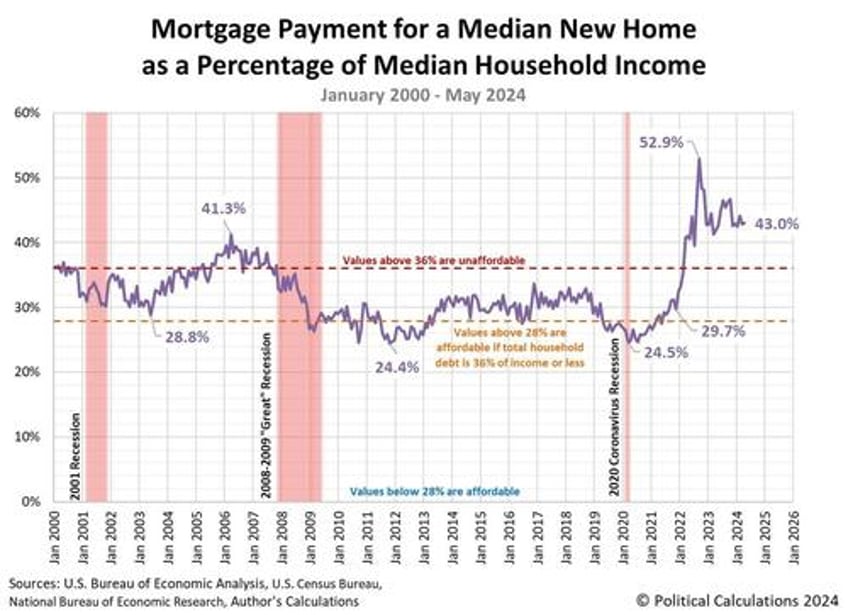

The affordability of new homes sold in the United States was little changed in May 2024.

With the mortgage payment for the typical new home sold consuming 43% of the income earned by a household in the exact middle of the distribution of income in the U.S., new homes remain out of affordable reach for the majority of American households.

How unaffordable is that?

According to real estate analytics firm ATTOM, in more than one-third of the markets they examined, "homeowners were spending at least 43% of their wages on housing, a level the firm defines as "'seriously unaffordable.'"

We should point out here that ATTOM's analysis applies to both new and existing homes in the local markets they reviewed.

That figure is coincidentally the one that applies nationally for the median new home sold and the nation's estimated median household income.

The following chart shows how the relative affordability of the typical new home sold in the U.S. has developed from January 2000 through May 2024.

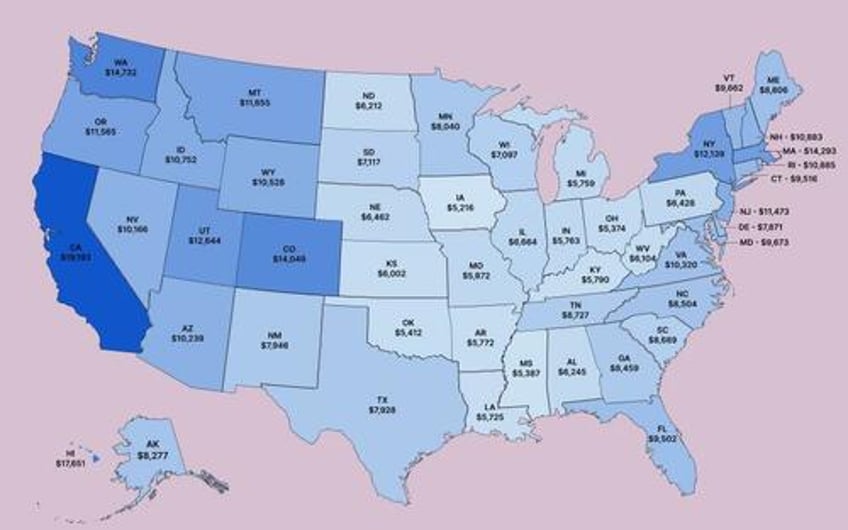

While that percentage applies nationally, in truth, all real estate markets are local.

To that end, we thought it would be interesting to present Wealthvieu's Patrick Ross' map of how much monthly income a household in any of the 50 states would need to afford the median home sold within it, which gives a good indication of which states offer the most and least affordable housing.

The data in the chart applies for both new and existing homes sold in each state in April 2024.

Finally, if you really want to drill down into really local real estate markets, here's ATTOM's interactive chart with their analytical results