Home improvement retailer Lowe's beat second-quarter earnings expectations but fell short on sales, slashing its full-year outlook due to "lower-than-expected DIY sales" in a "pressured macroeconomic environment." Lowe's and other industry peers like Home Depot have warned about an uncertain outlook as housing market trends slow amid high interest rates and elevated inflation, impacting low/mid-tier consumers.

Goldman's Kate McShane provided clients with an earnings snapshot for Lowe's second-quarter earnings:

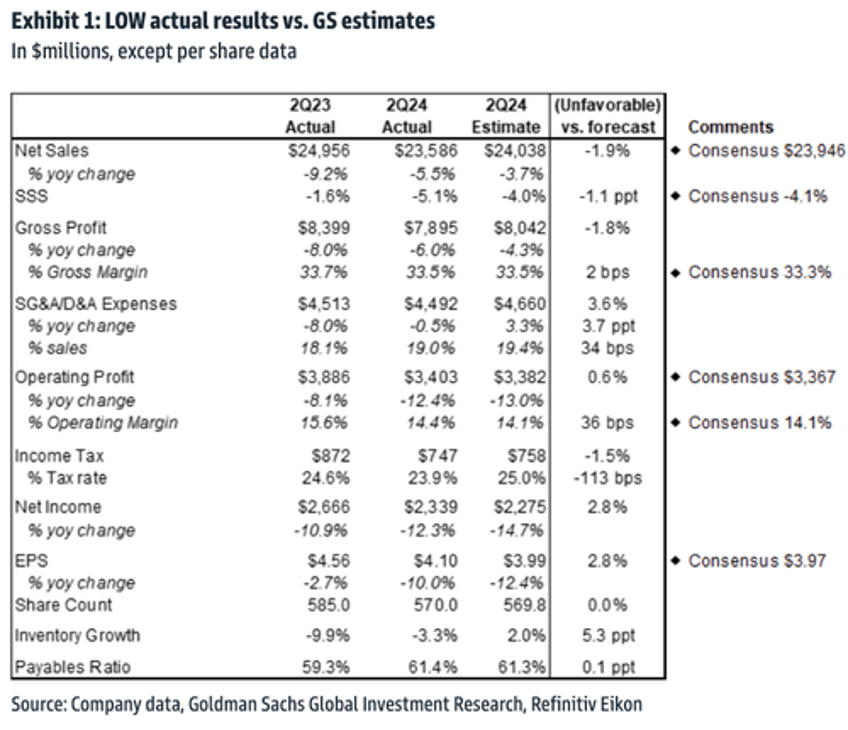

LOW reported 2Q24 adj. EPS of $4.10, above the GS and consensus (Refinitiv) estimates of $3.99/$3.97. Adj results excludes a pre-tax gain associated with the 2022 sale of the Canadian retail business. Net sales decreased 5.5% y/y to $23.586bn, below the GS estimate of $24.038bn and consensus of $23.946bn, while comparable sales decreased 5.1% y/y vs. the GS estimate of -4.0% and consensus of -4.1%. Operating margin decreased 114 bps y/y to 14.4% (vs. GS/consensus of 14.1%/14.1%) as operating expenses (SG&A and D&A) as a % of sales increased 96 bps y/y to 19.0% while gross margin decreased 18 bps y/y to 33.5%.

Here's more on McShane's earnings breakdown for the second quarter:

Sales decreased 5.5% y/y to $23.586bn, below the GS estimate of $24.038bn and consensus of $23.946bn. Comparable sales decreased 5.1% y/y as a decline in DIY big ticket discretionary and unfavorable weather was partially offset by positive comps in Pro and online

Gross margin decreased 18 bps y/y to 33.5%, compared to the GS estimate of 33.5% and consensus of 33.3%.

Total operating expenses (SG&A and D&A) decreased 0.5% y/y to $4.5bn and represented 19.0% of sales compared to 18.1% in the prior year. Operating margin decreased 114 bps y/y to 14.4%, above the GS/consensus estimates of 14.1%.

Inventory decreased 3.3% y/y to $16.8bn and compares to the -5.5% sales decline. LOW's payables ratio of 61.4% compares to 59.3% in the prior year.

Lowe's reduced its full-year forecast because of a pull back in consumer spending, especially in do-it-yourself projects.

"Based on lower-than-expected DIY sales and a pressured macroeconomic environment, the company is updating its outlook for the operating results of the full year 2024," the retailer wrote in a statement.

