The short-cover rally Goldman analysts forecasted early last week in Chinese iron ore prices has completely reversed. After all, analysts from the bank said the rally should be sold. Now, analysts have revised their Q4 2024 iron ore price forecast to $85/t, down from $100, based on strong global supply and soft demand in the world's second largest economy. They add that the buildup in Chinese port stocks suggests prices will be pressured lower unless lower-cost producers cut production.

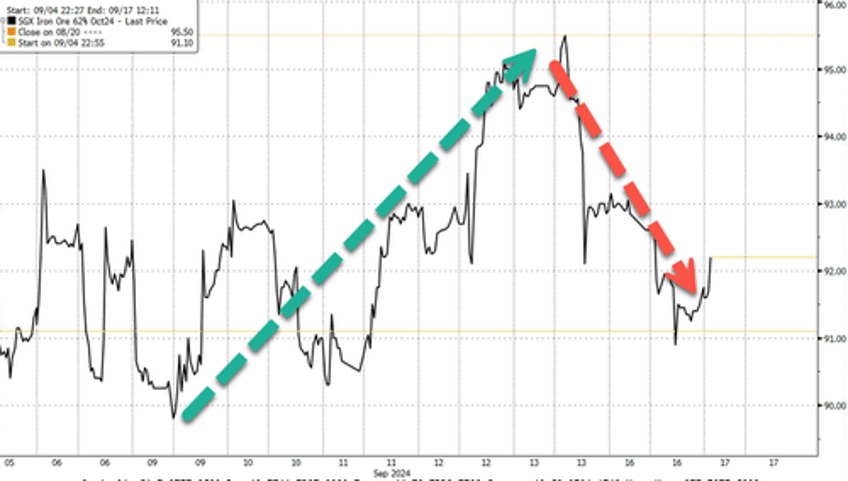

Last week, ahead of Goldman's iron ore note telling clients, "desk expect short cover rally," prices in Singapore sank to the $90/t level, the lowest level since 2022, on concern that global supply is running ahead of demand. Prices jumped shortly to the $95/t level, where Goldman told clients: "Be ready to sell at the $95-100" level, noting that iron ore's "fundamental outlook remains bleak."

One week later, on Monday, Goldman analysts Aurelia Waltham, Daan Struyven, and Samantha Dart pointed out that iron ore prices recently hit a nearly two-year low of $90/t, driven by strong global supply despite stabilizing Chinese demand.

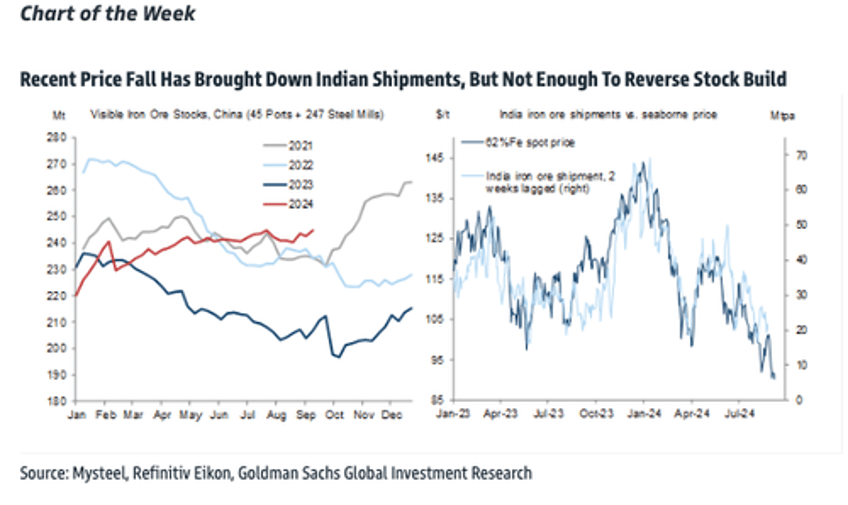

They said prices of the industrial metal have plunged by around 20% since July, but shipments remain 2% higher than last year, with similar arrivals into China. They added that India has reduced exports, but without a significant demand recovery, further production cuts from lower-cost producers are needed to rebalance the market and shore up prices.

Due to the supply imbalance, the analysts revised their Q4 2024 price forecast down to $85/t, noting that restocking before China's Golden Week could provide short-term support. However, they said prices are expected to drop further in October on rising stocks.

The most important chart from the analyst's chart pack is that elevated iron ore stocks in China due to a faltering economy have driven down prices. In other words, stocks must come down to experience a meaningful price recovery.

