By Graham Summers, MBA

Nothing has changed in the U.S. in the last month.

The primary framework for investing in the U.S. is as follows:

1) The stock market is bubbling up due to:

- There being too much liquidity in the financial system.

- Inflation, particularly core inflation remains elevated (4.8%).

- Stocks are a better inflation hedge that bonds or cash.

2) The U.S. economy isn’t growing rapidly, but it’s not contracting either.

- The Atlanta Fed’s GDP Now metric shows economic growth of 2.4%.

- The Federal government is running its largest deficit as a percentage of GDP in history outside of wartime/ a recession. Much of this deficit is going towards social programs and stimulus measures.

- Social spending and economic stimulus measures will continue if not increase as we head into the 2024 Presidential election.

- The recent debt ceiling deal removes all spending caps through the 2024 election.

Put simply we are in a situation in which nothing is going great, but pretty much everything is going OK. Inflation remains high, but it has come down from its peak. The economy is still growing, albeit at a sub-3% pace. And there is ample liquidity in the financial system.

All of this is generally “risk on” for the markets… which means this situation will continue until something significant breaks. This doesn’t mean that stocks won’t correct or ever fall in price again. But it does mean that we are likely in a new bull market and that things will continue to be in “risk on” mode until something major breaks.

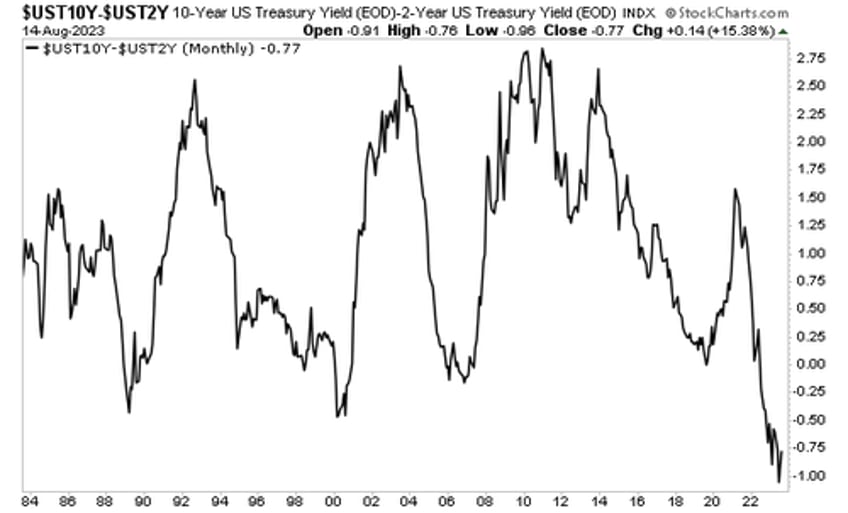

Regarding the potential for a recession, the yield curve, particularly the all-important 2s10s (what you get when you subtract the yield of the 2-Year U.S. Treasury from the yield of the 10-Year U.S. Treasury) remains extremely inverted.

This has predicted every recession since 1955. However, the actual recession doesn’t hit until this dis-inverts, meaning it moves back into positive territory. And as the below chart shows, it can take months if not years for the yield curve to dis-invert once it becomes inverted.

Put simply, until this chart moves back into positive territory, this is just a warning that a recession is coming eventually. Nothing more.

So again, there are red flags in the financial system today, but these are warnings not signals that it’s time to get REALLY bearish. The purpose of investing is to make money, not miss out on gains because of a warning. So we ride this bull run for as long as we can until it ends.

Indeed, my proprietary Bull Market Trigger is about to register its first “buy” in over a decade.

This signal has only registered TWO times in the last 25 years: in 2003 and 2010. And it’s close to registering a new signal today,

If you’ve yet to take steps to prepare for invest accordingly, we have published an exclusive special report How to Time a Market Bottom.

It details the my proprietary bull market trigger, how stocks have performed following prior signals, and what it is stating right now.

Normally this report would be sold for $249. But we are making it FREE to anyone who joins our Daily Market Commentary Gains Pains & Capital.

To pick up your copy, swing by:

https://phoenixcapitalmarketing.com/TMB.html