The head of climate research at commodities hedge fund firm Andurand Capital Management says now is not the time to bet on a bull market for carbon credits. There is growing pessimism in the voluntary carbon markets amid turmoil within the world's top arbiter of corporate climate targets for allowing controversial carbon credits to offset Scope 3 emissions.

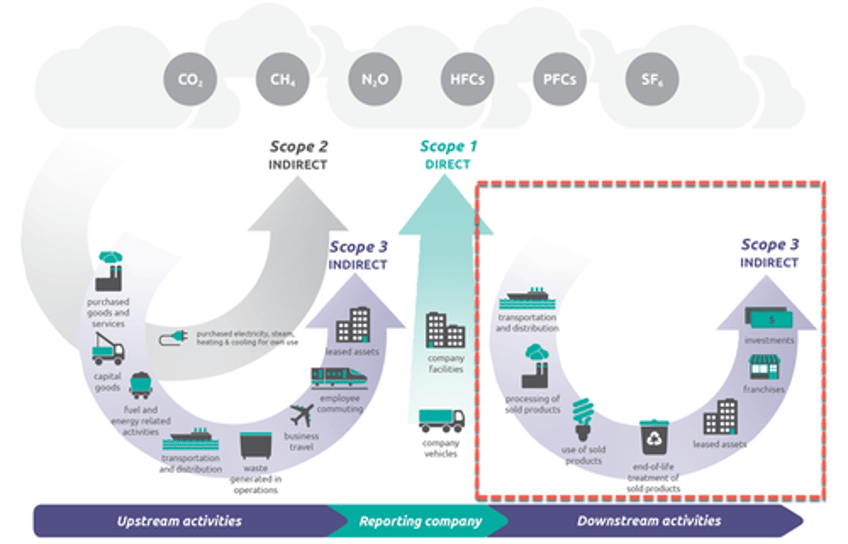

"I don't think you're going to find people stampeding to buy credits to offset their Scope 3 emissions," Andurand's Mark Lewis told Bloomberg in an interview. Scope 3 is emissions not owned or controlled by the reporting organization but released in the supply chain owned by other companies, such as transportation and leased assets. These types of emissions can account for nearly 90% of total emissions, depending on the industry.

The Science Based Targets initiative (SBTi), a globally recognized certifier of corporate emissions goals, made an announcement on April 9. This decision, which allowed the use of offsets for Scope 3 emissions, sent shockwaves through the carbon markets. Wind farm companies can now sell carbon offset credits to other companies to offset their pollution, without necessarily reducing their own emissions.

Lewis noted that too many risks remain for companies to dramatically increase their reliance on carbon credits.

Luiz Amaral, the chief executive of SBTi, has taken a nuanced stance on Scope 3 emissions, stating that "not all Scope 3 emissions are created equal." He emphasized the need for "difficult" discussions to determine the most effective course of action, acknowledging the complexity of the issue.

Lewis at Andurand explained any relaxation of rules guiding the use of carbon credits, such as those outlined by SBTi, is "clearly bullish for the voluntary market — at the margin — because clearly it means there are potentially more buyers now than there were before."

But here's the caveat: "I don't think there's a stampede out of the door today to rush into the market," he said.

Furthermore, several multinationals, including Shell, Europe's largest oil company, and the world's number four iron ore producer, Fortescue Metals Group, along with other companies, have quietly shelved or at least reduced carbon offset plans amid mounting concerns carbon offsets are prone to 'greenwashing' and most credits don't actually benefit the climate.

A few years ago, Elon Musk posted on X, "ESG is a scam. It has been weaponized by phony social justice warriors."

Last year, we noted, "Carbon Credits Are The Biggest Scam Since Indulgences... How You Can Avoid Being Fleeced."