"The only question is if it's spent in a new political-economy which is short-term inflationary... or in an old political-economy, which is just inflationary"

Intro: Michael Every Knows

Authored by GoldFix ZH Edit

Yesterday we read an excellent post here on ZH entitled:"BTFP Is Being Phased Out Before Rates Are Cut: Does A Crisis Finally Lie Ahead?" (linked below) in which Michael Every comments on the changing political dynamic governing economic decisions.

Mr. Every understands the end of financialization as the Western engine for economic growth is here and astutely frames it in political terms. He also understands the West must build and make things again. Nevertheless, we must still consider that old Financial engine and our collective need to keep it working until we’ve finished building its replacement economic engine.

He then asks what the path forward will be in that regard. 'Will we spend money on the new or the old economy?' That thoughtful question is something each nation's leadership involved in this painful decision-process needs to weigh.

We may know the answer to his question. The answer is both.

The "New Economy" gets spent on in the West because the world is mandating it. The "Old Economy" gets spent on (hospice care) partly because the politicians want to get re-elected and partly because without the tax revenues they provide, there is no money for the new economy to be built.

Nations spend on both types of economies and monetize that spending in the hopes productivity returns soon making the changeover from old engine to new engine not too painful.

This much we are sure of. They will spend money on:

Every’s New Political Economy: financing future growth by spending money now in the hopes it can generate wealth in the future

while simultaneously continuing to finance…

Micheal’s Old Political-Economy: subsidizing consumer demand as palliative care to keep sinking industries comfortable

Paying for all this by…

Monetizing the debt, financial repression, and taxing those that can afford to pay hoping the changeover goes relatively painlessly.

Those governments charged with making these decisions will have to decide how much of their shrinking resources will be allocated to each economy. Te next question we'd ask as investors is, who benefits and who suffers?

Which Stocks Benefit From the Spending?

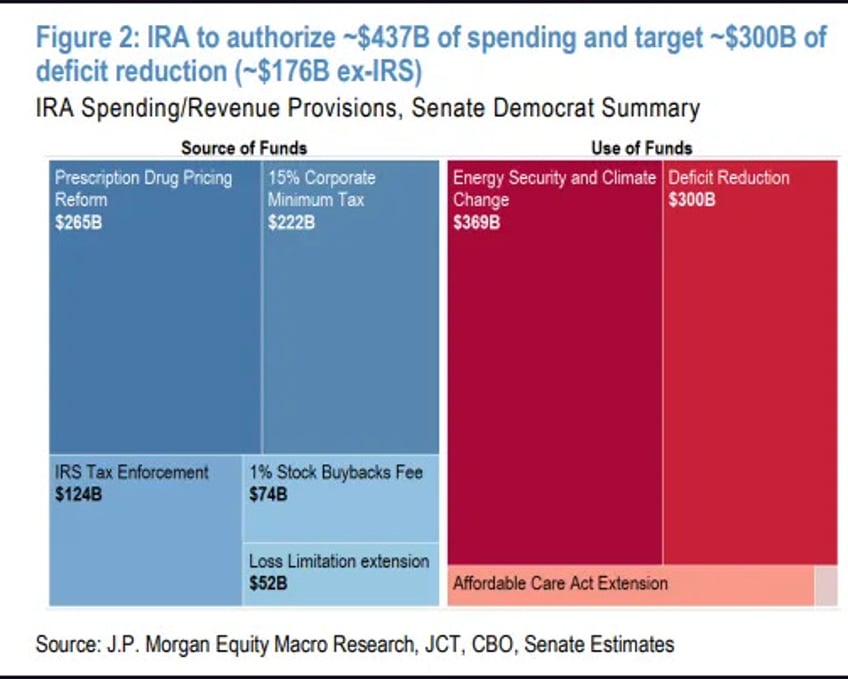

Fortunately JPM provided an answer as to what types of companies benefit in this set up last year. The specific industries that benefit (and suffer) are here at bottom and includes 200 companies involved.

One other thing Michael gets…. How western nation-states adapt to the changeover will make all the difference. That is where the political game is to be played out.

Enjoy.

"BTFP Is Being Phased Out Before Rates Are Cut: Does A Crisis Finally Lie Ahead?"

Unpopulism

Authored by Michael Every for RaboBank via ZeroHedge

The Fed just tweaked its BTFP programme. It’s still being phased out on 11 March, but effective immediately the adjusted rate for borrowing will ”be no lower” than that of reserve balances. This prevents markets arbitraging the BTFP’s typical 4.88% rate vs. the 5.40% rate on reserve balances, with this gap widening due to the market expectation --read ‘salivation’-- of rate cuts. In short, Wall Street was making money thrice: first, via lower bond yields (“because rate cuts”), second on higher everything else (“because rate cuts”), and third because of arbitrage: markets always exploit those variations rather than lending consumer savings to businesses for productive investment, as economics textbook wrongly teach. So, that’s one blow vs. easy money. Another is this morning’s chatter that the BoJ might raise rates before the Fed cuts following the strong US PMI data seen yesterday. If the looming Fed meeting doesn’t clearly open the door for that magical March rate cut, then it looks likely yields can travel significantly higher again, short term.

