Gold and Silver ETF flows diverge with price

I am seeing many questions asking why and how the gold and silver ETFs can be seeing mass attrition in assets within their funds while at the same time the price of the metals are moving higher.

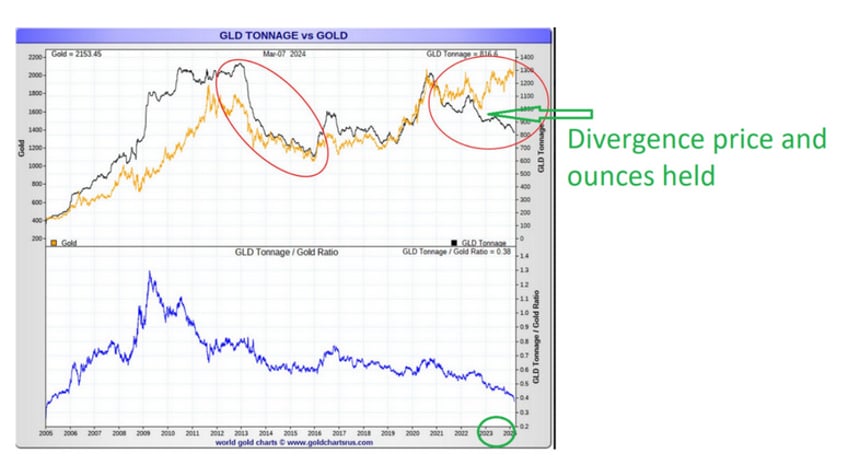

In fact, we have been seeing this steady decline in shares outstanding which equates to ounces held in these popular ETFs since 2021. However, the divergence in price and asset outflows began in late 2022. What changed?

There is no doubt, numerous Central Banks, have been net buyers of gold, as well as India and China, large net buyers and importers of both gold and silver. That will explain some of the demand and why supply has been flowing out of London where a lot of the ETFs custody their metals. However, it does not fully explain the price action and share depletion we are seeing in the ETFs.

One has to remember, What ETFs are. See my article here. https://www.goldsilvervault.com/understand-the-real-structural-risks-between-owning-physical-metals-held-directly-vs-etfs-in-a-brokerage-account/

One also has to understand that the Banking system with Basel 3 began a systematic approach to deleveraging Banks’ balance sheets for certain activities in the precious metals markets starting in July of 2022. This article explains in detail what is occurring. https://www.goldsilvervault.com/basel-3-and-londons-relationship-with-gold/

To understand the ETF structure, listen to the first 30 minutes of this audio broadcast. [ in which Bob] presents a comprehensive understanding of how commodity ETFs work, and who they benefit.

I have done many other presentations on market dynamics and Wall Street’s structured product creation in the precious metals sector. These securities and derivatives have an unusual relationship when it comes to commodities, especially precious metals. One has to remember; the precious metals markets are a business to professional players. Making money off spreads, leverage, leasing, loans, arbitrage, product issuance, and many other activities are just industry practices. However, the collateralization and financialization of the precious metals have resulted in the physical market having a dilutive effect against the paper price. This is because the paper price trades enormous volumes over the physical market.

[Edit- Bob also did an interview with Palisade Gold Radio 2 years ago explaining Basel 3 and possible impact before this happened That video can be found here]

For many physical investors, this can become very frustrating to understand. Many precious metal dealers and promoters take advantage of this frustration by simply saying the precious metals market is completely manipulated. This has no educational merit whatsoever and eventually detracts more mainstream investors from investing in this asset class.

