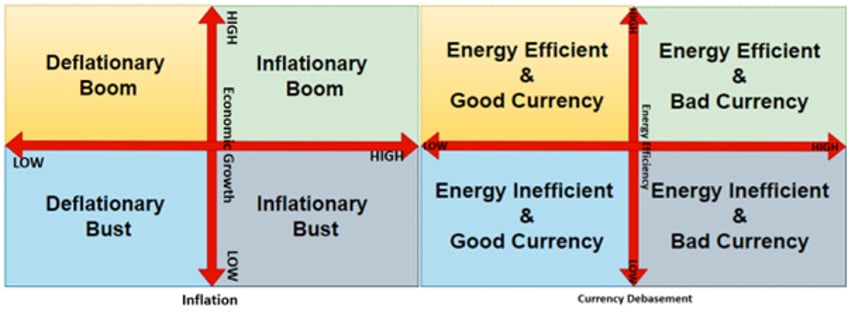

Investors who analyze the financial world through the lens of the business cycle and use market ratios to allocate their portfolios among the four asset classes of the Permanent Brown Portfolio understand that, beyond the constant noise generated by Wall Street and its parrots, there are two key financial ratios that shape the business cycle across its four quadrants. Additionally, one ratio has historically served as a leading indicator of shifts between economic booms and busts over time: the valuation of a country's stock market relative to the price of gold, measured against its 7-year moving average. This ratio, often referred to as the indicator of monetary illusion, provides critical insights into the economy's health and direction.

Monetary illusion occurs when individuals perceive their wealth, income, or purchasing power based solely on nominal values, disregarding the effects of inflation or deflation. This cognitive bias can lead to flawed financial decisions, such as mistaking nominal wage increases for real gains in purchasing power, even when inflation erodes actual income. On a broader scale, monetary illusion influences economic behaviour, affecting consumption, savings, and investment patterns. For example, during inflationary periods, consumers may feel wealthier due to higher nominal wages or asset prices, even if there is no real increase in economic value. Similarly, businesses might misinterpret rising revenues as improved performance without accounting for inflation-adjusted profitability. Policymakers may also exploit this illusion by implementing inflationary measures to stimulate spending, masking the long-term erosion of purchasing power.

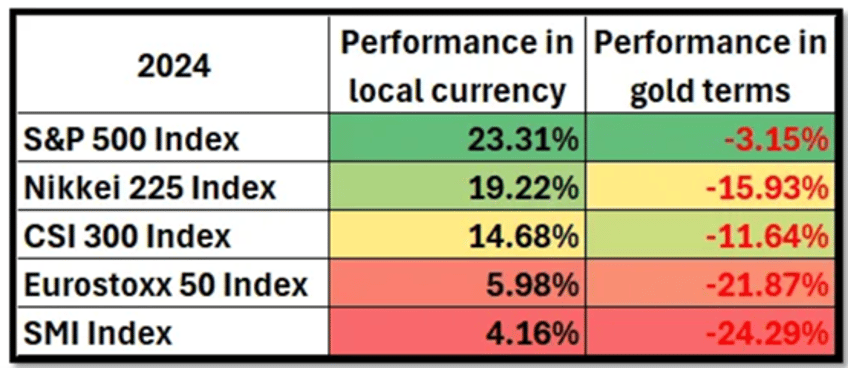

The best example of monetary illusion happened in 2024 when all major equity markets in the world recorded positive performance in their local currency while it is clear to anyone who can understand that these returns was only illusions as when measured in gold terms, these performances were negative.

As January 2025 is now in the history books, media highlights the apparent strength of European equity markets, with the UK FTSE hitting new highs in local currency. However, measuring performance in local currencies is misleading. To accurately gauge market performance, returns should be assessed in a common currency, such as the US dollar or gold, which accounts for global value and strips away distortions like currency fluctuations and inflation. Without this perspective, nominal gains can create an illusion of prosperity, masking the true international value of investments.

For enthusiasts of luxury branded cars, the Ferrari 308, particularly the GTB and GTS models, was a highly desirable sports car during the 1980s. Between 1985 and 1988, the price of a new Ferrari 308 in the UK typically ranged from £25,000 to £35,000, depending on the model, optional features, and market conditions. In 1985, a new Ferrari 308 GTB or GTS might have cost around £25,000 to £28,000 in London, while in New York, it was priced between $35,000 and $40,000. This implied a "red Ferrari exchange rate" (GBP/USD) of roughly 1.14, compared to the actual average exchange rate of 1 GBP = 1.30 USD at the time. The Ferrari 308 gained popularity in the U.S. partly due to its appearance in the TV show Magnum, P.I., which enhanced its cultural appeal. However, it remained a luxury item, with prices reflecting its status as a high-performance, exotic sports car. By 1988, the price of a new Ferrari 308 in London remained relatively stable at £30,000 to £35,000, while in New York, prices rose to $45,000 to $50,000. This implied a GBP/USD exchange rate of 1.42, compared to the actual average rate of 1 GBP = 1.80 USD that year. While the Ferrari 308's price in London saw little change between 1985 and 1988, it increased by 25% in New York. Many at the time believed the car itself had appreciated in value, while in reality it was largely a currency-driven phenomenon. Without considering currency fluctuations, the true picture was missed entirely as it is nowadays in financial markets.

