Gold Makes New ATH as CITI Raises Price Target to $3300 (seriously)

"Using our quarterly price changes model, we see gold prices rising to well over $3,300/oz, though we view this is a bull case given the potential for jewelry and scrap over the next 12 months. We take a more conservative base case... which suggests gold increases to $2,900-3,000/oz over the next 6-12 months"

- Kenny Hu, Max Layton and team for Citi.

Contents (1890 words, 19 charts)

- Bullion Bank Leads Team $3,000+

- Citi Says More Upside is Coming

- Bottom Line: Target Raised

- The Bank’s 4 Main Reasons (Fresh insights here)

- Trump 2.0 Accelerates and Broadens Dedollarization

- Investor Demand Will Surge on Geopol Risk and US Economic Slowdown

- Price Target Breakdown: $3,000 at least with $3,400 depending.

- **Addendum: What’s New Here?

Bullion Bank Leads Team $3,000+

CITI’s new Gold report published February 6th makes a straightforward case: Gold’s rally is being driven by physical demand, not speculation. The bank has hinted at this before in August 2024. It was also about this time other major Bullion Banks unveiled their own new physical demand-skewed models for valuing Gold. In this way, Citi, BOA, and Goldman have been ahead of the curve in sharing their methodology with investing clients

This change in risk metrics was significant as it acknowledged China/BRICS demand and set the table for price-target upgrades regardless of what the Dollar or interest rates did. And that is exactly what we got. Gold and Silver rose dissuaded neither by Dollar strength nor higher rates since those reports in August.

Citi Says More Upside is Coming

As of two days ago, with Citi (and UBS) raising their targets, every major bullion bank has raised its price target to $3,000 now. Two of them, BOA (and today) Citi have raised their soft targets even higher With this latest analysis, Citi joins the $3,000 short term club and describes more specifically the rationale for potentially even higher prices.

Here’s a breakdown of that new report

Bottom Line: Target Raised

Central banks are buying at record levels, investment demand is absorbing nearly all new supply, and concerns over de-dollarization are keeping gold in focus. The report outlines why these trends are likely to continue while also highlighting potential risks from trade policy, interest rates, and economic shifts.

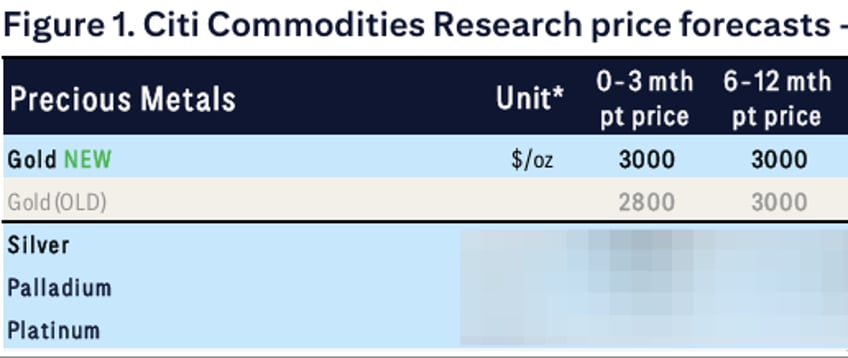

Gold’s strength has led the bank to raise its short-term target to $3,000/oz, with longer-term targets holding steady at the same level for now (see below). The reason: 95% of mine supply is expected to be absorbed by investors by late 2025, leaving little room for price declines.

There are 4 main reasons for the price target hike and their ongoing bullishness. The Bank shares some in-depth analysis drilling into the specifics of how the secular drivers of physical Gold demand are manifesting in reality. In short, they’ve done the work.

Citi’s 4 Main Reasons

Here are CITI’s four main reasons as derived from their analysis; All of which demonstrate the growing physical gold demand seen these past two years as continuing and spreading.

1- Mine Supply is All Spoken for Now

"The bank's gold pricing model, based on physical flows, projects investment demand exceeding 95% of mine supply in Q4 2025 supporting historically high gold prices."