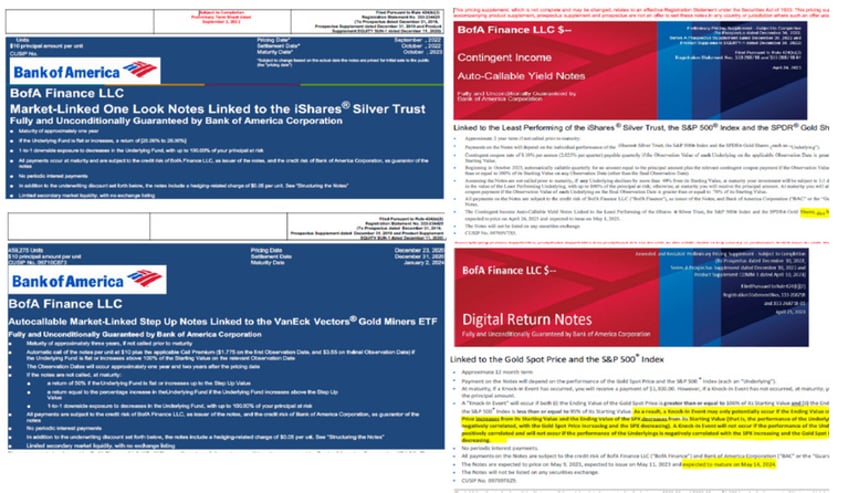

In 2020, Wall Street’s use of derivatives in precious metals exploded. Like most industries, when there is great public interest in a product or service, industry will create more supply to meet that demand. However, in the precious metals markets, Gold and silver cannot be created from thin air. That is where derivatives and structured products enter the picture. In 2020, the Office of Comptroller of the Currency, Report on Bank Trading and Derivatives Activities began to report a big jump in derivatives issuance. I have been reporting what these products look like and who issues and buys these products. Oddly many of these derivative products used the ETFs like SLV and GLD as underlying instruments for benchmark performance. This meant that these large banks who also have separate market making and authorized participant businesses, may have deposited their underlying metal or inventory (as the industry calls it) to create ETF shares that could be then used to benchmark their tertiary derivative/structured investment vehicles bought by institutions and accredited investors. To explain what these structured products are, just go back to the movie The Big Short. Remember when Michael Burry went to the Wall Street Banks to buy a specific investment product against the housing market? Well, that is what these precious metal derivatives products are. They are contracts created to invest with or against a benchmark per se.

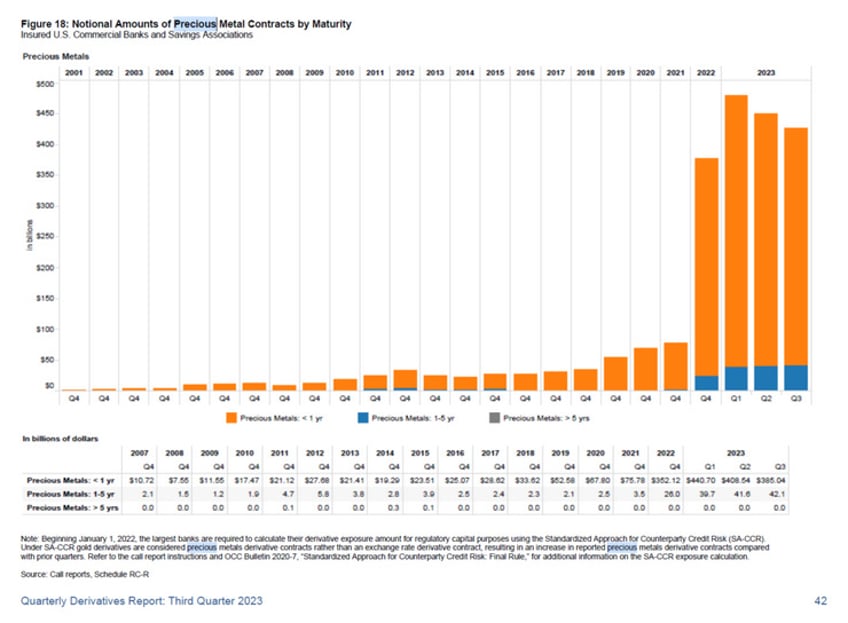

The chart below shows the notional amount of derivative contract exposure among banks through the 3rd quarter of 2023 (latest chart). The chart is a little deceiving since at the beginning of 2023 gold was added to the precious metals category (Silver, Platinum, Palladium) and removed from the Foreign Exchange category. This makes tracking the general category more difficult for back testing purposes. However, in 2023 the category began to the see a decline. In fact, from the 2nd quarter of 2023 to the 3rd quarter of 2023, there was a decline of $50 billion in notional value of derivatives.

The chart below shows the divergence in the largest Gold ETF (Symbol=GLD) beginning in 2023.

At this point you may be asking what are these derivative products issued by the banks or their investment firms? The following is just a small taste of the numerous products issued for multiple strategies surrounding the gold and silver market. Oddly, this can have an enormous footprint on the price of the metals while not providing much benefit to the actual physical industry of mining for example. The reason is these structured products use derivatives instead of metal. Therefore, institutions who want participation in gold and silver can get that exposure to price with these vehicles without ever touching a real ounce. Once you understand this, then you can start to grasp why gold and silver in the western markets can become a frustrating market to understand.

Something began to happen in 2023 that may have correlation to the secular decline in ounces held in ETFs. The structured products shown above which were issued in 2020, 2021, etc, started to mature in 2023 and 2024. This is when the divergence in the ETF ounces held/ shares outstanding began to diverge. There was no need by the investment banks to hold these shares of the ETF and tie up their metal inventory or collateral if these structured products were maturing and not reissued. This can also be corroborated by the large decline in notional value of derivative exposure held by these banks.

When one examines Basel 3, the leverage of the financial system, and the profiteering by banks and the financial industry to issue derivative products/supply through the use of ETFs when demand is high, is there any wonder why these ETFs have begun to diverge with the underlying physical market? Please remember, many of these structured products influenced gold and silver prices through options and other securities. They even bet against the price of the metals by providing buffered or protection against limited downside events. That would be an entire article for another day.

This breakout in the metals has been a result which I have been trying to explain since 2022. While the paper precious metals markets have been deleveraging, the physical market has been exerting more global influence on price.

For institutions and high net worth investors that want actual exposure to real precious metals, legally owned and held by them, please reach out to me. If you are investing in ETFs, structured products, derivative instruments, or other investments that provide only price representations, then you could be the product rather than the product you are invested in.