A proposal seeking to eliminate a hefty price tag for New York City renters is drawing fierce opposition from the real estate industry

NYC considers ending broker fees for tenants, angering real estate industryBy JAKE OFFENHARTZAssociated PressThe Associated PressNEW YORK

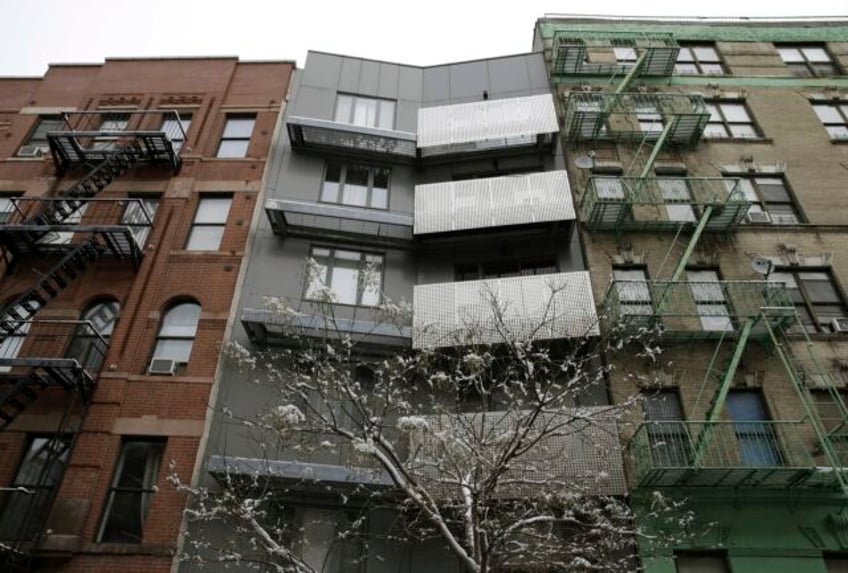

NEW YORK (AP) — It’s a familiar and agonizing experience for legions of New York City renters: before moving into a new apartment, a tenant must first shell out thousands of dollars in fees to a real estate broker, even if that person was hired by the landlord.

The hefty one-time payments, known as broker fees, are ubiquitous in New York but nearly unheard of anywhere else. In most other cities, landlords cover the commission of agents working on their behalf.

But legislation backed by a majority of the New York City Council would require landlords who hire brokers to pay their fees, marking a potential sea change in one of the country’s most expensive housing markets.

Renters, who make up more than two-thirds of city households, are hailing the latest attempt at reform. At a hearing Wednesday, many New Yorkers recalled paying exorbitant fees to brokers who appeared to do little more than open a door to an apartment or direct them to a lockbox.

“In most businesses, the person who hires the person pays the person,” said Agustina Velez, a house cleaner from Queens who said she recently paid $6,000 to switch apartments. “Enough with these injustices. Landlords have to pay for the services they use.”

But the proposal has triggered fierce opposition from New York’s real estate industry.

Ahead of the hearing, hundreds of brokers gathered to voice their objections at a rally organized by the Real Estate Board of New York, the industry’s powerful lobbying group.

Through hours of testimony, they warned the legislation would sow chaos in the rental market and decimate the livelihoods of the city’s roughly 25,000 real estate agents. Many predicted landlords would pass on the costs of paying brokers to tenants through increased rents or keep apartments off the market altogether.

“This is the start of a top-down government-controlled housing system,” said Jordan Silver, a broker with the firm Brown Harris Stevens. “The language is so incredibly vague we actually have no idea what this would look like in the world.”

The bill’s sponsor, City Councilman Chi Ossé, has said he was moved to act following a recent apartment search that was “tiring, treacherous, and competitive.” Another local official, Brooklyn Borough President Antonio Reynoso, testified that he’d once paid a $2,500 fee to a broker he never met.

Their frustration was echoed at Wednesday’s hearing by dozens of ordinary renters, along with a mix of labor unions, housing policy groups and some prominent business leaders. Critics said paying brokers’ fees serves as a barrier to those who’d otherwise move to the city while preventing low-income New Yorkers from relocating to new homes.

Such broker fees were previously banned in 2020 under a package of renter protection laws passed by the state. But they were quickly reinstated following a lawsuit led by the Real Estate Board of New York.

Brokerage firms estimate that roughly half of the city’s apartments require a tenant-paid broker fee. The price of those fees can vary widely, though the standard amount is 15% of the annual rent. For the average apartment in Manhattan, where the median monthly rent recently hit $4,500, that would amount to a fee of $8,100.

Under the legislation, tenants would still pay brokers that they hired directly. The bill’s brief language — less than 200 words — only requires the party that hires the real estate agent pay their fee.

“How the market works is not as simple as a few sentences, which is what the bill is,” said Ryan Monell, a vice president at the Real Estate Board of New York. “It’s a misnomer to compare New York to other cities. This is really an exceptional market.”

Brokers are adamant that their jobs are far more intensive than merely opening the door to tenants. Many said they help put together listings, review applications, answer questions posed by tenants and arrange tours at all hours of the day. But some also acknowledged that the current system favors landlords.

“I think it’s not logical. The landlord should pay the listing agent who is working on their behalf,” said Maria Octavio, a real estate broker with the firm of Douglas Elliman. “Because it’s worked this way for many years, the owners are used to it.”

Anna Klenkar, a broker at Sotheby’s, said the industry group — known as REBNY — had contacted her employer after learning that she planned to testify Wednesday in support of the legislation. “It feels less like we’re protecting ourselves, and more like we’re protecting landlords, whom REBNY also represents,” she testified.

A spokesperson for REBNY did not respond to an emailed inquiry about whether they had reached out to the employer.

Mayor Eric Adams, a Democrat, warned the bill could have unintended consequences. He had strong real estate industry backing during his campaign and moonlighted decades ago as a real estate agent while working in the city’s police department.