GBP/USD FX Rate between December 31st 1984 and December 31st 1988.

Returning to financial markets, one doesn’t need a PhD in technical analysis to understand that the performance of the FTSE index differs significantly when expressed in local currencies versus USD. As the USD rallies, UK share prices appear cheaper, much like the Ferrari 308 did between 1985 and 1988. In this context, nobody will be surprised that while the FTSE 100 has reached new highs in pounds, it has not achieved new highs in USD since October 2007. This discrepancy highlights the importance of evaluating market performance in a common currency to gain a clearer, more accurate perspective, free from the distortions of exchange rate fluctuations.

Performance of the FTSE 100 Index in local currency rebased at 100 as of December ,29th, 1995.

Performance of the FTSE 100 Index in USD, rebased at 100 as of December 29th, 1995.

Savvy investors understand that the definition of a bull market is an asset or an index that rallies in terms of all key currencies. When it rises only in local currency terms, it reflects a domestic shift rather than genuine international strength. Examining the FTSE 100's performance in gold terms makes it clear to anyone who can read a chart that the UK equity market is not in a bull market as some in Canary Wharf try to pretend but has been in a bear market since December 1999. This perspective underscores the importance of measuring performance against stable, universal benchmarks to avoid the distortions of currency fluctuations and monetary illusion.

Performance of the FTSE 100 Index in GBP (Blue line) in Gold terms (red line), rebased at 100 as of December 29th ,1995.

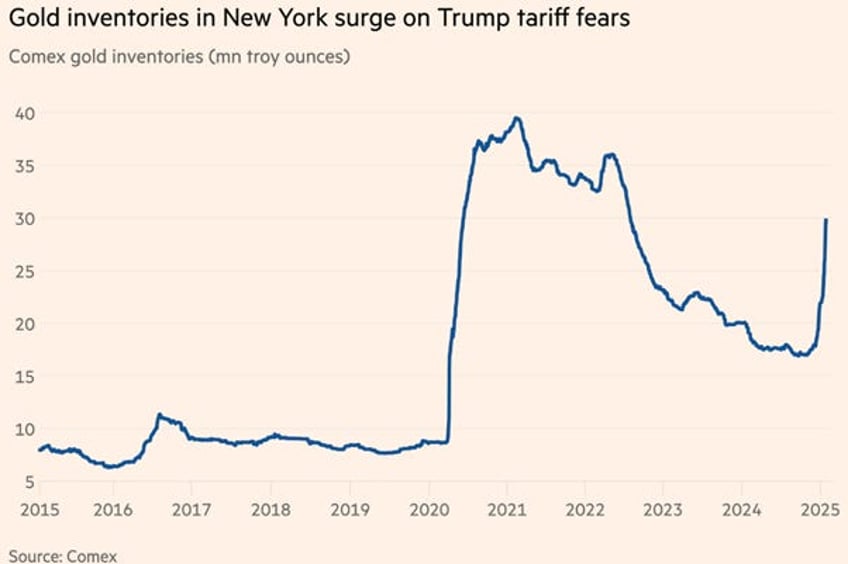

"Follow the money, and you will find the culprit," as the adage goes. This time, it’s not money but gold leaving the UK in anticipation of capital controls and a sovereign debt crisis on that side of the pond.

https://www.ft.com/content/86a5fafd-603e-4ee1-9620-39b5f4465f53

Since the U.S. election in November, gold traders and financial institutions have moved 393 metric tonnes into Comex vaults, pushing inventories up nearly 75% to 926 tonnes, the highest since August 2022. This month alone, Comex gold inventories have surged 36%, with 244 metric tonnes of inflows, the largest monthly increase since May 2020.