Here's more color on the depressing iron ore market from the analysts:

Following soft China macro data in July, activity came in broadly below market expectations, and our China economists have downgraded their 2024 GDP growth forecast to 4.7% from 4.9% previously. Year-on-year industrial production growth fell, fixed asset investment growth improved less than expected, although export growth was stronger. After two months of decline, the volume of steel exports increased by 21% MoM to 9.5Mt in August, bringing YTD YoY growth to +19%. This likely helped to limit the extent of the drop in flat steel production last month (-4.6% MoM in August) and iron ore consumption as Mysteel data showed sluggish domestic demand.

Looking ahead, we maintain the view that the potential for falling exports is a key risk to steel production in China over the coming year and could result in a further decline in Chinese iron ore demand, given that we see increased support from domestic demand as unlikely.

Following a substantial fall in the iron ore price over the past three months, China's approaching Golden Week holiday (beginning October 1st) could bring some price stabilisation over the next two weeks as mills restock raw materials, creating a demand pull on port stocks. Indeed, last week's data showed a 2.6% WoW increase in mills' in-plant stocks, marking the largest jump since the pre-Lunar New Year restock. There is also a near-term risk of a short covering rally due to substantial short positioning in both iron ore and Chinese steel markets.

However, while the build in port stocks came to a halt last week, they remain ~30Mt above the 2016-2023 September average. Meanwhile, total Chinese iron ore stocks (including tonnes held at mills) continue to rise, counter-seasonally, and despite Indian iron ore shipments having declined in response to lower prices. Furthermore, even with India's decline, high frequency vessel tracking data shows that global iron ore seaborne shipments in the first two weeks of September were 3% higher than the same period in 2023, and Vale has raised guidance for this year to 323-330Mt.

As a result, we believe that another leg lower in prices towards the 95th percentile (~$80/t on a grade adjusted basis) would be needed to (1) completely remove new Indian tonnes from the seaborne market and (2) pressure supply further down the cost curve in order to rebalance fundamentals. We therefore revise down our 2024Q4 price forecast to $85/t (previously $100/t).

In a separate note, a team of Goldman analysts led by Aurelia Waltham and Daan Struyven said that iron ore's "fundamental outlook remains bleak" as prices traded at a two-year low.

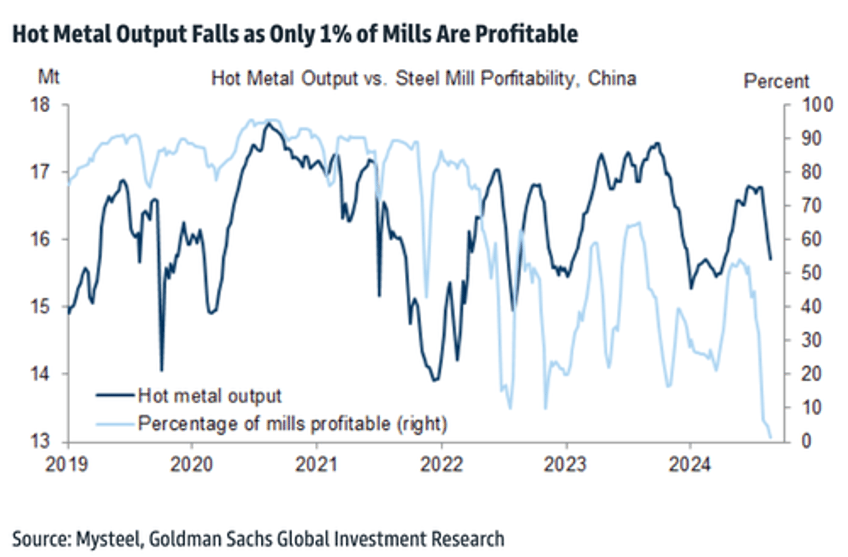

This was the most stunning chart from the analysts' report: Only 1% of steel mills are profitable in the world's second-largest economy. As profitability collapses, hot metal output declines.

Earlier this month, Goldman's Rich Privorotsky told clients, "Iron ore is dropping to 90, China will continue to struggle, and commodities as a whole, I think, are reflecting the downgrade to growth expectations in the geography."

China's steel industry has been under pressure amid a severe property market downturn and weak economic recovery.

Last month, Baowu Steel Group Chairman Hu Wangming warned that economic conditions in the world's second-largest economy felt like a "harsh winter."

As the world's largest steel producer, Baowu Steel's chairman said the steel industry's downturn could be "longer, colder, and more difficult to endure than expected," potentially mirroring the severe downturns of 2008 and 2015.

Another team of Goldman analysts, led by Yuting Yang and Lisheng Wang, recently published high-frequency economic indicators, including consumption and mobility; production and investment; other macro activity, and markets and policy, that revealed there was no imminent recovery in China.