McShane provided more color on the lowered full-year guidance:

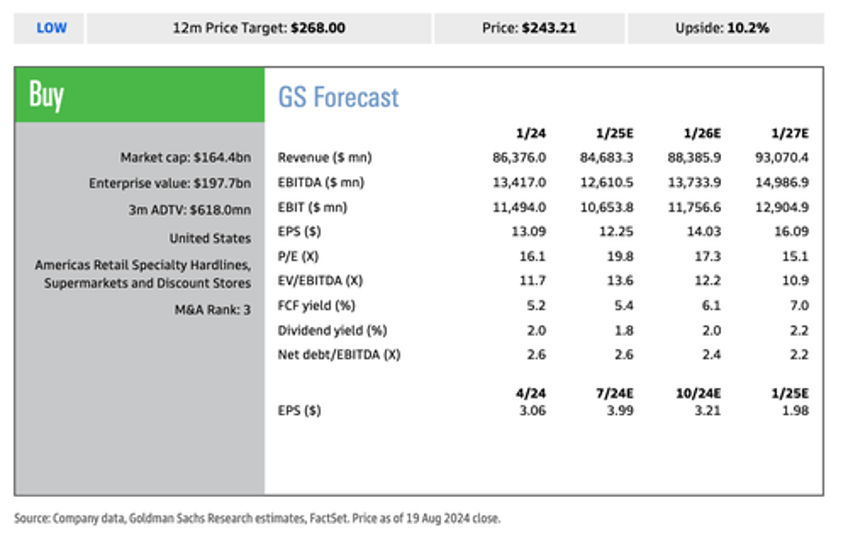

LOW lowered their FY24 guidance, including sales of $82.7bn-83.2bn (vs. $84bn-85bn prior), comparable sales of -3.5% to -4.0% (vs. -2% to -3% prior), adj. operating margin of 12.4%-12.5% (vs. 12.6%-12.7 prior), adj. EPS of $11.70-$11.90 (vs. $12.00-$12.30 prior). Guidance for interest expense remains at $1.4 and capital expenditures of $2bn.

Marvin R. Ellison, Lowe's chairman, president and CEO, commented on the earnings report:

"The company delivered strong operating performance and improved customer service despite a challenging macroeconomic backdrop, especially for the homeowner."

McShane noted, "Although LOW missed expectations, we think this was somewhat expected after the HD print last week."

She added that LOW is "Buy rated" for clients with a 12-month price target of $268, noting that "deterioration in the pricing environment from increased competition or softer-than-expected demand could weigh on profitability."

Here are other analyst commentary from Wall Street's top banks (courtesy of Bloomberg):

Morgan Stanley (overweight)

- "Our key takeaway on LOW's results is better than feared for 2Q earnings," as well as its revised forecast, analyst Simeon Gutman writes

- Lowe's is "holding to its promise" of managing margins, with "solid" gross margin performance in 2Q and what looks to be "exceptional cost control"

- He thinks shares can "tread water in the near term," and hold on to their ~4% gain since rival Home Depot reported last Tuesday

- That said, Gutman views consensus estimates for next year as "too high" amid expectations for a prolonged recovery in home improvement

JPMorgan (overweight)

- "Importantly, the gross and operating margin upside in 2Q is consistent with our relatively positive view of LOW's margin outlook and contrary to the bear case that the company over- earned/under-invested and had high risk implied in its guide (it also counters a gross margin miss in 1Q)," analyst Christopher Horvers writes

- Both gross and operating margin topped expectations as "productivity efforts continued to drive expense control," he says

- Bottom line on print: "nothing surprising with margin upside underpinning a more positive view." He'll be listening for quarter-to-date commentary to gauge how "prudent" the annual forecast might be

RBC (sector perform)

- The 5.1% comparable sales decline was "largely expected" after Home Depot's results last week, according to analyst Steven Shemesh

- Pro comps gain of mid-single digits (vs. low-single digit growth in 1Q), which shows continued outperformance vs. Home Depot, but slowing DIY comp. sales probably give investors "some pause" even with likelihood of lower interest rates later this year

- "Better gross margin and less SG&A deleverage vs. consensus is also noteworthy, but revised FY'24 guidance implies that 2H EPS still needs to come down by ~8% at the mid-point," he adds

- Still, he expects the comp miss/guidance cut to be viewed in "somewhat of a positive light" as it lowers the bar and makes for easier comparisons next year

- Shares likely to remain "range bound" until there is more clarity on the "potential duration of consumer malaise"

In markets, LOW shares are marginally lower in premarket trading in New York. What's important to note about the few years of sideways price action is that it stems from the Federal Reserve's interest rate hiking cycle, which lifted off in early 2022. High interest rates and elevated inflation have pressured low/mid-tier consumers, forcing many to pull back on discretionary spending.

Last week, Lowe's rival Home Depot beat quarterly expectations for earnings and revenue but issued a warning for the quarters ahead that weaker consumer trends will emerge. One major theme this earnings season has been top execs overly concerned about discretionary spending pullbacks from low-end consumers.