariffs on Canada, Mexico and China come into force tomorrow barring any last minute negotiations. US commerce secretary Lutnick said on Fox yesterday that they will be implemented but that the level is still being decided. That could signal some room for the 25% on Canada and Mexico to be lower. On top of that Mr Trump is set to address a joint session of Congress outlining his agenda tomorrow, his first such speech since his inauguration last month. The fall out from an extraordinary televised row on Friday in the Oval Office between Trump and JD Vance on one hand and Zelenskiy on the other will also be a big talking point. Yesterday we had a large number of NATO countries’ leaders convene in London for an emergency (another!) summit on Ukraine. This was planned before Friday’s argument in the White House but it took on added importance after the clash. There was a lot of solidarity for Ukraine after the meeting but a lot still hinges on the US's involvement.

In Germany things are moving fast after the election and speculation has increased over special funds for defence and infrastructure being established while the existing parliament sits rather than wait for the new one where centrist policies won't have the two-thirds majority to reform the debt break on their own. Reuters reported yesterday that economists advising the talks have suggested the need for a EU400bn fund for defence and a EU400-500bn one for infrastructure. If this actually occurs before the new coalition is formed it will be a real positive "shock and awe" for Germany and Europe. Let's see what we hear on this in the coming days. Things continue to move at pace in Europe and after we paraphrased Lenin's famous "There are decades where nothing happens; and there are weeks where decades happen" quote two weeks ago, after the Munich Security Conference, the phrasing might need to be updated from weeks to days!

In terms of the data, the main focus will be on the US jobs report (Friday) and ISM indices in the US (today and Wednesday). Powell has a keynote economic speech on Friday to look forward to. In Europe, the ECB will likely cut rates a further 25bps on Thursday, the same day as a special EU summit on defence and Ukraine is set to take place. It’s getting hard to keep up with all these summits and emergency meetings. MNI sources yesterday suggested that we will hear about a EU100bn common funding for defence at this meeting which is a mere drop in the ocean as to what Europe will likely need to spend on defence in the next several years.

In China we see the annual session of 14th NPC starting on Wednesday where the government is expected to outline its plans for 2025 including targets for the fiscal deficit and government bond issuance. In Japan, the release of the annual shunto wage hike demands by labour unions on Thursday is a key event. As earnings season winds down after 485 of the S&P 500 and 310 of the Stoxx 600 have now reported, maybe keep an eye out for Broadcom's results on Thursday which is the next cab off the ranks in terms of the Mag-7 or a firm member of the BATMMAAN group of stocks. Their market cap briefly went above Tesla last week and is only just behind now.

Going through a couple of the main events this week in a little more detail now and all roads point to the tariff deadline tomorrow and payrolls on Friday. Our economists have previously published here that 25% tariffs on Canada and Mexico, If sustained, would likely create a 0.4-0.7ppts drag on 2025’s US GDP and boost core PCE by 0.3-0.7ppts. It is possible that the revenues from the tariffs allow for larger US tax cuts which may help reduce the growth impact but we’re also starting to see some of the trade uncertainty hit confidence so there are a lot of moving parts. Overall, it’s hard to see China tariffs being negotiated lower but there’s still a chance that those on Mexico and Canada are lower than 25% as hinted by Lutnick yesterday. We will see today.

With regards to payrolls, our economists expect headline (160k forecast vs. 143k previously) and private (150k vs. 111k) payroll gains to rebound from weather-related and potential seasonal-factor related drags in the prior month. However there is a drag factored in from the start of federal government layoffs even if March may see a larger impact. DB think the unemployment rate will tick up a tenth to 4.1%. Today’s manufacturing ISM (DB at 51.8 vs. 50.9 last month) and Wednesday’s services ISM (DB at 52.1 vs. 52.8) will have employment components that along with Wednesday’s ADP report may sharpen the street’s forecasts as the week progresses.