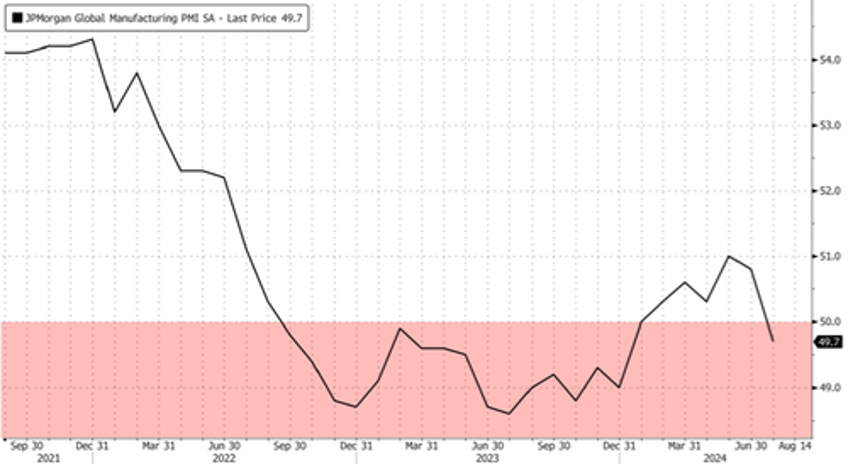

Meanwhile, JPM Global Manufacturing PMI has slid (<50) into a contraction.

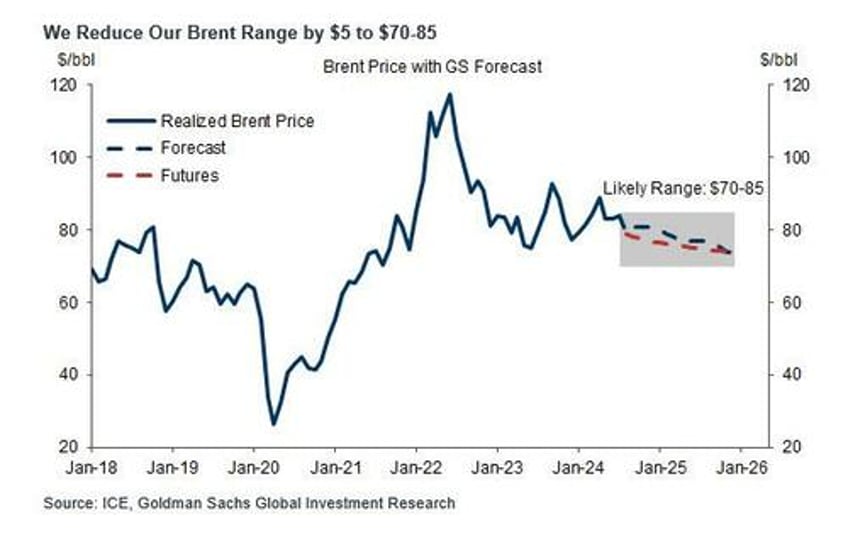

Besides cutting iron ore price targets, Goldman Daan Struyven recently slashed his expected range for Brent oil prices by $5 to $70-$85 per barrel, citing weaker Chinese oil demand, high inventories, and rising US shale production.

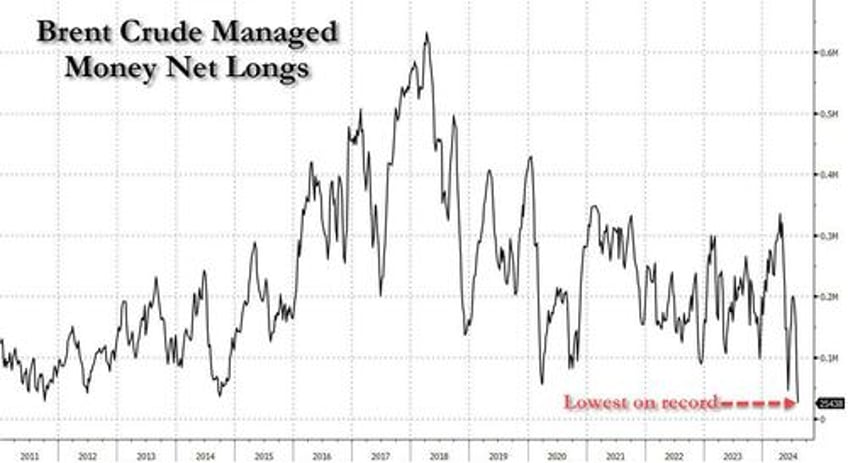

None of this is new to the market, where sentiment is downright apocalyptic. As noted several weeks ago, bullish positioning in oil just hit an all-time low.

China's rapid deceleration and signs of a US slowdown have capped further upside for commodity prices. Whether US interest rate cuts that begin this week will boost economic growth remains uncertain. At the same time, more clarity on Chinese economic policies is expected to emerge after the US elections in November.