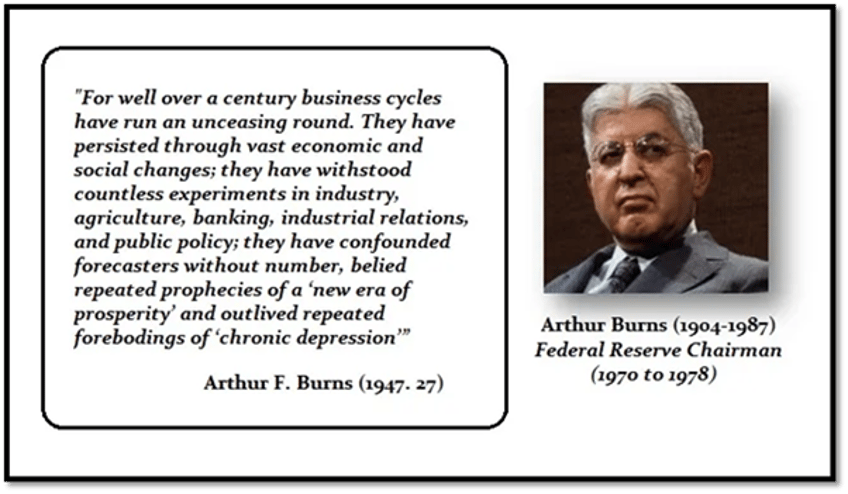

This raises a critical question for investors: what single store of value can measure global asset performance without bias from monetary illusion? First, what defines a store of value? It is an asset, currency, or commodity that preserves purchasing power over time, resisting depreciation and remaining stable or appreciating relative to inflation and economic shifts. Its effectiveness hinges on scarcity, durability, and broad acceptance. Crucially, a store of value differs from money, which facilitates exchange but fluctuates with economic cycles. History shows that no system, whether gold, fiat, or Bitcoin, can eliminate the business cycle. As former Federal Reserve Chairman Arthur Burns acknowledged, the business cycle always prevails. Supply and demand drive everything; nothing is immune to fluctuation, not even gold.

Consider 1985, when the pound fell to $1.03. Americans bought British assets as if they were on sale, while Brits thought they were overpaying. Yet, prices soared afterward. Why? Because value is relative, and markets are driven by cycles, not static measures. The illusion of stability is just that, an illusion.

In this context, claiming that Bitcoin, gold, or any asset is a ‘store of wealth’ is either misleading or ignorant. Take, for example, the price of an average house in the U.S. measured in both USD and gold terms. Over the past 50 years, its value has fluctuated significantly, ranging from 113 ounces of gold to over 800 ounces at the peak of the housing bubble in March 2001. In USD terms, the same house rose from less than $200,000 in 1963 to over $500,000 by the end of September 2024. When measured in Dow Jones units, the value of the average U.S. house peaked in June 1982 at over 105 units, only to hit a historical low of less than 12 units by the end of September 2024. These fluctuations demonstrate that no asset is immune to volatility, undermining the notion of a static "store of wealth."

Price of an average US house in Gold (blue line); Dow Jones (red line); USD (green line) since 1963.

What investors must understand is that nothing is a store of value across history because EVERYTHING will rise, and fall based on supply and demand.

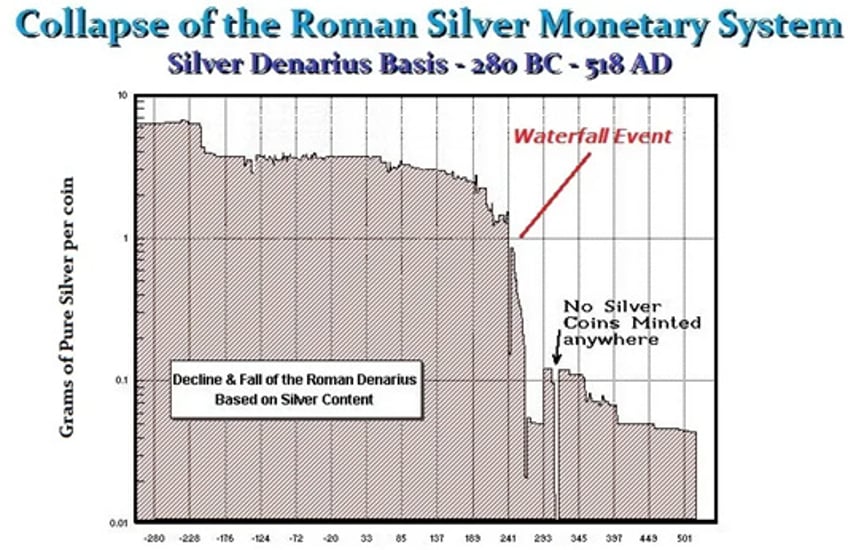

There is significant confusion about modern money, with many assuming governments create it directly, as in ancient times. After 600 BC, states minted coins for trade but soon exploited "seigniorage," profiting by declaring currency value higher than its metal content. Today, money is virtual, existing as electronic entries. For instance, when a foreign investor converts currency to buy domestic real estate, they expand the money supply through book entries, not central bank action. Similarly, banking leverages deposits; $1,000 deposits can result in two accounts reflecting $1,000 each, even though no new physical money is created. This virtual nature means bank panics can occur if everyone withdraws funds loaned elsewhere. Clearly, money is no longer a store of value, as its purchasing power fluctuates with economic cycles. Since governments monetized profit creation centuries ago, wealth preservation now depends on tangible assets, not money itself.

