How Trump’s 2025 Tariffs on Canada & Mexico Impact Gold & Silver

Washington’s trade war chess match could reshape the precious metals playbook.

Submitted by GoldFix, ZH Edit; Authored by Scottsdale News

The Oval Office sent shockwaves through global markets as 25% tariffs on Canadian and Mexican imports, along with 10% tariffs on Chinese goods, take effect today – Saturday, February 1st 2025.

While Washington debates border policies, precious metals investors are scrambling to understand what these sweeping changes mean for their portfolios. Let’s cut through the noise and examine the real impacts on the precious metals market.

Despite the best wishes of bullion collectors, President Trump’s actions on Tariffs leave no carve outs or exception for bullion and monetary metals.

North America’s favorite bullion beauties – Mexican Libertads and Canadian Maples – just became tariff targets. Basic math suggests a $30 silver coin could jump an additional $7.50 overnight. Reality? More complicated than a DC lobbyist’s expense report. Both mints have contingency plays and options:

- Adjusting production processes

- Exploring different distribution channels

- Utilizing existing inventory in U.S. warehouses

- Optimizing their supply chains

For instance, while RCM does mint a lot of their coins in Canada, some production can be done in the United States to mitigate tariffs.

Not Just Coins – Cast Bars Too

Here’s the kicker – 80% of U.S. silver grain used in the bullion market comes from abroad – mostly Mexico. This isn’t just about a few sovereign coins; your favorite cast bars and rounds could get caught in the crossfire as US based dealers and mints work to find alternative raw material providers.

That grain is used by mints in the US to produce thousand of different cast bar products domestically.

Domestic Silver: Why the U.S. Can’t Go It Alone

While headlines focus on international trade shifts, it’s crucial to understand America’s domestic silver landscape. Can American Mines meet our demand?

Yet despite this impressive domestic production, U.S. mines only satisfy about 17% of our national silver demand.

This production gap explains why the new tariffs could have broad market implications. With 63% of U.S. silver consumption relying on imports primarily from Mexico, Canada, Peru, and Chile, and approximately 80% of silver grain used in domestic bullion products coming from international sources, the market will need time to adjust.

To put these numbers in stark perspective, U.S. mines produce approximately 28 million ounces of silver annually, while domestic demand reaches roughly 162 million ounces. This dramatic shortfall – about 134 million ounces – underscores why international trade plays such a crucial role in America’s silver market.

In 2021, United State American Silver Eagles sold approximately 40 million 1 oz coins just by themselves.

Gold & Silver did NOT get an exemption on Canada and Mexico Tariffs. Maple Leafs will be 25% higher immediately.

— Josh Philip Phair (@JoshPhilipPhair) February 1, 2025

(Buy American says Trump, no more Justin Trudeau bullion)

Let the games begin.

Moves & Counter Moves

Canadian Prime Minister Justin Trudeau said Friday that Canada is ready with a respone if Trump were to move ahead with the tariffs, but he did not give details.

“We’re ready with a response, a purposeful, forceful but reasonable, immediate response,” he said. “It’s not what we want, but if he moves forward, we will also act.”

Such diplomatic language from one of the world’s largest precious metals producers suggests we could see additional market complications as countries adjust their trade policies.

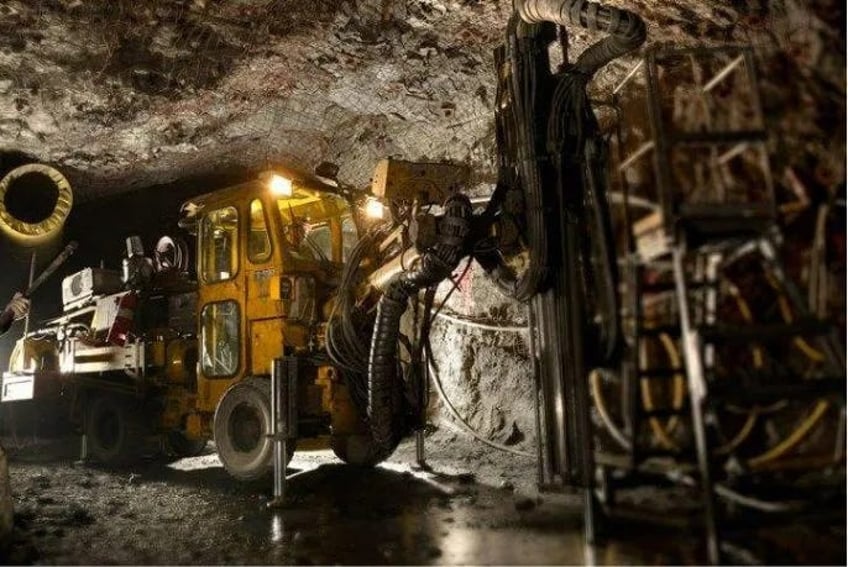

The tariffs’ impact extends far beyond precious metals, with significant implications for Canadian lumber, automotive parts, and oil imports (though oil may see a reduced 10% rate).

From Mexico, the tariffs will affect a broad spectrum of imports including vehicles, automotive parts, and agricultural products – a shift that could influence consumer prices across multiple sectors, from pickup trucks to Super Bowl guacamole, as noted in the AP report.

What This Means for Investors

While the 25% tariff sounds dramatic, the actual market impact will likely be more nuanced. Smart investors should consider:

- Buy existing inventory while available

- Watch for market inefficiencies during the adjustment period

- Monitor for potential opportunities in alternative products

- Keep an eye on secondary market developments

In the bullion industry, tariffs present a unique challenge due to the traditionally razor-thin margins and intensely competitive pricing structure. However, mints and dealers have historically demonstrated remarkable adaptability, and will likely explore various strategies to maintain competitive pricing for their global customer base.

From supply chain restructuring to manufacturing relocations, the industry has multiple tools at its disposal to navigate these new trade waters.

Scottsdale Mint will have more details about the possible impacts these actions will have in the coming days.

Source: How Trump’s 2025 Tariffs on Canada & Mexico Impact Gold & Silver

Free Posts To Your Mailbox