The normally crucial consumer price index measure of inflation printing today for March is likely to take a back seat to the next red flashing headline on tariffs on everyone's Bloomberg terminal, but under the hood - with the Trump Put now exposed - can a cooler than expected CPI print raise the Powell Put strike enough to enable a true tradable bottom here?

Having dipped lower in the previous month (following a few straight months of re-acceleration), expectations were for both headline and core measures to continue trending lower on a YoY basis... and they were.

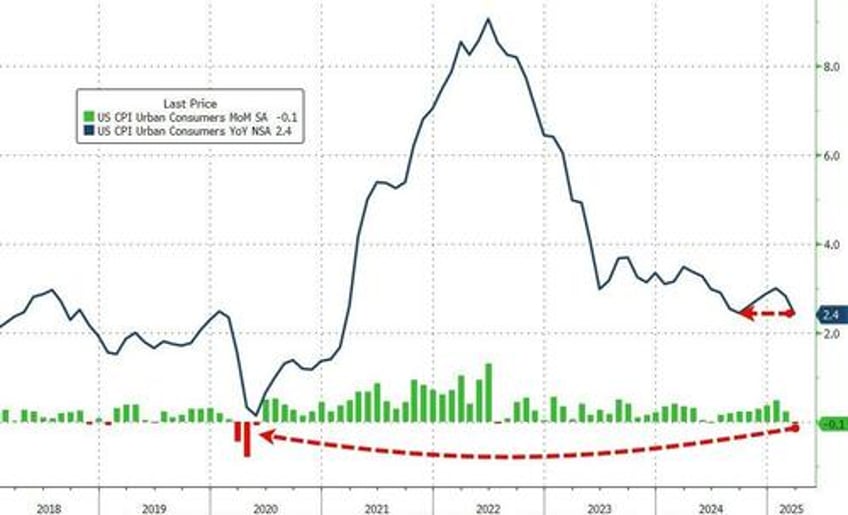

Headline CPI FELL 0.1% MoM (vs +0.1% exp), which dragged the YoY CPI to +2.4%, matching the September lows...

Source: Bloomberg

That is the weakest MoM print since May 2020.

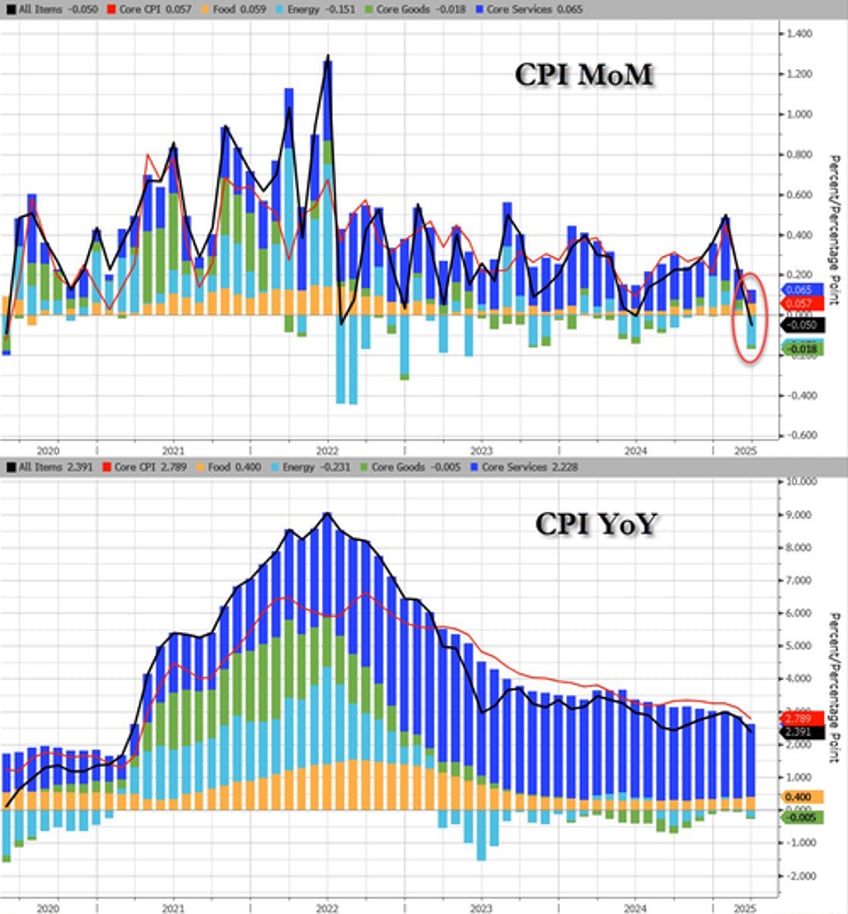

Core CPI also printed cooler than expected (+0.1% MoM vs +0.3% MoM exp), pulling the YoY print down t0 +2.8% YoY - the lowest since March 2021...

Source: Bloomberg

Services inflation tumbled...

Source: Bloomberg

While goods inflation is flat (zero-ish), services cost inflation is fading fast...