The exact word they used was “extremely” as in: “Investment demand should underpin extremely high gold prices by historical standards.” Their point being that as demand increases immediate offtake from newly mined supply, the correlation between price and mined supply strengthens. The reasons are multiple. Not the least of them is: Less metal to cover existing leases, and less new supply that needs immediate hedging.

2- Physical Demand is Both Growing and Broadening

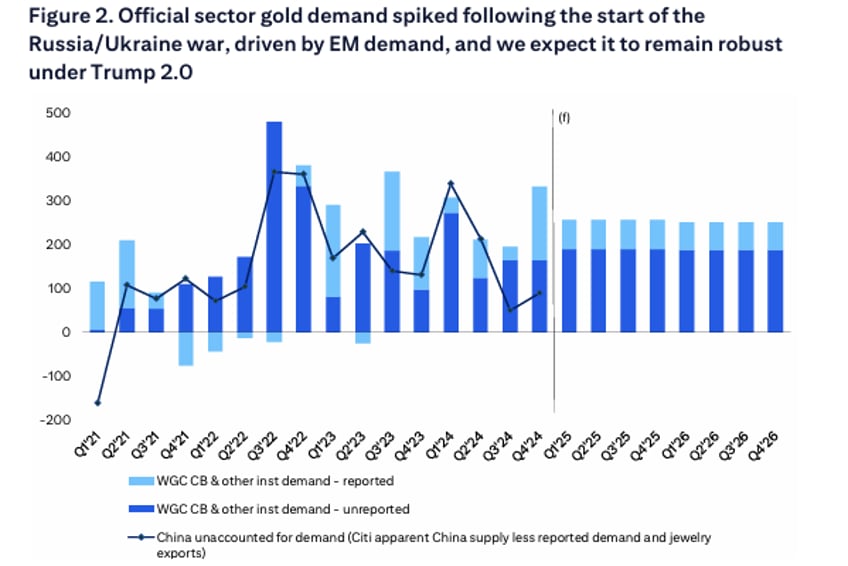

Notably, the bank has expanded its central bank and institutional research, forecasting sustained strong demand, particularly under Trump 2.0, which should support gold prices. Trade tariffs are expected to accelerate reserve diversification and de-dollarization among central banks, with China still leading the shift.

3- The Return of Western Investors

Paraphrasing: Private investment demand is set to rise in the coming months across bars, coins, ETFs, and OTC markets (see Figure 5). Gold is expected to climb as a hedge against mounting risks, including slowing growth, trade tensions, high interest rates, a weakening U.S. labor market, currency devaluation outside the U.S., and potential equity market declines.

It is particularly notable Citi is very much in the camp an economic slowdown is coming to the US. They view this as a time when investors will put a large portion of their wealth into Gold and Silver as they extricate themselves from Tech stocks. interestingly, Michael Hartnett, the respected CIO at BofA and a Gold and Silver bull himself of late has also intimated this. More on that below.

4- Gold Tariff Calculus is Bullish

Citi does not expect gold to be included in broad tariffs during Q2 2025, given its status as a financial asset and the legal tender classification of gold coins. However, if initial tariff announcements lack explicit exemptions, U.S. premiums could spike. Current COMEX vs. LBMA spread trading suggests a ~20% probability of gold being included. Graphics illustrating their points are included

Equally as important, we feel tariffs can only drive gold prices higher because implementation of them is a road to sanctions and then wealth confiscation for nations subject to tariffs.

Tariffs are bullish for Gold because they are bearish for Trust. Citi believes tariffs, if implemented will add at least 2% to Gold prices and 5% to Silver.

Next we explore the Geopolitical and Economic drivers behind those reasons. followed by the bank’s final price determinations for 2025.

Trump 2.0 Accelerates and Broadens Dedollarization

Drilling down into Citi’s work points to sustained central bank and institutional gold demand over the next 2–3 years, keeping prices elevated. Trump’s policies are expected to reinforce reserve diversification trends among emerging market (EM) central banks. Trade tensions and a strengthening U.S. dollar further incentivize EM central banks to increase gold holdings as currency support.

Continues here

Free Posts To Your Mailbox