For those who believe the recent surge in Bitcoin signals it will replace the USD as the world’s reserve currency, such belief amounts to propaganda. Bitcoin is simply a trading vehicle which has been created to facilitate money laundering, not a currency. While this may be an unpopular view, investors should remember that much speculation surrounds its origins. Bitcoin (BTC) was created on January 3, 2009, by the mysterious figure or group known as Satoshi Nakamoto, who has been absent since 2011. Yet, 1 million Bitcoins remain untouched in their original account. Valued at over $70 billion at the time of writing, this wallet represents 3% of all mined Bitcoin, making its owner, if an individual, one of the top 15 richest people globally.

https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html

Bitcoin’s price volatility mirrors the 1966 mutual fund bubble, where funds were listed and traded at premiums to net asset value (NAV). When the bubble burst, investors lost heavily, as funds crashed 70-90% despite the Dow dropping only 26.5%. This led to mutual funds being delisted and traded solely at NAV. Similarly, Bitcoin’s value fluctuates at 10x the volatility of the dollar, making it an ‘hazardous store of wealth’ and purely a speculative trading vehicle, akin to commodities like wheat or cattle. While profits can be made, Bitcoin is not a stable store of value, it rises and falls like any other asset. The idea of Bitcoin replacing the dollar misunderstands what defines a reserve currency. Once the S&P 500-to-Oil ratio falls below its 7-year moving average, signalling an economic bust, Bitcoin will once again depreciate against gold, further undermining its role as a reliable value reserve. In a nutshell, Bitcoin is a high-volatility asset class, neither a stable currency nor a store of value.

S&P 500/Oil ratio (blue line); 84 months Moving Average of the S&P 500/Oil ratio (red line); Bitcoin to Gold ratio (yellow line).

This brings us back to how investors should allocate their portfolios in the current phase of the business cycle. Given that the U.S. is the only major economy still in an inflationary boom, it should come as no surprise that the U.S. equity market will continue to outperform the other major equity markets of the G4 economies (U.S., China, Eurozone, and Japan) when measured in a common unit of valuation such as gold.

Performance of S&P 500 Index (blue line); CSI 300 Index (red line); EuroStoxx 50 (green line); Nikkei 225 (yellow) in Gold terms rebased at 100 since December 31st 2019.

Those familiar with the Permanent Browne Portfolio know it can be divided into contracts on one side (i.e., cash and bonds) and properties on the other (i.e., equity and gold). According to Keynesian theory, contracts like cash and bonds are seen as stores of value, with governments acting as economic guarantors of safety for their citizens. However, this view overlooks the fact that governments can default on their obligations and arbitrarily redefine what constitutes cash. A closer look at government bond indices across the G4 economies (i.e., the U.S., China, Europe, and Japan) reveals that, when measured in gold terms, these bond markets have been poor stores of value since the start of the decade. This challenges the Keynesian assumption and highlights the limitations of relying solely on government-backed contracts for wealth preservation.

Performance of US Treasury Index (blue line); China Government bond index (red line); German Bond Index (green line); Japan Government Bond Index (yellow) in Gold terms rebased at 100 since December 31st 2019.

Investors understand that markets are ultimately driven by liquidity, so it should come as no surprise that the rate of change in the USD liquidity proxy index is closely correlated with the rate of change in the S&P 500 to Gold ratio and its movement around the 7-year moving average. Since October 2024, shadow liquidity has been tightening and turned negative on a yearly basis, reinforcing the downtrend that began after the ratio peaked in February 2024. This trend will likely lead to a break below the 7-year moving average in the coming months—a development that has historically been a poor omen for the U.S. economy and equity markets. History shows that elevated risk assets tend to underperform following significant liquidity spikes, and with gold outpacing the S&P 500's total return since 2021, this may signal an imminent economic bust in the U.S.

Upper Panel: USD Liquidity Proxy 12-month rate of change (yellow histogram); Lower Panel: S&P 500 to Gold ratio (blue line); 7-year Moving Average of the S&P 500 to Gold ratio (red line).

In this context, the misleadingly called barbaric rock appears on track to beat stocks again in 2025, as it did in 2024.

2024 Performance of S&P 500 index in USD (blue line); Performance of S&P 500 index in Gold terms (red line) (rebased at 100 as of December 29th, 2023).

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/monetary-illusion

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.