Source: Bloomberg

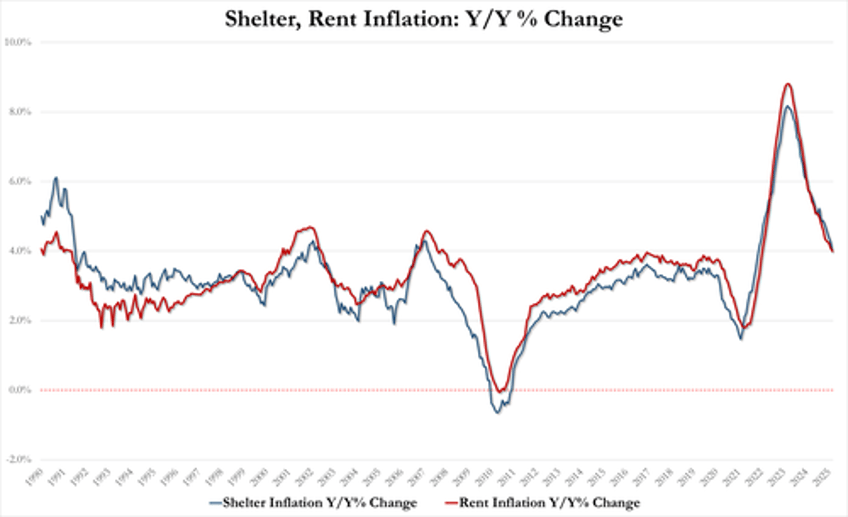

Shelter and Rent inflation is slowing fast:

Shelter inflation +0.3% MoM, +3.99% YoY, down from 4.25% in February (lowest since Nov 2021)

Rent inflation +0.3% MoM, +3.99% YoY, down from 4.09% in February (lowest since Jan 2022)

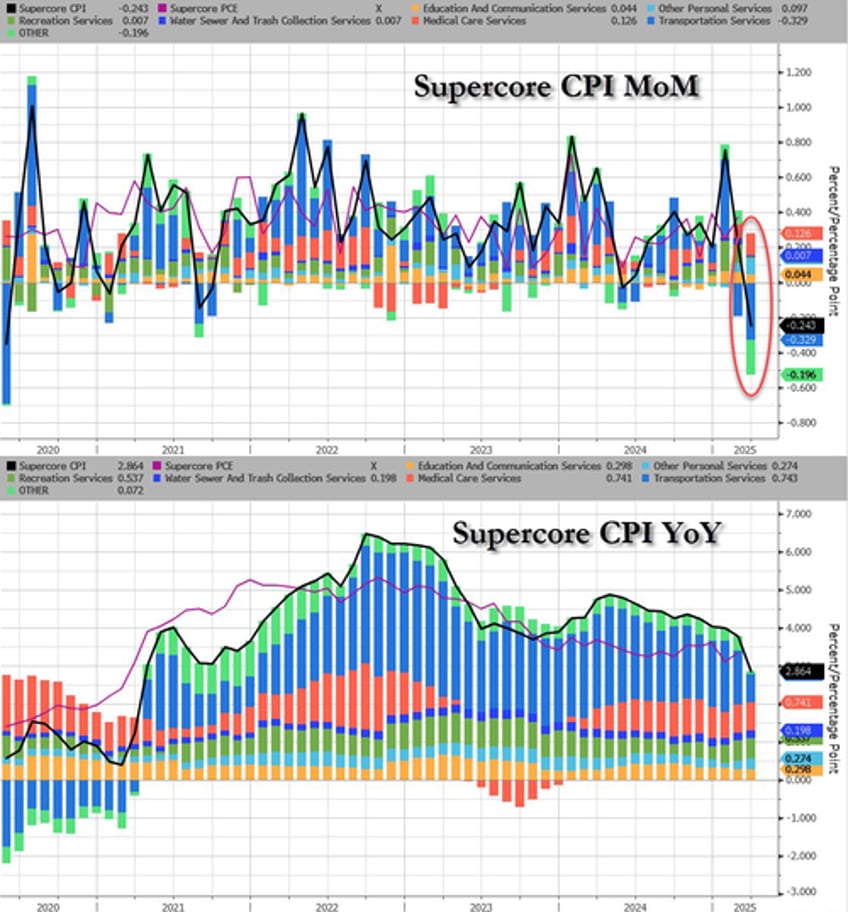

The so-called SuperCore CPI - Services Ex-Shelter - dropped 0.1% MoM dragging it down to +3.22% YoY - the lowest since Dec 2021...

Source: Bloomberg

Source: Bloomberg

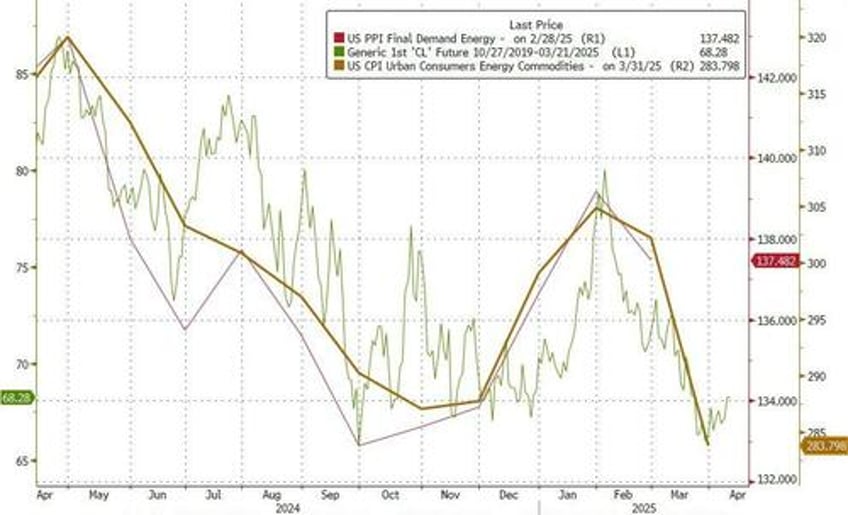

Drill Baby Drill (and tariffs recession fears) have dragged energy prices lower and pulled CPI lower with it...

Source: Bloomberg

But, but, but... Democrats at UMich said inflation would explode because Orange Man Bad?