Gold Lease Rates Explode as US Repatriation, Delivery Logistics Grow

On January 30th this was written regarding The Musical Chairs of Gold Supply

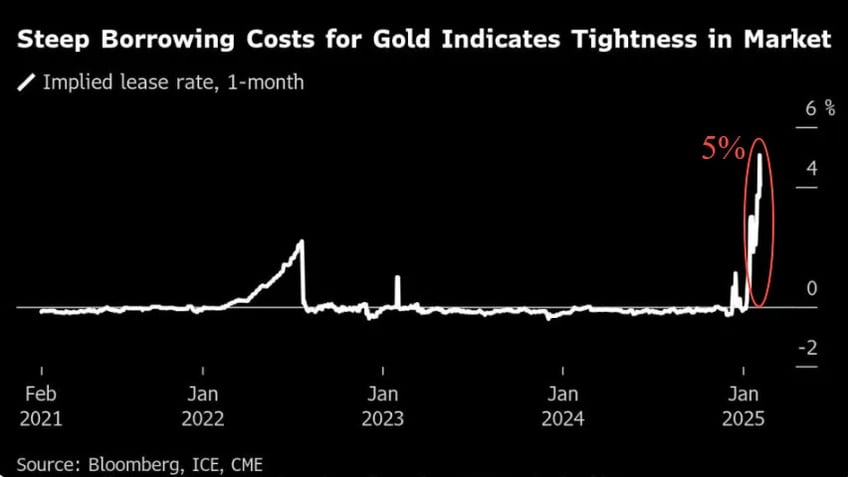

Bullion banks relied on a game of musical chairs, borrowing gold to meet short-term needs. But when enough chairs are removed—when buyers refuse to lease their holdings—banks are forced to compete for an ever-dwindling supply. That’s what’s happening now. From: Zerohedge Edit-The LBMA Doesn't Have the Gold

Yesterday, Bloomberg, in an article entitled Gold at Bank of England Trades at Discount as Tariff Fears Drive U.S. Demand describes the current gold market situation. The article states that:

‘Gold stored in the Bank of England (BOE) vaults is trading at a discount to the broader market as concerns over potential Trump tariffs drive a rush for physical bullion. The surge in demand has created weeks-long withdrawal delays, making BOE gold less attractive than metal stored in commercial vaults.’

The situation can perhaps be more aptly described using more (free) market-based terminology:

World Gold prices are higher than in England and therefore BOE Gold is being pulled out as world prices equalize higher. Logistics are perhaps being used to throttle demand instead of simply raising BOE prices. London's franchise is weakening as primary determinant of world gold prices

In summary, the world currently wants its gold back with the USA currently leading the repatriation charge

More GoldFix analysis of that Bloomberg article again:

BOE Under Strain

The Bank of England, which holds over 400,000 gold bars worth $450 billion, is struggling to keep up with withdrawal requests. Much of the 8,000 tons of gold in London is locked up in central bank reserves, exchange-traded funds (ETFs), and long-term investor holdings, limiting the supply available for immediate trade.

The problem has been characterized solely as if the true global price is the BOE price, and the buyers are wrong here. Some would even say that the BOE logistics are throttling demand in hopes that prices equalize at the lower level sooner rather than later after the Gold rush is over. We are not saying that is happening. We are implying that is happening

Hell has broken loose https://t.co/IQJnxyQ6Xd pic.twitter.com/eNGji3Vfkk

— zerohedge (@zerohedge) February 5, 2025

The logistics problem is actually real. But is it the cause or the result of the Bullion shortage? The LBMA and BOE, as responsible protectors of their market also had to know it was a risk given the events of the last 3 years including the Covid crisis, and multiple nations like India repatriating their Gold. You simply cannot blame the customer for wanting to buy your product without raising eyebrows.

Time will tell when price equalizes between the two venues.

Continues here

Free Posts To Your Mailbox