Acronyms like BTFP are important. Try explaining what played out in the last 16 years without saying NIRP, QE, QT, RRP, MMT, or BTFP. However, all the alphabetti-spaghetti serves a political-economy goal: the real key is in understanding what that goal is. Sadly, one can’t study political economy at a Western university today, just ‘political science’, taught by Marxists, and ‘economics’, taught by crony capitalists. For that and other reasons, Wall Street shows no interest in thinking in this way - which is fine until it gets the underlying assumption wrong.

It was OK not to grasp NIRP and QE proved financial capitalism’s political economy was rotten because those acronyms were Cantillon pipes taking money to The Street. With each new missive from a Fed-plumbing expert I asked, “Who are they bailing out this time?”

It wasn’t OK to miss that NIRP, QE, and de facto MMT of huge fiscal spending into public pockets supported by central banks changed the political economy. And we got huge demand, and huge inflation, helped by the corporate oligopolies The Street and global regulators helped build over decades.

It wasn’t OK to look at BTFP in 2023 and scream “rate cuts!” Those making that call were still in the Yes-We-Cantillon mode of expecting a bailout. Yet post-inflation, the Fed saw the political-economy game had changed. Banks couldn’t be allowed to fail, but rates had to stay high. Now BTFP is being phased out before rates are cut. Does a crisis lie finally ahead, or a Brave New World?

It isn’t OK not to see we are in a post-Ukraine and post-10/7 “pre-war” world of national insecurity, and face a Red Sea crisis that suggests at least that freight rates plateau at four times recent lows. Headlines of war with Russia should be taken seriously but not literally, but speak to the direction of fiscal, monetary, industrial, and trade policy. A new political-economy waits to be born while the old refuses to die: and so monsters arise - at least for a Wall Street thinking acronyms spell CASH.

Grasping the zeitgeist, the Financial Times op-eds ‘The world must start to prepare for Trump 2.0’, making the specific point that, “US allies, especially in Europe, need to begin rethinking security arrangements.” Indeed, EU defence spending needs to increase not just to 2% of GDP, but arguably by at least 2 percentage points, for decades, if it is to have any hope of ‘strategic autonomy’. That will, in turn, require new industries, guns-or-butter choices, and a new fiscal-monetary-industry-trade policy under a new political-economy (as argued here in detail). Moreover, the US will need to do the same too given it also has hard choices to make – which is why it’s likely to lean on its allies: it’s a cliché, but freedom really isn’t free: and as we see in the Red Sea, neither is ‘free’ trade.

Meanwhile, in China the PBOC is setting up a loan bureau to direct cash to strategic sectors, which will only lead to more trade clashes with the US and Europe ahead. Yet, oddly in a political-economy where Common Prosperity and national security rules, authorities are also now demanding SOE CEOs be ranked by how their stock performs: sadly, Wall Street shows us that incentive system produces the polar opposite of both common prosperity and national security.

So, can we still get those 2024 rate cuts? Yes, but we need supply to stay cheap and steady when it’s now getting pricier and wobblier – as the ECB is likely to note today (see our meeting preview here); and we need demand to stay in check when rate cuts are designed to increase it, and as we also have to contend with more populist fiscal policies. For example, even in a fiscally prudent Australia where the market was begging for rate cuts (despite property already overheating again as soon as they were sniffed), the government is rolling back large tax cuts for high earners with a low marginal propensity to consume in favor of more expensive tax cuts for lower-income earners with a much higher chance of going shopping. And to offset their higher taxes, wealthy Aussies will do what the tax system incentivizes: buy more investment property, forcing house prices even higher, to offset tax via the interest payments on their mortgage. But “rate cuts soon!’, right?

Point me to a government willing to tighten its belt as in the pre-Covid political-economy, and I will show you someone who will lose their next election. More money is going to be spent. The only question is if it’s in a new political-economy to boost supply, which is inflationary short term but disinflationary longer term, and which will mean geopolitical tensions, or in an old political-economy to boost demand, which is just inflationary – especially when supply is not assured unless we get a geopolitical retreat by the West.

So markets will have to adapt – and the ones who read political economy will do it fastest. For example, the FT also notes ‘Wall Street’s bargain with Trump’, which with commendable honesty points out the pink paper had “only nice things to say about Benito Mussolini in a June 1933 supplement entitled ‘The Renaissance of Italy: Fascism’s gift of order and progress’.” That’s meant as a warning, of course. However, it makes a less convincing case for handwringing over business’ attraction to strong leaders after decades of backing politically blind globalization, which is now crumbling at the edges after producing the very populism being decried.

In short, populism is “unpopulism” for markets when they aren’t getting the same old Cantillon cash.

//end

Continues here

Free Posts To Your Mailbox