Only Above Ground Stocks Can Save Silver Supply Now

"Absent an economic act of God or an industry-specific innovation, demand will be only satisfied by considerably higher price."

- Vincent Lanci

Metals Focus just put out its weekly report. This piece breaks down that work. You can get it at their site here (free with sign up). Alternatively we have the original PDF here, free as well.

Contents: (1800 words)

- Bottom Line: Wake Up Call

- Analysis: Only Above Ground Stocks and Scrap Can Save Silver Supply Now

- Final Note: The Industry is Upside Down With Financialization

- Full MF Report: with emphasis and observations

1- Bottom Line: Wake Up Call

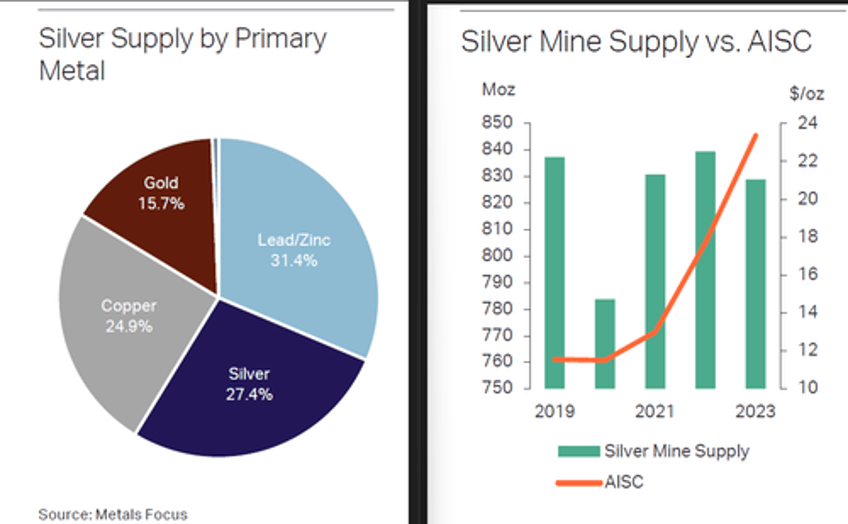

This report’s title asks the right question. It is titled: Can silver mine supply meet increasing industrial demand? Their conclusion is a resounding no.

"As such, it is only continued drawdowns from above-ground stocks that can balance the market in the next few years"

Given the current situation and mining dynamic, unless industrial demand decreases (thrift or slowdown) or recycling of jewelry and investor coins increases significantly (highly unlikely), “Only continued drawdowns from above-ground stocks that can balance the market in the next few years” This is a wake up call for the industry in frankness from a notably imperturbable organization. The tone is not panic, by any means, but the facts as presented do raise questions.

2- Analysis: Only Above Ground Stocks (and Scrap) Can Save Silver Supply Now

Unless there is a global economic slowdown, (unlikely for the next 6 months as banks are now in an interest rate lowering cycle) above groundstocks will be used to fill the gap between Supply and Demand. The wildcard is China of course with their insatiable demand. That can also turn negative.

The silver industry is now in an unenviable position after years of economic neglect of having to be bailed out of its deficit problems by forces outside its control unless some of the aforementioned things happen.

Absent an economic act of God or an industry-specific innovation, demand will be only satisfied by considerably higher price.

The industry is increasingly not in control of its own fate, and will have to rely on intermediaries like banks who scour and procure metal from existing supply (usually clients holding out for a better deal, or their own stocks) , and producers of concentrate who are selling their materials in increasing frequency before silver is extracted to China.

Here are (fifteen) numbered points that lead to this conclusion

- Silver Mining Supply continues to dwindle, fall short of growing demand

- Above Ground stocks will be increasingly tapped to cover the shortfall

- Much of the shrinking supply comes from decreasing ore yields

- Over the past decade, silver grades have fallen by 22%

- Silver mine price inelasticity is a feature, not a bug, with over 55% of silver being a by-product of another mined metal

- Despite higher prices, mines will not be able to ramp up much production.

Much more here

Free Posts To Your Mailbox