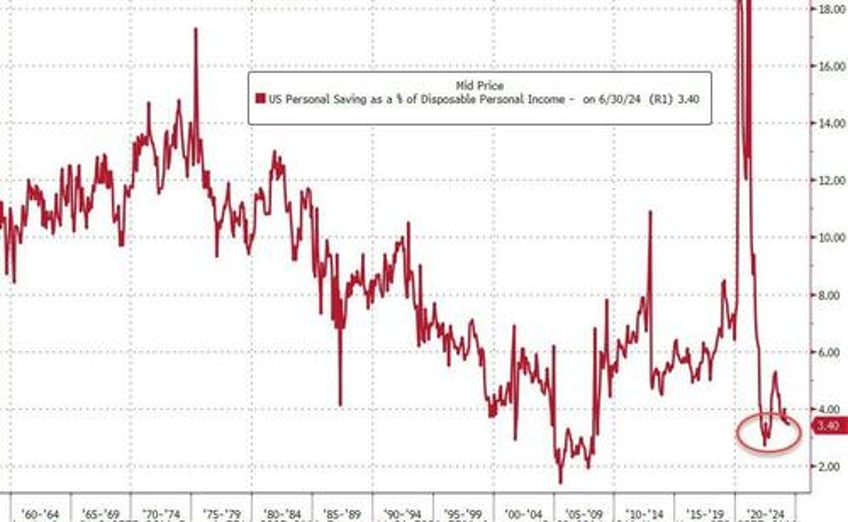

With home values at or near record highs nationwide, and savings rates plunging, Americans are increasingly tapping into home equity.

While some are using it for home renovations, others likely need extra cash amid the Bidenomics blowback, which has created an environment of elevated inflation and high interest rates.

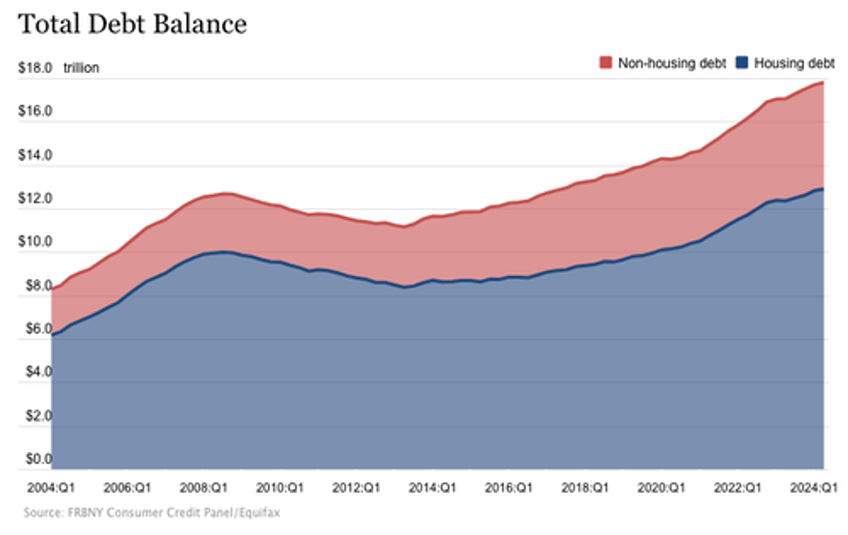

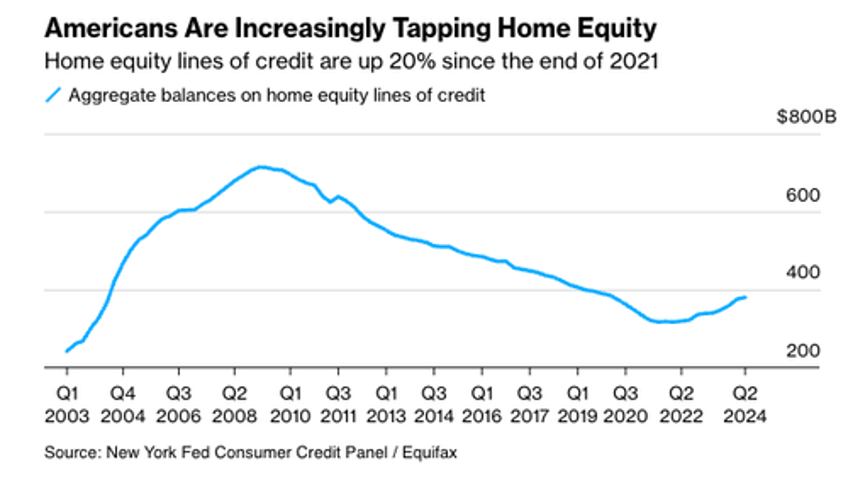

A new report released by the Federal Reserve Bank of New York's Quarterly Report on Household Debt and Credit on Tuesday shows originations of both home equity loans and home equity lines of credit (HELOCs) balances increased by $4 billion, representing the ninth consecutive quarterly increase since the first quarter in 2022. The total stood at $380 billion, a $63 billion increase from the low of $317 billion reached in the third quarter of 2021.

"Homeowners continued to increase HELOC balances as an alternative way to extract home equity," Andrew Haughwout, Director of Household and Public Policy Research at the New York Fed, wrote in the report.

Besides home renovations, other considerations that drive homeowners into taking out a HELOC include debt consolidation and emergency cash management as credit card debt hits record highs and the cost of living increasingly becomes unaffordable for the working poor and middle class under Biden's first term.

Home equity products are the most viable option for homeowners in these challenging economic times.

While tapping home equity has many benefits, it also has many risks, including putting the property at risk by accruing significant debt and diluting the valuable asset when home prices reverse.