Asian equity markets are mostly rebounding at the start of the month tracking Friday’s strong finish on Wall Street. As I check my screens, the Nikkei (+1.67%) is outperforming with the Hang Seng (+1.12%), and the Shanghai Composite (+0.27%) also edging higher on strong Chinese factory activity data (more below). Additionally, hopes of a fresh fiscal stimulus from China after the policy meeting this week, offsetting the looming tariffs, is supporting risk sentiment. Elsewhere, the S&P/ASX 200 (+0.84%) is also higher. Markets in South Korea are closed for a public holiday. S&P 500 (+0.15%) and NASDAQ 100 (+0.14%) futures are higher and yields on 10yr USTs are +2.5bps, settling at 4.233% as I type.

Over the weekend, Chinese manufacturing activity grew more than expected in February, indicating a strong start to 2025 led by bouncebacks in new orders. China's official manufacturing PMI rebounded to 50.2 in February, up from 49.1 in January (v/s 49.9 expected). The non-manufacturing PMI saw a smaller uptick in February, to 50.4 from 50.2, in line with consensus forecasts. The index has been at, or above, the 50 threshold for 26 months now. At the same time, the Caixin's manufacturing PMI also rebounded to 50.8 in February (v/s +50.4 expected) from 50.1, a three-month high, benefiting from an uptick in both output and new orders.

In the crypto world, US President Donald Trump in a social media post over the weekend has revealed the names of five cryptocurrencies that he says he'd like to be included in a new strategic reserve to establish the US as the Crypto Capital of the World thus sending their values skyrocketing and partly reversing a recent slump. Following the announcement, the price of the two major digital currencies (Bitcoin and Ether) rose more than 9% and 13% on Sunday respectively. So one to watch.

Looking back at last week, there was a clear risk-off move across global markets as investors faced up to the threat of more US tariffs again. That was exacerbated by some weak US data, including a decline in the Conference Board’s consumer confidence reading, as well as Nvidia’s results, which showed the smallest revenue beat in two years. By the end of the week, that meant the S&P 500 was down -0.98%, even as it recovered by +1.58% on Friday thanks to a late month-end rally with all the gains for the day occurring in the last 90 minutes. The big tech stocks were the main driver of that in both directions, with the Magnificent 7 falling -4.73% in its worst weekly performance since September despite a +2.04% rebound on Friday. Over in Europe, there was a much stronger performance however, and the STOXX 600 posted a 10th consecutive weekly gain, with a +0.60% advance (+0.01% Friday).

On Friday, we also got the latest PCE inflation data for January, which is the Fed’s target measure. That was broadly as expected, with headline PCE at +0.33% on the month, and core PCE at +0.28%. However, it meant both headline and core PCE were still lingering above the Fed’s 2% target on an annual basis, at +2.5% and +2.6% respectively. The other important release was the merchandise trade deficit, which unexpectedly surged more than +25% to $153.3bn in January (vs. $116.6bn expected). The surge likely reflects companies seeking to import goods before tariffs come into place, with gold shipments one potential factor. The release caused a big hit to Q1 GDP estimates with the Atlanta Fed’s GDPNow estimate plummeting to show an annualised contraction of -1.5%, though traditional nowcast models may need to be heavily discounted given the nature of the trade distortions.

For sovereign bonds, the risk-off tone pushed yields lower around the world, with the 10yr Treasury yield falling -22.3bps last week (-5.2bps Friday) to 4.21%. That’s the 7th consecutive weekly decline for the 10yr yield, which is the first time that’s happened since June 2019. Meanwhile in Europe, yields on 10yr bunds fell -6.4bps (-0.8bps Friday) to 2.40%. And over in Japan, the 10yr yield fell -5.2bps (-2.3bps Friday) to end a run of 7 consecutive weekly increases.

Finally, the risk-off move last week hit several other asset classes. Commodities fell back across the board, with Brent crude oil prices down -1.68% on the week to $73.18/bbl. Bitcoin saw a significant decline, closing at a 3-month low on Friday of $84,212 before the weekend rally. And credit spreads widened too, with US HY widening +4bps to 275bps, whilst Euro HY was up +3bps to 284bps